Wall Street, that grand theater of capitalism’s farce, has once again proven its flair for dramatic exits. As the crypto market collapsed into a fiscal pantomime, fund managers scrambled to discard their altcoin ETFs like hot potatoes at a masquerade ball. Billions vanished in the blink of an eye, victims of liquidity that evaporated faster than a mirage in a desert of speculation.

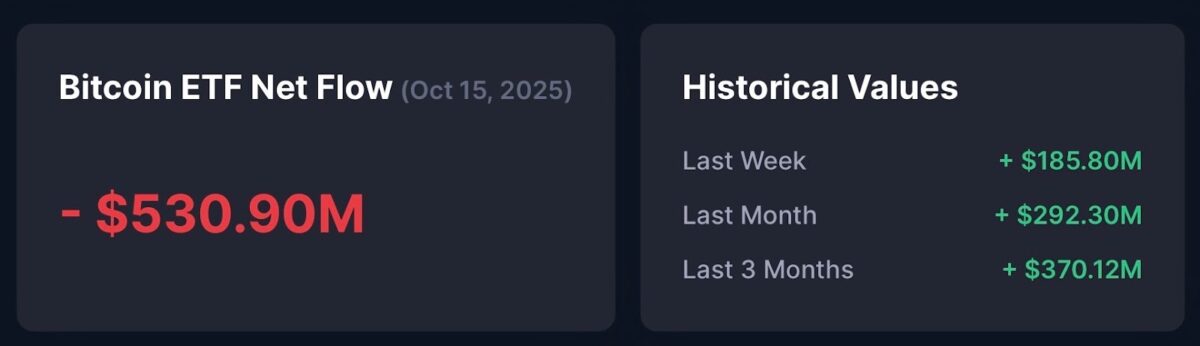

Farside Investors, that paragon of financial clarity, reported U.S. Bitcoin ETFs hemorrhaging $530 million in 24 hours-a fiscal tragedy rivaling the fall of Byzantium. ARK Invest’s ARKB, now a ghost of its former self, shed $275 million, while Fidelity’s FBTC followed suit with a $132 million waltz into oblivion. Bitcoin, that digital Icarus, plummeted below $105,000, and altcoins? They dissolved into vapor, their value slashed by 70% in a week-a performance worthy of a Shakespearean tragedy… if Shakespeare had ever met a blockchain.

The exodus laid bare the fragile architecture of these crypto-linked ETFs, which crumbled like a house of cards in a hurricane. Yet amid the chaos, Bitcoin clung to life with the tenacity of a moth drawn to flame. Enter ElonTrades, that modern-day oracle of X, declaring, “When gold peaked in August 2020, BTC sprinted from $10K to $60K. Now we’re seeing a similar setup!” One might call it poetic justice-or perhaps a cry for help disguised as analysis.

“When gold peaked in August 2020, $BTC ran from $10K to $60K within months.

Now we’re seeing a similar setup; gold euphoric (RSI > 85), BTC oversold (~32), and macro conditions starting to ease.”

-ElonTrades (@ElonTrades) October 17, 2025

ETF Innovation Continues Despite Market Turmoil

If you thought the collapse would silence the siren song of innovation, you’d be mistaken. 21Shares, that Swiss alchemist of assets, boldly filed for a 2x leveraged ETF tied to Hyperliquid’s HYPE token-a DeFi governance asset that thrives on chaos. Imagine, if you will, a financial instrument that doubles your risk just as regulators sharpen their pencils and investors clutch their pearls. A masterstroke? A suicide note? Only time will tell, but it’s undeniably theatrical.

Thus, the ETF market splits into two camps: Wall Street, retreating like Scrooge McDuck from a sinking ship, and crypto issuers, charging ahead with the reckless glee of gamblers at a roulette table. A comedy of errors, really. And somewhere in the middle, Bitcoin twitches-neither savior nor villain, just a star in a script no one wrote. 🎭🧨

Read More

- Movie Games responds to DDS creator’s claims with $1.2M fine, saying they aren’t valid

- The MCU’s Mandarin Twist, Explained

- These are the 25 best PlayStation 5 games

- SHIB PREDICTION. SHIB cryptocurrency

- Scream 7 Will Officially Bring Back 5 Major Actors from the First Movie

- All Golden Ball Locations in Yakuza Kiwami 3 & Dark Ties

- Server and login issues in Escape from Tarkov (EfT). Error 213, 418 or “there is no game with name eft” are common. Developers are working on the fix

- Rob Reiner’s Son Officially Charged With First Degree Murder

- MNT PREDICTION. MNT cryptocurrency

- ‘Stranger Things’ Creators Break Down Why Finale Had No Demogorgons

2025-10-17 21:59