As a seasoned observer of the dynamic world of media and entertainment, I find myself both impressed and intrigued by the insights shared by Kareem Daniel (CEO, Disney Media & Entertainment Distribution) and Dana Walden (Chairman, Disney Television Studios) in this interview. Their strategic approach to content creation, distribution, and monetization is a testament to their deep understanding of the industry and its evolution.

For a company like The Walt Disney Company, which boasts a market capitalization of over $200 billion, a sum of $47 million might not seem significant when considering its overall profits. However, during August, this seemingly small amount carried immense significance as it marked the first-ever quarterly profit generated by Disney’s streaming business.

Clearly, significant cost reductions through layoffs and price hikes in subscriptions, among other measures, significantly contributed to Disney+ turning a profit from its initial losses. Although August’s $47 million profit was surpassed by a more substantial quarterly earnings of $321 million in November, Disney still has some distance to cover in order to offset the debt accumulated during the launch of their streaming service.

Despite the ongoing need for further financial refinements, Disney’s streaming service achieved significant triumphs across various aspects in 2024, if we look at the bigger picture.

From a programming perspective, several Disney television brands experienced remarkable years, with FX leading the charge. Under John Landgraf’s leadership, the once-network-turned-streaming-platform garnered near-universal critical acclaim for its grandiose production of Shogun, which translated into viewership success. Meanwhile, The Bear continued its cultural impact and Nielsen victories in season three. Both shows broke Emmy records for their number of wins, contributing significantly to FX’s victory over larger competitors like HBO and Netflix in the overall Emmy count.

In the meantime, Hulu managed to find success in unexpected areas, like reality series The Secret Lives of Mormon Wives, while shows such as Futurama and Only Murders in the Building remained popular streaming choices. Interestingly, ABC also had significant achievements in 2024: The fall drama High Potential quickly became a hit and now leads broadcast TV in the key adults under 50 demographic. Additionally, ABC secured a major victory by taking over the rights to the Grammy Awards from its longtime host, CBS.

Inside Out 2, Deadpool & Wolverine, and Moana 2. These hits are crucial to Disney’s streaming service, because they eventually become popular choices for streaming. For instance, Inside Out 2 became the most-watched movie on Disney+ in three years, and viewership of the original film increased significantly before the release of the new movies.

From a technical standpoint, the combination of Hulu with Disney+ was executed smoothly, avoiding much debate – quite remarkable given the potential issues that could have arisen from adding mature content on a Disney-linked service. This merger has led to an increase in Disney+ usage and viewership of Hulu shows, while also providing Disney the opportunity to shift more customers towards its Disney Bundle. Similarly, this month’s addition of ESPN+ on Hulu, along with allowing non-bundle users to preview a large selection of Hulu and ESPN content, has also been successful.

Eventually, during the autumn season, Disney managed to prevail in a prolonged dispute with DirectTV regarding cable carriage. This victory potentially adds more subscribers for all of Disney’s streaming services. Similar to the 2023 agreement with Charter, DirectTV will now offer Disney’s streaming services as part of their linear channel package. In essence, this could potentially slow down the trend of people canceling cable and boost viewership on Disney’s streaming platforms.

However, in 2024, the most significant indicator of the company’s success might not be its quarterly profits, but rather how well it fared in the struggle for public interest and attention.

It’s commonly known that YouTube controls a large portion of Americans’ digital screen time, but when you consider both streaming and traditional TV viewing (broadcast and cable), Nielsen data shows that Disney outperforms all other conglomerates in this area since September. In fact, during November alone, Disney-owned properties accounted for 11.1% of total U.S. television viewing, surpassing both YouTube (10.8%) and Netflix (7.7%). This superiority is primarily due to the vast audiences attracted by sports broadcasts on ESPN and ABC, as well as news coverage from ABC. Interestingly, 43% of Disney’s viewership comes from streaming platforms, a figure that is expected to grow further.

