Author: Denis Avetisyan

New research demonstrates how applying control theory can dynamically stabilize the often-volatile token economies powering decentralized artificial intelligence networks.

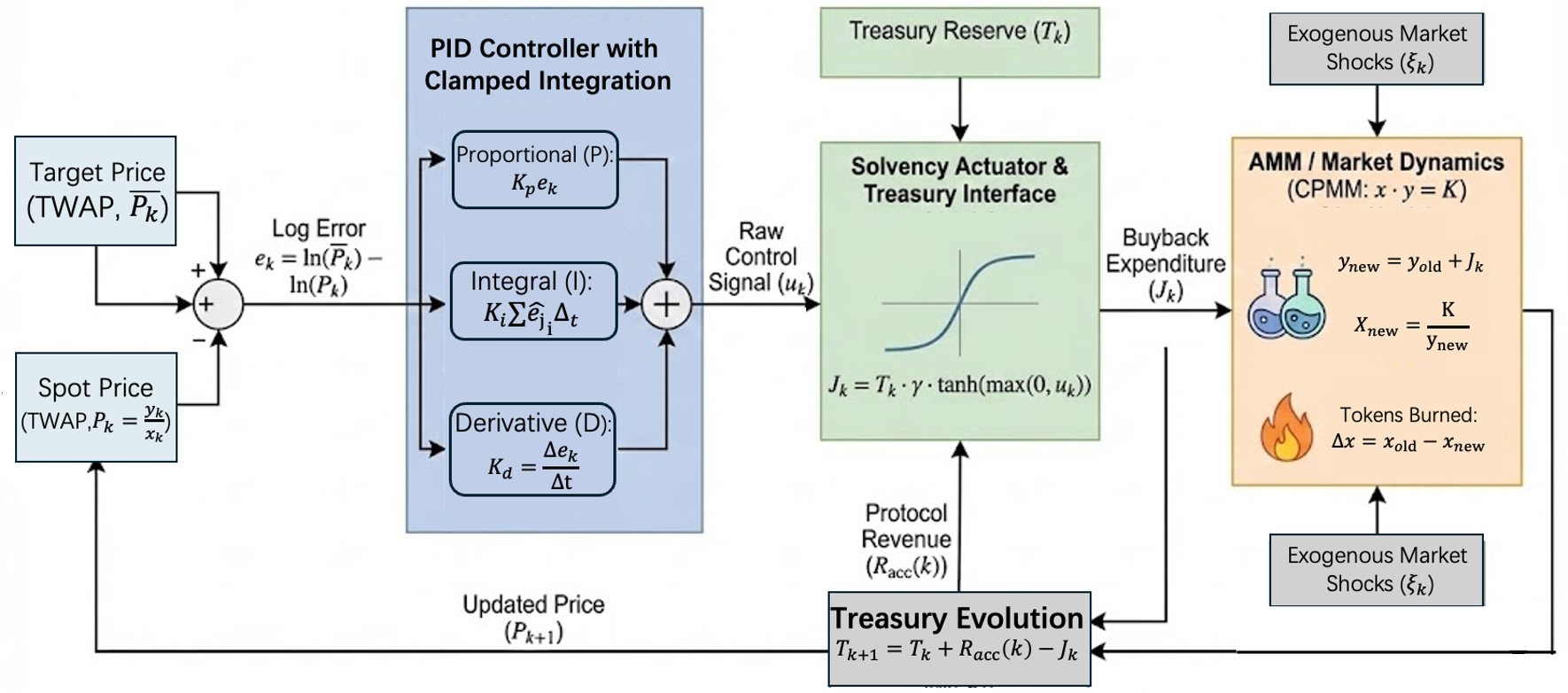

This paper introduces a Dynamic-Control Buyback Mechanism (DCBM) leveraging PID controllers to mitigate market instability and enhance the long-term sustainability of decentralized AI systems.

Decentralized artificial intelligence networks promise computational power through open access, yet their economic foundations remain vulnerable to destabilizing volatility. This paper, ‘A Control Theoretic Approach to Decentralized AI Economy Stabilization via Dynamic Buyback-and-Burn Mechanisms’, introduces a formalized control-theoretic framework-the Dynamic-Control Buyback Mechanism (DCBM)-to actively regulate token economies as dynamical systems. Agent-based simulations demonstrate that DCBM substantially outperforms static tokenomic models, reducing price volatility by 66% and operator churn by over 50% in turbulent market conditions. Does this represent a necessary shift from reactive, rule-based tokenomics towards proactive, structurally constrained control loops for truly sustainable decentralized intelligence?

