Oh, what a curious tale this is! In the vast expanse of Asia, where the sun rises over the land of the rising sun, there lies a corporate giant, Metaplanet, whose heart beats in the rhythm of the digital coin, Bitcoin. 🧠💰 With the precision of a masterful conductor, this Japanese firm has extended its lead, acquiring yet another 5,268 BTC on October 1st, a purchase made at the lofty price of $116,870 per Bitcoin, thus investing a staggering $615 million. Yet, the stock, like a falcon in flight, has plummeted by over 10%, a spectacle that leaves one both awestruck and bewildered. 🪜

Metaplanet Becomes Fourth-Largest Bitcoin Treasury Firm

As of October 1, 2025, this illustrious company now boasts a total of 30,823 BTC, a treasure trove purchased for roughly $3.33 billion, with an average cost per Bitcoin of $107,912. The CEO, Simon Gerovich, with a voice as resonant as a cathedral bell, declared that they are now the fourth-largest Bitcoin Treasury firm globally, a position that places them in a dominant spot, though one might question the necessity of such a title. 🎩

🪜Metaplanet is now the 4th largest publicly-traded Bitcoin treasury company in the world

– Simon Gerovich (@gerovich) October 1, 2025

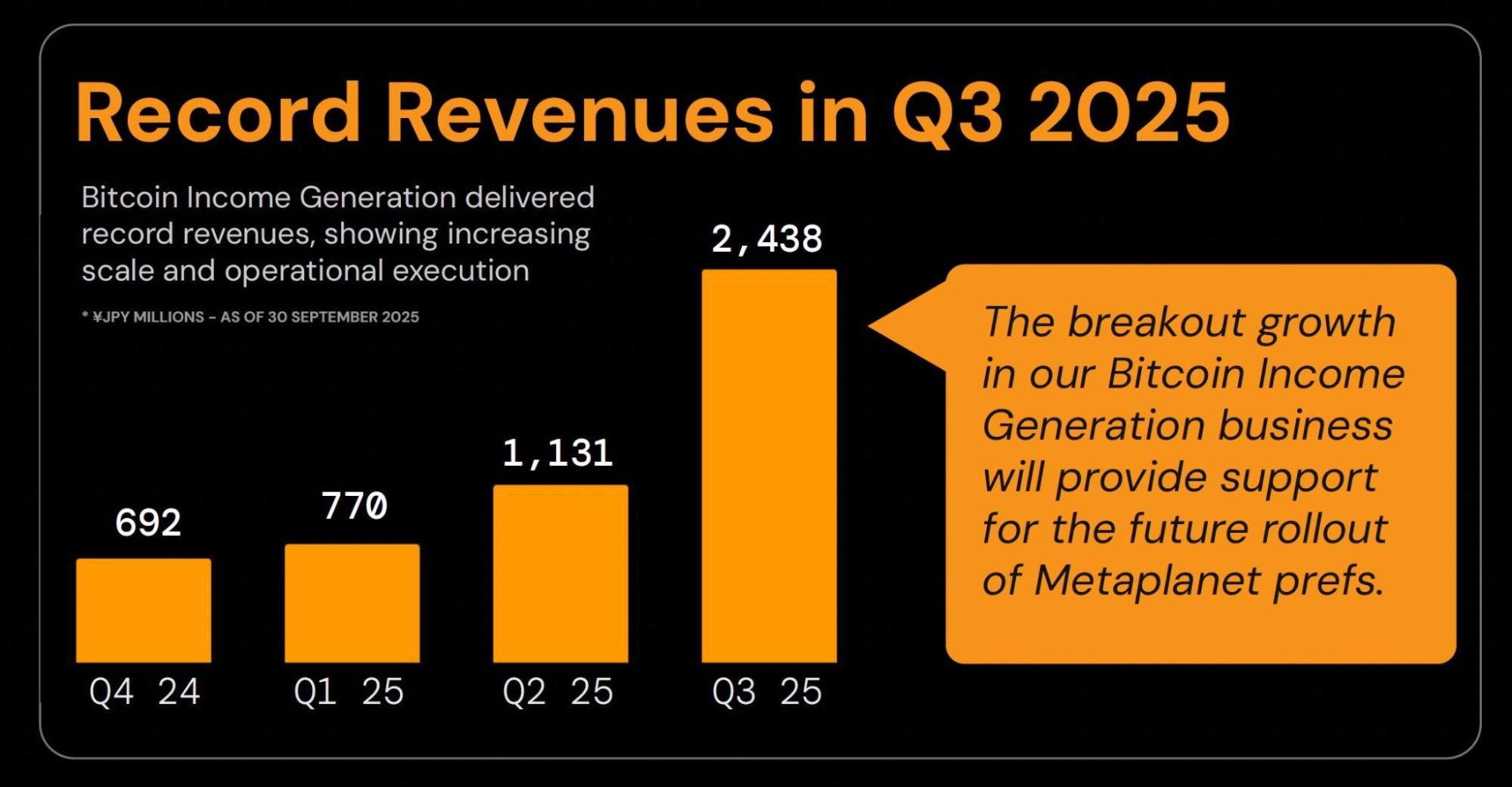

More importantly, the Japanese firm has disclosed the results of the Bitcoin Income Generation Strategy. During the third quarter of 2025, the segment reported quarterly revenue of 2.438 JPY billion, a figure that marks a 115.7% increase from Q2. One might say that the company has found its golden goose, though the question remains: will it lay eggs of gold or merely feathers of confusion? 🦆

Following the strong Q3 performance, the Japanese firm revised its full-year 2025 consolidated guidance. The updated forecast reflects a 100% increase in revenue and an 88% rise in operating profit compared to previous projections. A feat that would make even the most stoic of accountants raise an eyebrow in disbelief. 🤯

