Author: Denis Avetisyan

New research reveals how geographical concentration and firm characteristics are shaping success in Britain’s rapidly evolving artificial intelligence economy.

This study analyzes the factors driving firm performance within the UK AI ecosystem, highlighting the importance of scale, specialization, and regional innovation clusters.

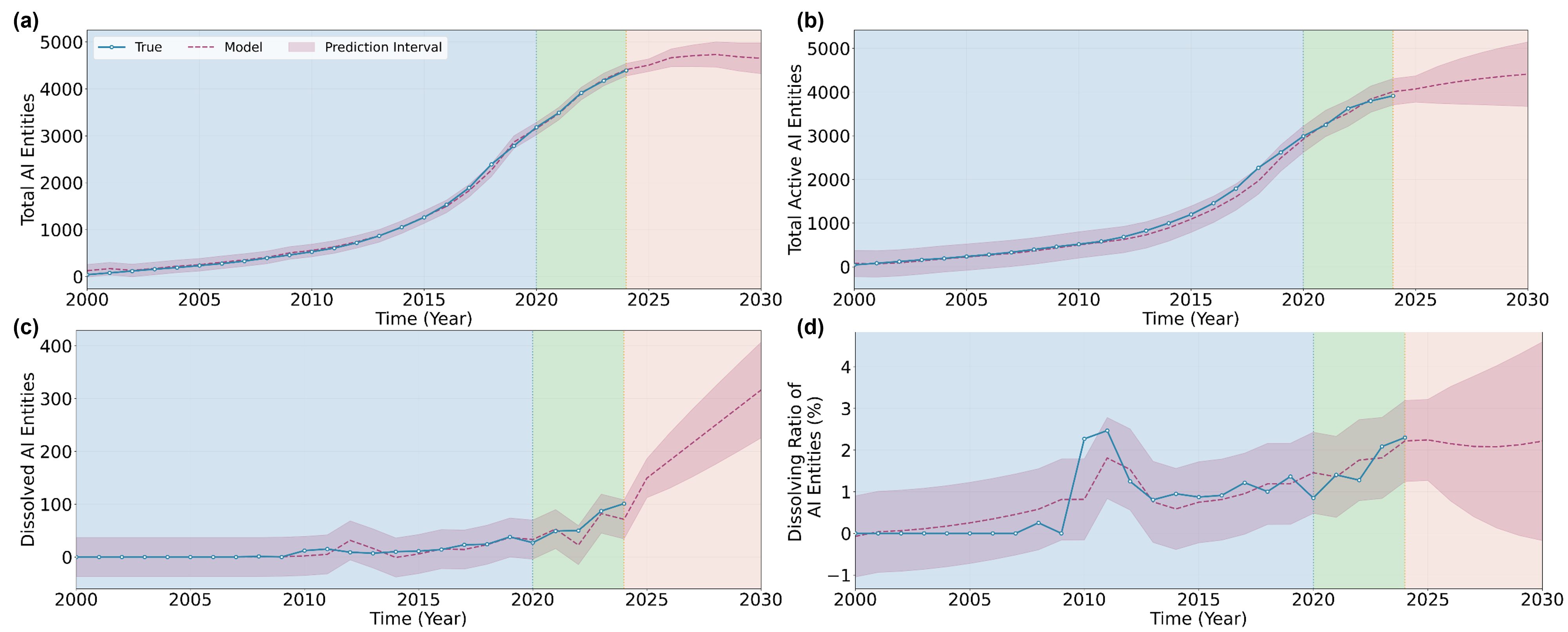

Despite rapid growth in the UK’s artificial intelligence sector, a comprehensive understanding of the interplay between firm performance, geographical concentration, and regional socioeconomic factors remains elusive. This study, ‘Code, Capital, and Clusters: Understanding Firm Performance in the UK AI Economy’, analyzes a novel dataset of UK AI entities to reveal that firm size and technical specialization are primary revenue drivers, significantly influenced by local conditions. Our findings project sectoral expansion to 4,651 entities by 2030 alongside increasing consolidation, suggesting a shift toward slower growth and heightened competition. How can policymakers strategically shape these evolving AI ecosystems to foster both aggregate growth and balanced regional development beyond London?

