It’s Monday, Jan. 12, and the crypto world is doing its usual dizzying dance-volatility, chaos, and more charts than a county fair. XRP is already bragging about its best Q1 in three years, and it’s only 12 days into 2026. A viral “whale” theory drops right on Bitcoin‘s 17th birthday-perfect timing, right? And Cardano? Four-hour short liquidations printing exactly $0. Really, Cardano? Now we’re counting zeros like a grocery list. Oy 😂🤨

TL;DR

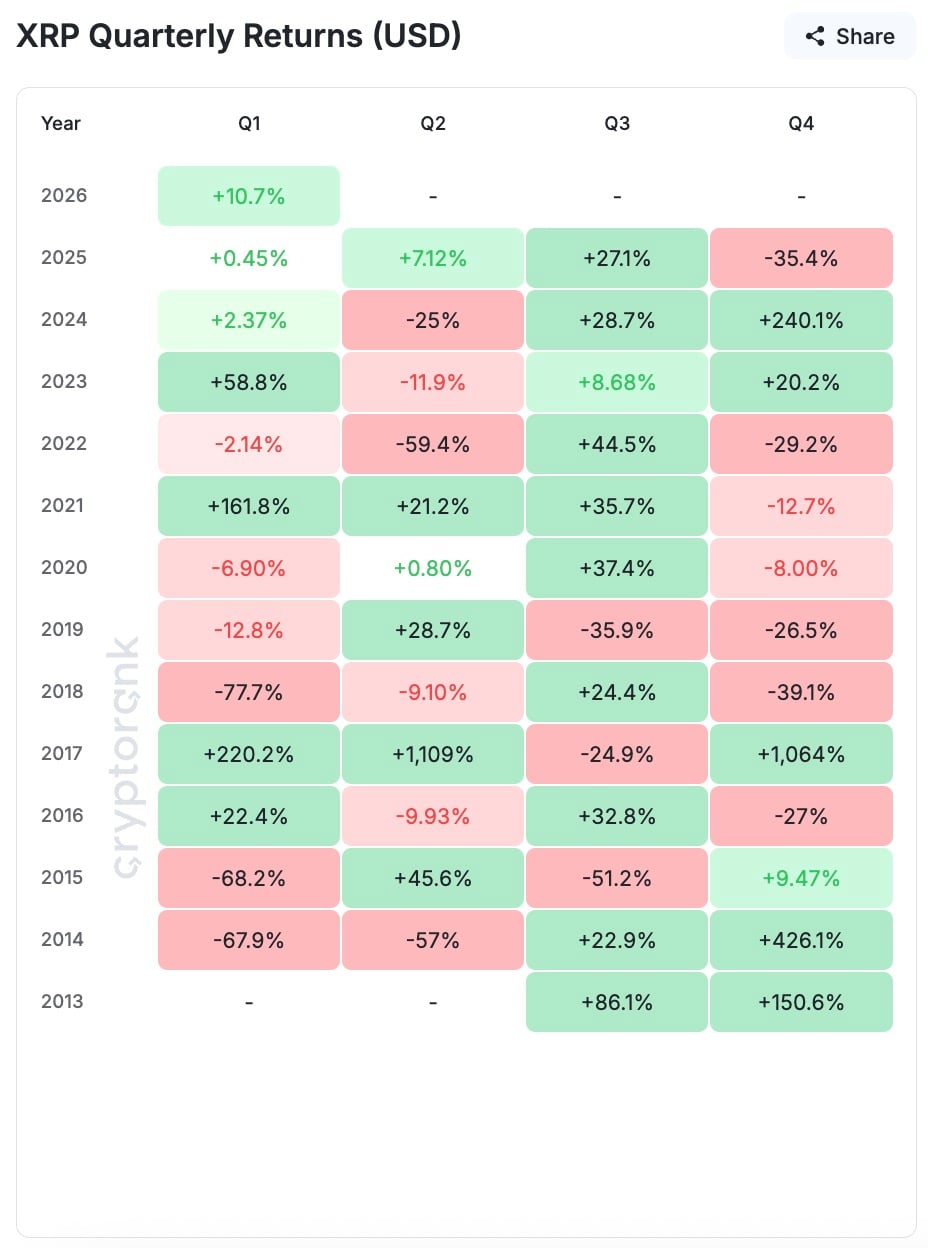

- XRP is +10.8% in early 2026, beating all Q1 starts since 2023. If anyone asks, yes, that’s a thing.