The CEO, with a voice that echoes through the halls of finance, noted that the Q3 results demonstrate operational scalability. Yet, one wonders if the company’s true test lies not in its financials, but in its ability to navigate the tempest of market sentiment. 🌪️

Metaplanet Bitcoin Income Generation Revenue | Source: Metaplanet

Metaplanet Stock Crashes 10%

Despite the strong Q3 performance, the stock, like a ship in a storm, has come under selling pressure and has corrected 10.26% today, slipping all the way to 516 JPY. Over the last month, the stock has corrected by 37%, a decline that has left traders in a state of existential dread. 🧠💸

Yet, even in this turmoil, institutions have continued to purchase, as if drawn to the siren song of Bitcoin. Capital Group has recently become the largest shareholder of Metaplanet, taking a massive 11.45%, a move that suggests either profound faith or a willingness to gamble on the whims of the market. 🎲

Benchmark Equity Research has reaffirmed its “Buy” rating on Metaplanet, citing the Japanese Bitcoin treasury firm’s continued crypto accumulation despite recent stock price weakness. In a research note last week, analyst Mark Palmer set a price target of 2,400 Japanese yen for Metaplanet by the end of 2026, a prediction that is as bold as it is uncertain. 🧠

Read More

- All Itzaland Animal Locations in Infinity Nikki

- Exclusive: First Look At PAW Patrol: The Dino Movie Toys

- All Golden Ball Locations in Yakuza Kiwami 3 & Dark Ties

- James Gandolfini’s Top 10 Tony Soprano Performances On The Sopranos

- Not My Robin Hood

- Ethereum’s Volatility Storm: When Whales Fart, Markets Tremble 🌩️💸

- Unlocking the Jaunty Bundle in Nightingale: What You Need to Know!

- Super Animal Royale: All Mole Transportation Network Locations Guide

- 7 Lord of the Rings Scenes That Prove Fantasy Hasn’t Been This Good in 20 Years

- Silver Rate Forecast

2025-10-01 14:19