XRP, that stubborn bluebottle of a coin, isn’t playing along with the rest of the market’s chorus. The wider crypto circus has bled billions in this latest pratfall, led by Bitcoin and Ethereum, yet XRP-third in line behind the stablecoins but second in stubbornness-hasn’t registered the dramatic valuation dump. In fact, compared to its peers, it’s holding up better than Ethereum, BNB, and Solana, as if the ledger suddenly decided to be polite at a library.

Sentiment Flips Bullish Again On XRP Price

Here’s where the tale thickens, like gravy that forgot it’s supposed to be thin. Santiment, that nosy gnome of social data, notes that the hype around BTC and ETH is thinning like old cheese, while XRP has climbed to a five-week high in bullish mood. Buyers seem to be creeping in on dips, buoyed by a healthy dollop of bullish chat, suggesting the XRP price chart is entering a rebuilding arc rather than a nosedive.

Of course, mood alone won’t grant you a unicorn. Still, a bit of divergence during a market-wide slump tends to attract the two things traders love: attention and a good old-fashioned wager.

Nasdaq Exposure in Focus

Evernorth has waved a parchment promising a Nasdaq listing under XRPN. If the spell sticks, regulated XRP exposure would slide neatly into institutional grubby hands-even if they never actually cradle the asset.

Pension funds. Asset managers. Institutional desks. The listing is meant to close that gap faster than a wizard’s sock drawer. Wrapped in regulation, digital assets get a respectable pat on the head, and open capital channels could nudge the long-term XRP price forecast-assuming the money men stop arguing about font choices long enough to press the button.

Regulatory Winds Shifting?

But let’s be honest, the only hinge that matters is regulatory clarity, the kind that doesn’t squeak when you lean on it. Brad Garlinghouse recently suggested that U.S. market-structure rules could arrive as soon as April, slapping a 90% probability sticker on near-term progress. The pronouncement has set policy buffs and traders chattering in echoing hallways.

If clearer rules do show up, XRP could shed its reputation as a speculative trinket and become a regulated bridge asset in the U.S. financial system. A structural plot twist, not merely a bounce on the price chart.

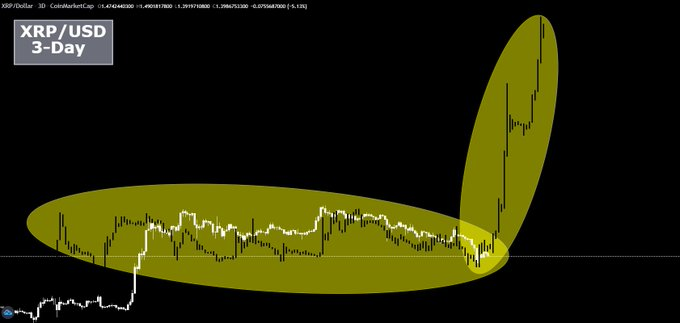

Meanwhile, chart nerds are wearing their optimism like a new tie. A widely followed analyst has spotted a three-day fractal that mirrors XRP’s 2017 breakout. In that old tale, months of navel-gazing eventually exploded into a meteoric rush toward the ceiling of all-time highs. If history enjoys a joke, targets around $4 and perhaps $9 have been floated-roughly 2x to 7x from today. If you enjoy math and drama, it’s a cocktail.

Ambitious? Absolutely. Possible? The market will decide, in a fashion that would amuse a bored goblin: conservatism or audacity, with perhaps a dramatic flourish of toenails on a chalkboard.

For the nonce, XRP stands at the crossroads where stubborn resilience, rising mood, regulatory optimism, and fractal daydreams share a bench and argue about values. Whether XRP/USD converts this divergence into dominance depends on how the unfathomable constants of fundamentals collide with momentum in the weeks to come. And if the bears regain their composure and drag the price below the fabled $1, the mood will promptly turn into something with more gloom and less popcorn.

Read More

- All Golden Ball Locations in Yakuza Kiwami 3 & Dark Ties

- All Itzaland Animal Locations in Infinity Nikki

- NBA 2K26 Season 5 Adds College Themed Content

- Elder Scrolls 6 Has to Overcome an RPG Problem That Bethesda Has Made With Recent Games

- Super Animal Royale: All Mole Transportation Network Locations Guide

- Unlocking the Jaunty Bundle in Nightingale: What You Need to Know!

- Critics Say Five Nights at Freddy’s 2 Is a Clunker

- BREAKING: Paramount Counters Netflix With $108B Hostile Takeover Bid for Warner Bros. Discovery

- James Gandolfini’s Top 10 Tony Soprano Performances On The Sopranos

- Gold Rate Forecast

2026-02-20 14:52