Author: Denis Avetisyan

A new network model integrates detailed financial data to reveal hidden connections and vulnerabilities within the euro area’s banking system.

This paper constructs an empirically grounded multilayer network using granular supervisory data to assess systemic risk and financial contagion across different market segments.

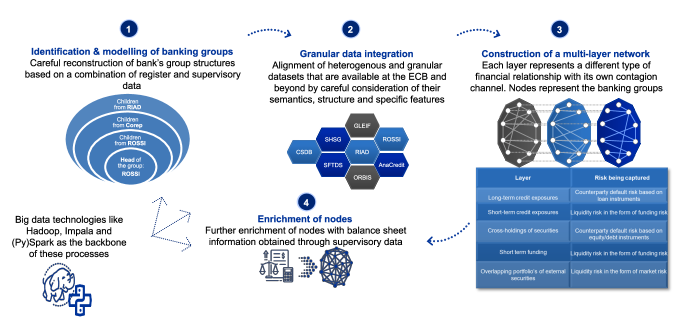

Despite increasing recognition of multi-channel contagion in financial systems, empirical systemic risk assessments often rely on simplified network representations due to data limitations. This paper, ‘Integrating granular data into a multilayer network: an interbank model of the euro area for systemic risk assessment’, addresses this gap by constructing an empirically grounded multilayer network of euro area banking groups, integrating supervisory and statistical data across multiple exposure types. The resulting network reveals pronounced heterogeneity in connectivity and centrality, demonstrating that flattened representations can obscure crucial systemic dynamics. Could this data-driven, layer-aware approach provide a more robust foundation for stress testing and proactive risk management in complex financial networks?

Unveiling the Hidden Architecture of Financial Risk

Conventional financial risk assessments frequently depend on consolidated data, which inadvertently simplifies the intricate web of relationships within the financial system. This aggregation can mask vital connections – the subtle dependencies between institutions and markets – that, when stressed, can amplify shocks and trigger systemic crises. By collapsing detailed information into broad categories, these models lose sight of how a failure at one entity can rapidly propagate through the network via complex chains of exposure. Consequently, risk is often underestimated, and the true vulnerabilities of the financial landscape remain obscured, hindering effective preventative measures and potentially leading to inaccurate predictions during times of economic turbulence.

Modern financial systems are characterized by intricate networks and interdependencies, demanding a shift from traditional risk assessment methods. A truly comprehensive understanding of systemic risk necessitates granular, disaggregated data – moving beyond aggregated figures to reveal the precise connections between institutions. Recent research addresses this need by integrating data from 114 banking groups operating within the euro area, offering an unprecedented level of detail. This detailed approach allows for the identification of hidden exposures and potential contagion pathways, ultimately providing a more accurate and robust assessment of financial stability. The ability to map these complex relationships is crucial for policymakers and regulators seeking to proactively mitigate risks and safeguard the broader economic landscape.

Constructing a Holistic View of Interconnectedness

The multilayer network leverages data reported under European regulatory frameworks – specifically the European Market Infrastructure Regulation (EMIR), the Common Reporting (COREP), and the Financial Reporting (FINREP) – to construct a comprehensive map of financial interconnectedness. EMIR data details derivative contracts and associated counterparty exposures, while COREP and FINREP submissions provide granular information on banks’ balance sheets, risk exposures, and capital adequacy. Integrating these datasets allows for a unified representation of the financial system, moving beyond siloed views of individual reporting requirements and enabling analysis of systemic risk across multiple institutions and market segments. This consolidated approach facilitates improved monitoring of financial stability and supports more effective macroprudential oversight.

The multilayer network’s coverage of interbank lending is significantly enhanced through the incorporation of data from securities financing transactions (SFTs) and money market segments (MMS). SFT data, including repurchase agreements, securities lending, and margin transactions, provides detailed information on collateralized funding relationships between banks. Concurrently, data from the money market segment, specifically regarding short-term funding and liquidity transfers, complements the SFT data by capturing uncollateralized interbank exposures. This combined data stream allows for a more comprehensive mapping of financial interdependencies and systemic risk within the interbank market, going beyond traditional reporting methods.

