Madam Polygon, that most enterprising of networks, now presides over a veritable treasure vault (TVL) of $1.13 billion in Real World Assets (RWAs), a sum that would make even the most jaded Regency financier blush. One might say the market is in quite a flutter, though perhaps not as much as a maiden’s heart at the first glimpse of a well-dressed investor.

This triumph follows Polygon’s recent “Rio” upgrade on the Amoy testnet, a maneuver as calculated as a well-placed proposal at a country ball. The report, jointly penned by Dune and RWA.xyz, arrived on Sept. 17, much like an invitation to a society soirée-one cannot attend without curiosity.

As the RWA Summit in New York unfolds, Polygon’s CEO, Sandeep Nailwal, waxed poetic on X, declaring 269 assets and 2,900 holders as his “dear companions” on the Polygon PoS chain. A man of many tokens, it seems.

The Dune and RWA report, that most enlightening of pamphlets, reveals Polygon’s RWA dominion: 62% of tokenized global bonds (courtesy of Spiko’s euro MMF and Cashlink’s cash), and a smattering of U.S. schemes. A veritable feast of financial innovation! 📜

– Sandeep | CEO, Polygon Foundation (※,※) (@sandeepnailwal) September 17, 2025

Key Trends From the 2025 RWA Report

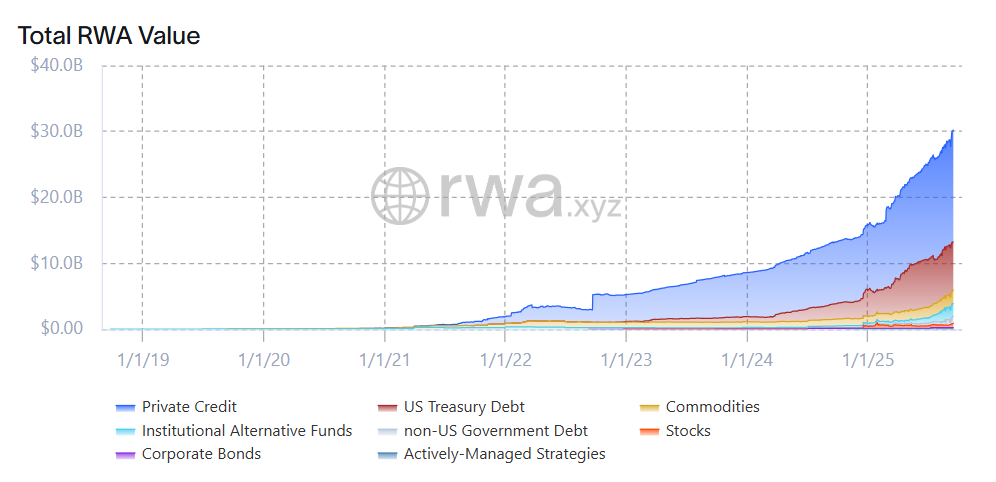

The “RWA REPORT 2025” (a tome of such girth it could double as a doorstop) declares a 224% surge in tokenized assets since 2024. The authors, with all the gravitas of a dowager duchess, cite U.S. Treasuries as the sector’s first successful flirtation with product-market fit. Capital, they note, now waltzes into riskier assets like private credit and bonds-a dance of high stakes and higher yields.

DeFi protocols, those modern-day alchemists, are transforming RWAs into programmable “building blocks” for onchain finance. A most ingenious contrivance, if one ignores the occasional market crash. 🏗️

Polygon’s Strength and Competition

Total RWA value. | Source: rwa.xyz

Polygon’s dominion lies in tokenized global bonds, a market it commands with 62% of the spoils. Poor Ethereum, that once-proud titan, now holds a mere 5% of this niche. One might say the tables have turned, much like a fortune in the stock exchange.

Solana, though no slouch, boasts a $500 million RWA market, a sum that pales beside Polygon’s coffers. Yet, competition is the spice of life-or so the economists would have us believe.

Polygon also leads in U.S. T-Bills, with 29% of Spiko’s USTBL TVL. A feat that would make even the most austere banker raise an eyebrow. Meanwhile, Nasdaq’s SEC filing for tokenized securities suggests traditional finance is donning its dancing shoes. 🕺

As Aishwary Gupta, Polygon’s Global Head for RWA, quipped, the industry has moved beyond “pilots” to “real products” that unlock liquidity. A sentiment as refreshing as a summer breeze-or perhaps as fleeting as a speculative bubble. 🌬️

Read More

- All Golden Ball Locations in Yakuza Kiwami 3 & Dark Ties

- Hollywood is using “bounty hunters” to track AI companies misusing IP

- What time is the Single’s Inferno Season 5 reunion on Netflix?

- Gold Rate Forecast

- Mario Tennis Fever Review: Game, Set, Match

- NBA 2K26 Season 5 Adds College Themed Content

- A Knight Of The Seven Kingdoms Season 1 Finale Song: ‘Sixteen Tons’ Explained

- Every Death In The Night Agent Season 3 Explained

- 2026 Upcoming Games Release Schedule

- Beyond Linear Predictions: A New Simulator for Dynamic Networks

2025-09-17 19:57