Deconstructing Centralization: The Rise of Distributed Intelligence

Decentralized AI networks are reshaping how artificial intelligence models are created and utilized, moving beyond the traditional centralized control of large tech companies. This emerging paradigm allows anyone to contribute computational resources, data, or even AI models themselves, and receive compensation for their contributions-fostering a more democratic and accessible AI landscape. Unlike conventional AI development, where models are often locked behind proprietary APIs, these networks aim to provide open access to powerful AI capabilities, enabling a wider range of applications and innovations. By distributing the infrastructure and governance of AI, these networks enhance resilience against single points of failure and censorship, while simultaneously incentivizing continuous improvement and adaptation through community participation and token-based rewards. This shift promises not only greater innovation but also a more equitable distribution of the benefits derived from artificial intelligence.

Decentralized AI networks, while promising, require a bedrock of verifiable trust to function effectively, and blockchain technology provides that foundation. By distributing data and computational tasks across numerous nodes, these networks eliminate single points of failure and potential censorship. However, ensuring the integrity of contributions and preventing malicious actors necessitates an immutable record of all transactions and data interactions. Blockchain achieves this through cryptographic hashing and a distributed consensus mechanism, meaning any attempt to alter data would require controlling a majority of the network – a prohibitively expensive and complex undertaking. This inherent security allows participants to confidently share resources and collaborate on AI model development and deployment, fostering a transparent and reliable ecosystem where the provenance and authenticity of AI outputs are demonstrably verifiable.

The sustained functionality of decentralized AI networks hinges on carefully constructed tokenomic models. These systems utilize cryptographic tokens not merely as currency, but as mechanisms to align the incentives of diverse participants – from data providers and model trainers to computational resource contributors and validators. A well-designed token economy rewards positive contributions to the network, such as high-quality data or efficient model performance, while simultaneously disincentivizing malicious behavior or underperformance through penalties like stake slashing or reduced rewards. This creates a self-sustaining ecosystem where participants are economically motivated to maintain network health, ensure data integrity, and contribute to the ongoing improvement of AI models. The distribution and utility of these tokens are therefore paramount, shaping the long-term viability and resilience of the decentralized AI infrastructure.

Token Deflation as a Systemic Stabilizer

Buyback-and-Burn (BnB) mechanisms function by utilizing project revenue to repurchase tokens from the open market, subsequently removing those tokens from circulation through a burning process – a permanent removal from the total supply. This deflationary pressure, created by reducing the circulating supply, can positively impact token value, assuming consistent demand. The effectiveness of BnB is directly correlated to the volume of tokens repurchased and burned relative to the overall supply and trading activity; higher burn rates, all other factors being equal, typically correlate with increased scarcity and potential price appreciation. However, the sustainability of BnB depends on the project’s ability to consistently generate revenue sufficient to fund ongoing repurchases without negatively impacting operational expenses.