- 17 years after Satoshi’s first transaction, a wallet with 26,916 BTC stirs the rumor mill. Spoiler: probably not as dramatic as it sounds.

- Cardano (ADA) shows abnormal liquidation data with $0 shorts. Zero. A chill in the market? Maybe. Or a prank.

XRP scores best Q1 since 2023

XRP kicked off 2026 with a +10.8% surge, the strongest Q1 start since 2023, says Cryptorank. It’s early-only 12 trading days-and yet this move is somehow surprising, given Q1s are usually the hangover of the year. What is this, a miracle? I’m not buying lunch for this yet.

Compared to 2025’s modest +0.45% and 2024’s +2.37%, this rally already eclipses those years and is chasing 2023’s explosive +58.8%. Sure, sure, it could all vanish by February, but for now we’re all pretending this makes sense.

On the charts, XRP broke above $2.35 in early January, then slid back to the $2.04-$2.07 zone by Jan. 12. It’s still volatile, which means the trend hasn’t quit its day job, it’s just filing a bunch of paperwork first. Is there a punchline here? Not yet, folks, not yet. 😂

Whether XRP can keep leading or just coast depends on people buying above the $1.98 support zone, aligning with the short-term Bollinger median. If this momentum holds, XRP might be heading into its first positive Q1-Q2 combo since 2021-yes, dreams do come true, apparently.