Last week, Robert Fishman of MoffettNathanson, a Wall Street analyst, penned a research report stating that after a series of tumultuous years filled with “management shifts, shareholder disputes [and] excessive optimism followed by doubt” regarding streaming, Disney’s transformation into a dominant streaming player is now progressing from theory to reality. In addition, Fishman expressed confidence that Disney is on the path towards achieving significant profitability in its streaming business. While it will take several more years before substantial returns are realized, the goal of profitability is now within reach.

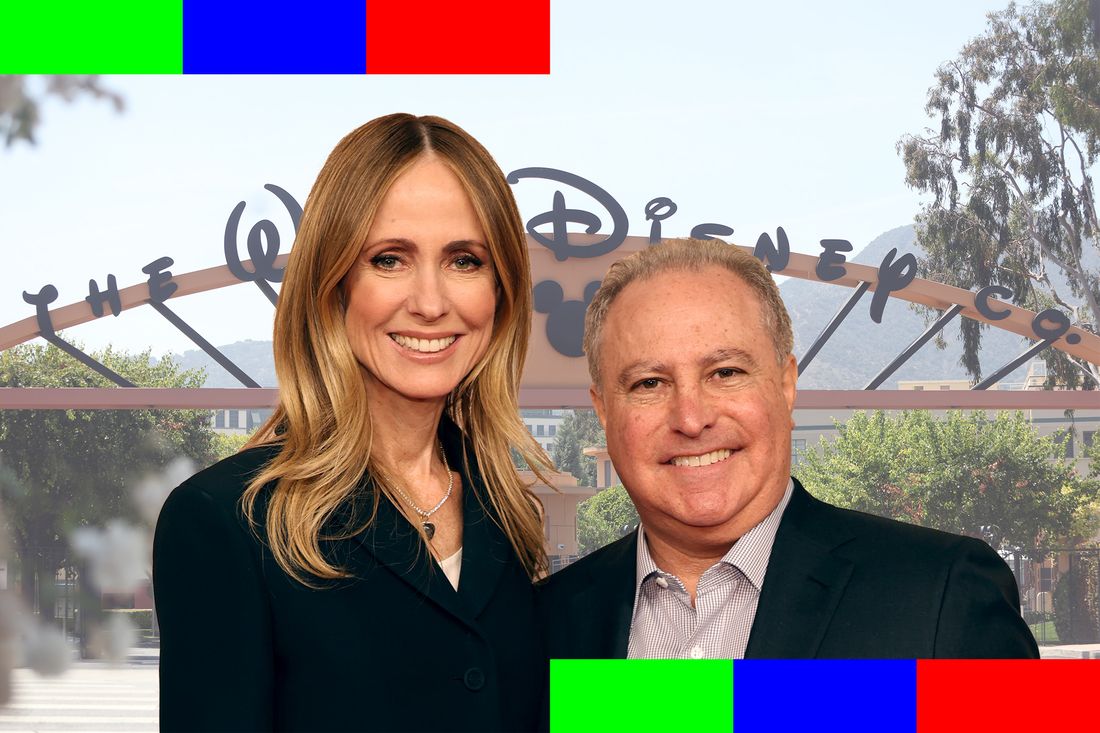

Under the leadership of Dana Walden and Alan Bergman, appointed co-chairs of Disney Entertainment in February 2023, Disney is being steered towards its promised land of streaming. These top lieutenants of CEO Bob Iger oversee all content creation and platforms for the company, including their emphasis on streaming services. Since assuming their roles, they have taken charge of both producing Disney’s films and TV shows as well as distributing and marketing these projects globally. Post the internal corporate turmoil experienced under previous leadership, Walden, Bergman, their team members, and ESPN chairman Jimmy Pitaro (in charge of ESPN+) can now concentrate on a crucial task: transforming Disney into a thriving streaming service provider.