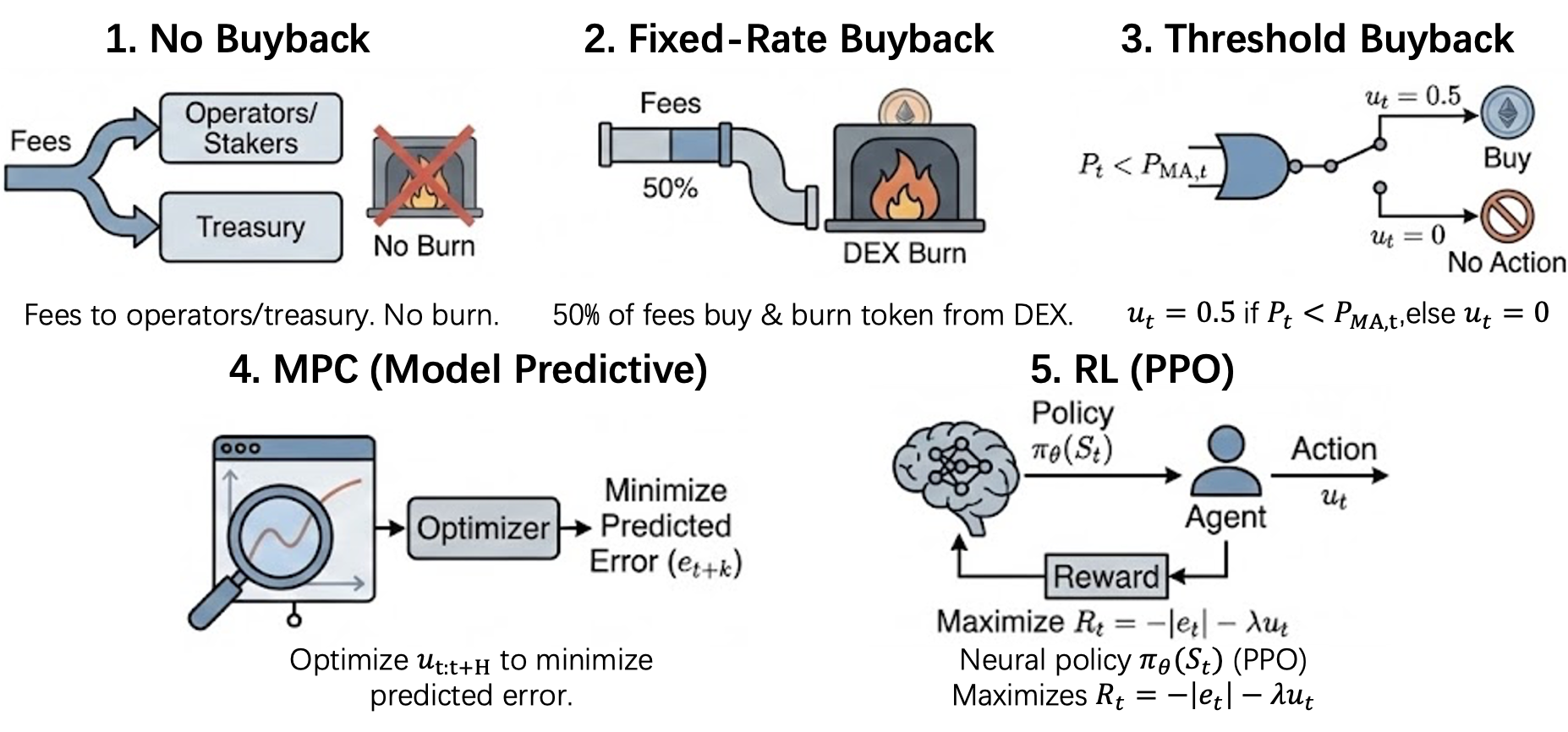

Buyback-and-Burn (BnB) mechanisms are not monolithic; implementations vary significantly based on triggering conditions and execution parameters. Fixed-Rate Buybacks involve regularly purchasing tokens from the market and permanently removing them from circulation, providing a predictable deflationary pressure. Threshold Buybacks initiate purchases only when specific on-chain metrics, such as trading volume or token price, reach predetermined levels. More complex variations, like Dynamic Control Buyback Mechanisms (DCBM), adjust buyback rates based on real-time market data and pre-defined algorithms, attempting to optimize for both price impact and deflationary effectiveness. Each approach presents trade-offs; fixed rates lack responsiveness, threshold mechanisms may be ineffective during periods of low activity, and dynamic systems require careful calibration to avoid unintended consequences or manipulation.

Buyback-and-Burn (BnB) mechanisms vary in their responsiveness to market fluctuations. Fixed-Rate Buybacks execute token burns at pre-determined intervals, providing predictable supply reduction but lacking adaptability. Threshold Buybacks, conversely, initiate burns only when specific market conditions – such as reaching a certain trading volume or price point – are met, offering reaction to external factors. However, analysis indicates that Dynamic Control Buyback Mechanisms (DCBM) outperform both fixed and threshold approaches; DCBMs utilize algorithms to adjust burn rates based on a wider array of real-time data, resulting in more efficient token supply management and, consequently, improved performance metrics compared to static or condition-based strategies.

The Cost of Consensus: EVM Gas and Operational Limits

Gas Costs represent the computational effort required to execute operations on the Ethereum Virtual Machine (EVM). Each transaction, including the deployment and interaction with smart contracts, necessitates a certain amount of gas, priced in Ether (ETH). The complexity of the operation determines the gas used; more complex computations, data storage, or state changes demand higher gas units. Users specify a gas price willing to pay per unit, and miners prioritize transactions based on this price, creating a market-driven fee structure. Insufficient gas supplied with a transaction will result in failure, while any unused gas is returned to the user. These costs are essential to consider when evaluating the economic viability of any on-chain operation, including decentralized finance (DeFi) strategies and automated market maker (AMM) interactions.

