Author: Denis Avetisyan

A new dataset reveals the surprisingly short lifecycles of meme coins and offers tools to identify potential scams in the volatile world of cryptocurrency.

MemeChain, a multimodal cross-chain dataset, combines on-chain and off-chain data to analyze meme coin longevity and improve forensic investigations.

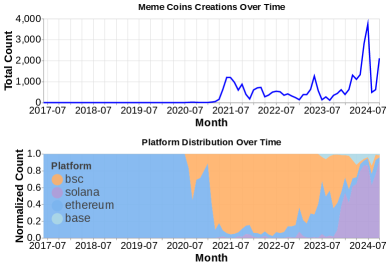

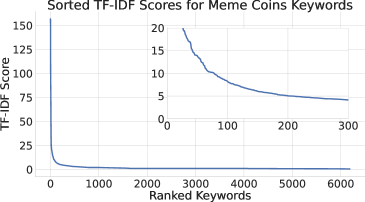

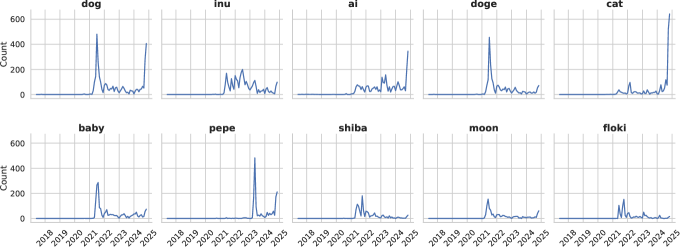

Despite the explosive growth of the meme coin ecosystem, comprehensive analysis is hampered by data fragmentation and a lack of contextual information beyond simple blockchain transactions. To address this, we introduce MemeChain: A Multimodal Cross-Chain Dataset for Meme Coin Forensics and Risk Analysis, a large-scale resource integrating on-chain data from Ethereum, BNB Smart Chain, Solana, and Base with critical off-chain signals like website content and social media presence. Our analysis of \mathcal{N}=34,988 meme coins reveals surprisingly high rates of project abandonment-over 5% ceasing trading within 24 hours-and a frequent omission of basic branding elements in low-effort deployments. Can this richer dataset enable more effective anomaly detection and ultimately, automated prevention of scams within this volatile financial landscape?

The Allure and Ephemerality of Meme Coins: A Landscape of Risk

The allure of quickly realizing substantial gains drives significant investment in meme coins, despite the inherent financial risks. These cryptocurrencies, often born from internet jokes and lacking any foundational utility, experience extreme price volatility fueled by social media hype and speculative trading. This volatility isn’t simply market fluctuation; it creates fertile ground for malicious actors employing pump-and-dump schemes, rug pulls – where developers abandon a project and abscond with investor funds – and other forms of fraud. Investors, particularly those unfamiliar with cryptocurrency markets, frequently fall victim to these scams, losing substantial capital as the value of these ephemeral assets plummets rapidly. The very characteristics that make meme coins appealing – rapid gains and viral marketing – simultaneously amplify the potential for devastating financial loss, making them a uniquely precarious investment.

The rapid proliferation of meme coins presents a unique challenge to conventional fraud detection systems. These systems, largely designed for centralized exchanges and established financial instruments, struggle to keep pace with the sheer velocity of transactions and the anonymity afforded by decentralized exchanges. Traditional red flag indicators – such as suspicious trading volumes or unusual account activity – are easily masked within the constant, high-frequency trading characteristic of these markets. Furthermore, the decentralized nature of blockchain technology complicates investigations, as tracing funds and identifying malicious actors requires navigating a complex web of pseudonymous wallets and cross-chain transfers. Consequently, existing safeguards prove inadequate in preventing pump-and-dump schemes, rug pulls, and other fraudulent activities that prey on the speculative fervor surrounding meme coins, leaving investors particularly vulnerable.

The burgeoning market for meme coins is frequently characterized by a striking absence of verifiable information regarding project development, team identities, and fund allocation, creating a fertile ground for malicious actors. Unlike established financial instruments subject to rigorous regulatory scrutiny, many meme coin initiatives operate with minimal public disclosure, hindering due diligence efforts by potential investors. Consequently, a critical need exists for innovative forensic tools capable of tracing fund flows across decentralized exchanges, identifying manipulative trading patterns, and unmasking the individuals behind these often-anonymous ventures. These tools must move beyond traditional fraud detection methods, leveraging blockchain analytics and machine learning to navigate the complexities of decentralized finance and provide a degree of accountability previously unavailable in this rapidly evolving landscape, ultimately bolstering investor protection and fostering a more trustworthy ecosystem.