The Ascendance of Artificial Intelligence: A Technological Imperative

Artificial Intelligence has swiftly transitioned from a futuristic concept to a foundational technology, comparable to electricity or the internet in its potential for widespread impact. This maturation isn’t limited to isolated applications; instead, AI is proving to be a general-purpose technology – one that meaningfully accelerates progress across diverse sectors like healthcare, finance, manufacturing, and transportation. The technology’s ability to automate complex tasks, analyze vast datasets, and generate novel insights is driving productivity gains and enabling innovations previously considered unattainable. Consequently, AI is not merely enhancing existing processes, but fundamentally reshaping industries and creating entirely new economic opportunities, solidifying its position as a defining technology of the 21st century and beyond.

The leap from conceptual artificial intelligence to practical applications stems largely from concurrent progress in both computational hardware and the development of Deep Learning algorithms. Historically, AI faced limitations due to the inability of available hardware to process the complex calculations required for sophisticated models. However, innovations like Graphics Processing Units (GPUs), originally designed for gaming, provided the necessary parallel processing power. Simultaneously, Deep Learning-a subset of machine learning utilizing artificial neural networks with multiple layers-allowed algorithms to learn from vast datasets with minimal human intervention. This synergistic relationship unlocked the potential for AI to move beyond theoretical exercises and become commercially viable, enabling breakthroughs in areas like image recognition, natural language processing, and predictive analytics – ultimately driving the current wave of AI-powered innovation.

The accelerating advancements in artificial intelligence have attracted considerable financial investment and prompted proactive governmental responses worldwide. National strategies, such as the UK’s Industrial Strategy and subsequent AI Action Plan, demonstrate a growing recognition of AI’s transformative potential and the need to cultivate a supportive ecosystem for its development and deployment. These initiatives typically involve substantial funding commitments directed toward research and development, skills training programs designed to address the emerging talent gap, and the establishment of ethical guidelines to navigate the societal implications of increasingly sophisticated AI systems. This policy focus extends beyond mere financial support; it also encompasses efforts to foster collaboration between academia, industry, and government, creating a dynamic environment conducive to innovation and ensuring that the benefits of AI are widely shared.

