The trigger? A jobs report so dismal it could make a mime cry. August saw the U.S. add just 22,000 jobs – which is about as impressive as a chocolate teapot. Analysts were expecting 75,000. That’s like ordering a steak and getting a soggy cracker. Naturally, Wall Street collectively flipped their playbooks faster than a pancake on steroids.

- Bank of America: Once the proud defenders of “no cuts,” they’ve now joined the dark side, penciling in two 25-basis-point trims for September and December. One might say they’ve seen the error of their ways-or at least the error of their spreadsheets. 📉

- Goldman Sachs: Ever the overachievers, they’re betting on three cuts-September, October, November. It’s almost like they’re trying to outdo everyone else at the party. Or maybe they just really want to get home early. 🏃♂️💨

- Citigroup: Not to be left out, they’re also predicting three cuts, shaving off 75 basis points in equal steps. Apparently, symmetry is very in this season. ✂️

If you’re keeping score-and let’s face it, who isn’t?-that’s a near-unanimous pivot from “no cuts” to “multiple cuts incoming.” It’s like watching a flock of sheep suddenly decide they’re all going vegan. 🐑🥗

Why It Matters for Crypto (Or: Why Your Wallet Might Get Fat) 💰

When rates fall, money gets cheaper, credit flows like cheap wine at a wedding, and investors suddenly remember they like risk. And where does that risk-loving cash go? Straight into speculative assets like Bitcoin, Ethereum, Solana-you name it. Rate cuts in 2025 could be the opening act for the next liquidity wave, the kind of macro backdrop that historically sends crypto into bull mode faster than you can say “HODL.” 🚀

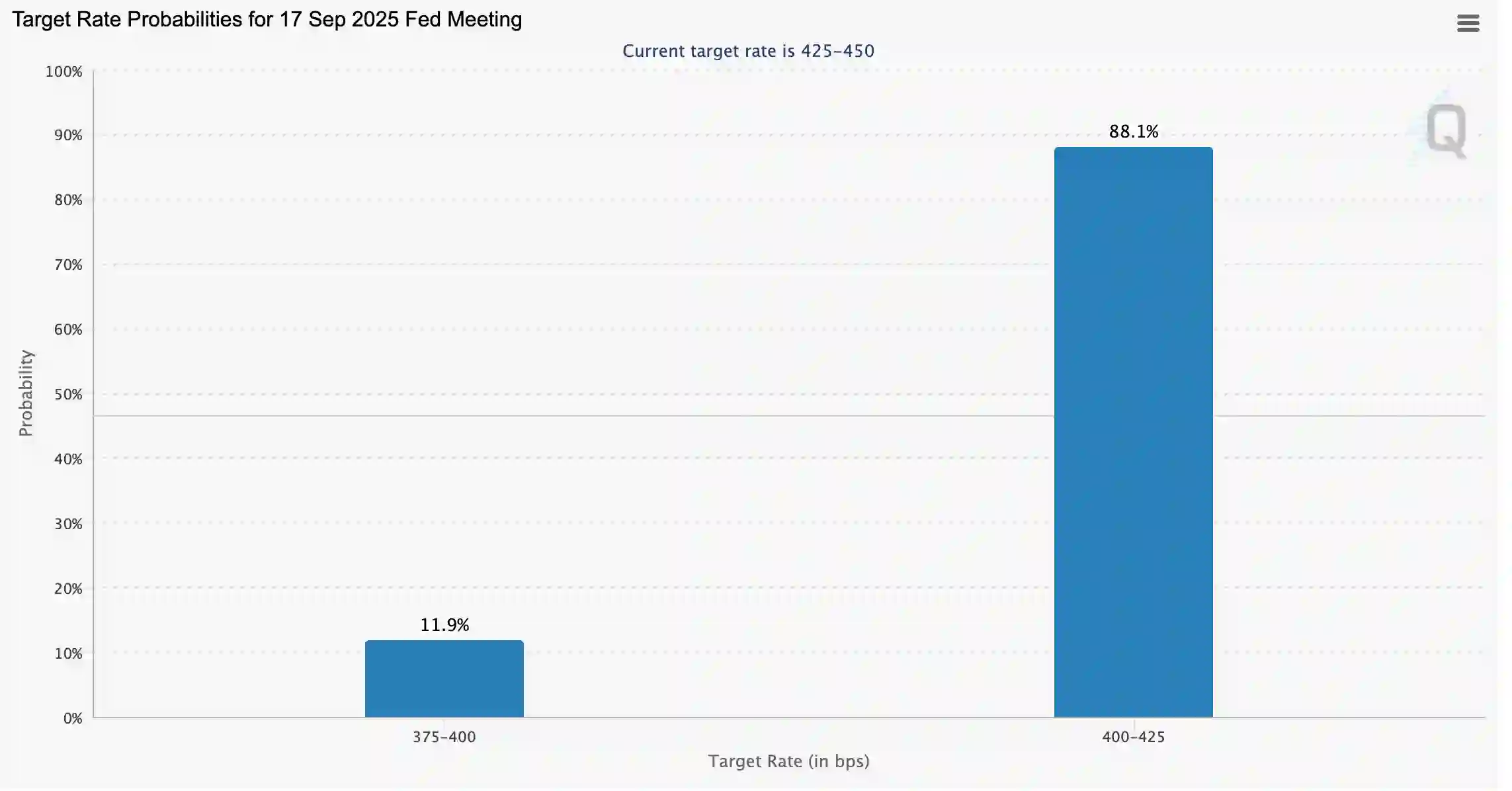

The Chicago Mercantile Exchange’s FedWatch tool shows traders are already smelling the coffee-or perhaps the champagne. There’s an 88% chance of a 25bps cut at the September FOMC meeting, with a cheeky 12% calling for 50bps. That’s consensus, folks. The market has spoken, and it sounds suspiciously like a cash register. 💳🔔

The Fed’s Dilemma (Or: How to Herd Cats While Juggling Chainsaws) 🐱🪄

Powell himself hinted at this madness during his Jackson Hole speech in late August. The Fed’s twin mandate-jobs and inflation-is being squeezed tighter than a tube of toothpaste in a dystopian future. Inflation is cooling, but job growth is wobbling harder than a toddler on a sugar high. With the labor market cracking, “maximum employment” is under threat, and the Fed may have no choice but to cut rates to keep the wheels from coming off the economic clown car. 🚗🤡

For crypto traders, rate cuts are bullish by design. Liquidity sloshes around like beer at a frat party, and risk assets-the ones that thrive when money is cheap-get the biggest tailwind. The Fed may still pretend it’s the boss of everything, but the market has already decided: 2025 is shaping up to be risk-on. So grab your popcorn (and maybe some antacids). This is going to be a wild ride. 🎢🎢

Read More

- All Golden Ball Locations in Yakuza Kiwami 3 & Dark Ties

- All Itzaland Animal Locations in Infinity Nikki

- NBA 2K26 Season 5 Adds College Themed Content

- Critics Say Five Nights at Freddy’s 2 Is a Clunker

- Super Animal Royale: All Mole Transportation Network Locations Guide

- Elder Scrolls 6 Has to Overcome an RPG Problem That Bethesda Has Made With Recent Games

- BREAKING: Paramount Counters Netflix With $108B Hostile Takeover Bid for Warner Bros. Discovery

- James Gandolfini’s Top 10 Tony Soprano Performances On The Sopranos

- Gold Rate Forecast

- Unlocking the Jaunty Bundle in Nightingale: What You Need to Know!

2025-09-06 23:34