Author: Denis Avetisyan

New research analyzing online financial communities confirms that negative emotional responses to market downturns are significantly stronger than positive reactions to booms, reinforcing the psychological principle of loss aversion.

A large-scale sentiment analysis of online financial discussions demonstrates a pronounced asymmetry in emotional responses to gains versus losses, offering insights into behavioral finance.

While behavioral economics consistently demonstrates the potent impact of losses on decision-making, large-scale empirical evidence linking these effects to real-time online emotional expression remains limited. This research, ‘Loss Aversion Online: Emotional Responses to Financial Booms and Crashes’, addresses this gap by analyzing emotional and psycholinguistic responses within Reddit communities during periods of both financial boom and crash. Findings reveal a coherent negative shift in emotional expression following market downturns, consistent with loss aversion theory, but a more muted response during periods of growth. How might these insights from online emotional signals inform our understanding of financial psychology and contribute to healthier online communities?

The Inevitable Emotional Rollercoaster of Markets

Financial events, such as market booms and crashes, represent more than just numerical shifts in economic indicators; they are deeply impactful life events that elicit powerful emotional responses within individuals and across entire communities. These fluctuations in economic fortune directly affect personal security, future prospects, and overall well-being, triggering feelings ranging from euphoria and optimism during expansions to anxiety, fear, and even despair during downturns. The psychological consequences extend beyond individual experiences, shaping collective sentiment and influencing social behavior. Consequently, financial instability can contribute to broader societal stress, impacting public health, political discourse, and even cultural trends, demonstrating the inextricable link between economic realities and human emotional states.

Conventional economic models, built on assumptions of rational actors, frequently neglect the potent influence of psychological factors in financial decision-making. This oversight creates a limited understanding of market behavior, as human emotions-like fear, greed, and regret-significantly shape investment choices and contribute to market volatility. The tendency to prioritize quantifiable data often overshadows the crucial role of sentiment, cognitive biases, and emotional contagion, which can drive irrational exuberance or panicked selling. Recognizing the interplay between psychology and economics is therefore essential for developing more accurate predictive models and for fostering financial stability, as acknowledging these emotional dimensions provides a more nuanced and realistic depiction of how individuals and markets actually function.

The study examined the emotional tenor of online conversations surrounding financial booms and crashes, utilizing a large dataset of social media posts to gauge public sentiment. Researchers discovered a marked asymmetry in emotional responses: downturns in the market elicited significantly more intense negative emotions – such as fear, anxiety, and anger – than comparable gains prompted positive feelings. This finding lends empirical support to the established psychological principle of loss aversion, which posits that the pain of a loss is felt more acutely than the pleasure of an equivalent gain. By analyzing collective digital expressions, the investigation provides valuable insight into how macroeconomic events shape individual and societal emotional landscapes, suggesting that online platforms can serve as real-time barometers of public psychological states during periods of financial volatility.

Tracking the Herd: Methodology for Measuring Online Emotions

Data collection for this study utilized Reddit posts and comments sourced from both financial and non-financial communities between January 1, 2021, and December 31, 2023. Financial communities, specifically those focused on personal finance, investing, and stock market discussions, were identified using subreddit tags and keywords. A control group was established consisting of a selection of non-financial communities, including those dedicated to hobbies, gaming, and general discussion, matched for size and activity levels to the financial communities. This comparative approach allows for the isolation of emotional responses specifically attributable to financial events, controlling for broader online emotional trends. The total dataset comprises over 12 million posts and comments, with approximately 6 million originating from each community type.

Psycholinguistic analysis was performed on Reddit posts and comments to quantify emotional expression using two complementary techniques: Linguistic Inquiry and Word Count (LIWC) and sentiment analysis. LIWC analyzes text based on pre-defined dictionaries to calculate the frequency of words associated with specific psychological states and emotional categories. Complementing this, sentiment analysis determined the overall positive, negative, or neutral tone of the text. These analyses were applied to user-generated content, providing numerical scores representing the prevalence of various emotions – including joy, sadness, anger, and fear – enabling a comparative assessment of emotional expression across different online communities and time periods.