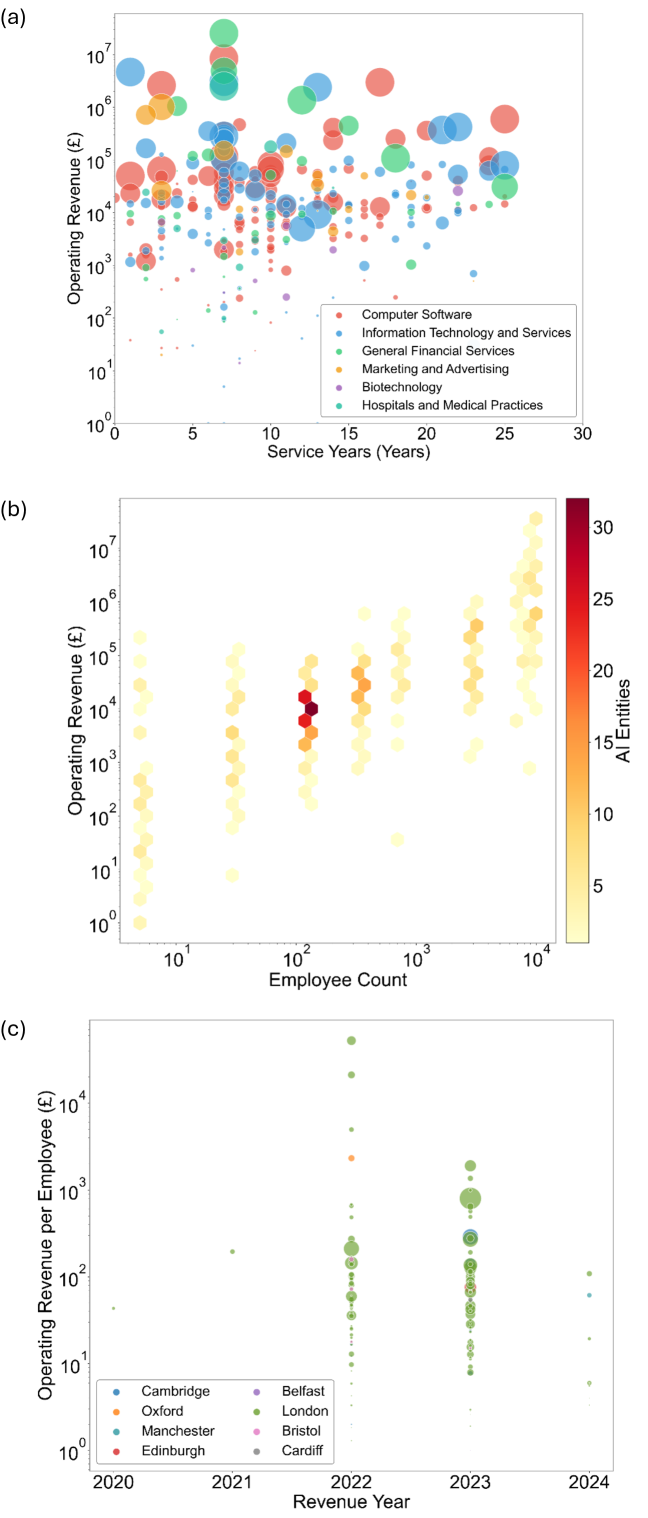

The United Kingdom currently holds a prominent position in the global artificial intelligence arena, ranking third in overall valuation amongst nations. However, maintaining this competitive edge and fostering continued growth necessitates a detailed comprehension of the AI ecosystem’s intricacies. A comprehensive analysis of 451 AI firms-spanning the years 2000 to 2024-reveals crucial patterns in investment, innovation, and market dynamics. This research highlights the need for strategic interventions to support emerging companies, attract skilled talent, and cultivate a favorable regulatory environment. Sustained success isn’t simply about initial investment; it demands an ongoing, data-driven understanding of the forces shaping the AI landscape and proactive adjustments to policy and infrastructure.

Dissecting the UK AI Ecosystem: A Categorical Analysis

The UK artificial intelligence landscape consists of two primary firm types: Dedicated AI Firms and Diversified Entities. Dedicated AI Firms focus on the research, development, and intellectual property creation at the core of AI technologies, representing innovation in areas such as machine learning algorithms and novel AI applications. Diversified Entities, conversely, are established companies across various sectors – including finance, healthcare, and manufacturing – that are integrating AI technologies into their existing products, services, and operational processes. These firms typically do not originate AI technologies but instead apply them to enhance or transform their core business functions, driving adoption and practical implementation of AI solutions. This distinction is critical for understanding the dynamics of the UK AI ecosystem, as Dedicated AI Firms represent the source of innovation while Diversified Entities drive market application and scalability.

The mapping of the UK AI ecosystem relied on a multi-source data aggregation strategy. The primary dataset was the WAIFinder Database, which catalogues firms engaged in AI development. This was supplemented with data obtained via web scraping from Glass.ai, focusing on firm profiles and reported AI-related activities. Official administrative records from Companies House provided validation of firm registration, financial data, and key personnel information. The combination of these sources allowed for a robust and verified dataset of UK AI firms, enabling quantitative analysis of ecosystem characteristics and firm-level attributes.

The WAIFinder database, Glass.ai data, and Companies House records were enriched with socio-economic data obtained from the Office for National Statistics at the Postcode Level. This granular data included indicators such as population density, average household income, employment rates, skill levels of the workforce, and the prevalence of digital infrastructure. Incorporating these indicators allowed for the mapping of AI firm distribution not just geographically, but also in relation to contextual socio-economic factors, enabling analysis of correlations between firm location and local economic conditions. This approach facilitates a more nuanced understanding of the conditions supporting, or hindering, AI firm growth and potential failure rates across the UK.