The integration of data from AnaCredit, the statistical data collection system on individual bank loans, significantly enhances the granularity and precision of the multilayer network. AnaCredit provides detailed information on loan characteristics, including borrower identity, loan type, outstanding amounts, and geographical distribution. This data allows for a more accurate mapping of credit exposures between financial institutions and non-financial entities, improving the network’s ability to identify systemic risk concentrations and assess the impact of individual borrower defaults. The inclusion of AnaCredit data moves the network beyond aggregate reporting, enabling a higher resolution view of interdependencies within the financial system and facilitating more targeted regulatory oversight.

Simulating Contagion and Systemic Vulnerabilities

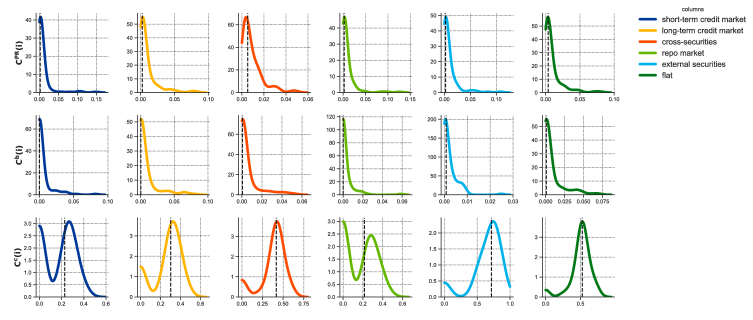

An agent-based model was constructed utilizing a multilayer network to simulate interactions within both long-term and short-term funding markets. This model represents financial institutions as agents operating within a network structured with distinct layers for each market type. The multilayer approach allows for the observation of liquidity flows and interconnectedness between these markets, capturing how shocks originating in one layer can propagate to others. Agent behaviors are defined by parameters governing borrowing, lending, and asset holdings, enabling the simulation of complex financial transactions and the emergence of systemic effects. The model’s architecture facilitates the analysis of funding dynamics and the identification of potential vulnerabilities within the financial system.

The agent-based model simulates fire sale dynamics by incorporating behavioral responses of financial institutions to negative shocks; when an institution faces liquidity stress, it is modeled as attempting to rapidly liquidate assets, potentially at depressed prices. This asset disposal then impacts the valuations held by other institutions in the network, triggering further liquidations and a cascading effect. The propagation of shocks is captured by the network structure itself, where interbank lending and asset holdings define exposure; a shock originating with one institution is transmitted to others based on these direct and indirect connections, with the magnitude of transmission determined by the volume of exposure and the behavioral responses of the affected agents. The model allows for observation of how initial liquidity concerns can escalate into systemic events due to these feedback loops and interconnectedness.

