Author: Denis Avetisyan

A new framework learns to represent assets in a way that anticipates future correlations, improving portfolio construction and risk management.

This paper introduces Future-Aligned Soft Contrastive Learning (FASCL), a representation learning technique that aligns asset embeddings with future return correlations using a soft contrastive loss.

Effective asset retrieval-identifying financially similar instruments-remains a critical challenge despite reliance on historically-rooted price patterns or static sector classifications. This paper introduces ‘Cross-Sectional Asset Retrieval via Future-Aligned Soft Contrastive Learning’, a novel representation learning framework designed to overcome these limitations by aligning asset embeddings with anticipated future return correlations. Through a soft contrastive loss function, the approach-FASCL-learns representations that prioritize assets likely to exhibit correlated future behavior, demonstrably outperforming thirteen baselines across a variety of predictive metrics. Could this future-aligned approach unlock more robust and profitable investment strategies by moving beyond backward-looking similarity measures?

The Illusion of Static Relationships

Conventional time series analysis, reliant on techniques like forecasting and Pearson correlation, frequently encounters limitations when applied to financial markets due to an inherent inability to model the intricate, non-linear dependencies between assets. These methods largely assume relationships are static and linear – a simplification that overlooks the dynamic interplay and feedback loops characteristic of complex financial systems. While effective in certain scenarios, they struggle to capture phenomena like volatility clustering, mean reversion, or the impact of unforeseen events, leading to inaccurate predictions and suboptimal investment strategies. The core issue lies in their inability to represent the nuanced ways in which assets respond to each other, particularly during periods of market stress or rapid change, ultimately hindering a comprehensive understanding of asset behavior.

Financial datasets are notoriously complex, presenting challenges for traditional analytical techniques due to their high dimensionality and pervasive noise. The sheer number of assets, indicators, and time points creates a data space where meaningful patterns can be obscured by irrelevant fluctuations. Consequently, attempts to represent these assets as lower-dimensional embeddings – a crucial step for many machine learning algorithms – often yield suboptimal results. These flawed embeddings fail to capture the intricate relationships between assets, limiting the performance of downstream tasks such as portfolio optimization or risk management. The noise, stemming from market volatility, unpredictable events, and data inaccuracies, further exacerbates this issue, distorting the underlying structure of the data and hindering the creation of robust and informative representations.

Despite the promise of self-supervised learning to extract meaningful representations from unlabeled financial data, current methodologies often fall short in predicting future asset behavior. While these approaches attempt to learn underlying patterns without explicit labels, they frequently struggle with the inherent complexities of financial time series – including non-stationarity, volatility clustering, and the influence of external, often unpredictable, events. Many existing models rely on simplistic objectives, such as predicting masked values or future steps, which prove inadequate for capturing the nuanced, long-range dependencies crucial for accurate forecasting. Consequently, the learned embeddings often lack the predictive power necessary to outperform traditional statistical methods or even serve as robust features for downstream tasks, highlighting a persistent gap between the theoretical potential and practical performance of self-supervised learning in finance.

A Framework for Correlated Futures

FASCL employs a Transformer Encoder to create asset embeddings from time series data, a process designed to model temporal dependencies inherent in financial markets. The Transformer architecture, utilizing self-attention mechanisms, allows the model to weigh the importance of different points in the time series when generating the embedding for a given asset. This contrasts with recurrent neural networks which process data sequentially, potentially losing information from earlier time steps. By considering the entire time series context simultaneously, the Transformer Encoder captures complex relationships and dependencies that may not be apparent through simpler methods, resulting in a more informative and nuanced asset representation. The output is a fixed-dimensional vector embedding for each asset, summarizing its historical price behavior and capturing its temporal characteristics.

The Patch Embedding technique addresses the challenge of processing lengthy time series data with Transformer Encoders. Instead of feeding the entire series directly into the encoder, the technique divides the time series into discrete, non-overlapping segments, or “patches”. Each patch is then linearly projected into an embedding vector. This approach significantly reduces computational complexity and allows the Transformer to efficiently capture local temporal dependencies within each patch, while also enabling the model to learn relationships between these patches to understand the broader time series structure. The patch size is a hyperparameter that determines the granularity of the temporal analysis.