Analysis of data collected from WAIFinder, Glass.ai, and Companies House records indicates a total lifetime revenue of £284.7 million generated by the sampled UK AI firms. This quantification was coupled with the identification of geographically concentrated areas of AI activity. Further analysis revealed contextual factors impacting firm performance, specifically those correlated with both successful growth and instances of firm failure. These factors include, but are not limited to, access to venture capital, the availability of skilled labor as indicated by postcode-level socio-economic data from the Office for National Statistics, and the presence of supporting infrastructure such as research institutions and accelerator programs.

Predictive Modeling of AI Firm Dissolution: A Probabilistic Approach

The annual firm dissolution rate within the AI ecosystem currently stands at 2.29%, a figure critical for gauging the overall stability and identifying areas of potential risk. This rate serves as a key performance indicator, reflecting the dynamic nature of the field and the challenges faced by emerging companies. Monitoring this dissolution rate allows for proactive assessment of vulnerabilities and informs strategies to support the sustained growth of the AI landscape. A consistently high rate could indicate systemic issues related to funding, market competition, or technological disruption, while a declining rate suggests a maturing and more robust ecosystem.

To forecast firm growth and predict dissolution, we implemented a suite of time series models including Autoregressive Integrated Moving Average (ARIMA), Error, Trend, Seasonality (ETS), and Multifactor Exponential Smoothing (MFLES). These models were selected for their capacity to analyze sequential data and identify patterns indicative of future performance. Model selection prioritized techniques capable of accommodating varying levels of trend and seasonality present within the firm-level financial data. The performance of each model was evaluated using metrics such as Mean Absolute Error (MAE) and Root Mean Squared Error (RMSE), with final model selection guided by cross-validation results to minimize overfitting and ensure generalizability to unseen data.