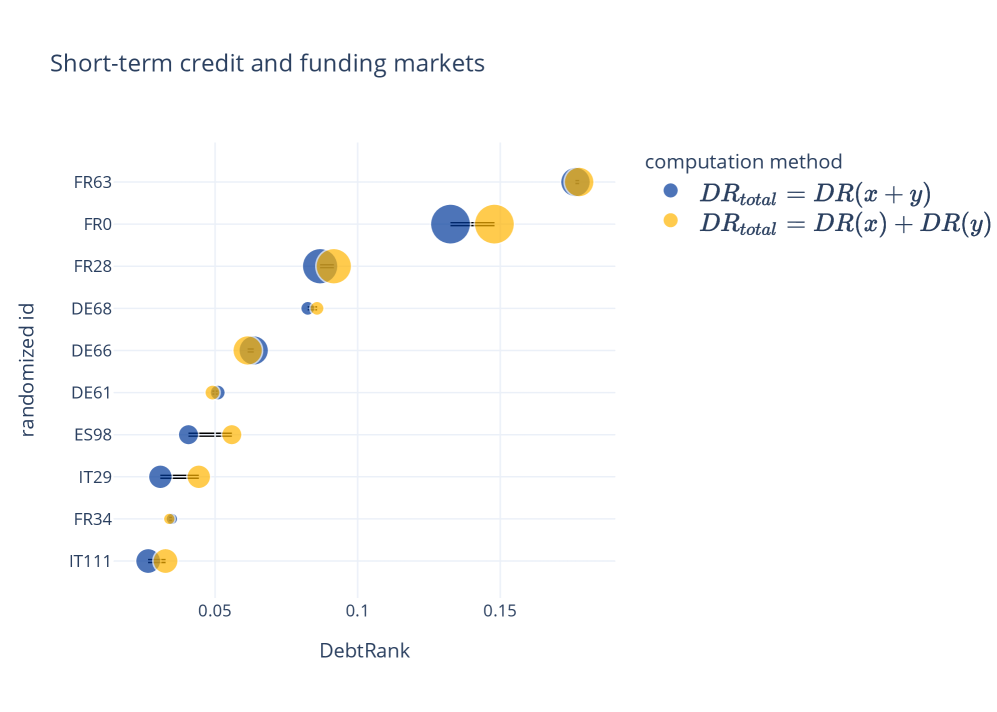

DebtRank, a methodology for quantifying systemic importance, was applied to the multilayer network representing financial institutions and their interdependencies. Analysis revealed a pronounced disparity in systemic impact between funding markets. Specifically, the short-term funding/repo market demonstrated significantly higher systemic risk contribution than the short-term credit market. This indicates that disruptions within the repo market, characterized by overnight lending and borrowing of securities, have a more substantial potential to propagate shocks throughout the financial system compared to disruptions in traditional short-term credit relationships. The DebtRank metric identifies institutions central to this funding network as disproportionately influential in overall systemic stability.

Implications for Safeguarding Financial Stability

The financial system’s intricate connections often obscure vulnerabilities until a crisis emerges. Recent advancements in network theory and agent-based modeling now allow for a more holistic examination of these risks, revealing previously hidden weaknesses. By integrating these approaches, researchers can map the complex web of interdependencies between financial institutions, identifying potential contagion pathways and systemic risks that traditional methods might miss. This integrated analysis moves beyond assessing individual bank solvency to evaluating the stability of the entire system, showing how localized shocks can propagate and amplify through interconnectedness. The model demonstrates, for example, that even seemingly robust institutions can become vulnerable during a cascade of defaults, highlighting the need for proactive monitoring and regulation that accounts for systemic risk, rather than isolated failures.

