$WULF aims to secure 250-500 MW of new HPC signings annually and plans to mine Bitcoin through at least the end of 2026.

It’s earnings season once again, and while many companies had their usual corporate banter, TeraWulf’s Q3 2025 call somehow managed to pierce through the monotony. Not for the earnings numbers (yawn), but for subtly revealing a blueprint that might just etch Bitcoin miners into the annals of energy-infrastructure providers for the AI era. Oh, joy. 🤓

Let’s break this down-slowly, because even Kafka would need a flowchart to follow this.

Growing Deal Sizes

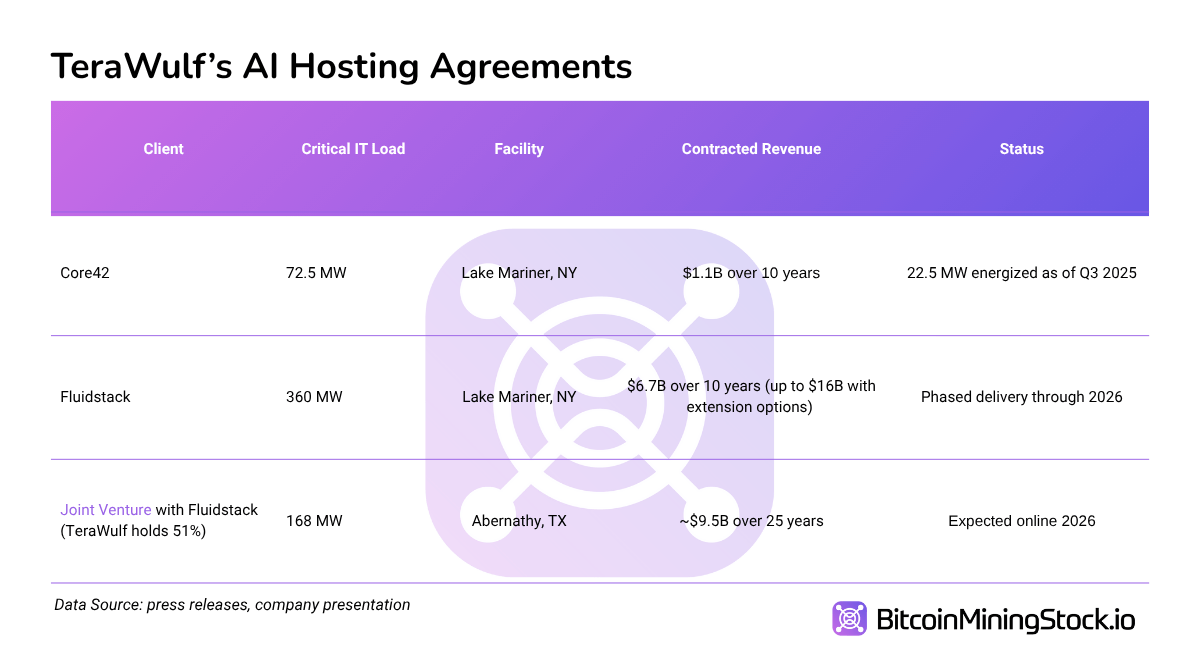

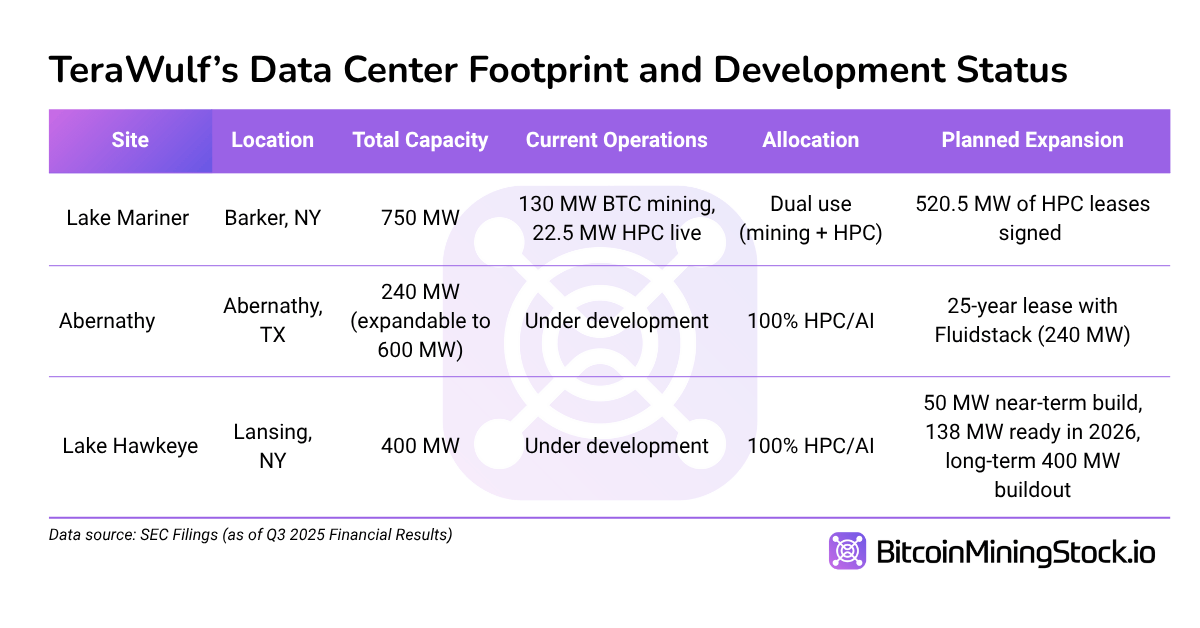

Back in August, TeraWulf signed two HPC lease deals with Fluidstack, accounting for 360 MW. And what made this sprinkle of madness even more exhilarating? The involvement of Google. Yes, that Google. The kind of institutional credibility that makes crypto infra buildouts look almost… reasonable. Almost.

By November, TeraWulf reported 520 MW+ in total contracted HPC IT load. One of the largest we’ve seen in the Bitcoin mining sector, achieved in a matter of months. Impressive, or perhaps a testament to how the wild west of crypto has now teamed up with Big Tech.

The 72.5 MW Core42 lease signed at the end of last year is still in the mix. But Fluidstack has emerged as the star of the show. Beyond lease size, they have formed a joint venture to co-develop the Abernathy site into a 240 MW HPC campus with expansion potential up to 600 MW. Folks, this is capitalism at its finest-co-building instead of leasing. Revolutionary 🤯.

