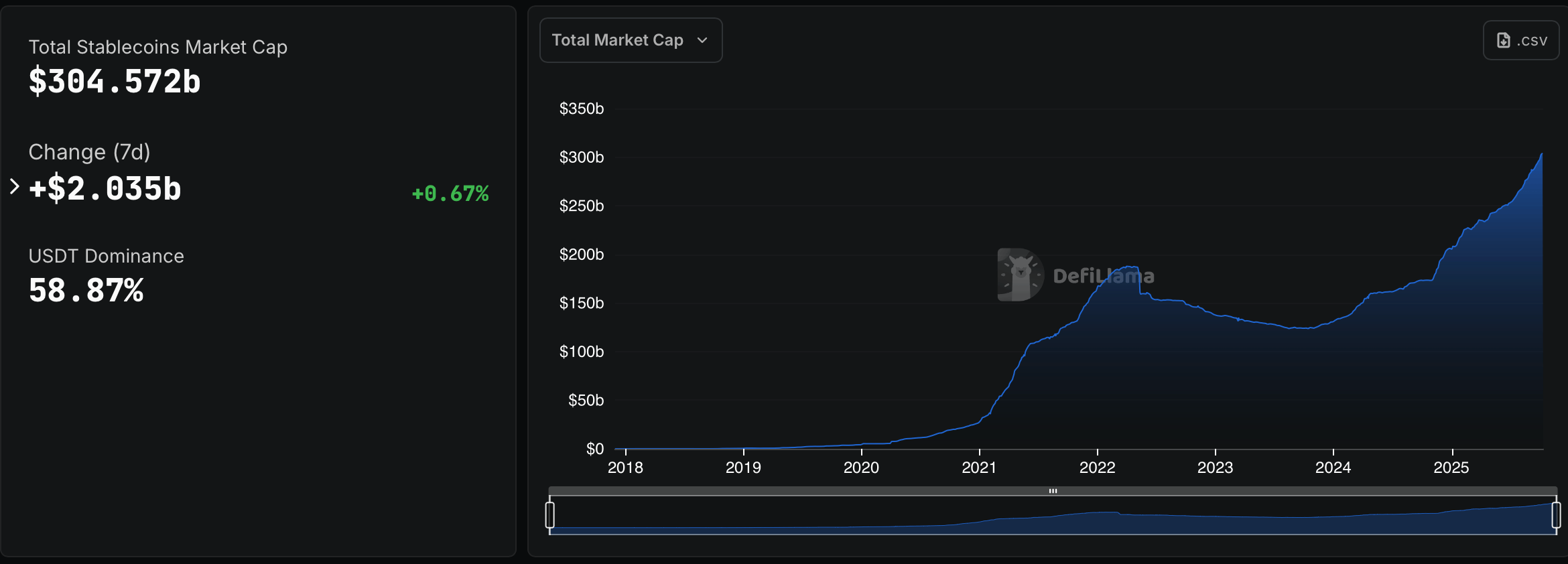

Behold, an enchanting narrative from the realm of numismatics: the steadfast stablecoin market has burgeoned by $2.035 billion in a mere seven days, amassing a cosmic capitalization of $304.57 billion, or so the scribes from Defillama proclaim. A 0.67% proliferation in a single week, they claim, but The Great Gervasi of Market Price – ah, far more profound forces simmer below.

The Steady March of Stablecoins: A $304 Billion Digital Enigma

Once a novelty, a sandbox frolic for traders in the pulsing crypto bazaar, that sought sanctuary from the catastrophic capers of volatility, stablecoins have evolved. Now they serve as the so-called stalwart digital doppelgängers for traditional fiat currencies. Inevitably pegged to the mighty “Benjamin” most often, they permit their holders to ferry and conserve value sans the mercurial waltzes of, let us say, Bitcoin or Ethereum. 📈

A stablecoin, oh brave new tidal advance, is a cryptic creature engineered to eternalize a steadfast value relative to a fiat currency – most commonly the U.S. dollar. Unlike the capricious undulations of most digital assets, it aims to remain aloof at $1. The architects do this by anchoring each vexing token with assets such as cash, futurity cornerstones like U.S. Treasury bills, or other reserves. Thus, stablecoins emerge as the tranquil sanctuary in crypto’s tempestuous tempests. 😎