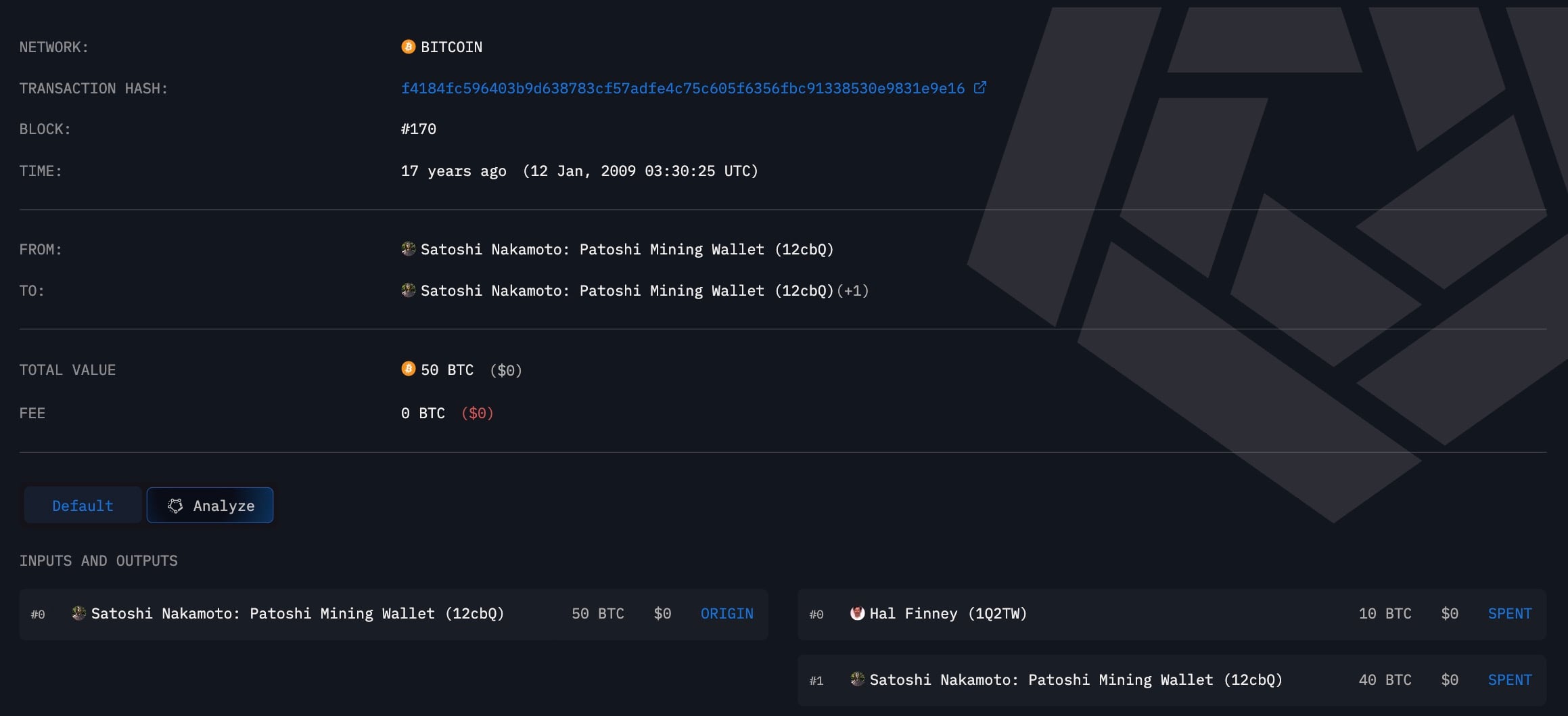

Satoshi’s first ever Bitcoin transaction turns 17, but then this happens

Almost 17 years ago, Satoshi Nakamoto sent 10 BTC to Hal Finney. Groundbreaking, yes, and then the internet started talking like a parrot. The day got extra spicy when a mysterious wallet transfer supposedly showed 26,916 BTC-worth over $2.44 billion today. Great, a wallet that has never moved suddenly wants to make a grand entrance. Classic.

Screenshots spread like wildfire, showing a wallet labeled “Satoshi Whale” holding 26,900 BTC. The transfer appeared to come from an address with no prior activity-the cryptoverse loves a good mystery, right? The image even got a boost from CZ himself.

But the facts don’t exactly back the hype. There’s no on-chain record of a 26,900 BTC purchase. The wallet simply had a one-time inbound transaction, and digging a bit deeper suggests consolidation or internal reshuffling-definitely not a $2.4 billion buy-in from a dormant whale waking up after a decade.

Still, the timing lined up with Hal Finney’s transaction, giving the story a little symbolic punch to trend on social media. Meanwhile, the actual Satoshi stash remains untouched-over a million BTC sitting idle, the crypto version of a locked garage sale.