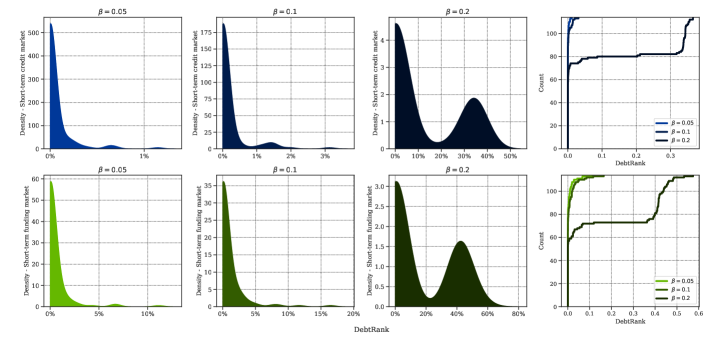

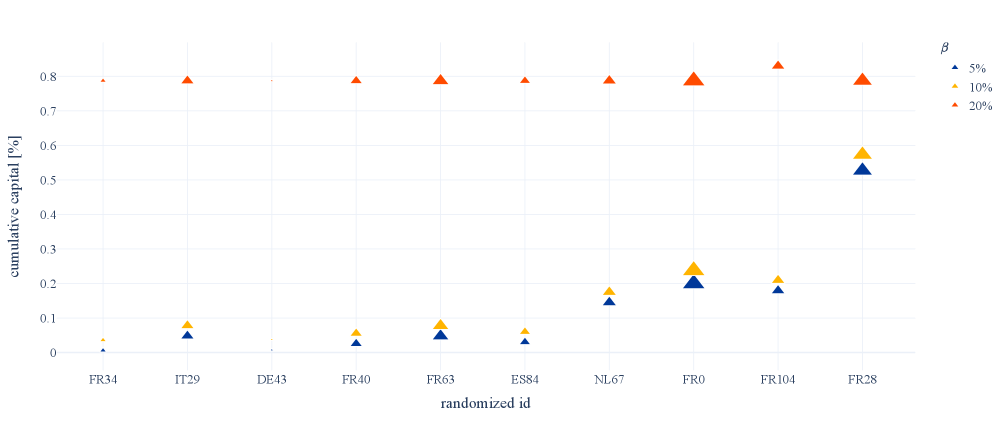

The agent-based model serves as a crucial tool for proactively assessing the resilience of the financial system through rigorous stress-testing and scenario analysis, directly informing evidence-based policy decisions. Recent simulations revealed a counterintuitive outcome: increasing the liquidity buffer scaler β from 0.05 to 0.2 did not enhance stability as conventionally expected. Instead, this adjustment resulted in a substantial increase in both the number of bank defaults and the total amount of defaulted capital. This suggests that simply increasing liquidity buffers may not be a universally effective strategy, and could, under certain network conditions, exacerbate systemic risk by altering bank behavior and interconnectedness – a finding that necessitates a more nuanced approach to financial regulation and oversight.

The research demonstrates a novel application of DebtRank to assess the systemic importance of financial institutions, moving beyond traditional metrics. This methodology quantifies the interconnectedness of banks through their interbank lending relationships, revealing which institutions, if destabilized, pose the greatest risk to the broader financial system. Simulations using this model identified potential maximal default cascades involving up to 43 banks, highlighting the potential for rapid and widespread contagion. Consequently, DebtRank provides a basis for targeted regulation and the implementation of differentiated capital requirements, allowing policymakers to proactively strengthen the resilience of systemically important institutions and mitigate systemic risk before a crisis emerges.

The construction of a multilayer network, as detailed in this study, inherently acknowledges the fragmented nature of financial systems. This approach mirrors Hannah Arendt’s observation that “The banality of evil lies in the fact that ordinary people can commit extraordinary crimes simply by participating in a system.” Similarly, systemic risk doesn’t reside in isolated failures, but emerges from the interconnectedness and often-unseen interactions within the network. The granular data integration allows for a more nuanced understanding of these connections, moving beyond simplified models and revealing how seemingly insignificant exposures can propagate throughout the system, potentially triggering widespread contagion. This focus on detailed linkages directly addresses the challenge of identifying vulnerabilities hidden within the complex web of financial relationships.

Looking Ahead

The construction of empirically-grounded multilayer networks, as demonstrated, offers a compelling shift from abstract models of systemic risk. However, the very act of translating supervisory data into network topology inevitably introduces a degree of abstraction – a necessary simplification, perhaps, but one demanding constant scrutiny. Future work must address the sensitivity of contagion pathways to these translation choices, and explore methods for quantifying the uncertainty inherent in network construction.

A persistent challenge lies in bridging the gap between microstructural detail and macro-level stability. The current model, while incorporating granular data, still relies on aggregated metrics for interbank exposures. Disentangling the roles of genuine systemic interconnectedness from spurious correlations, revealed through more refined data, remains a critical area for investigation. The patterns are there, undoubtedly, but discerning signal from noise requires both statistical rigor and a willingness to question established assumptions.

Ultimately, the value of this approach will be determined by its predictive power. Moving beyond static network analysis towards dynamic modeling – incorporating time-varying exposures, evolving regulatory frameworks, and even behavioral factors – presents a formidable, yet essential, undertaking. The goal is not merely to map the landscape of systemic risk, but to anticipate its transformations, recognizing that the patterns of contagion, like all complex systems, are perpetually in flux.

Original article: https://arxiv.org/pdf/2602.10960.pdf

Contact the author: https://www.linkedin.com/in/avetisyan/

See also:

- Movie Games responds to DDS creator’s claims with $1.2M fine, saying they aren’t valid

- The MCU’s Mandarin Twist, Explained

- These are the 25 best PlayStation 5 games

- SHIB PREDICTION. SHIB cryptocurrency

- Scream 7 Will Officially Bring Back 5 Major Actors from the First Movie

- Server and login issues in Escape from Tarkov (EfT). Error 213, 418 or “there is no game with name eft” are common. Developers are working on the fix

- Rob Reiner’s Son Officially Charged With First Degree Murder

- All Golden Ball Locations in Yakuza Kiwami 3 & Dark Ties

- MNT PREDICTION. MNT cryptocurrency

- ‘Stranger Things’ Creators Break Down Why Finale Had No Demogorgons

2026-02-12 07:55