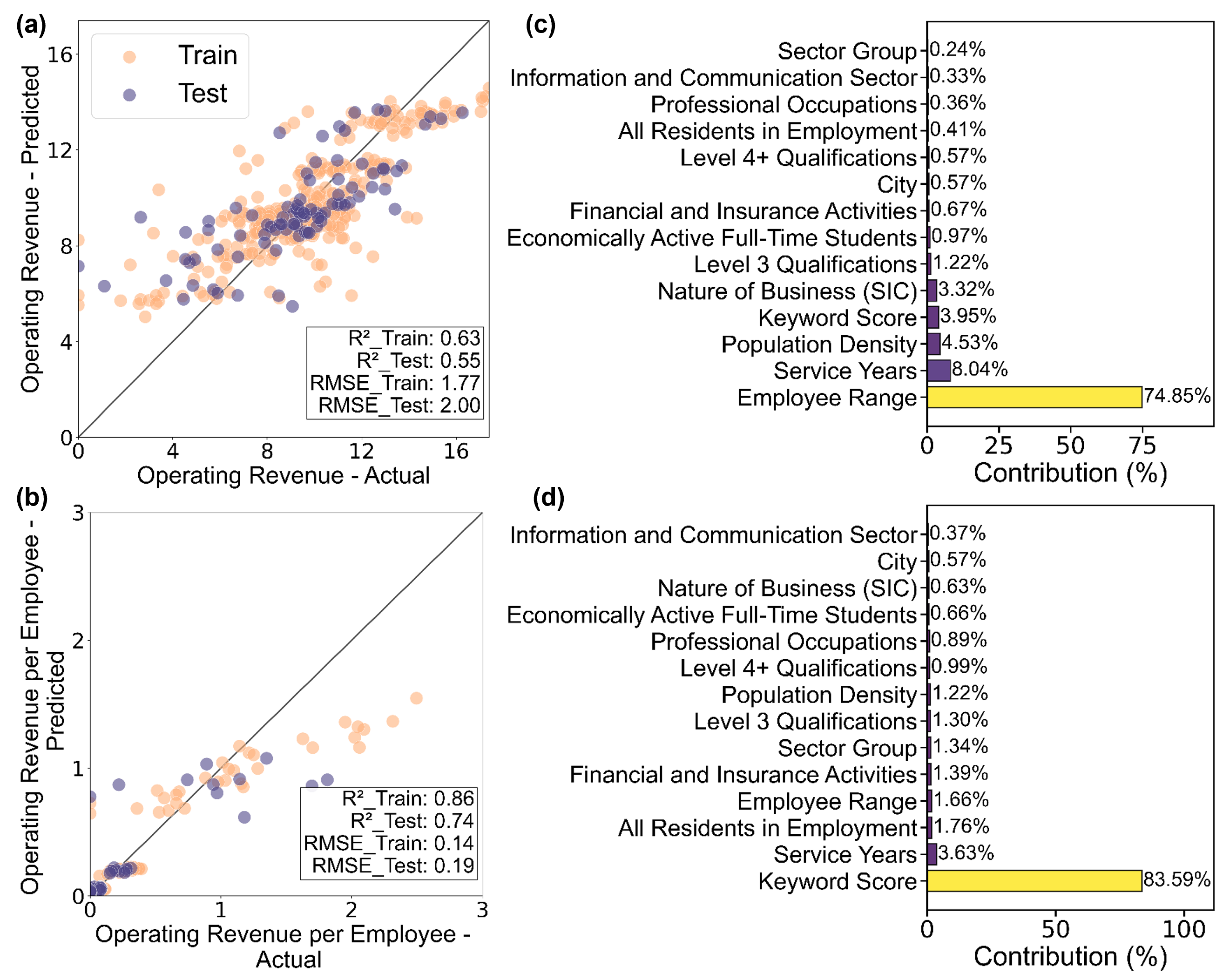

The prediction model leveraged CatBoost, a gradient boosting algorithm, to establish a relationship between firm-specific attributes and relevant local socio-economic indicators. Performance was evaluated using the R2 metric on training data, yielding a value of 0.63 for Operating Revenue and 0.86 for Operating Revenue per Employee. This indicates that the model explains 63% and 86% of the variance in these respective financial metrics, suggesting a strong predictive capability based on the selected features and algorithm.

Model interpretability was assessed using the SHAP (SHapley Additive exPlanations) framework, which quantified the contribution of each feature to the prediction. Analysis revealed that employee range accounts for 74.85% of the variance in operating revenue, indicating a strong correlation between company size and revenue generation. Furthermore, keyword score, representing the relevance of a firm’s described activities, explains 83.59% of the variance in operating revenue per employee, suggesting a significant relationship between a firm’s specialized focus and its revenue efficiency. These SHAP values provide insights into the primary drivers of financial performance within the analyzed dataset.

