While the crypto circus limps along, its clowns nursing bruised egos and empty wallets, a quieter spectacle unfolds in the shadows: the tokenized U.S. Treasury market, a digital mirage of financial respectability, has swallowed $1.9 billion since the year’s dawn. Ah, the irony! The very assets once deemed ‘boring’ now outshine their volatile brethren.

Digital Treasuries: A Slow Waltz to $11 Billion

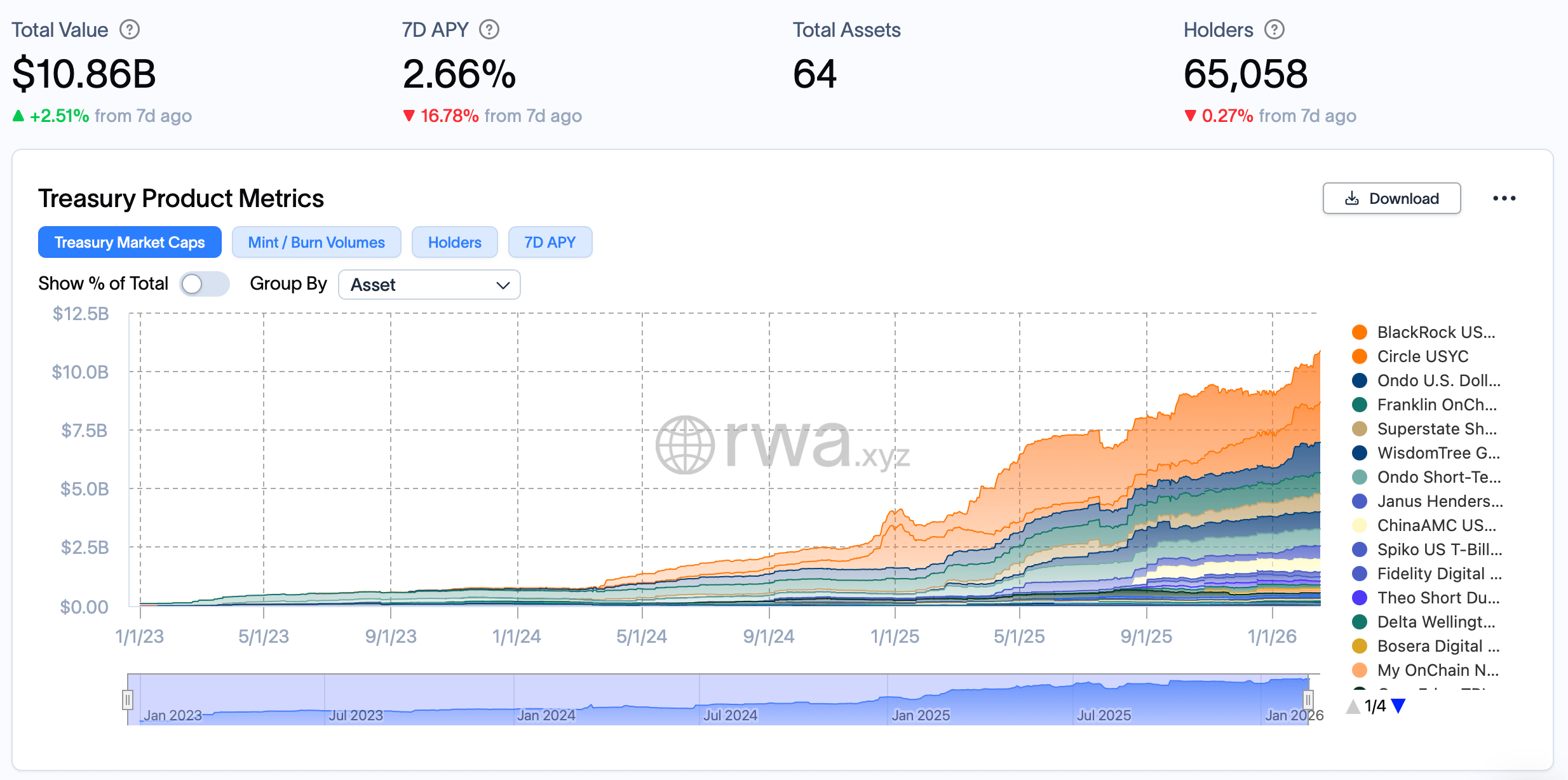

This week, rwa.xyz data reveals the tokenized U.S. Treasuries sector tiptoeing 2.51% closer to the $11 billion precipice, currently lounging at $10.86 billion. A modest gain, perhaps, but in this theater of the absurd, every step forward is a triumph of hope over experience.

