Ah, the fickle dance of the markets! Chainlink, that once-proud stallion of the altcoin stables, now stumbles like a drunkard in a Dostoevskian tavern, its price sagging under the weight of traders’ waning enthusiasm. After a feeble attempt to cling to the heights of $11, LINK has surrendered to gravity, plummeting over 6% today, inching closer to the abyss of $9. Will the buyers, those elusive saviors, emerge from the shadows to catch this falling knife? Or will they, too, succumb to the paralyzing grip of doubt?

There is no panic, no frenzied screams in the streets-only the quiet, almost dignified retreat of demand. Rebounds, like fleeting moments of hope in a nihilistic novel, are swiftly extinguished, leaving behind the bitter taste of unfulfilled promises. This is not the market of the heart, but of the mind-a cold, calculating reassessment of value, devoid of emotion, yet brimming with existential dread.

As LINK teeters on the precipice of technical oblivion, the on-chain data whispers tales of betrayal and abandonment. Ah, the irony! The very hands that once lifted it now push it down.

Spot Market Data: A Symphony of Controlled Despair

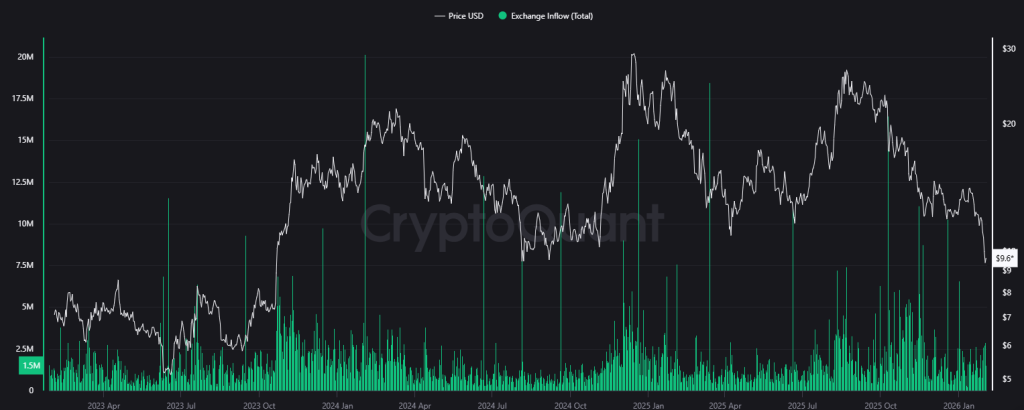

Behold, the metrics of despair! Net exchange inflows, averaging 2,500,000-4,000,000 LINK per day, tell a story of controlled selling-not the frantic exodus of panic, but the methodical divestment of faith. Even as the price attempts its pitiful recoveries, holders seize the moment to distribute, like rats abandoning a sinking ship. Exchange balances, swollen with the spoils of doubt, mock the feeble attempts of buyers to stem the tide. Green candles, those fleeting moments of optimism, are drowned out by the relentless volume of red sessions. A market in search of a bottom, yet finding only the abyss.

And where are the accumulation clusters, those beacons of hope in a sea of despair? Nowhere to be found. History, that cruel mistress, reminds us that LINK’s bottoms have always been marked by the cessation of exchange inflows. Yet, here we are, still bleeding, still falling.

Leverage: The Unraveling of Dreams

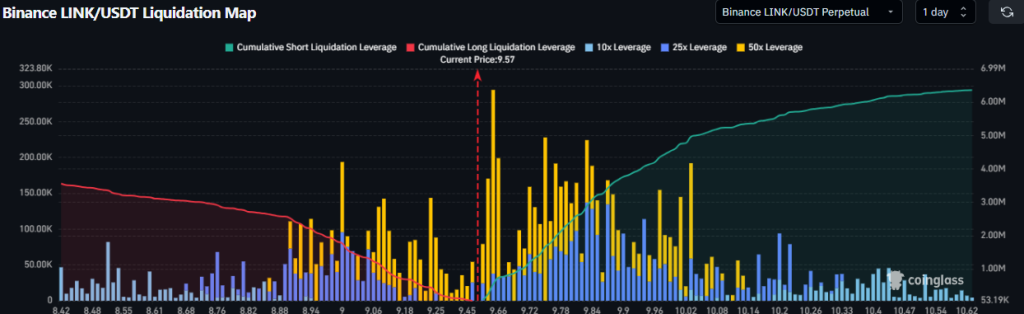

Ah, leverage-the opium of the speculative masses! Open interest, that barometer of greed and fear, has shriveled by 2%, from $470 million to a mere $450 million. Not a stampede into shorts, mind you, but a quiet unwinding of long positions, a retreat from the battlefield. Funding rates, once the bullish tailwind, have cooled to neutrality, leaving LINK adrift in a sea of indifference. Shorts, those vultures of the market, circle but do not strike-their absence of aggression a testament to the market’s lethargy.

Yet, beware the liquidity between $9.00 and $9.50-a minefield of long liquidations, with exposure exceeding $60-$80 million. Above, the short-side liquidity is thin, a precarious balance that could snap at any moment. Will the spot demand stabilize, or will LINK be dragged into the abyss?

Chainlink’s Odyssey: A Journey to $8?

LINK, once a beacon of hope in the early days of 2026, now traces a path of lower highs and lower lows, trapped in a descending channel of despair. The $14 hurdle, once within reach, now seems a distant memory, its rejection a decisive blow that sent LINK tumbling below the $10 support zone. That level, once a fortress, has now become a barrier, a reminder of what could have been. The current price action suggests a pilgrimage to the $8 demand zone, a place of historical accumulation, yet also of potential ruin.

As long as LINK trades below $9, the market structure favors a descent into the $7.50-$8.30 zone, a crossroads of historical demand and accumulation. A defense of $9 could offer a fleeting respite, a moment of compression and stabilization. But this phase is defined by distribution, not accumulation, by risk reduction, not leverage expansion. The market waits, like a character in a Dostoevsky novel, for a sign, for a spark of conviction. Until then, LINK is not being chased-it is being tested, its soul laid bare for all to see.

Read More

- All Golden Ball Locations in Yakuza Kiwami 3 & Dark Ties

- NBA 2K26 Season 5 Adds College Themed Content

- Hollywood is using “bounty hunters” to track AI companies misusing IP

- What time is the Single’s Inferno Season 5 reunion on Netflix?

- Heated Rivalry Adapts the Book’s Sex Scenes Beat by Beat

- All Itzaland Animal Locations in Infinity Nikki

- Elder Scrolls 6 Has to Overcome an RPG Problem That Bethesda Has Made With Recent Games

- Mario Tennis Fever Review: Game, Set, Match

- BREAKING: Paramount Counters Netflix With $108B Hostile Takeover Bid for Warner Bros. Discovery

- EUR INR PREDICTION

2026-02-02 13:48