The White House is promising that 2026 tax refunds will be “the largest ever.” Get ready, because if you thought your tax return was already a nice little bonus, brace yourself for a windfall thanks to retroactive tax cuts and a couple of other quirks that could have you doing a double-take when that check hits your account. 💸

Record Refunds Expected in 2026, According to the White House

The Trump administration says 2026 tax refunds are set to break records. We’re talking about the largest tax refunds in U.S. history, thanks to a delicious mix of retroactive tax cuts, unchanged withholding rules for 2025, and legislative timing that caused many people to overpay their taxes throughout the year. Oops! 🙃

According to several reports and analyses, the One Big Beautiful Bill Act (OBBBA), passed in July 2025, is driving this refund frenzy. Why? Because the IRS didn’t update the withholding tables halfway through the year, so workers continued paying taxes based on outdated rules. Surprise! In 2026, they’re going to get back a chunk of that money. 🍀

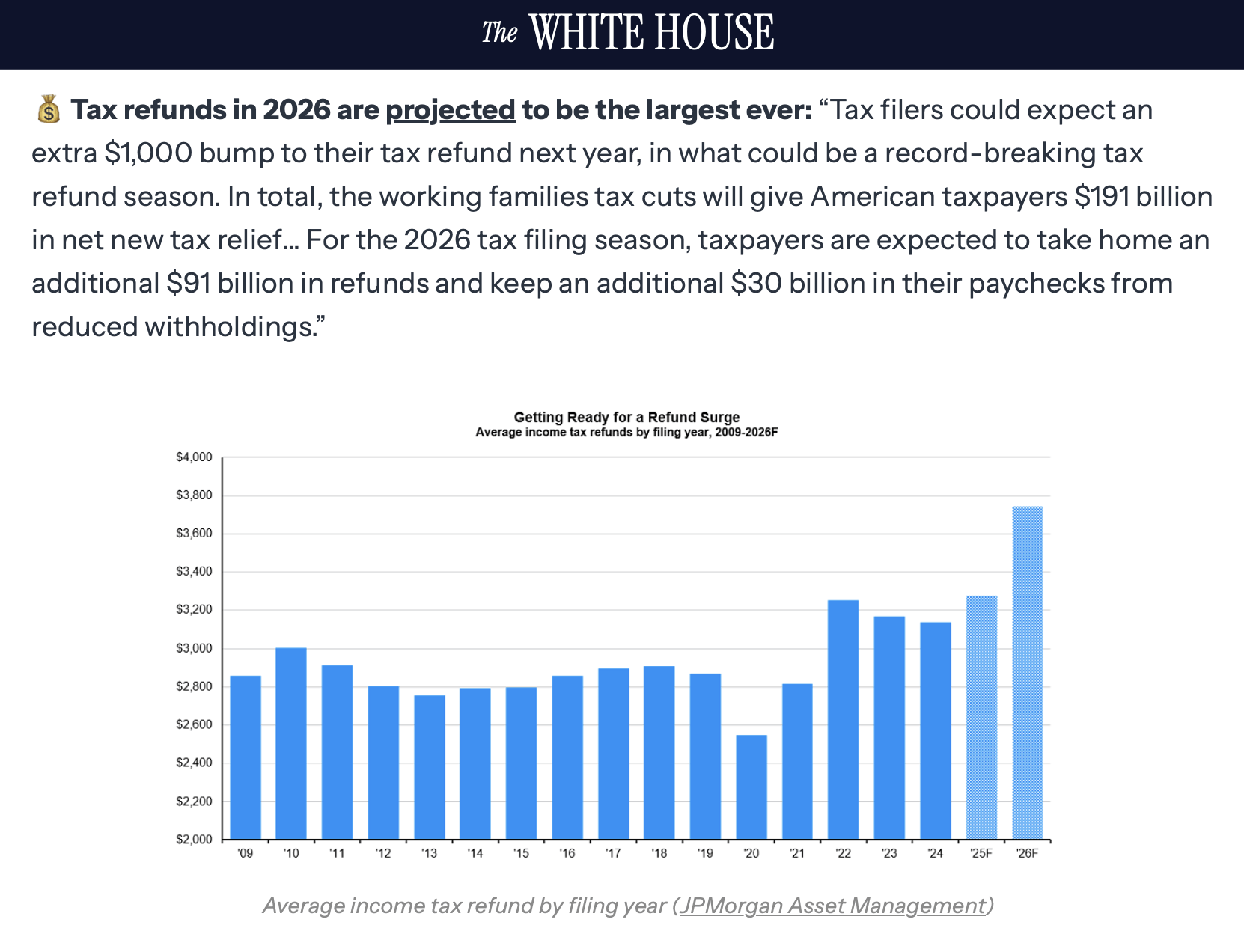

The White House and the U.S. House Committee on Ways and Means predict that the average refund could climb by about $1,000, adding as much as $91 billion to the total nationwide. And don’t get too excited just yet – there’s another $30 billion in reduced withholdings on the horizon, which will increase take-home pay but won’t touch those 2026 refunds. 💰

When you throw in other tax-credit changes, this package delivers about $191 billion in net tax relief. While this sounds like a massive giveaway (and it kind of is), the benefits are a bit more nuanced. For example, tips and overtime are no longer taxed (up to $25,000 for single filers), Social Security benefits are tax-free for almost 90% of seniors, and the cap on state and local tax deductions is jumping from $10,000 to $40,000. 🎉

Families are also getting a bump in the Child Tax Credit, and the standard deduction and qualified business income deductions continue under extended rules. Now, the administration is all like, “Look, we’re helping working families!” but the data shows a bit more complexity. Middle- and upper-middle-income households (those making between $60,000 and $400,000) are expected to see the biggest windfalls. Meanwhile, high-income earners will likely capture the lion’s share of these juicy benefits, leaving lower-income households with a smaller slice of the pie. 😬