The economic viability of Buy-and-Burn (BnB) strategies is directly impacted by the computational costs associated with executing smart contracts on the Ethereum Virtual Machine (EVM). Specifically, the controller component of a BnB mechanism requires approximately 150,000 gas units for each execution. This gas consumption represents a tangible expense for operators, and cumulative costs across multiple transactions can significantly affect the overall profitability and scalability of the strategy. Therefore, efficient controller design and optimization of gas usage are crucial considerations when implementing BnB mechanisms on the Ethereum network.

Elevated gas costs on the Ethereum network directly impact the profitability of Buy-and-Burn (BnB) strategies, particularly when executing frequent or high-volume transactions; however, the implementation of the Dynamic-Control Buyback Mechanism (DCBM) mitigates these effects. Testing demonstrates that DCBM achieves a 66% reduction in price volatility compared to a Threshold model, despite equivalent gas expenses. Furthermore, operator churn is significantly reduced from 19.5% with the Threshold model to 8.1% when utilizing DCBM, indicating improved operational stability and cost-effectiveness even within a high-gas environment.

The pursuit of stable decentralized AI economies, as explored in this paper, mirrors a fundamental tenet of applied mathematics. Every exploit starts with a question, not with intent. G. H. Hardy observed, “A mathematician, like a painter or a poet, is a maker of patterns.” This creation of patterns, in this instance a dynamic control mechanism-the DCBM-isn’t about imposing order, but about understanding the inherent instabilities within the system. The paper’s application of control theory to tokenomics isn’t simply a stabilization technique; it’s an intellectual dismantling and reconstruction of economic forces, seeking to predict and counteract volatility-a deliberate probing of the system’s limits. It’s a test, a questioning of the underlying assumptions, all to forge a more resilient decentralized AI network.

What’s Next?

The presented Dynamic-Control Buyback Mechanism (DCBM), while demonstrating promise in simulated decentralized AI economies, inevitably highlights the inherent messiness of attempting to control emergent systems. The simulations operate, naturally, on assumptions – simplified models of rational actors and predictable market responses. The next iteration must grapple with the unavoidable reality of irrationality, malicious actors, and the unpredictable cascades that characterize real-world tokenomics. One suspects the most valuable data will arise not from achieving stability, but from observing how the system fails – the precise points of fracture revealing deeper flaws in the underlying assumptions.

Further exploration should focus on the limitations of PID control within this context. While effective for many engineering problems, its reliance on incremental adjustments feels… quaint, when applied to the potentially exponential growth and volatility of decentralized networks. Perhaps more sophisticated control methodologies – model predictive control, or even reinforcement learning approaches that adapt to unforeseen circumstances – are required. It is a question of whether one attempts to impose order, or to nudge the system towards a desired equilibrium.

Ultimately, the best hack is understanding why it worked. Every patch is a philosophical confession of imperfection. The true metric of success won’t be a flat token price, but a deeper comprehension of the complex interplay between incentives, algorithms, and human behavior in these nascent economic systems. The goal isn’t to eliminate volatility – that is likely impossible, and perhaps undesirable – but to understand its origins and to build systems resilient enough to absorb it.

Original article: https://arxiv.org/pdf/2601.09961.pdf

Contact the author: https://www.linkedin.com/in/avetisyan/

See also:

- All Golden Ball Locations in Yakuza Kiwami 3 & Dark Ties

- Hollywood is using “bounty hunters” to track AI companies misusing IP

- What time is the Single’s Inferno Season 5 reunion on Netflix?

- A Knight Of The Seven Kingdoms Season 1 Finale Song: ‘Sixteen Tons’ Explained

- NBA 2K26 Season 5 Adds College Themed Content

- Gold Rate Forecast

- Mario Tennis Fever Review: Game, Set, Match

- Beyond Linear Predictions: A New Simulator for Dynamic Networks

- Train Dreams Is an Argument Against Complicity

- Pokemon LeafGreen and FireRed listed for February 27 release on Nintendo Switch

2026-01-16 20:48