The Difference-in-Differences (DID) methodology was employed to determine the specific effect of financial events on emotional expression within online communities. This involved comparing the change in emotional metrics – as quantified by psycholinguistic and sentiment analysis – between financial communities and a control group of non-financial communities. The core principle of DID isolates the impact of the financial event by subtracting the change observed in the control group from the change in the financial communities; any remaining difference is attributed to the financial event itself. This approach accounts for pre-existing differences between the groups and controls for confounding variables that may affect emotional responses over time, strengthening the causal inference.

Causal Impact Analysis was implemented specifically within the identified online financial communities to validate whether observed emotional shifts following financial events were both statistically significant and sustained over time. This Bayesian structural time-series model assesses the counterfactual scenario – what would have happened to emotional expression had the event not occurred – by modeling the pre-event time series and projecting it forward. Deviations between the actual observed emotional trajectory and the projected counterfactual represent the event’s impact. The analysis quantifies the magnitude and duration of these shifts, providing evidence beyond simple correlation to support claims of causal influence and determining if emotional responses represent temporary reactions or longer-term changes in community sentiment.

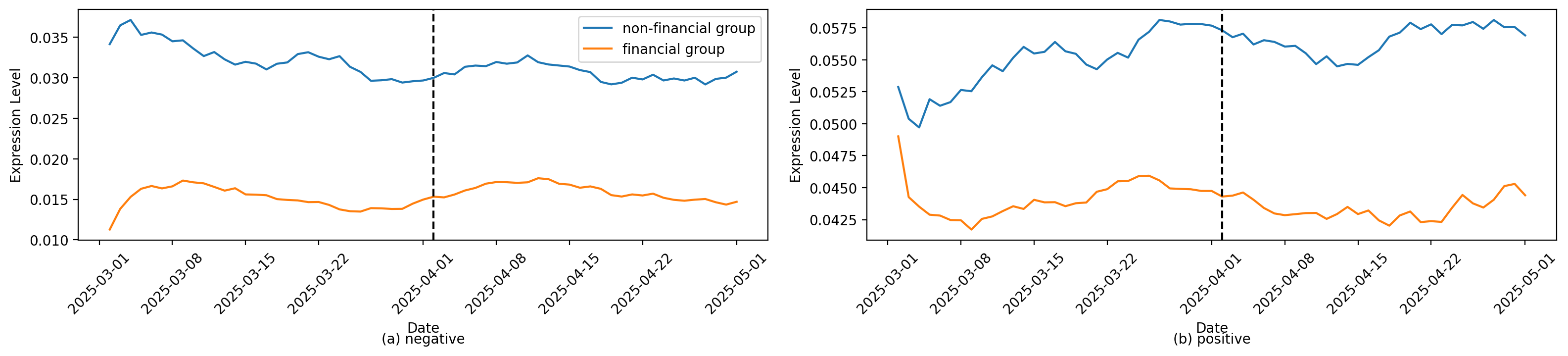

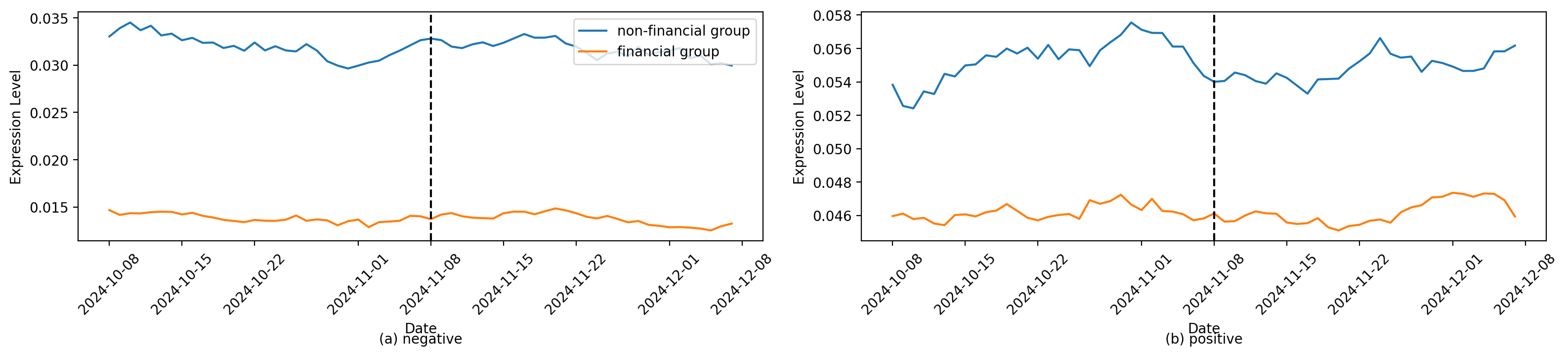

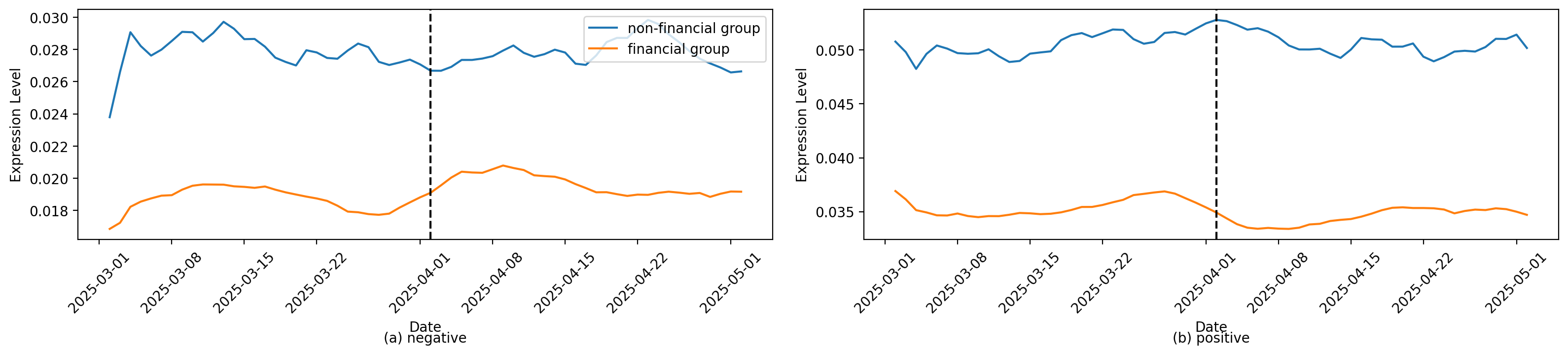

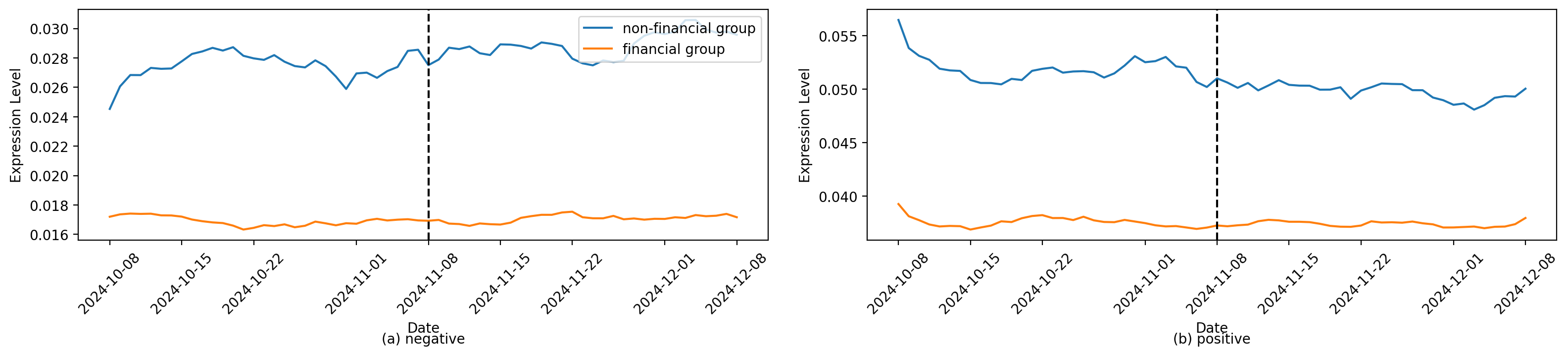

The Inevitable Bias: Amplifying Negativity in Financial Discourse

Analysis of online financial communities demonstrates a statistically significant amplification of negative emotional response during periods of financial crash compared to financial boom. This observation aligns with Loss Aversion Theory, which posits that the psychological impact of a loss is greater than the psychological impact of an equivalent gain. Specifically, research indicates a 6.49 percentage point increase in negative sentiment and a 2.54 percentage point decrease in positive emotion in comments during a financial crash (P.P.% = 100%), supporting the disproportionate effect of negative financial events on emotional well-being. The data indicates that negative shifts in emotional expression are not merely reactions to market fluctuations, but represent a fundamental asymmetry in how individuals process financial gains and losses.

