XRP has entered a prolonged period of existential uncertainty, trading sideways beneath a key resistance zone. The muted price action is not random. Derivatives data suggest a heavy concentration of short contracts is capping upside attempts, much like a well-dressed gentleman refusing to acknowledge the elephant in the room.

This resistance wall has created tension in the market, akin to a society dinner party where everyone is trying to avoid the subject of inheritance. Will XRP trigger a short squeeze, or will it remain a mere footnote in the grand narrative of financial despair?

XRP Is Facing a Wall

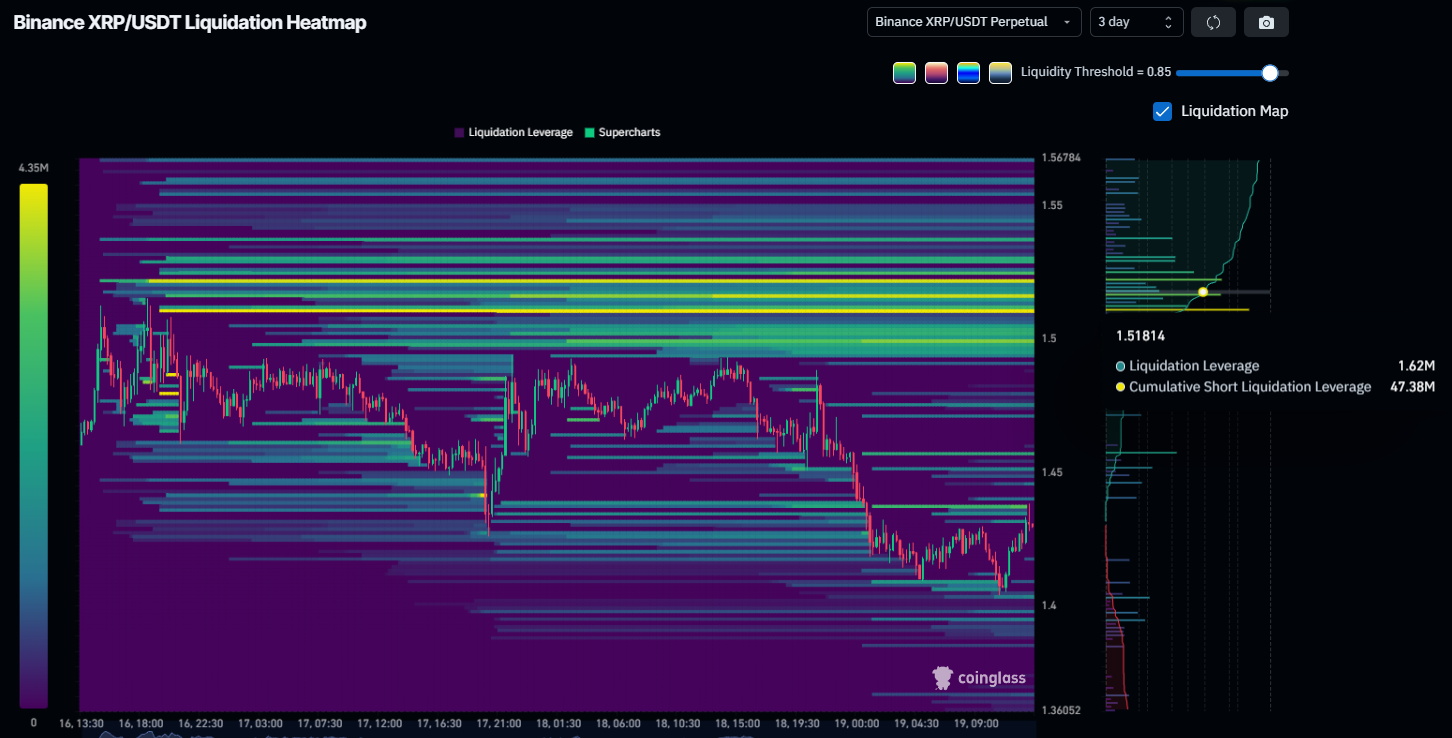

Futures market data and liquidation heatmaps highlight a critical level near $1.51. At that price, approximately $47 million in XRP short positions face liquidation. This concentration has formed a visible barrier above current price action, as unyielding as a Victorian widow’s resolve to never remarry.

Traders holding short contracts are incentivized to defend this level. A sharp breakout could force rapid short covering, triggering a temporary price spike. However, such moves often exhaust buy-side liquidity quickly. Large players may sell into strength, turning the level into a short-term ceiling rather than sustained support-much like a politician’s promises.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

On-chain data reflects continued stress among XRP holders. Net realized profit and loss metrics show that investors are still selling at a loss. On February 17 alone, roughly $117 million in realized losses were recorded-proof that even in crypto, the only thing more painful than losing money is admitting it.

This level of capitulation indicates persistent fear. When holders exit positions at a loss, it signals reduced confidence in near-term recovery. Sustained loss realization can limit bullish momentum until selling pressure subsides, much like a cat refusing to acknowledge it’s been caught in the act.

