Darling, Venezuela’s back on the global stage, and the crypto crowd is all aflutter! But fear not, my dears, for the on-chain data whispers of mere caution, not the hysterical wails of a market in freefall. How positively restrained! 🧐✨

Traders in a Tizzy? The Data Says, “Calm Your Nerves, Darlings!”

Oh, the drama of it all! Whenever the geopolitical winds blow, the market darlings get their knickers in a twist. And now, Venezuela has sashayed back into the spotlight, leaving crypto traders clutching their pearls. But hold your horses, my loves! A report shared by Cryptoquant on January 5th reveals that while there’s a smidge of tension, it’s hardly the stuff of panic. How utterly civilized! 🍸

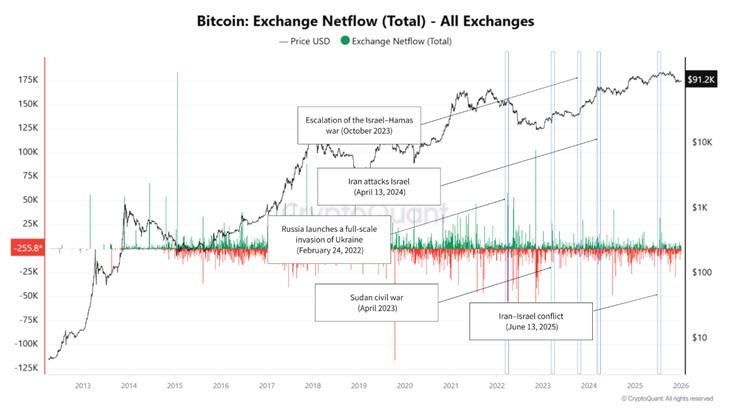

The ever-so-clever minds at XWIN Research, a Japan-based crypto think tank, have taken their magnifying glasses to the matter. They’ve examined how bitcoin exchange netflows behave during geopolitical shenanigans. Their verdict? Darling, it’s all rather predictable. 🕵️♂️

The metric to watch, my darlings, is Exchange Netflow. It’s the darling of indicators, showing whether bitcoin is waltzing into exchanges (oh, the horror of selling!) or sashaying out (how chic, holding on!).

They’ve reviewed the grand dramas of our time: Russia’s Ukrainian escapade, Sudan’s civil war, the Israel-Hamas tango, and Iran’s theatrics. In each case, bitcoin prices did their little jitterbug, but sustained inflows? Hardly. No one’s rushing for the exits, darlings. How reassuring! 💃🕺

And the pièce de résistance? Since 2023, the market’s grown a backbone. Initial flutters fade faster than a fashion trend. Witness bitcoin strutting at $93,055, with a market cap of $1.85 trillion and daily trading volume of $38.07 billion. Darling, that’s engagement, not retreat! 💎

As for Venezuela, it’s the same old song. A bit of price sensitivity, but no stampede to sell. The market’s cautious, not catatonic. How utterly mature! 🧘♀️

Technically speaking, darling, bitcoin’s holding above $90,000, forming higher lows, and lounging near $93,000. No breakdowns here, just a bit of consolidation. How dreadfully composed! 📈

Contrast this with the real dramas-U.S.-China trade tiffs, regulatory crackdowns, or liquidity lockdowns. Now those are the plots that shake the crypto world! 🌪️

The conclusion, my dears? Venezuela’s just another act in the grand play. The market’s watching, not fleeing. How utterly Noël Coward of it all! 🎭

FAQ📍

- How’s Venezuela ruffling bitcoin feathers?

Darling, it’s all caution, no chaos. Investors are sipping their martinis, not selling their souls. 🍸 - What’s the Exchange Netflow gossip during geopolitical dramas?

Historically, darlings, even in the thick of it, sustained inflows are as rare as a quiet night in Soho. No panic selling here! 🚫💨 - Why’s bitcoin so blasé about local conflicts?

The market’s grown up, darling. It knows the difference between a headline and a hurricane. 🌪️ - What should one watch if Venezuela turns into a real thriller?

Keep an eye on netflows and liquidity, darling. Only global financial earthquakes cause real crypto tremors. 🌍💥

Read More

- All Itzaland Animal Locations in Infinity Nikki

- Exclusive: First Look At PAW Patrol: The Dino Movie Toys

- All Golden Ball Locations in Yakuza Kiwami 3 & Dark Ties

- James Gandolfini’s Top 10 Tony Soprano Performances On The Sopranos

- Unlocking the Jaunty Bundle in Nightingale: What You Need to Know!

- Gold Rate Forecast

- Ethereum’s Volatility Storm: When Whales Fart, Markets Tremble 🌩️💸

- 7 Lord of the Rings Scenes That Prove Fantasy Hasn’t Been This Good in 20 Years

- Super Animal Royale: All Mole Transportation Network Locations Guide

- Elder Scrolls 6 Has to Overcome an RPG Problem That Bethesda Has Made With Recent Games

2026-01-05 18:03