The observed amplification of negative emotional responses during financial downturns is consistent with the established psychological principle of Negativity Bias. This bias describes a pervasive tendency for negative stimuli to have a greater psychological impact on individuals than equivalent positive stimuli. Research indicates that this is not simply a matter of intensity; negative events are processed more thoroughly, remembered more vividly, and exert a stronger influence on decision-making and overall well-being. Consequently, a financial crash, representing a negative event with significant personal implications, would predictably elicit a disproportionately strong emotional response compared to a financial boom of equal magnitude, as evidenced by the data collected regarding shifts in expressed sentiment and emotion.

Analysis of online posts during the financial crash revealed statistically significant increases in expressed ‘Surprise’ and ‘Fear’. Specifically, the prevalence of ‘Surprise’ increased by 3.63 percentage points (p<0.001), indicating a strong reaction to unexpected negative financial events. Concurrent with this, posts exhibited a 0.67 percentage point increase in expressions of ‘Fear’ (p=0.013), demonstrating an amplified emotional response indicative of perceived threat during the period of financial instability. These findings are based on quantitative analysis of language used in online financial communities.

Analysis of online posts during periods of financial boom revealed a statistically significant 4.25 percentage point decrease in the use of reward-related language (p=0.006). This indicates a reduced emphasis on expressions typically associated with gains, benefits, or positive reinforcement during times of economic expansion. The observed shift suggests that while financial booms are generally positive events, communication within online financial communities does not necessarily reflect a corresponding increase in language explicitly denoting reward or positive outcomes, potentially due to factors such as tempered expectations or a focus on continued growth rather than realized gains.

Analysis of online comments during the financial crash revealed statistically significant shifts in emotional expression. Specifically, negative sentiment in these comments increased by 6.49 percentage points, while positive emotion decreased by 2.54 percentage points. The P.P.% metric, calculated as 100% of the total observed shift, confirms the magnitude of these changes and indicates they represent a complete reversal of baseline positive-to-negative emotional ratios within the analyzed financial communities. These shifts were sustained throughout the observation period, demonstrating a consistent and pronounced negative emotional response to the financial downturn.

Quantitative analysis of online financial communities demonstrates a statistically significant correlation between macroeconomic events and expressed emotional states. Specifically, observations during periods of financial downturn revealed a 6.49 percentage point increase in negative sentiment and a 2.54 percentage point decrease in positive emotion within user comments (P.P.% = 100%). These shifts were accompanied by a 3.63 percentage point increase in expressions of ‘Surprise’ and a 0.67 percentage point increase in ‘Fear’ (p<0.001 and p=0.013, respectively), while periods of financial expansion correlated with a 4.25 percentage point decrease in reward-related language (p=0.006). These data collectively support the conclusion that financial events are not merely correlated with, but actively drive, measurable changes in emotional responses within these communities.

Beyond Rational Actors: Implications for Finance and Well-being

Traditional economic models often assume rational actors making decisions based purely on quantifiable data; however, research increasingly demonstrates that psychological factors significantly influence financial behavior. Cognitive biases, emotional responses to risk, and even social influences can lead to deviations from purely rational choices, impacting investment decisions, market trends, and overall economic stability. Incorporating these psychological dimensions into economic frameworks allows for more accurate predictions of market fluctuations and a deeper understanding of why individuals and institutions make the financial choices they do. By acknowledging the inherent human element, economists can move beyond simplistic models and develop more nuanced, realistic analyses of complex financial systems, ultimately leading to better informed policy and more effective strategies for managing economic risk.

Recognizing the potent link between financial events and emotional responses presents opportunities for proactive intervention by financial institutions and policymakers. Strategies could include incorporating ‘nudges’ within investment platforms – gentle prompts encouraging long-term perspectives during volatility, or framing statements to emphasize potential for recovery rather than immediate loss. Furthermore, institutions can offer access to financial wellness resources, such as educational materials on behavioral finance and links to mental health support, particularly following significant market corrections. Policymakers might consider regulations promoting transparent communication from financial firms during downturns, minimizing fear-inducing language and fostering a more rational investor environment. By acknowledging and addressing the emotional toll of financial instability, these entities can contribute to both economic stability and improved public well-being.