XRP Holders Mature

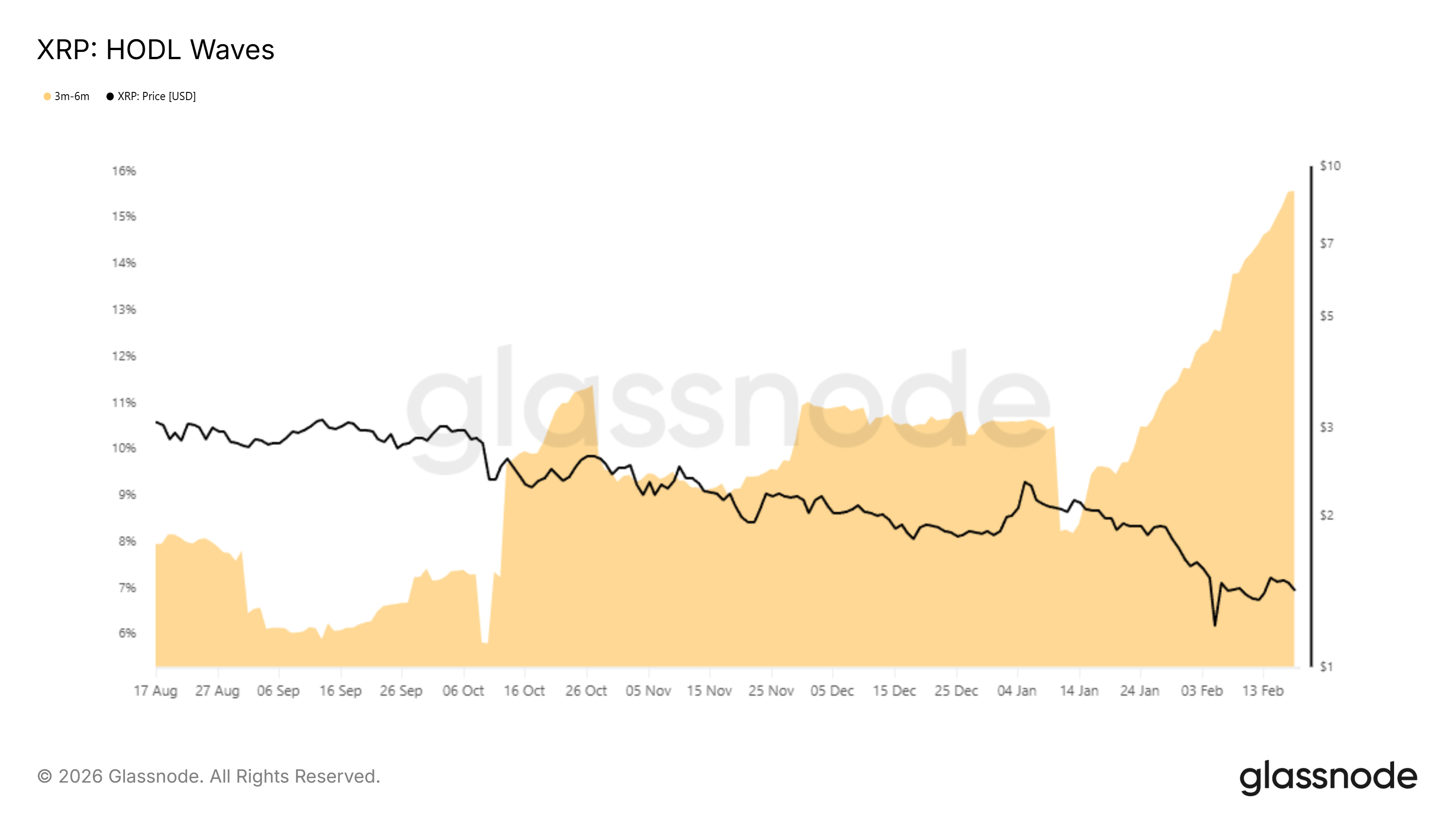

Despite ongoing distribution, another cohort is showing resilience. Many XRP holders remain underwater but are choosing to HODL rather than liquidate. This behavior is as steadfast as a Victorian gentleman’s resolve to maintain his composure in the face of scandal.

The three-month to six-month holding group has expanded notably. Their share of total XRP supply increased from 8% to 15%. As these wallets mature, their reluctance to sell may counterbalance panic-driven distribution and stabilize price action-though stability in crypto is as likely as a snowball’s chance in hell.