The framework employs a Soft Contrastive Loss function to align asset embeddings with observed future return correlations. This loss minimizes the distance between embeddings of assets exhibiting high positive correlation in future returns, and conversely, maximizes the distance between embeddings of assets with low or negative correlation. The contrastive approach operates by defining pairs of assets and calculating a loss based on the similarity of their embeddings relative to their future return correlation; the loss encourages embeddings to reflect these relationships. The ‘soft’ aspect of the loss utilizes a probabilistic approach, allowing for nuanced representation of correlation rather than strict binary classifications of similar or dissimilar assets, resulting in a more robust and generalizable embedding space.

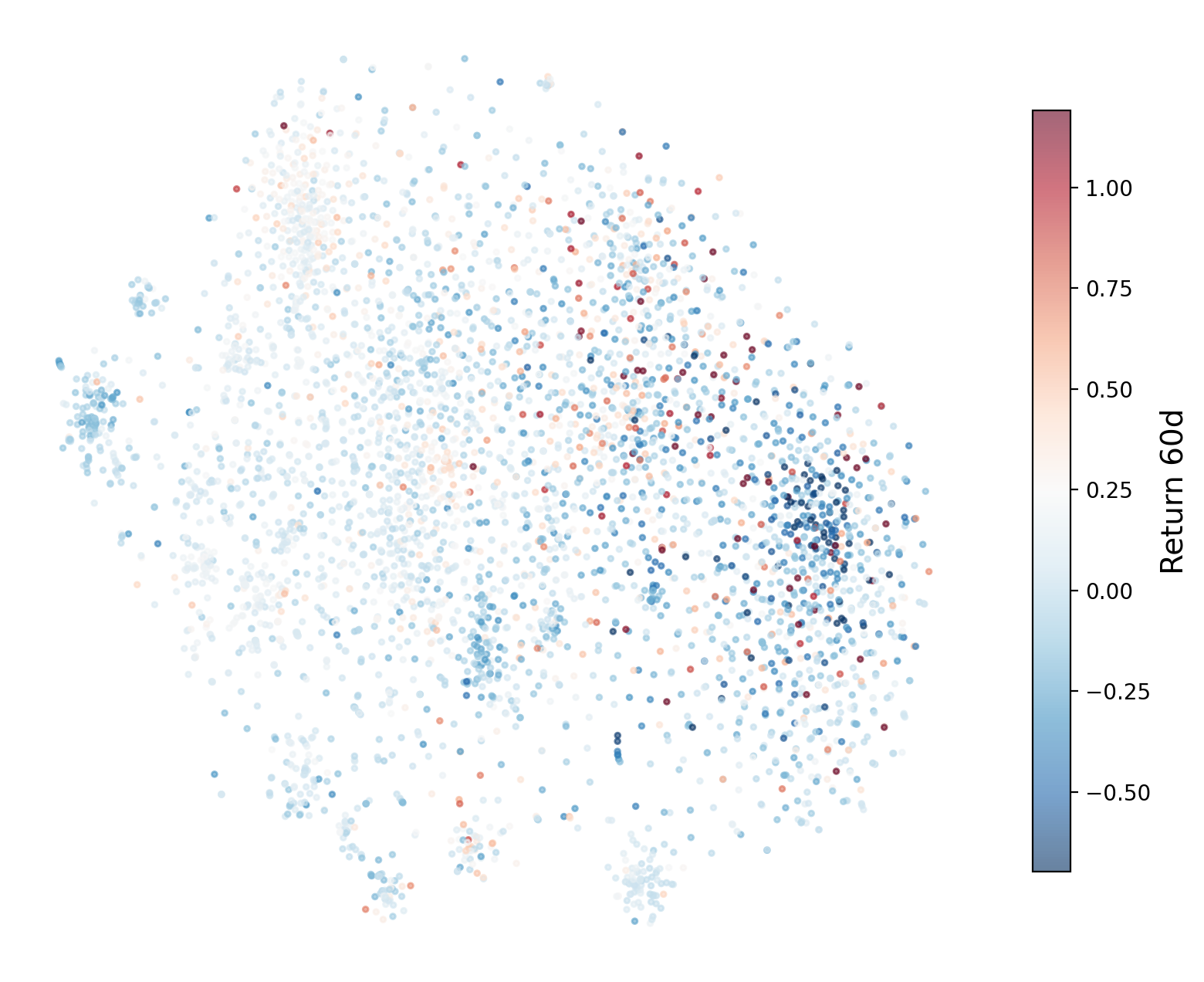

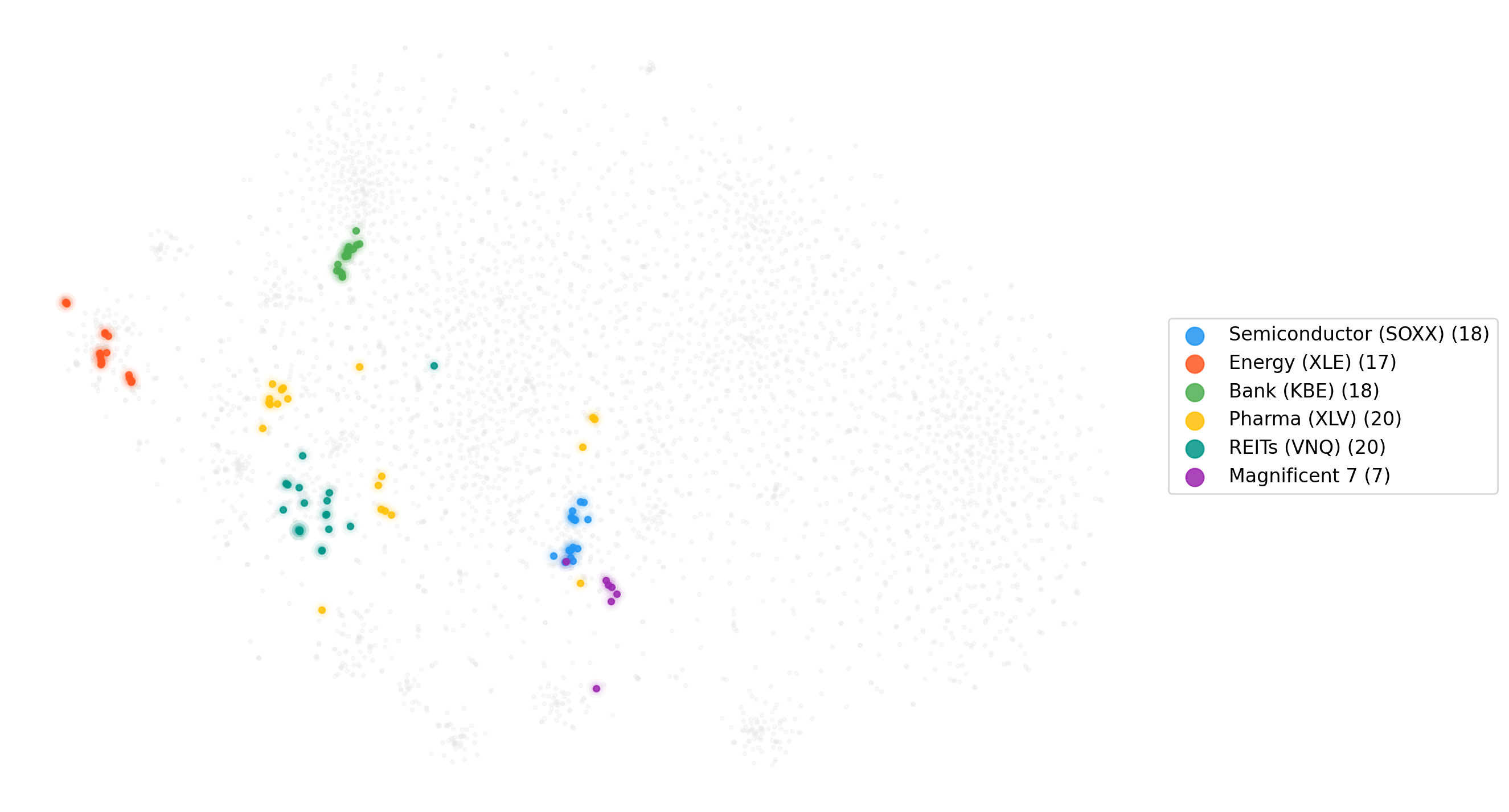

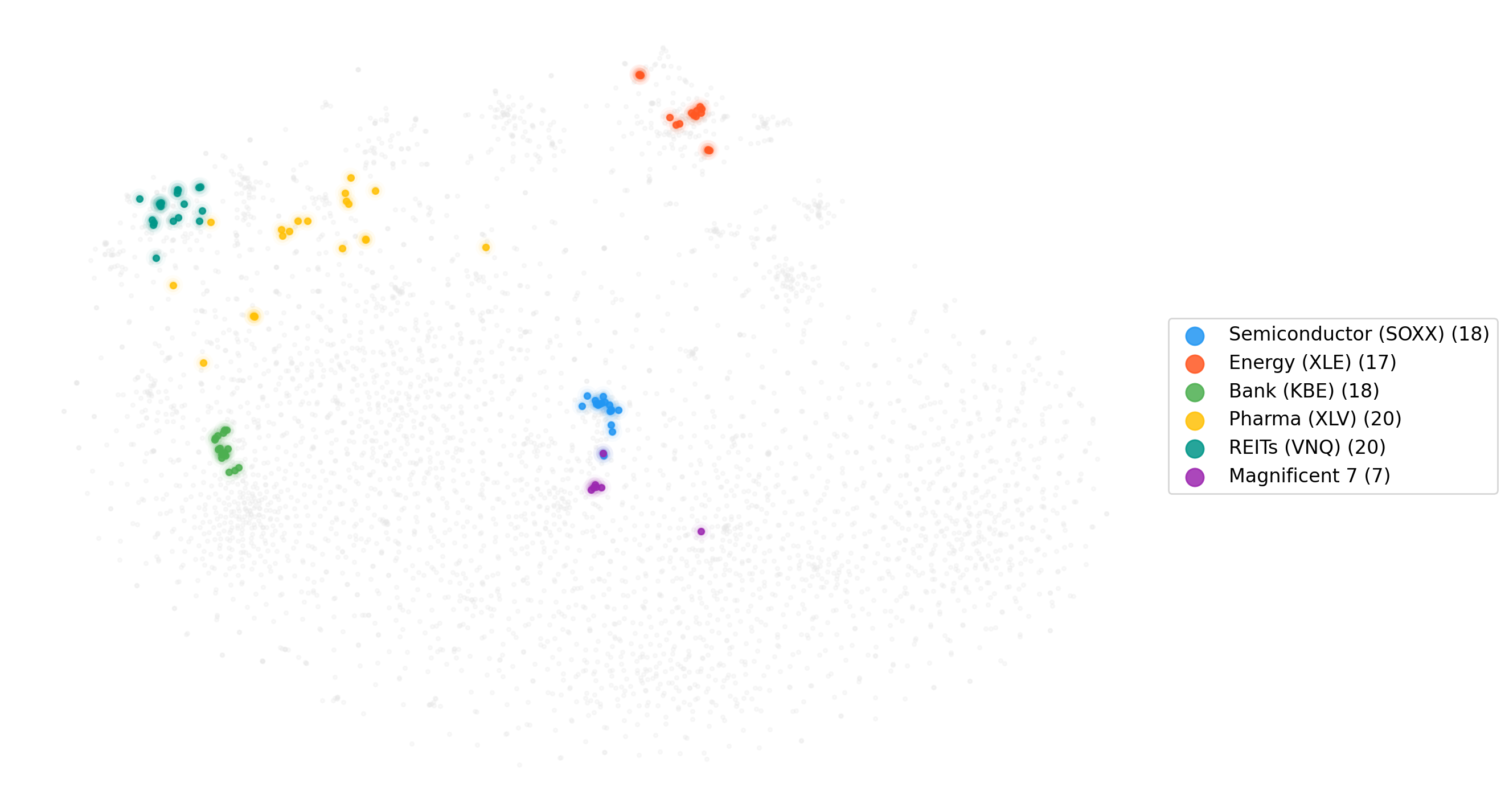

FASCL’s embedding spaces are designed to capture relationships beyond simple asset representation, functioning as a quantifiable map of market structure. These spaces are not merely a collection of asset vectors, but rather a geometric representation where proximity indicates correlation and similarity in behavior. The framework aims to encode information regarding asset interconnectedness, sector relationships, and potentially latent factors driving market dynamics within the embedding dimensions. Analysis of these spaces, utilizing techniques like dimensionality reduction and clustering, allows for the identification of market segments, influential assets, and potential systemic risks. This structural understanding enables applications beyond prediction, including portfolio construction, risk management, and anomaly detection, by leveraging the encoded relationships between assets.