It’s clear that mission isn’t yet complete, right? Netflix recently earned more than $2 billion in profit during its latest quarter, which is approximately seven times what Disney made. In the battle for top Hollywood talent, sports rights, and more, Disney must also confront tech giants like Amazon and Apple. The road ahead is challenging, but if Disney manages to navigate these hurdles effectively, 2024 may well be seen as the year the Disney streaming revival started. To gain some understanding of how they’ve managed to reverse their streaming fortunes and triumph in 2024, I interviewed Bergman and Walden last Friday – a unique occasion where both executives were interviewed together. Over a roughly 40-minute phone call (and a brief email exchange afterward), the pair discussed various topics, including the current status of Marvel and Star Wars, the reasoning behind cancelling The Acolyte, whether FX will continue to make risky bets like Shogun in today’s cost-cutting era, and even addressed the pressing question for any parents with young children: Will there be new full-length episodes of Bluey?

The interview was held before some unexpected events at Disney, such as their resolution of legal disputes with President-elect Donald Trump and the disclosure that a plotline about transgender issues was taken out from an upcoming children’s show on Disney+.

Looking back at Disney’s streaming performance in 2024, one significant milestone was when the division reported its first profit after years of operating at a loss. Besides reducing costs, could you elaborate on other strategies we employed to reverse this trend and set streaming on a profitable course? Furthermore, what steps are being taken now to establish it as a long-term profitable business model for Disney?

Dana Walden: The success of our streaming business is due to bringing together creative teams across the company and empowering creative executives to make decisions. This accountability begins with telling the finest stories. In general, whether we’re discussing the popularity of shows, awards, or critical acclaim, we always start by asking, “Are we providing our subscribers with the best stories?” And I believe the answer is a resounding yes.

Over time, we’ve been making significant strides with our platforms. Recently, we brought on board Adam Smith, a seasoned tech professional from YouTube, to lead this charge three months ago. The impact has been substantial, as evidenced by the increased number of tests taking place worldwide that aim to improve user experience on our platforms. I firmly believe that our advertising team, headed by Rita Ferro, is unparalleled in the industry. In the last quarter alone, we generated a billion dollars in global streaming ad revenue, marking a 16% increase compared to the same period last year. We’ve also successfully launched Hulu on Disney+, Star and ESPN on Disney+ and Latin America, as well as ABC News Live on Disney+. With Joe Earley at the helm of our streaming business, we’ve managed to pool resources effectively across the company, leading to a clear strategy that has already yielded profitability early on and immense growth potential.

Alan Bergman: As you’re aware, we were initially losing a significant amount of money, several billions to be exact. However, within just a couple of years, we’ve managed to reverse this trend. Alongside the strategies that Dana has mentioned, we’ve boosted our service prices, as they were quite low when we first launched. We’ve also significantly increased our subscriber base and improved engagement while reducing churn. This has effectively moved us towards profitability. In fact, we achieved this a quarter ahead of schedule. Looking forward, our goal is to attain double-digit growth and margins by 2026, with the help of our expanding content offerings and enhanced personalization. >

Excellent Dialogue AI

There’s widespread concern within the entertainment industry, as well as among viewers, that achieving profit margins in double digits might lead to significantly fewer shows and movies being produced, with potential increases in subscription fees. Could you share how much your production of shows, movies, and other programming has decreased to reach profitability? Has it been substantial? And what can we expect moving forward?

Walden: Joe, it seems we’ve been discussing this topic quite a while now. Our goal has never been to generate the highest volume of content; instead, we aim for quality. We believe that the ideal mix of programming is crucial rather than sheer quantity. Furthermore, our content comes from various sources. These include original productions tailored exclusively for our streaming platforms, movies from Alan’s catalog, and linear-first programs, which, when they appear on Hulu, perform as if they were originals.

Frankly, I’m not convinced reducing our programming is a good idea. The initial content strategy during the streaming wars, in my opinion, wasn’t very effective. Subscribers found themselves overwhelmed and struggled to discover suitable content. However, our brand-centric organization has significantly helped our subscribers find shows they enjoy that they may not have known about previously.

