Lo and behold, a strategist foretells doom and gloom for Bitcoin, should it fail to cling tenaciously above the $100,000 mark. This prognostication carries whispers of an era’s twilight, alongside a potential vendetta plotted by risk-asset hosts, as interpreted by the insightful mind of Bloomberg Intelligence strategist Mike McGlone. Indeed, the fate of Bitcoin could weigh heavily and tempt it into a grueling pilgrimage, all the way down to the humble realm of $10,000.

$10K: Not So Unthinkable, Once $100K Falters

On a day engraved in the annals of January 18, McGlone, a senior macro strategist, ventured forth on the battlefield of social media platform X-an arena where many tender souls expose their nervous dreams. With earnest diction, he elucidated a grim possibility: Bitcoin’s inability to preserve its lofty perch above $100,000 might signify the arrival of a late-cycle juggernaut, cradling the potential for an inevitable declension.

“$10,000 Bitcoin trajectory-’25 not holding might lead to considerate shorts in ‘26,” he consigned into the void, his words carrying the weight of lifetime wisdom. Scratching beneath the surface, McGlone wove Bitcoin’s fortunes with the broader threads of liquidity and risk-assets-a tapestry rich in historical narrative. Cast your eyes back to the year 2009: Bitcoin, eager to entice, charted a life’s course entangled with epochs marked by reckless monetary injections and raucous swings of investor passion. The present, he warned, sings an atypical melody, battered and reshaped by the relentless hands of differing cycles.

“Ignited in 2009, Bitcoin arose as the beacon of liquidity-pumped reflation within risk-assets, its failure to brandish above $100,000 perhaps betraying a final dance-a melancholic reversion to roots at $10,000,” he expressed with solemn caution.

McGlone garnished his speech with prophetic eloquence as he projected initiatives from long-term moving averages in the year of 2025, with a silver lining potentially forming in early 2026-a scenario he painted as less a new bull market and more a stringent “prove-strength” trial. An era marked by underwhelming risk-adjusted performance since 2021, wild speculation akin to latter-day merchants of doubt, and persistently recurring chart patterns screamed of the likelihood of mean reversion. Ultimately, a retreat to $50,000-no more than a typical hiatus for an asset that dared too much, too swiftly.

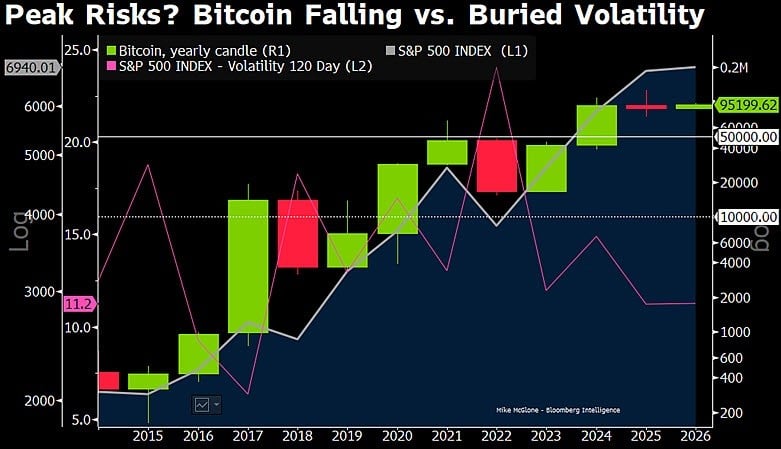

Complementing his words, McGlone unfurled a chart, both illustrative and implicit. Titled “Peak Risks? Bitcoin Down as Silenced Volatility,” it set Bitcoin’s yearly flames against the august S&P 500 lighthouse and 120-day equity turmoil. This amalgamation, he lamented, spells an unfavorable fortune for Bitcoin’s grand ascensions-an ancient adage made newly relevant. Imperative still, a resilient stock market-the backbone upon which Bitcoin and its confederates may someday march forward. Both Bitcoin and gold, each a celestial body in its own right, once delivered divine alpha for a span akin to a decade, until recent upheavals.

Within this grander macroeconomic orchestra, cash-infused cryptocurrencies stand before a curious conundrum-accused of being “up-too-much afflicted.” Thus the nonchalant ‘gold, thy trust may yet be affirmed until the looming eras transpire. In words cast from pessimism’s forge, McGlone pronounced Bitcoin as a guiding beacon as economies wend their way beyond inflation’s shadow.

As investors partake in this intricate dance, the siren song of institutional adoption, exchange-traded funds, and the stalwart security of the vast network interweave. Bitcoin, bound by a disciplined issuance calendar, offers a a muted retort to those volunteering concerns of overabundance. The memories of its past resurgence, following depths of despair, haunt even as discussions of a concluding act ripple through speculative forums.

FAQ ⏰

- Why doth $100,000 hold great significance for Bitcoin?

Beneath the shadow of this fateful figure, one stands at the precipice of late-cycle fragility and beckoning risks, warns McGlone. - What terminal bankruptcy might Bitcoin witness?

A likely path leads sorrowfully towards the embrace of $10,000, as per McGlone’s cosmic wisdom. - What role doth volatility play in Bitcoin’s fate?

The decline of equity volatility paired with lofty stock indices casts shadows over Bitcoin’s expected quintessence. - Does not the embrace of institutions spare Bitcoin?

Alas, fraught though ETFs and institutional forays might appear, the dominant cycles of macroeconomic landscapes chart Bitcoin’s course.

Read More

- Movie Games responds to DDS creator’s claims with $1.2M fine, saying they aren’t valid

- The MCU’s Mandarin Twist, Explained

- All Golden Ball Locations in Yakuza Kiwami 3 & Dark Ties

- These are the 25 best PlayStation 5 games

- SHIB PREDICTION. SHIB cryptocurrency

- Scream 7 Will Officially Bring Back 5 Major Actors from the First Movie

- Server and login issues in Escape from Tarkov (EfT). Error 213, 418 or “there is no game with name eft” are common. Developers are working on the fix

- Rob Reiner’s Son Officially Charged With First Degree Murder

- MNT PREDICTION. MNT cryptocurrency

- Every Death In The Night Agent Season 3 Explained

2026-01-20 04:58