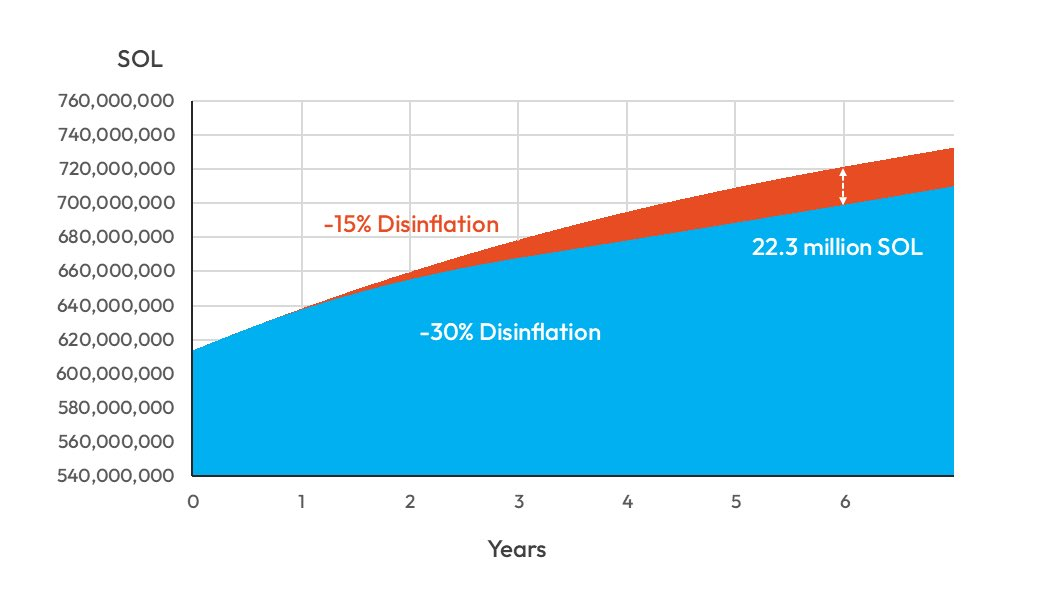

Oh, Solana, our eccentric friend in the world of blockchains, has decided to play a rather daring game of financial juggling. 🤹♂️💰 They’re slicing a staggering 22.3 million SOL ($2.9 billion) from their emissions over six years-because who needs money when you can have chaos?

This harebrained scheme would rocket the blockchain into a “low-inflation wonderland,” where validators might just faint from the thrill (or the math). 🤯

Solana’s Supply-Squeezing Scheme Risks Making 50 Validators Cry Over Coins 😢

The proposal, affectionately named SIMD-0411, suggests doubling the annual disinflation rate from 15% to 30%. “It’s like telling a sleepy sloth to sprint!” declared the authors, who also happen to be experts in counting beans and wearing top hats. 🎩

“This change is so simple, even a goldfish could handle it. No bugs, no errors-just a sprinkle of magic dust on the code,” they claimed, probably while sipping tea from a teacup labeled “Blockchain Wizardry.”

If this passes, Solana’s “terminal inflation” target of 1.5% will arrive in 2029-three years earlier than originally scheduled. Because why plan for 2032 when you can panic in 2029? 🚀

Supporters argue the current emissions are a “leaky bucket,” spilling coins like a toddler with a soda bottle. By tightening supply, Solana hopes to join Bitcoin and Ethereum in their “scarcity club,” where members pay dues in existential dread and crypto profits. 🤝

“Our models predict a 3.2% smaller total supply-22.3 million SOL less than before. At today’s prices, that’s $2.9 billion in vanished money! Excessive emissions are like a greedy uncle at a family reunion: always ruining the vibe.”

Beyond price support, Solana plans to overhaul DeFi incentives. Because nothing says “fun” like turning your validator into a high-stakes game of Russian roulette. 🎰

High inflation is now being compared to “high interest rates in traditional finance”-a fancy way of saying, “We’re making staking yields drop from 6.41% to 2.42% by year three. Good luck, have fun, don’t cry!” 😭

But this “hard money” pivot is as risky as a clown on a tightrope. Validator margins might start to feel like a circus elephant on a diet-squashed, but still somehow expected to juggle flaming torches. 🐘🔥

Up to 47 validators could become unprofitable in three years. The authors call this “minimal churn,” which is just a polite way of saying “we’re fine if half your validators quit and take up knitting.” 🧶

Still, it raises the question: Will Solana consolidate into a “Big Blockchain” oligarchy? Only time will tell if this is the dawn of a new era-or the beginning of a long, sad goodbye. 🌅😢

Read More

- All Golden Ball Locations in Yakuza Kiwami 3 & Dark Ties

- NBA 2K26 Season 5 Adds College Themed Content

- Hollywood is using “bounty hunters” to track AI companies misusing IP

- What time is the Single’s Inferno Season 5 reunion on Netflix?

- Heated Rivalry Adapts the Book’s Sex Scenes Beat by Beat

- Brent Oil Forecast

- Elder Scrolls 6 Has to Overcome an RPG Problem That Bethesda Has Made With Recent Games

- Mario Tennis Fever Review: Game, Set, Match

- All Itzaland Animal Locations in Infinity Nikki

- BREAKING: Paramount Counters Netflix With $108B Hostile Takeover Bid for Warner Bros. Discovery

2025-11-22 18:54