Furthermore, there’s a great deal of worth in our package. We’ve recently started offering a sneak peek of Hulu content to individual Disney subscribers, and these subscribers are already actively interacting with that content. This means we have two profitable prospects: persuading these subscribers to upgrade to the bundle and enhancing the value for our existing subscribers.

Bergman’s Comment: In terms of branded content from our studios, there was a phase where we produced more films specifically for the streaming service. However, what we discovered is that our major theatrical releases perform exceptionally well on this platform, especially sequels and prequels. For instance, promoting “Inside Out 2” led to an enormous increase in streams and viewing hours for the original “Inside Out”. The same pattern was observed with “Alien”, “Apes”, and “Moana”. In other words, the marketing strength of our big-screen movies stimulates global interest, encouraging viewers to revisit these titles, thereby boosting the entire platform. This strategy has proven effective for us. At this stage, we’re not looking to cut costs at all.

As a dedicated admirer, I can’t help but notice that there seems to be a shift in your content budget or the quantity of projects being produced, isn’t that correct?

As a dedicated fan, I’ve noticed that our studio was releasing several films directly onto a streaming platform. However, upon examining their performance, we discovered they weren’t meeting our desired level of success. Interestingly, we observed that pay-one window titles were thriving instead. Consequently, we shifted our perspective on this matter. While there was initially reduced investment in original Disney+ movies from our end, we’ve managed to move past that hurdle. Now, as we plan for future volumes, we’re focusing on strategies that will ensure a successful outcome.

Could there be a resurgence in original programming on platforms like Hulu, FX, ABC, and what remains of cable production? Given the historical patterns in television, could we witness an increase in investment for such content once more?

One advantage of Alan and I collaborating closely is that we’re now designing our platforms in a comprehensive manner. Consequently, as we move forward through the year, we’ll be creating general entertainment series that coincide with our major branded films when they’re released on the platform, and branded series at their respective releases. Previously, it wasn’t feasible to collaborate as closely or carefully due to the structure of our company which wasn’t conducive to such coordination. (Paraphrased version)

It’s reasonable for us to scale back on certain aspects, as part of this process was exploring the right amount and type of content needed for success in streaming. Additionally, we’re dealing with programming from our linear channels, original content, and local productions by our international teams. So, I would put it this way: Instead of reducing the overall intensity [of production], we’ve adjusted the balance or mix across the platform.

In a different wording: Originally, Moana 2 was planned as a series, but you switched that concept into a theatrical movie release. Rather than creating the next season of The Mandalorian for streaming, you chose to produce The Mandalorian & Grogu for cinemas instead. Were these decisions challenging? And how does this reflect changes in your approach towards major franchises and original content linked to them on streaming platforms?

Bergman: We found that for Moana 2 and The Mandalorian, it was more suitable to produce them as standalone films rather than part of our animation or Star Wars series respectively. This approach is taken on a case-by-case basis for us. However, when it comes to our major franchises, we strongly believe that a theatrical release is beneficial due to the global reach and marketing power it provides since we operate globally, making these titles accessible everywhere.

In reference to FX, it’s interesting to note how it could have followed the path of TNT or USA and essentially faded as a brand for high-budget original programming. However, that didn’t happen under your leadership. When Disney acquired Fox and FX, what factors ultimately convinced you and Bob Iger that FX deserved a spot in the emerging streaming landscape you were creating? On a broader note, I’m curious about the success John Landgraf has achieved at FX this year.

In essence, it’s fair to say that Bob deserves the credit for the vision. John and I have been working together for nearly three decades, but it was really Bob who spotted an opportunity to elevate this brand. To put it in perspective, for John and his team to create FX as a premium content provider on basic cable was quite exceptional. Moreover, Bob was an admirer of John’s talent, and he recognized the potential that John could unlock with adequate resources.