Empirical Evidence: Beyond Correlation

FASCL consistently surpasses the performance of established time-series analysis techniques, including Dynamic Time Warping and conventional forecasting models, in predicting future return correlations. Quantitative results demonstrate a Future Return Correlation (FRC@K) of 0.3837 at K=1, representing a 12% relative improvement over the next best performing method, Pearson correlation. This indicates FASCL’s superior ability to identify assets with strongly correlated future returns, providing a more accurate representation of co-movement than traditional approaches. The model’s performance advantage is maintained across varying forecast horizons, as evidenced by its consistently lower Tracking Error at all K values compared to baseline methods.

Evaluation of the FASCL model’s learned embeddings demonstrates improved alignment with market dynamics as measured by Trend Consistency and Sector Precision. Quantitative results indicate a Future Return Correlation (FRC@K) of 0.3837 when K equals 1, representing a 12% relative improvement over the second-best performing method, Pearson correlation. This metric assesses the model’s ability to predict future return correlations based on learned embeddings, with higher values indicating greater predictive power. The observed improvement suggests FASCL effectively captures relationships in historical data to forecast future co-movements between assets.

Ablation studies were conducted to assess the contribution of specific components within the FASCL framework. Comparisons against a Multi-Horizon Return Regression baseline demonstrated that the implemented contrastive loss function significantly improves performance. These studies involved systematically removing or altering key elements, including the contrastive loss and variations in embedding strategies, to quantify their impact on model accuracy. Results indicated that the chosen embedding strategies, in conjunction with the contrastive loss, are critical for capturing nuanced relationships and achieving superior performance in forecasting asset return correlations; modifications to either component resulted in measurable decreases in key metrics such as Future Return Correlation (FRC@K) and Trend Consistency (TC@K).

Within the FASCL framework, patch embeddings are aggregated using Mean Pooling to generate a unified representation. Performance validation demonstrates that FASCL consistently exhibits the lowest Tracking Error across all evaluated K values, signifying a stronger degree of co-movement between the query asset and its retrieved peers. Quantitative results further indicate a Trend Consistency (TC@K) of 64.4% at K=1 with a 60-day forecasting horizon, and an Information Coefficient (IC@K) of 0.3549 at K=5 utilizing a 20-day horizon; these metrics confirm the model’s ability to identify assets with similar return patterns and predictive power.

The Illusion of Control, and the Seeds of Growth

The core benefit of utilizing FASCL-derived embeddings lies in their ability to represent financial assets in a way that accurately captures subtle similarities often missed by traditional methods. This nuanced understanding facilitates the identification of assets with correlated behaviors, even those not readily apparent through conventional metrics. Consequently, portfolio construction can move beyond simple index-tracking or broad sector allocations, enabling investors to build more diversified portfolios with reduced risk exposure. By pinpointing genuinely dissimilar assets, the framework minimizes unintended concentration and maximizes the potential for stable, long-term returns, offering a powerful tool for optimizing portfolio resilience and enhancing overall investment performance.

The utility of these newly derived embeddings extends beyond theoretical improvements in asset similarity; practical application through spread trading strategies reveals substantial gains in profitability. Analysis demonstrates a Sharpe Ratio of 5.33 when employing a K-nearest neighbors approach with K=20, signifying a compelling risk-adjusted return. This performance notably surpasses alternative methods, with the FASCL-based strategy achieving a 28% higher Sharpe Ratio compared to the second-best performing technique, Pearson correlation. This quantifiable improvement suggests a viable pathway for investors to enhance portfolio performance through informed trading decisions facilitated by these embeddings, marking a significant step toward practical implementation of advanced financial modeling.