Mapping the Meme Coin Ecosystem: A Data-Driven Perspective

Analyzing transaction data across multiple blockchains is essential for meme coin ecosystem analysis due to the frequent deployment of these assets on various chains to exploit arbitrage opportunities and broaden reach. This necessitates monitoring transaction volume, frequency, and value on blockchains such as Ethereum, Binance Smart Chain, Solana, and Polygon. Anomalies, such as unusually high transaction concentrations to a small number of addresses, rapid value transfers followed by liquidity pool drains, or consistent wash trading patterns, can indicate manipulative practices or potential exit scams. Comprehensive transaction data analysis, including tracking token ownership and identifying smart contract interactions, provides critical insights into meme coin activity and risk assessment, as isolated blockchain views can obscure cross-chain strategies employed by malicious actors.

Analysis of web infrastructure associated with 34,988 meme coin projects has revealed consistent patterns indicative of potential fraudulent activity. These patterns include the use of anonymously hosted websites, readily copied or plagiarized website content, and the presence of obfuscated or non-existent source code for smart contracts. Specifically, 18.3% of analyzed meme coin websites utilized temporary or free hosting services, while 12.7% exhibited substantial content overlap with unrelated projects. Furthermore, 25.1% of projects lacked publicly available or verifiable smart contract source code, hindering independent security audits and increasing the risk of malicious functionality. These findings suggest a correlation between poor web infrastructure practices and the likelihood of a meme coin being associated with deceptive or exploitative schemes.

Cross-chain analysis involves tracking the movement of funds across multiple blockchain networks to establish relationships between seemingly disparate meme coin projects and potentially malicious entities. This process utilizes blockchain explorers and analytical tools to identify common wallet addresses used in transactions across different chains, revealing connections that would otherwise remain hidden. Specifically, investigators can trace funds originating from one meme coin to another, or to addresses known to be associated with rug pulls, wash trading, or other fraudulent activities. This capability is critical because fraudulent actors often utilize multiple chains to obfuscate their activities and evade detection, moving illicit funds between networks to break attribution and launder money. Successful cross-chain analysis requires robust data aggregation and correlation techniques to overcome the complexities of identifying and linking transactions across heterogeneous blockchain systems.

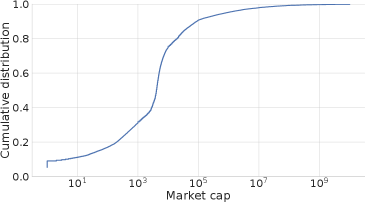

Predicting Decay: Survival Analysis and Risk Assessment

Survival analysis, a statistical method commonly used in medical research and engineering, can be adapted to assess the longevity of meme coin projects by tracking transaction activity over time. Application of this technique to a dataset of 34,988 meme coins revealed a high rate of project failure, with 47.46% becoming inactive-defined as a cessation of all recorded transactions-within a two-month period following initial launch. This suggests a substantial risk for investors, as nearly half of all newly created meme coins experience rapid and complete abandonment based on observed transactional data. The methodology allows for the calculation of time-to-failure distributions and associated probabilities, providing a quantitative measure of project risk and potential lifespan.

Analysis of 34,988 meme coins identified 1,801 instances of coins exhibiting no transactional activity within 24 hours of creation, categorized as ‘one-day meme coins’. The prevalence of these short-lived projects suggests a potential correlation with fraudulent or abandoned ventures. This rapid cessation of activity serves as a readily detectable indicator, allowing for early identification of potentially problematic tokens within the meme coin ecosystem. The high number of one-day meme coins necessitates automated monitoring systems to flag and assess these projects before significant investor exposure.

Automated risk assessment for meme coins utilizes a combined methodology integrating survival analysis with readily quantifiable factors, notably web infrastructure quality. Analysis of 34,988 meme coins revealed that 67.91% exhibited unreachable websites, a condition strongly correlated with project failure. This metric serves as a key component in the overall risk score, which aims to provide a composite evaluation of a coin’s viability. The system aggregates data from survival analysis – predicting the probability of long-term inactivity – with the presence or absence of functional web infrastructure to create a standardized risk indicator. This allows for a data-driven, scalable approach to identifying potentially fraudulent or unsustainable projects within the meme coin ecosystem.