Now, let’s talk about historical context because we love to compare things to the good old days, right? Over the last decade, average refunds have ranged from $2,800 to $4,300, with total refunds typically landing between $275 billion and $330 billion. But projections for 2026? A whopping $366 billion. That’s right, folks – “largest ever” territory, even before you adjust for inflation. In real terms, the difference is slimmer, but hey, it’s still a win. 🏆

And of course, crypto enthusiasts are all fired up about these numbers. Many believe that a wave of early-2026 liquidity could spark another round of retail interest in bitcoin and other digital assets, just like the stimulus-driven buying sprees of 2020 and 2021. Sure, the market is a little different now, but some are holding out hope that this wave of consumer cash will light the fuse for a new risk-asset rally. 🚀

Whether or not these refunds will break records depends on the economic landscape, but analysts are already claiming the ingredients for a big payout are already set. Let’s just hope we don’t have to wait for another four years for the next “largest ever” check, right? 😆

FAQ ❓

- Why does the White House expect record refunds in 2026?

Because retroactive 2025 tax cuts and unchanged withholding tables led to widespread overpayments. Surprise money, anyone? - How much larger could refunds be?

Some estimates predict an extra $1,000 per filer, and a total of $91 billion in additional refunds. 💸 - Who benefits most from these tax changes?

Middle- and upper-middle-income households are expected to see the largest benefits. Sorry, high earners – you’re getting most of the goodies. 😜 - Why are crypto advocates excited about larger refunds?

They believe that extra cash could lead to a boost in interest for bitcoin and other digital assets. It’s like retail Christmas, but in March. 🎄

Read More

- All Golden Ball Locations in Yakuza Kiwami 3 & Dark Ties

- NBA 2K26 Season 5 Adds College Themed Content

- Hollywood is using “bounty hunters” to track AI companies misusing IP

- What time is the Single’s Inferno Season 5 reunion on Netflix?

- Heated Rivalry Adapts the Book’s Sex Scenes Beat by Beat

- Brent Oil Forecast

- Elder Scrolls 6 Has to Overcome an RPG Problem That Bethesda Has Made With Recent Games

- Mario Tennis Fever Review: Game, Set, Match

- All Itzaland Animal Locations in Infinity Nikki

- BREAKING: Paramount Counters Netflix With $108B Hostile Takeover Bid for Warner Bros. Discovery

2025-11-26 22:15