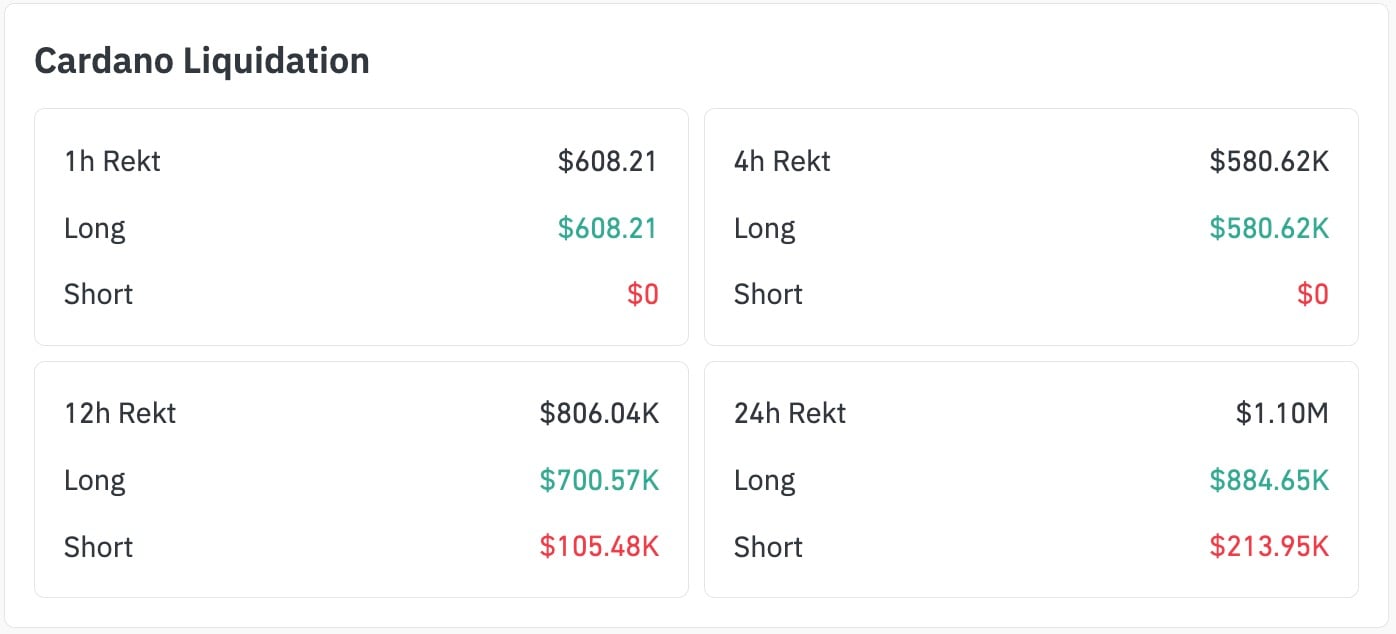

Cardano prints stunning $0 in short liquidations: What just happened?

Cardano (ADA) delivered a bit of a surreal show: according to CoinGlass, ADA shorts liquidated exactly $0 over the past one and four hours. Meanwhile, longs absorbed hundreds of thousands in losses-$580,600 in four hours, $884,600 in 24 hours. If you’re keeping score, that’s a weird kind of balance.

It’s rare to see zero short liquidations over multiple periods, which could be either a sign of something or nothing at all-depending on how you look at it. Either way, it’s interesting enough to watch with a raised eyebrow.

Price action shows the market consolidating after an earlier breakout. ADA jumped from $0.33 to $0.43 in early January, then slipped back under $0.39, parked in a narrow lane. It’s like a traffic jam where no one wants to move, but somehow you keep honking anyway. < /p>

The current imbalance suggests bearish positioning is almost done or taking a break, with most risk on the long side. Any further dip could wash out weak longs, especially if ADA drifts toward the $0.375 liquidity gap.

Crypto market outlook

The week kicks off with BTC at $90,496, down 0.94% in the last 24 hours, while altcoins struggle to sustain early January gains. It’s a real rollercoaster, folks.

Key levels to watch:

- Bitcoin (BTC): Needs to reclaim $92,000 to resume upside, while the support sits near $88,500.

- XRP: Holding $1.98 keeps the Q1 run alive, but $2.35 remains the resistance ceiling.

- Cardano (ADA): $0.375 is the key liquidation trigger with upside capped near $0.42 without volume.

This week is also a CPI one, so it may decide whether early 2026 optimism is justified or premature. With liquidation skews, fake whale narratives and Q1 charts heating up, the crypto market continues to blur the line between signal and noise.

Read More

- All Golden Ball Locations in Yakuza Kiwami 3 & Dark Ties

- NBA 2K26 Season 5 Adds College Themed Content

- All Itzaland Animal Locations in Infinity Nikki

- Elder Scrolls 6 Has to Overcome an RPG Problem That Bethesda Has Made With Recent Games

- Gold Rate Forecast

- What time is the Single’s Inferno Season 5 reunion on Netflix?

- Hollywood is using “bounty hunters” to track AI companies misusing IP

- EUR INR PREDICTION

- Star Trek’s Controversial Spock Romance Fixes 2 Classic TOS Episodes Fans Thought It Broke

- BREAKING: Paramount Counters Netflix With $108B Hostile Takeover Bid for Warner Bros. Discovery

2026-01-12 15:07