Joint Venture in Texas

The Abernathy joint venture brags about its unique structure: this includes a 25-year lease backstopped by a $1.3B Google credit enhancement. Moreover, TeraWulf has 51% controlling interest and rights for an additional 200 MW Fluidstack-led buildout.

In layman’s terms-think land ownership plus strategic leases, client partnerships and inviting hyperscaler credit enhancement, offering something rare in mining: a glimmer of hope. No, not just hope-long-term visibility.

Interestingly, it wasn’t even WULF’s idea. According to CEO Paul Prager, it was Google who suggested anchoring the JV in Abernathy. So, perhaps hyperscalers are quite keen on grid access and execution history-labels like “Bitcoin miner” seem less thrilling today.

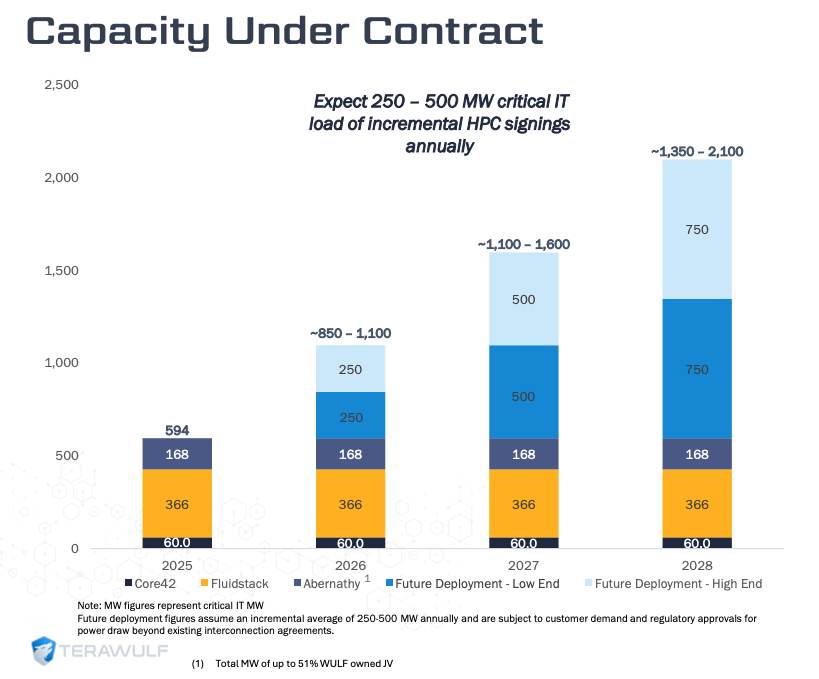

Targeting 250-500 MW of New HPC Signings Annually

Perhaps the boldest proclamation from the Q3 call was TeraWulf’s promise to raise its annual targets for HPC signings. From 100-150 MW annually, the new goal stands at 250-500 MW annually.

While execution risks remain, management seems steadfast and utterly confident-citing 150+ sites evaluated last year and a scaled-up dev team. Part of their $5.2B capital raised is earmarked for supporting these expansions. Ambitious? Definitely. Realistic? Let’s revisit this in another headline. 💼