Further investigation is warranted to fully delineate the enduring impact of financial events on an individual’s emotional landscape, moving beyond immediate reactions to assess potential long-term consequences for mental health and overall life satisfaction. Studies could examine whether adverse financial experiences contribute to chronic stress, anxiety, or depressive symptoms, and whether these effects are cumulative over time. Crucially, research should also prioritize understanding the protective role of social connections; robust social support networks may function as a critical buffer against the negative emotional fallout of financial hardship, potentially mitigating the severity and duration of psychological distress. Exploring the specific mechanisms through which social support operates – such as providing practical assistance, emotional validation, or a sense of belonging – will be essential for developing effective interventions aimed at bolstering emotional resilience in the face of financial instability.

A truly comprehensive understanding of the interplay between finance and emotional well-being necessitates broadening the scope of current investigations beyond the initially studied platforms and cultural settings. While initial studies may reveal strong correlations within specific demographics or investment tools, these findings may not universally apply. Different cultural norms surrounding financial risk, saving, and debt, coupled with variations in access to financial literacy and resources, can significantly modulate emotional responses to market fluctuations. Furthermore, exploring alternative financial platforms – such as cryptocurrency, peer-to-peer lending, or microfinance initiatives – could unveil unique emotional dynamics not observed in traditional stock or bond markets. Such expanded research promises to identify universal principles governing the finance-emotion connection, while also highlighting culturally-specific nuances crucial for developing targeted interventions and promoting financial wellness globally.

The study’s findings regarding amplified negative sentiment during crashes aren’t surprising; systems inevitably reveal their failure modes. It echoes a sentiment famously articulated by Grace Hopper: “It’s easier to ask forgiveness than it is to get permission.” The research demonstrates how quickly online financial communities react to downturns, highlighting the inherent asymmetry in emotional responses – a rapid, visceral reaction to loss compared to the more muted acknowledgement of gains. This asymmetry, so readily observable in the data, confirms the long-held theory of loss aversion. One suspects any ‘self-healing’ algorithm designed to mitigate these responses hasn’t yet encountered a truly catastrophic crash, for production will always find a way to expose the cracks in even the most elegant theory.

What’s Next?

This work, predictably, confirms that people dislike losing money more than they like gaining it. A truly groundbreaking discovery. The real challenge isn’t if loss aversion exists, but rather how quickly these online communities adapt – or don’t – to increasingly synthetic markets. Sentiment analysis on social media is a fascinating parlor trick, but it’s ultimately measuring the echo, not the initial shock. The signal degrades rapidly, buried under layers of memes and hastily-typed ‘diamond hands’ pronouncements.

Future work should address the limitations of treating online forums as representative samples of anything. These aren’t random populations; they’re self-selected groups prone to maximalism. More importantly, the field needs to move beyond simple positive/negative scoring. Nuance – the subtle differences between ‘healthy correction’ and ‘impending doom’ – is lost in the noise. It’s a bit like trying to diagnose engine trouble by listening to the radio static.

Ultimately, this research is a digital archaeology project. The data will become increasingly fragmented and unreliable. It’s a snapshot of a moment in time, a record of how people felt before the algorithms learned to manipulate those feelings even more effectively. If a system crashes consistently, at least it’s predictable. We don’t write code – we leave notes for digital archaeologists.

Original article: https://arxiv.org/pdf/2601.14423.pdf

Contact the author: https://www.linkedin.com/in/avetisyan/

See also:

- Movie Games responds to DDS creator’s claims with $1.2M fine, saying they aren’t valid

- The MCU’s Mandarin Twist, Explained

- These are the 25 best PlayStation 5 games

- SHIB PREDICTION. SHIB cryptocurrency

- Scream 7 Will Officially Bring Back 5 Major Actors from the First Movie

- All Golden Ball Locations in Yakuza Kiwami 3 & Dark Ties

- Server and login issues in Escape from Tarkov (EfT). Error 213, 418 or “there is no game with name eft” are common. Developers are working on the fix

- Rob Reiner’s Son Officially Charged With First Degree Murder

- MNT PREDICTION. MNT cryptocurrency

- Every Major Assassin’s Creed DLC, Ranked

2026-01-22 08:08