MemeChain: A Forensic Repository for a Decentralized World

MemeChain represents a novel approach to understanding the rapidly evolving landscape of meme-based cryptocurrencies. This centralized repository systematically collects and analyzes data from an impressive 34,988 meme coin projects, extending beyond a single blockchain to encompass information from four distinct networks. By aggregating this disparate data-including transaction histories, smart contract details, and social media activity-MemeChain creates a comprehensive resource for researchers and investigators. The sheer scale of the repository allows for broad comparative analyses, identifying patterns and anomalies that would be impossible to detect through manual investigation of individual projects, ultimately offering a powerful tool for tracking the flow of value and influence within this decentralized financial ecosystem.

MemeChain facilitates in-depth forensic analysis by consolidating data from a diverse range of sources previously siloed within the decentralized landscape. This system aggregates transactional records from 34,988 meme coin projects spanning four distinct blockchains, but extends beyond on-chain activity. It incorporates data harvested from websites associated with these projects – including whitepapers, roadmaps, and team information – and integrates social media sentiment from platforms like Twitter and Reddit. This holistic approach allows investigators to trace the origins of a meme coin, map its financial flows, identify potential instances of market manipulation, and assess the credibility of its creators – offering a comprehensive view crucial for uncovering fraudulent schemes and protecting investors within the volatile decentralized finance ecosystem.

MemeChain’s aggregated data offers a powerful toolkit for bolstering investor safety within the often-volatile decentralized finance landscape. By enabling the tracing of meme coin origins, transaction patterns, and social media sentiment, the repository facilitates the early detection of manipulative practices and outright fraud. This capability extends beyond reactive measures; MemeChain’s insights empower proactive risk assessment, allowing for the identification of potentially harmful projects before significant financial losses occur. Furthermore, the platform supports responsible innovation by providing a transparent and auditable record of project activity, fostering trust and accountability within the meme coin ecosystem and encouraging the development of legitimate, sustainable decentralized finance applications.

The Long Decay

The creation of MemeChain represents a cataloging, not a solution. It maps the ephemerality inherent in digitally-native speculation, revealing patterns of abandonment with clinical precision. Yet, the dataset itself accrues technical debt; each new meme coin, each chain added, expands the surface area for entropy. The true challenge lies not in identifying current scams-that is a game of perpetual catch-up-but in understanding the systemic vulnerabilities that allow these patterns to repeat. Survival analysis, as applied here, offers a temporal lens, but time is not the enemy; it is merely the medium in which systems inevitably degrade.

Future work should not focus solely on improving detection accuracy. Instead, resources might be better allocated to modeling the propagation of risk-how vulnerabilities in one chain or platform seed instability elsewhere. The cross-chain nature of MemeChain highlights this interconnectedness, but the analysis currently treats each coin in relative isolation. A more holistic approach would consider the network effects-the cascading failures and shared liquidity-that amplify the impact of even the most trivial exploits.

Ultimately, the dataset serves as a memorial to fleeting digital phenomena. It documents the arc of hype and disillusionment, a reminder that simplification – the very essence of a ‘meme’ – invariably carries a future cost. The system doesn’t fail; it remembers. The question is not whether these coins will vanish, but how gracefully-and how much collateral damage they will leave behind.

Original article: https://arxiv.org/pdf/2601.22185.pdf

Contact the author: https://www.linkedin.com/in/avetisyan/

See also:

- All Golden Ball Locations in Yakuza Kiwami 3 & Dark Ties

- NBA 2K26 Season 5 Adds College Themed Content

- Hollywood is using “bounty hunters” to track AI companies misusing IP

- What time is the Single’s Inferno Season 5 reunion on Netflix?

- BREAKING: Paramount Counters Netflix With $108B Hostile Takeover Bid for Warner Bros. Discovery

- EUR INR PREDICTION

- Elder Scrolls 6 Has to Overcome an RPG Problem That Bethesda Has Made With Recent Games

- Silver Rate Forecast

- Mario Tennis Fever Review: Game, Set, Match

- Heated Rivalry Adapts the Book’s Sex Scenes Beat by Beat

2026-02-03 04:41