The masses drift towards stablecoins for reasons simple: velocity, pecuniary efficiency, and an unwavering reliability that one might expect from socialism at its most dismal. Transactions are swift as a bolt, fees trivial, and volatility – that malevolent specter – is banished for many, rendering this the tool of the everyday cryptographer. For citizens outside the United States, stablecoins serve as a beacon of stability, a tether to the global markets otherwise inscrutable or inaccessible. ☕

A Glimpse Into the Current Stablecoin Cycle

Behold the titan, Tether ( USDT), reigning supreme as indicated by the meticulous counting of defillam.com, commanding a staggering 58.87% of the stablecoin kudos with its treasury swollen to some $179.3 billion. Circle’s USDC dallies next with a coffer of $74.77 billion, while Ethena’s USDe ascends to bronze glory with $14.29 billion. Together, these triumvirate of crypto-zeal challenge the cosmos itself, encapsulating more than 85% of this pecuniary sector.

Below these lofty titans, dalliances occur between dai (DAI), blithe sky dollar (USDS), and Blackrock’s BUIDL, each elf-dancing between $2.6 billion to $5 billion in effervescence of capitalization. Paypal’s PYUSD, a fledgling from yesteryear, has quietly nudged past $2.5 billion – an omen indeed that establishments of old are slowly being enamored by the crypto-spell. 🌐

Issuers of fiat-pegged digital licenses, like Falcon Finance’s USDf, First Digital’s FDUSD, and Ripple’s RLUSD – dreams of carving out niches, collectively underpinning a diverse and oft-contentious stablecoin ecosystem. 🎭

A Decade of Ascendancy

The stablecoin market’s ascension from an inconspicuous $3 billion in 2018 to a staggering beyond $300 billion in 2025 narrates a tale of a 100x proliferance in just septennial years. This spectacular growth sings in harmony – and furnishes! – the evolving landscape of decentralized finance (DeFi) and crypto-based payment systems. 📉

As centralized exchanges, DeFi concoctions, and fintech sages gradually rely on stablecoins as the backbone of liquidity and settlement, these beguiling digital tokens have solidified themselves as an indispensable stratum within the modern crypto tapestry. This week’s $2 billion rally declares steadfast trust amid the chaos, shielded from this week’s convulsions of the broader crypto market. 🏦

If prophecies hold, the stablecoin dominion could soon rival the GDPs of small sovereignties. The question is no longer of their permanence, but of their intimate embrace with our day-to-day finance. 🤔

🧠 FAQ

- What stands the total stablecoin market cap as of today?

As of the seven days that ended Oct. 11, it resides at a healthy $304.57 billion. - How much has it swelled recently?

The market blossomed by $2.035 billion in the past passing week, a 0.67% flourish. - Which stablecoin reigns supreme?

Tether ( USDT) leads the parade with 58.87% market mastery over the vale of all stablecoins. - How long has the stablecoin saga been unfolding?

The maiden journey of stablecoins began circa 2014, though their true ascent coincided with the rise of DeFi and broader shifts of the economic stage in 2020. - Why hold dear stablecoins?

They forage a connection betwixt the ironclad worlds of TradFi and blockchain, dispensing liquidity, speed, and trust in divided lands. - Are all stablecoins hitched to the dollar?

While many sing the praises of the U.S. dollar, others find allegiance to alternative assets such as U.S. Treasuries, algorithmic spells, or different national currencies. 🌟 - What horizon awaits the stablecoin market?

A continued embrace by payment systems, proliferation within institutional heralds, and the ever-evolving realm of regulation. 🌈

Read More

- All Golden Ball Locations in Yakuza Kiwami 3 & Dark Ties

- What time is the Single’s Inferno Season 5 reunion on Netflix?

- Gold Rate Forecast

- NBA 2K26 Season 5 Adds College Themed Content

- Hollywood is using “bounty hunters” to track AI companies misusing IP

- Mario Tennis Fever Review: Game, Set, Match

- The Abandons: Netflix Western Series Disappoints With Low Rotten Tomatoes Score

- Pokemon LeafGreen and FireRed listed for February 27 release on Nintendo Switch

- EUR INR PREDICTION

- Beyond Linear Predictions: A New Simulator for Dynamic Networks

2025-10-12 10:00