Rwa.xyz, ever the diligent chronicler, notes the average seven-day annual yield at 2.66%, a 16.78% tumble from last week. The bond holders, a mere 65,058 souls, have dipped by 0.27%. Ah, the fickle nature of digital allegiance! Ethereum, that grand dame of blockchains, still reigns supreme with $5.5 billion, while BNB Chain ($2.1 billion), Solana ($892.6 million), and Stellar ($829.3 million) trail in her wake. The lesser chains-Aptos, XRP Ledger, Avalanche C-Chain, Arbitrum-each clutch their modest shares, like courtiers vying for favor.

In the past month, Blackrock’s BUIDL fund led the charge with $460 million, a sum that would make a tsar blush. Ondo’s USDY ($302 million) and Circle’s USYC ($251 million) followed, while Superstate’s USTB ($148 million) and Centrifuge’s JTRSY ($103 million) brought up the rear. Even the smaller players-Spiko’s USTBL ($37 million), Libeara’s CUMIU ($31 million), Zeconomy’s DCP ($30 million)-added their crumbs to the feast.

Yet, not all is rosy in this digital idyll. Fidelity’s FDIT shed $36 million, and Ondo’s OUSG bled $45 million. Such is the ebb and flow of this peculiar market, where even the mighty stumble. With 64 treasury products in play, Blackrock’s BUIDL ($2.17 billion) sits atop the heap, trailed by Circle’s USYC ($1.71 billion) and Ondo’s USDY ($1.28 billion). Franklin Templeton’s BENJI ($897.1 million) and Superstate’s USTB ($771.9 million) complete the pantheon of digital titans.

As the sector teeters on the brink of $11 billion, one cannot help but wonder: is this a revolution or a mere sideshow? Capital flows steadily, like a river carving its path through the digital wilderness, yet the question lingers-are we witnessing the future of finance or a fleeting fancy? Growth persists, unhurried and unrelenting, as if guided by some unseen hand. If this pace holds, $11 billion will be but a waystation on a longer, stranger journey.

FAQ ❓

- What is the total value of the tokenized U.S. Treasury market in 2026? The sector hovers at $10.86 billion, a stone’s throw from $11 billion-a milestone that seems less like destiny and more like an afterthought.

- How much has flowed into tokenized U.S. Treasuries this year? Since 2026 began, these products have absorbed $1.9 billion, a testament to the enduring allure of the mundane.

- Which blockchain hosts the most tokenized U.S. Treasury products? Ethereum, with $5.5 billion, remains the undisputed monarch of this digital realm.

- Which funds control the largest share of tokenized Treasury assets? Blackrock’s BUIDL leads with $2.17 billion, followed by Circle’s USYC and Ondo’s USDY-a triumvirate of digital prowess.

Read More

- Exclusive: First Look At PAW Patrol: The Dino Movie Toys

- All Itzaland Animal Locations in Infinity Nikki

- Gold Rate Forecast

- Super Animal Royale: All Mole Transportation Network Locations Guide

- When is Pluribus Episode 5 out this week? Release date change explained

- 7 Lord of the Rings Scenes That Prove Fantasy Hasn’t Been This Good in 20 Years

- Firefly’s Most Problematic Character Still Deserves Better 23 Years Later

- James Gandolfini’s Top 10 Tony Soprano Performances On The Sopranos

- These are the 25 best PlayStation 5 games

- Zootopia 2 Director Reveals Idris Elba Actually Ad-libbed A Funny Line, And Fans Are Impressed

2026-02-18 00:57