The Future of Its Bitcoin Mining Biz

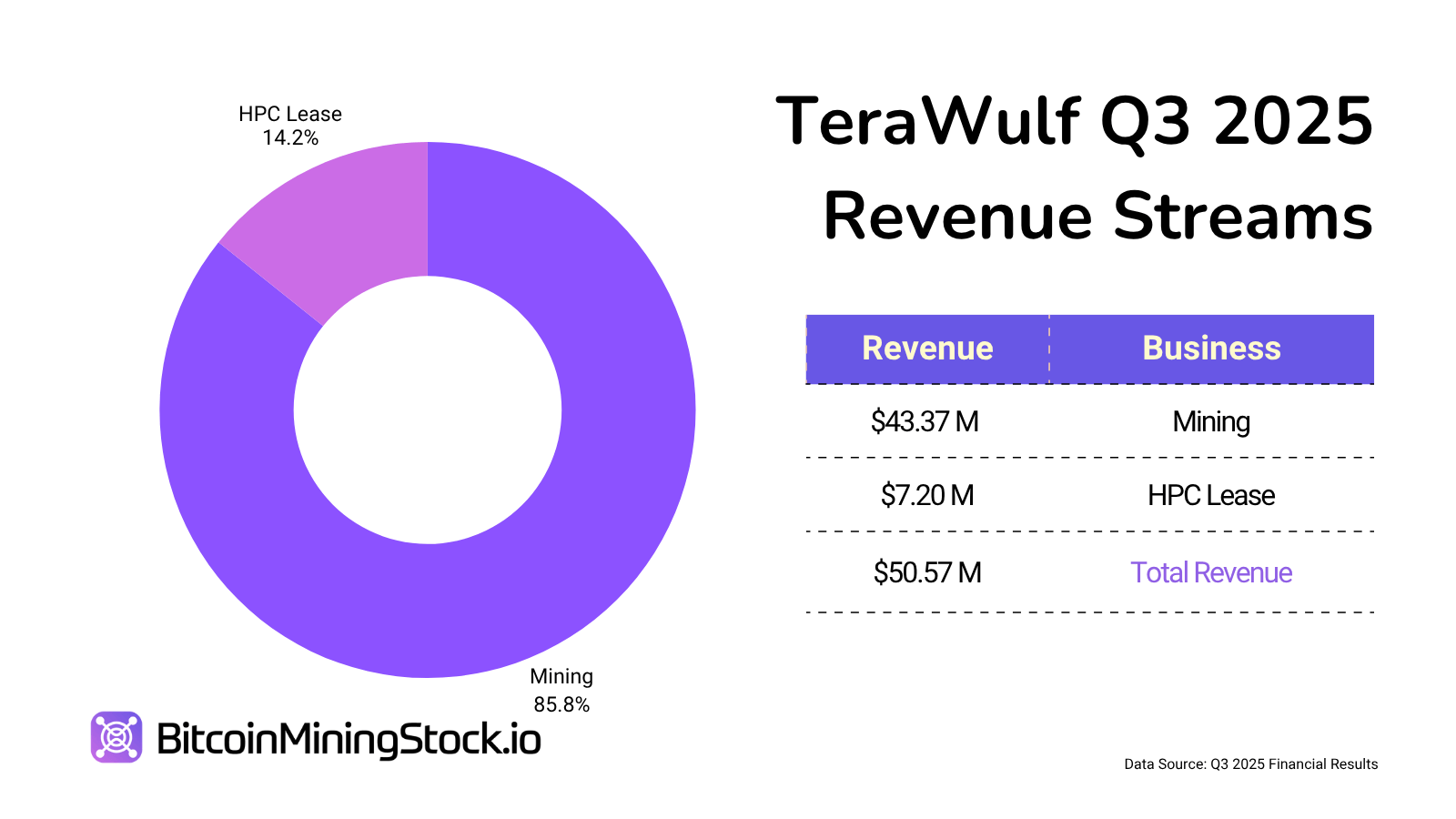

Even though HPC is a new frontier, Bitcoin mining remains the primary revenue contributor today. TeraWulf self-mined 377 Bitcoins (down from 485) in Q3 as they retired older mining units and repurposed infrastructure for HPC.

Future developments at their flagship site, Lake Mariner-where the HPC transition is underway-will be exclusively AI/HPC-focused. To all Bitcoin enthusiasts, no new Bitcoin mining infrastructure is being built-unless it supports dual-use capabilities.

Still, TeraWulf plans to mine Bitcoin through at least the end of 2026-clearly looking towards the AI/ HPC model for the foreseeable future. So, Bitcoin mining isn’t dead…yet.🪦

Final Thoughts

TeraWulf’s Q3 earnings call revealed more than just lease wins-it showcased a path that Bitcoin miners could embrace in the AI era. Instead of leasing infrastructure, TeraWulf is leveraging its portfolio-land, power, project execution-to form long-term partnerships. Will others follow? Probably.

Read More

- Movie Games responds to DDS creator’s claims with $1.2M fine, saying they aren’t valid

- The MCU’s Mandarin Twist, Explained

- These are the 25 best PlayStation 5 games

- SHIB PREDICTION. SHIB cryptocurrency

- Scream 7 Will Officially Bring Back 5 Major Actors from the First Movie

- All Golden Ball Locations in Yakuza Kiwami 3 & Dark Ties

- Server and login issues in Escape from Tarkov (EfT). Error 213, 418 or “there is no game with name eft” are common. Developers are working on the fix

- Rob Reiner’s Son Officially Charged With First Degree Murder

- MNT PREDICTION. MNT cryptocurrency

- ‘Stranger Things’ Creators Break Down Why Finale Had No Demogorgons

2025-11-17 11:03