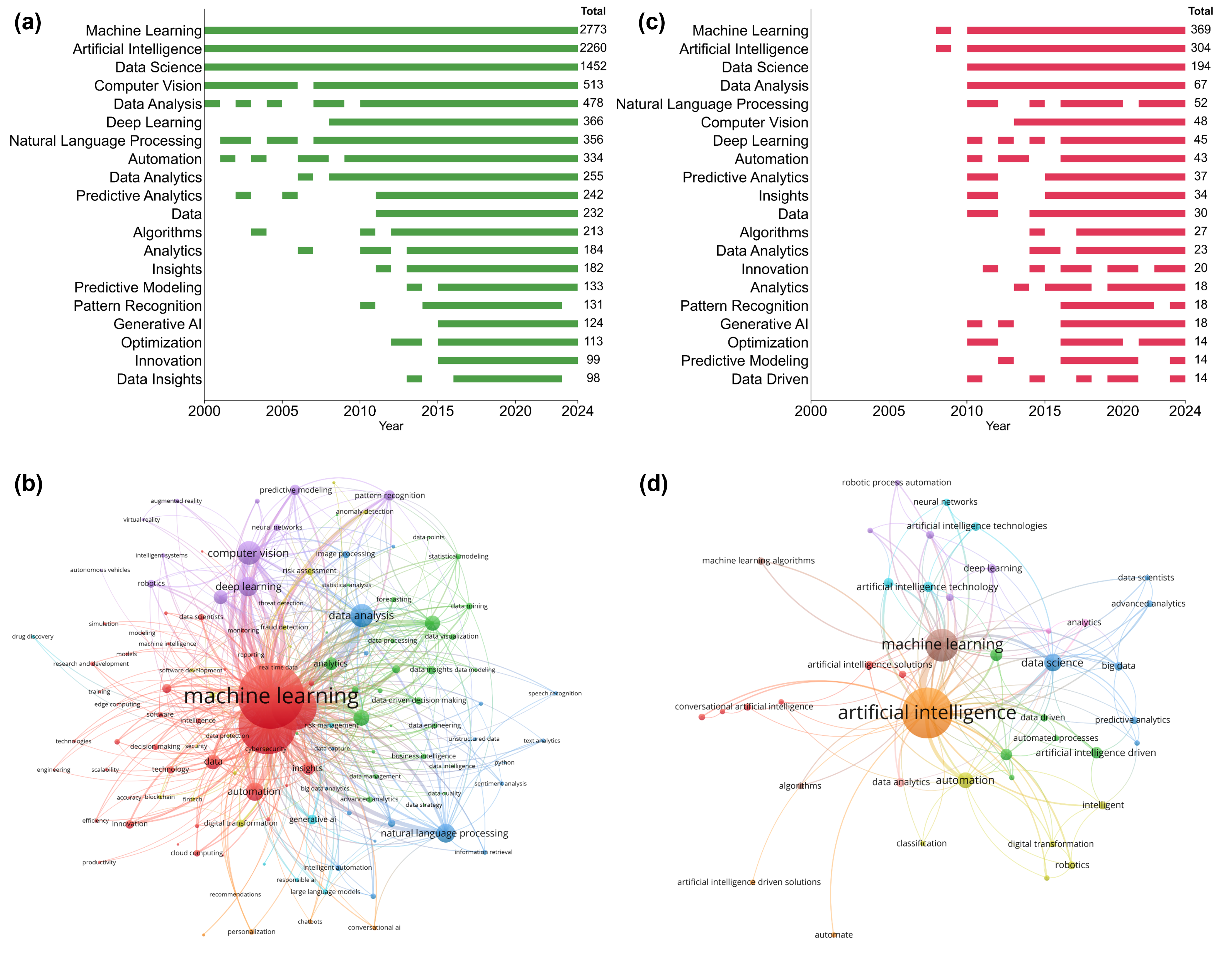

Leveraging AI Insights to Strengthen the UK’s Technological Advantage

The United Kingdom’s areas of artificial intelligence expertise were revealed through a detailed analysis employing machine learning techniques. Specifically, researchers utilized TF-IDF – a method for extracting the most important terms from a body of text – to pinpoint specialized fields within the UK’s AI landscape. This process involved analyzing a vast dataset of AI-related publications, patents, and company profiles to identify recurring themes and keywords. The resulting insights showcase a concentration of expertise in areas like natural language processing, computer vision, and machine learning applied to healthcare and finance, demonstrating the UK’s distinct strengths and potential for further innovation in these crucial sectors.

Analysis reveals a strong connection between the geographical concentration of artificial intelligence activity within the UK and underlying socio-economic conditions. Regions exhibiting higher densities of AI firms and research institutions consistently demonstrate greater population density and, crucially, elevated levels of educational attainment. This isn’t merely coincidence; access to a skilled workforce, fostered by strong educational infrastructure, appears to be a primary driver of AI cluster formation. Furthermore, denser populations provide a larger pool of potential employees and facilitate the knowledge-sharing networks essential for innovation, creating a positive feedback loop that reinforces localized AI development. These findings suggest that strategic investment in education and urban centers can proactively cultivate a more broadly distributed and robust national AI ecosystem.