The current framework, while robust with existing financial data, possesses significant potential for enhancement through the integration of alternative data streams. Incorporating news sentiment analysis, for instance, could provide valuable insights into market perceptions and anticipate price movements beyond historical trends. Similarly, the inclusion of macroeconomic indicators – such as inflation rates, GDP growth, and unemployment figures – promises a more holistic understanding of the broader economic context influencing asset performance. These additions would not merely supplement the existing model, but rather create a dynamic, multi-faceted system capable of adapting to changing market conditions and potentially uncovering previously hidden correlations, ultimately strengthening its predictive capabilities and informing more nuanced investment strategies.

The potential of the FASCL framework extends significantly beyond its initial application to equities. Researchers intend to investigate its adaptability to diverse financial instruments, including fixed income, commodities, and derivatives, to ascertain whether the nuanced asset relationships captured by the embeddings translate across different market structures. Furthermore, expansion into geographically varied markets is planned, aiming to determine if FASCL can effectively navigate the unique characteristics and regulatory landscapes of international financial systems. Successfully implementing FASCL across a broader spectrum of instruments and markets promises to deliver more robust and versatile investment strategies, potentially reshaping portfolio construction and risk management practices globally.

The pursuit of effective asset retrieval, as detailed within, isn’t about constructing a perfect system, but fostering an ecosystem where relationships-future return correlations, in this case-emerge and are revealed. This resonates deeply with the spirit of Paul Erdős, who once stated, “A mathematician knows a lot of things, but knows nothing completely.” The FASCL framework doesn’t aim for absolute predictive power; instead, it embraces the inherent uncertainty of financial time series, seeking to align embeddings with probabilistic future states. Monitoring these alignments, then, becomes the art of fearing consciously-acknowledging that revelation, not bug-free perfection, is the true measure of resilience. true resilience begins where certainty ends; the system doesn’t prevent failure, but reveals the conditions under which it will occur.

What Lies Ahead?

The pursuit of effective asset retrieval, as demonstrated by this work, is less about constructing a perfect system and more about anticipating its inevitable decay. Aligning embeddings with future return correlations is a temporary reprieve, a localized reduction in entropy. The embedding space, however skillfully crafted, will ultimately reflect the shifting sands of market dynamics – a beautifully rendered map of a territory that no longer exists. There are no best practices – only survivors.

Future work will undoubtedly focus on dynamic alignment, on frameworks that acknowledge and incorporate the non-stationarity of financial time series. But the fundamental challenge remains: architecture is how one postpones chaos, not eliminates it. The true measure of progress may not be increased predictive power, but increased resilience – the ability to gracefully degrade as the underlying assumptions crumble.

One anticipates a move beyond simple correlation, toward models that capture the complex interplay of systemic risk and emergent behavior. Order is just cache between two outages. The real innovation will lie not in building better retrieval systems, but in cultivating ecosystems that can adapt and evolve in the face of perpetual uncertainty.

Original article: https://arxiv.org/pdf/2602.10711.pdf

Contact the author: https://www.linkedin.com/in/avetisyan/

See also:

- Movie Games responds to DDS creator’s claims with $1.2M fine, saying they aren’t valid

- The MCU’s Mandarin Twist, Explained

- These are the 25 best PlayStation 5 games

- SHIB PREDICTION. SHIB cryptocurrency

- Scream 7 Will Officially Bring Back 5 Major Actors from the First Movie

- Server and login issues in Escape from Tarkov (EfT). Error 213, 418 or “there is no game with name eft” are common. Developers are working on the fix

- Rob Reiner’s Son Officially Charged With First Degree Murder

- All Golden Ball Locations in Yakuza Kiwami 3 & Dark Ties

- MNT PREDICTION. MNT cryptocurrency

- ‘Stranger Things’ Creators Break Down Why Finale Had No Demogorgons

2026-02-12 19:09