As a passionate cinephile, stepping foot onto the Disney lot was like entering a vibrant creative hub where the air buzzed with anticipation about collaborating with FX. The atmosphere shifted noticeably as everyone recognized the potential that FX offered for innovative programming. FX grasped this opportunity swiftly, recognizing it as a means to bolster their brand and venture into the future with daring shows like “Shōgun,” which in its previous iteration at Fox simply wouldn’t have been financially viable. With this collaboration, I believe they have created a timeless brand that represents unparalleled quality and a distinct style of programming, instantly recognizable to subscribers.

Is the achievement of FX in producing Shōgun, a project with a higher budget than any other they’ve undertaken before, making them more willing to invest in larger, riskier projects? Or is their strategy shifting towards taking on smaller-scale projects with lower budgets but significant potential returns, such as The Bear?

In simpler terms, Walden mentioned that since the second season of “Shogun” is approaching, their approach has always been to have a diverse range of projects. This includes shows like “Shogun,” “Nine Perfect Strangers,” and where “The Handmaid’s Tale” currently stands. Additionally, they are working on “The Secret Lives of Mormon Wives” and various successful documentary series. Their goal is to consistently provide a variety of content at different cost levels.

For John, Alien: Earth is quite the noteworthy production, and I’ve had the pleasure of watching the initial three episodes myself. It’s outstanding, and it carries a grandeur that makes us thankful for Alan and his team for allowing us to interact with this cherished Intellectual Property. However, when it comes to trusting one individual within a team with such a beloved IP, John seems as reliable an option as any. Consequently, we’ll persist in aiming high at every level.

Hey Alan, a significant aspect of your role involves overseeing Marvel. I penned an article not too long ago about “Agatha All Along,” and based on what both you and Bob have mentioned, it seems this production had a lower budget than any other Marvel show to date. Considering the conversation around limiting Marvel shows to two per year, if budget constraints can be managed without compromising quality, would you perhaps consider reconsidering that limit?

Bergman: Indeed, Agatha was a significant triumph for us and expanded the demographic that engages with Marvel’s series. Historically, our movies have appealed more to men than women, but Agatha provided an avenue to cater more effectively to female viewers as well. Regarding the number of titles, I don’t foresee us exceeding – at least I don’t have any immediate plans for that – two a year presently. However, ideas can always evolve, so it depends on the creativity we discover while evaluating our development projects.

Regarding costs, we’ve been scrutinizing them thoroughly to ensure affordability for our projects. Some of these projects may feature fewer visual effects compared to others, which can drastically affect the overall cost. Therefore, it’s evident that those with extensive visual effects carry a higher price tag. Currently, we are examining potential titles that will have reduced visual effects and will be priced more reasonably.

But the whole goal, in whatever we do, is quality. It’s the most important thing, and we won’t do anything that we don’t think is quality. So I think what you’re going to see is a mix of those series that have more visual effects and will certainly be more expensive. And then you’re going to see some titles that are less expensive because they have less visual effects. But what they’ll both have are great stories.

On the topic of popular franchises, let’s discuss Star Wars. It seems to have encountered some rough patches recently in comparison to Marvel. The series “The Acolyte” received positive feedback and performed well in viewership during its initial release, but we decided not to renew it for a second season. Could you tell us the reason behind this decision? Also, any insights into how “Skeleton Crew” is faring or its future would be appreciated.

Bergman explained that while they were content with the performance of Acolyte, it didn’t meet the expectations considering the complex nature of the project for a potential season two. As a result, no second season was produced. On the other hand, Skeleton Crew is currently in development and has shown signs of growth. The reviews for Skeleton Crew have been favorable, so we’ll see how things unfold as it progresses further.

What about the broader franchise, both on streaming and in theatrical?

Bergman: Looking ahead, we’ve got some exciting updates! First off, the second season of Andor, which we can hardly wait for. It’s outstanding – I’ve seen every episode and it’s an amazing season. Next up is the second season of Ahsoka, helmed by Dave Filoni. We also have several other series in the works, and we’ll decide on which ones to proceed with when they meet our high standards. As for the movies, right now we’re set to release Mandalorian in May ’26, and we’re developing more films. Once we’re ready, we’ll announce what those projects are.