XRP Price To Likely Consolidate

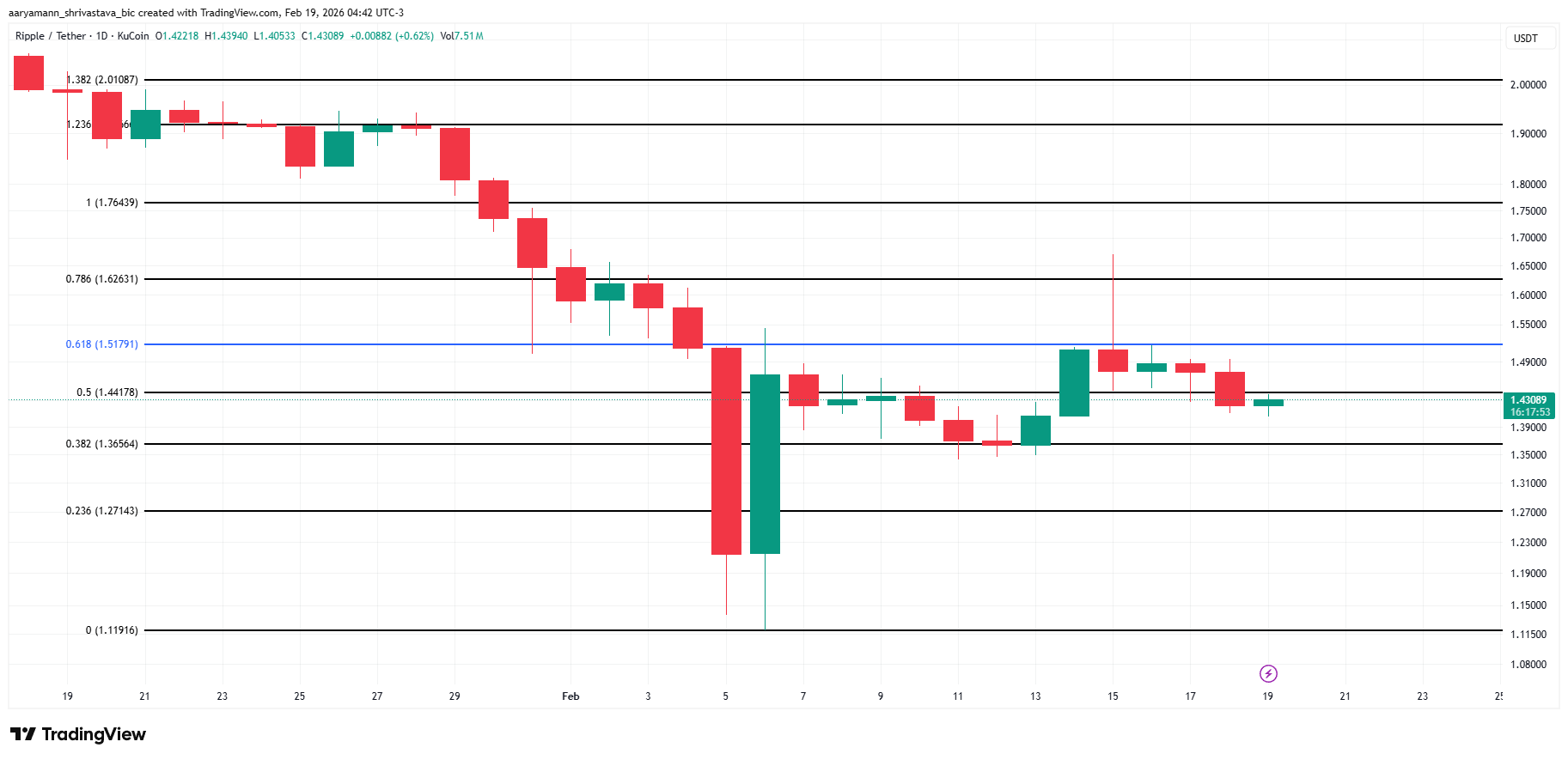

XRP is trading at $1.43 at the time of writing. The token remains below the $1.51 resistance, which aligns with the 61.8% Fibonacci retracement level. Reclaiming this barrier as support would signal technical improvement and potentially ignite recovery-though recovery in crypto is as reliable as a promise made over a drink.

For now, consolidation appears more likely. The $1.44 and $1.27 levels represent key support zones. Continued rejection near $1.51 may keep XRP range-bound between these thresholds. Selling pressure from loss-making investors could reinforce this sideways structure, much like a broken record stuck on repeat.

However, sentiment can shift quickly in crypto markets. If short sellers lose control and $1.51 flips into support, upside potential expands. A breakout could push XRP above $1.62 and attract momentum buyers. Such a move would invalidate the immediate bearish thesis and alter the short-term market structure-though in crypto, the only thing more fickle than the market is the weather.

Read More

- All Itzaland Animal Locations in Infinity Nikki

- Exclusive: First Look At PAW Patrol: The Dino Movie Toys

- All Golden Ball Locations in Yakuza Kiwami 3 & Dark Ties

- James Gandolfini’s Top 10 Tony Soprano Performances On The Sopranos

- Elder Scrolls 6 Has to Overcome an RPG Problem That Bethesda Has Made With Recent Games

- RaKai denies tricking woman into stealing from Walmart amid Twitch ban

- Silver Rate Forecast

- Not My Robin Hood

- Gold Rate Forecast

- Unlocking the Jaunty Bundle in Nightingale: What You Need to Know!

2026-02-19 17:46