A granular understanding of where AI activity concentrates within the UK empowers policymakers to move beyond broad national strategies and implement targeted investment. By identifying specific regions exhibiting strong AI potential – often linked to existing research institutions, skilled workforces, and supportive infrastructure – funding can be directed with greater precision. This localized approach isn’t simply about allocating capital; it’s about cultivating ecosystems that attract and retain AI talent, fostering collaboration between academia and industry, and encouraging the development of innovative solutions tailored to regional needs. Consequently, strategic investment in these hubs promises a higher return, accelerating the growth of the UK’s AI sector and solidifying its competitive edge on the global stage.

Sustained economic growth and societal advancement in the United Kingdom are anticipated through the strategic application of data-driven policies focused on artificial intelligence. Projections indicate a stable rate of business dissolution within the AI sector-estimated at 2.21%-translating to approximately 316 dissolutions annually by the year 2030. While some business attrition is expected, this consistent rate suggests a healthy level of market dynamism and innovation, rather than systemic instability. This allows for proactive resource allocation and targeted support, ensuring the UK maintains a competitive edge and continues to attract investment in emerging AI technologies, solidifying its position as a global leader and maximizing the benefits of this transformative field for its citizens.

The study illuminates how firm performance within the UK AI economy isn’t merely about adopting the technology, but about the underlying mathematical structure enabling scalable solutions. This resonates with John von Neumann’s assertion: “The sciences do not try to explain why we exist, but how we exist.” The analysis of firm scale and technical specialization, particularly within geographically concentrated clusters, reflects a search for ‘how’ successful AI firms operate – the provable mechanics of their success, rather than speculative explanations. The projected ecosystem consolidation suggests a natural selection towards mathematically robust and scalable models, validating the enduring power of disciplined, provable algorithms in a data-driven landscape.

What’s Next?

The observed concentration of activity within the UK AI economy, predictably centered on London, necessitates a more rigorous examination of the underlying mechanisms. The study demonstrates correlation, but fails to definitively establish causality – does proximity foster innovation, or does innovation simply gravitate towards existing capital and infrastructure? Future work must address this with longitudinal data and counterfactual modeling, moving beyond descriptive statistics. The current reliance on firm-level performance metrics, while pragmatic, risks obscuring the subtle dynamics of value creation within complex, collaborative ecosystems.

A crucial, and often overlooked, limitation is the inherent difficulty in quantifying ‘technical specialization’. The metrics employed, while reasonable, are ultimately proxies. A truly deterministic understanding requires a formalization of AI expertise, perhaps through the application of information-theoretic measures to codebases or a rigorous analysis of algorithmic complexity. Without such precision, the notion of ‘specialization’ remains frustratingly subjective.

The projected shift towards ecosystem consolidation, if accurate, raises a troubling question: will this lead to a convergence on a limited set of algorithmic paradigms, or will it stifle genuine innovation? The elegance of a mathematical proof lies in its generality; the true test of an AI ecosystem will be its capacity to generate not just incremental improvements, but fundamentally new approaches. Reproducibility, after all, is merely a prerequisite for progress – it does not guarantee it.

Original article: https://arxiv.org/pdf/2602.06249.pdf

Contact the author: https://www.linkedin.com/in/avetisyan/

See also:

- All Golden Ball Locations in Yakuza Kiwami 3 & Dark Ties

- The MCU’s Mandarin Twist, Explained

- Movie Games responds to DDS creator’s claims with $1.2M fine, saying they aren’t valid

- These are the 25 best PlayStation 5 games

- Scream 7 Will Officially Bring Back 5 Major Actors from the First Movie

- SHIB PREDICTION. SHIB cryptocurrency

- Server and login issues in Escape from Tarkov (EfT). Error 213, 418 or “there is no game with name eft” are common. Developers are working on the fix

- A Knight Of The Seven Kingdoms Season 1 Finale Song: ‘Sixteen Tons’ Explained

- Rob Reiner’s Son Officially Charged With First Degree Murder

- Gold Rate Forecast

2026-02-09 10:34