Dana, it’s clear that children’s programming is deeply rooted in the DNA of Disney, and when you introduced Disney+, there was a strong belief that you would excel – that the kids streaming market was essentially yours for the taking. You’ve certainly outperformed many platforms that debuted around the same time as Disney+; Max has essentially abandoned the kids sector. However, YouTube continues to pose a significant challenge to your long-standing supremacy in this area. So, what strategies are you planning to employ moving forward?

Walden: Essentially, we’re employing a comprehensive approach. Let me highlight an example: last year, Bluey was streamed for 800 million hours, and each episode is only eight minutes long. We’ve adapted our strategy to reach the youngest audience possible, and we engage with kids where they spend their time. That’s primarily on Disney+, but we also recognize that they’re heavily active on YouTube. So, we have a YouTube strategy with channels for Disney Junior, Disney Channel, Descendants, among others. It’s all part of a growing ecosystem that includes important intellectual properties like Spidey and his Amazing Friends. We’ve recently introduced Streams, which are channel programs – our Playtime channel took off quickly. For parents, it’s convenient not to have to select another show when one ends; instead, they get a continuous stream of Disney kids programming they can trust.

Let’s discuss Bluey. Will there be additional full-length episodes in the future? And, have you thought about purchasing the intellectual property directly from BBC Studios?

Walden: Thanks, Joe. Could you put that strategy on paper and just send it over to me? [Laughs.]

Of course! No, but what’s going on with Bluey? Will there be more full-length episodes?

In response to your question about the current status of Walden, I must clarify that at this point in time, I’m unable to provide you with specific details. However, I can share that we maintain a strong bond with the BBC and Joe Brumm. This week, we released another batch of mini-episodes for Bluey. I am optimistic about the future of Bluey, although I cannot disclose any new upcoming launches during this call. That being said, I’m quite enthusiastic about what lies ahead. [Please note that a few days after this conversation, Disney and BBC Studios announced plans for a Bluey movie, and Joe Brumm shared that he would no longer be writing new episodes, but this doesn’t necessarily mean the series has come to an end.]

As a passionate cinephile, I’ve always admired how Disney has expanded its animated offerings beyond just children’s programming. Post the Fox merger, they’ve truly made a mark in adult animation. Shows like The Simpsons, Family Guy, and more recently, originals such as Solar Opposites and the revival of Futurama on Hulu, are testament to this. I’m curious to learn about the strategies and efforts involved in growing this segment within a company as renowned as Disney.

It’s great you asked! Our adult animated series have established one of the most impactful brands in entertainment, and they can only be streamed exclusively on Disney+ and Hulu. We lead in this distinctive style of storytelling. To date, we’ve produced nearly 2,000 episodes across four series: The Simpsons, Family Guy, American Dad!, and Bob’s Burgers. They have amassed over 150 Emmy nominations and 48 wins, placing them among the top 10 most-watched titles on our streaming services worldwide. Most significantly, subscribers who watch adult animation tend to stream for an additional 10 hours per month and are less likely to cancel their subscriptions. Last year, our adult animated content generated a staggering 3.7 billion hours of interaction on our platforms.

I’m wondering how long you anticipate The Simpsons, Family Guy, and Bob’s Burgers will keep airing on Fox. At some point, wouldn’t moving the shows exclusively to ABC or one of Disney’s streaming services not be a more logical step? Or do you believe it’s probable that the current agreement will be renewed when it ends next year?

In essence, content from Fox that debuts on their network eventually becomes available on Hulu and Disney+. This partnership allows Fox to boost viewership for these shows during their second broadcast window by promoting them through sports programming like football. While I can’t disclose specifics about our agreements, I can assure you this strategy is beneficial for both parties, and we are delighted to maintain this successful relationship – it truly is a win-win situation.

