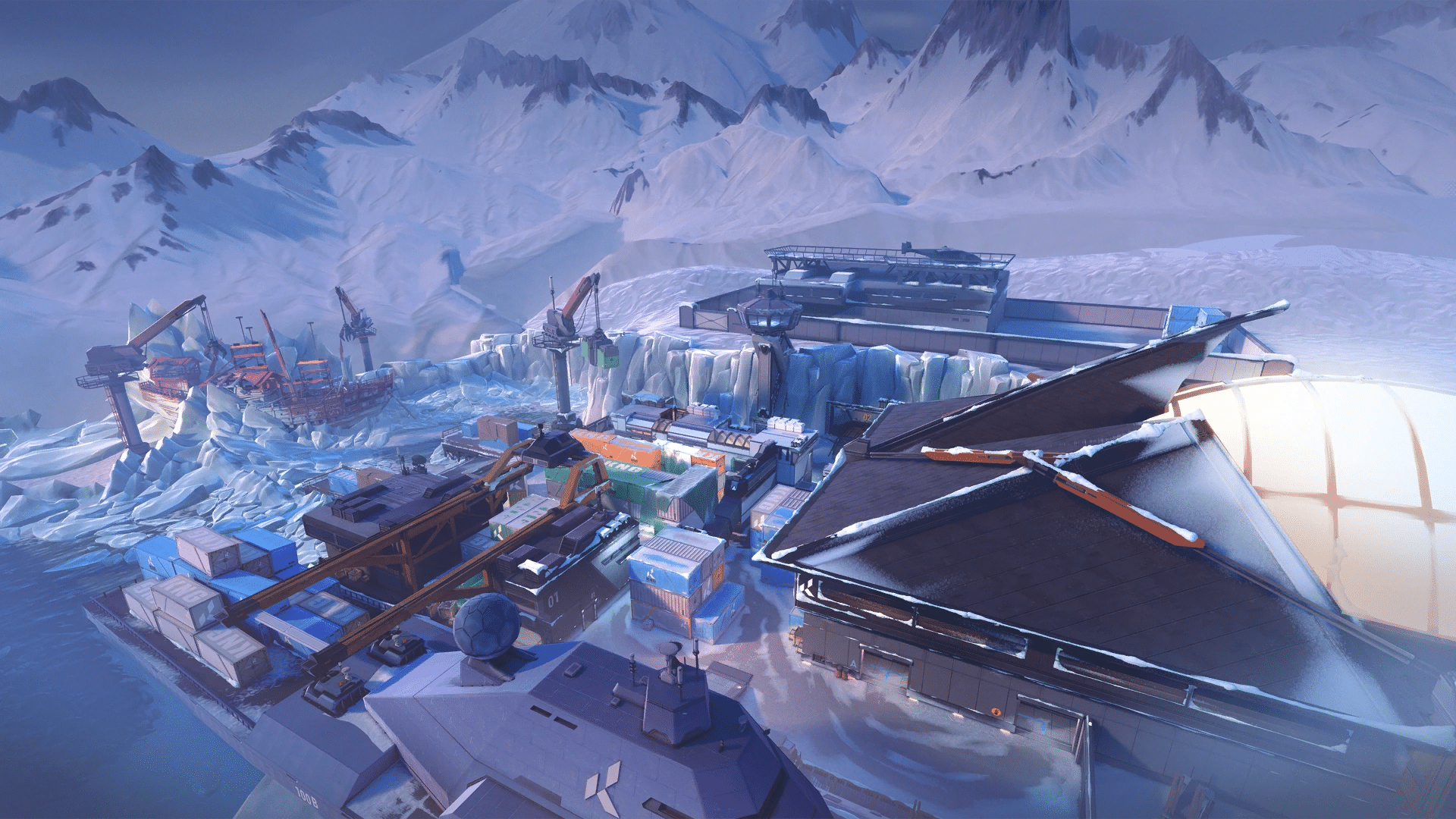

Valorant’s New KayO Armor: Players Are Loving This Fan Creation!

As a die-hard fan, I must say that Same-Salamander2472’s post about the KayO armor build serves as a heartwarming testament to the creativity flourishing within our vibrant Valorant community. The comments on this post echo a sincere appreciation for the skill and effort poured into crafting such an intricate design. For instance, slimypajamas69 couldn’t help but exclaim, “brooo, that is so cool nice one!” reflecting the widespread admiration for this exceptional build. It appears that players like us cherish the dedication of fellow fans who go above and beyond to breathe life into our digital characters, whether it’s through cosplay or other artistic endeavors. Instead of treating KayO as just a character to play, we yearn for more – more interpretations, more dimensions, more ways to celebrate our shared passion. This collective spirit of collaboration in celebrating our fandom is a defining trait of online communities, and it’s heartening to see the Valorant community thriving on this very principle.