Could we discuss the possibility of Disney altering its approach with regards to licensing some previously released Fox and Fox Searchlight films to external streaming services following their premiere on your platforms? However, it’s not happening with new titles from Marvel, Star Wars, or Pixar. Might there be a shift in this strategy, allowing tentpoles to be licensed to other streamers as well? I noticed that Warner Bros. has already sold the rights to Barbie (released last year) to Netflix – is anything similar possible with Disney?

Bergman: Regarding our major, significant movies under brands like Disney, Pixar, Marvel, and Lucasfilm, we approach them strategically. We believe it’s an edge for us to stream these blockbusters exclusively on Disney+. As for some of our non-branded films, we’ve acquired the rights, and we’ll keep exploring this option as our business adapts over time.

So that’s a “no” on Disney’s branded films being licensed outside Disney+?

Bergman: Not at this time, no. I don’t think it makes sense.

In essence, it has been observed that under Bob Iger’s leadership, Disney has primarily concentrated on producing blockbuster franchises, many of which earn over a billion dollars at the box office. With the arrival of Hulu and Disney+, there was speculation about a possible shift towards creating more films similar to those produced by Fox Searchlight or standalone Disney movies. While a few such productions have been made, they are not numerous. Could we expect this trend to change as the Disney+ and Hulu platforms become more developed and widely accessible?

Bergman: Our primary focus lies in major motion pictures, a strategy we’ve been sticking with for quite some time now, and it has proven successful for us. These big-screen movies aim not only to gross a billion dollars but also to generate revenue across the entire company. For instance, the release of Moana 2 will include a theatrical debut, prompting viewers to rewatch Moana 1. This leads to increased sales of consumer products. Moreover, these movies are integrated into our theme parks, streamed on Disney+, and used in games. In essence, this approach not only boosts individual productions but elevates the company as a whole. Bob and I have talked about this strategy for years, and its impact on the company is crucial.

We have certain films, such as “Freaky Friday” and the recently released “Hocus Pocus 2,” which were either shown in theaters or exclusively on Disney+. Additionally, we are considering other movies that will be released directly on streaming platforms. However, there won’t be many of these. We primarily focus on theatrical releases because we believe that a wider audience can be reached through global marketing efforts. Regardless of the release method, these films will eventually make their way to our streaming service.

As a fervent enthusiast, I find myself pondering what the future may hold for us. In particular, I’m curious about your insights regarding the landscape of our shared industry in 2025, and more specifically, the prospects that await Disney Streaming at that time.

Bergman: We’re deeply committed to our work and keep an eye on others, but we prefer not to imitate. You might have noticed some changes in sports, and as we move ahead, I believe sports will play a larger role in our services. I won’t delve into specifics at this moment.

Walden: It can be challenging to stay focused on our priorities while keeping an eye on the trends in the industry. However, it appears that further consolidation is likely for Hollywood in the near term. We don’t anticipate this will affect us significantly because we are already a consolidated entity. We have over a century of Disney behind us and nearly as much with Fox. Since we took those steps six years ago, we believe we’ve gained an advantage in understanding and navigating the current industry landscape.

Read More

- FARTCOIN PREDICTION. FARTCOIN cryptocurrency

- SUI PREDICTION. SUI cryptocurrency

- Excitement Brews in the Last Epoch Community: What Players Are Looking Forward To

- The Renegades Who Made A Woman Under the Influence

- RIF PREDICTION. RIF cryptocurrency

- Smite 2: Should Crowd Control for Damage Dealers Be Reduced?

- Is This Promotional Stand from Suicide Squad Worth Keeping? Reddit Weighs In!

- Epic Showdown: Persona vs Capcom – Fan Art Brings the Characters to Life

- Persona Music Showdown: Mass Destruction vs. Take Over – The Great Debate!

- “Irritating” Pokemon TCG Pocket mechanic is turning players off the game

2024-12-19 23:58