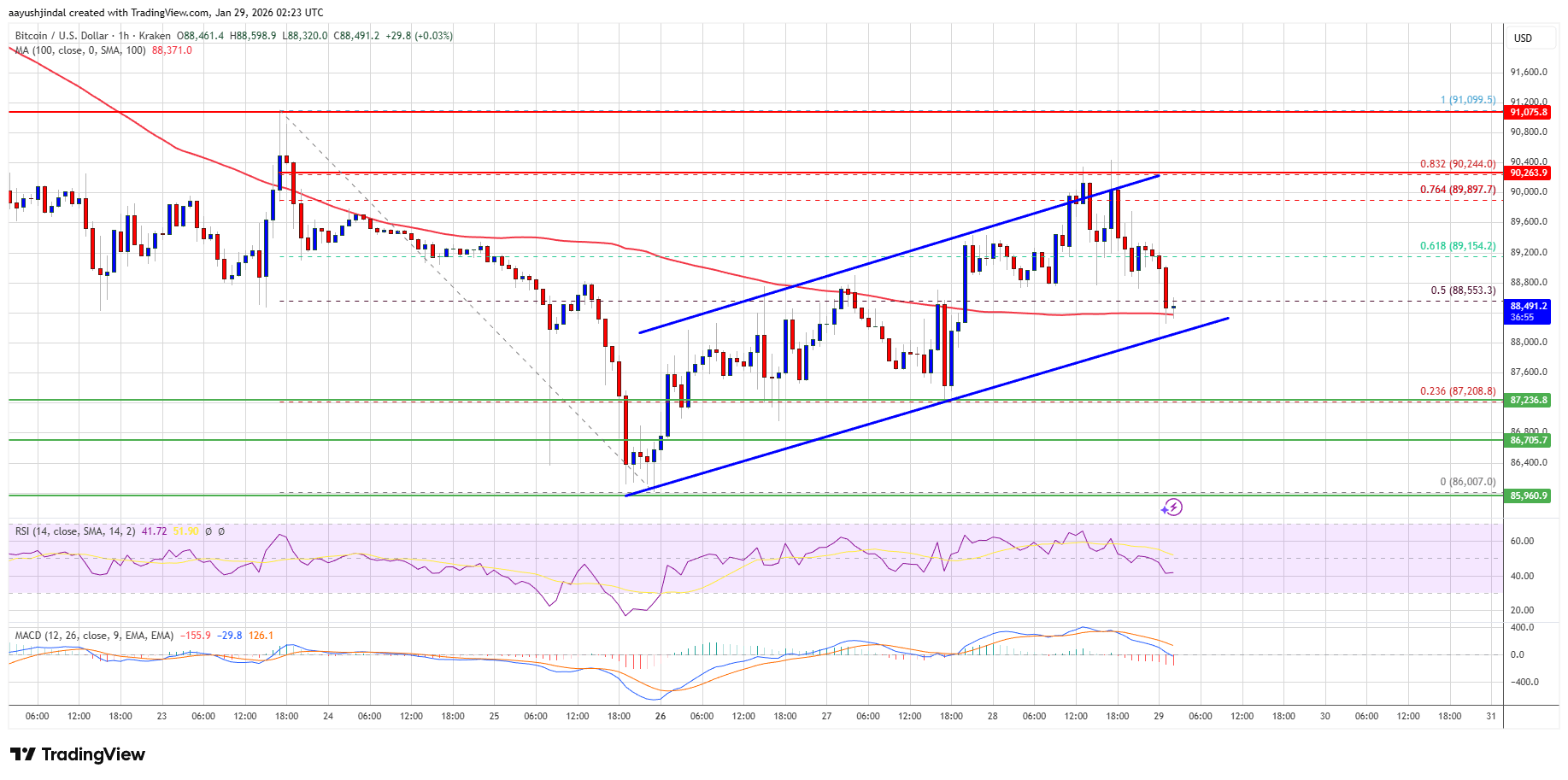

The digital phantom, this Bitcoin, it stirs and strives, as though possessed of ambition. It briefly flirted with the ninety-thousand ruble mark – a bold, though ultimately, rather pathetic attempt – before retreating, like a shy debutante rebuffed by a stern landowner.

- The beast, it seems, cannot hold its ground above ninety thousand. A disconcerting lack of fortitude, wouldn’t you agree?

- It clings now to eighty-eight thousand two hundred, supported, it is said, by a ‘simple moving average.’ One wonders if averages possess a spirit of their own.

- A ‘rising channel’…how fashionable! As though a mere line on a chart could contain the whims of the market.

- Should it fall below eighty-eight thousand, a further decline is predicted. Predictable, really.

A Momentary Illusion of Strength

The digital currency maintained a precarious balance, hovering just above eighty-eight thousand, like a peasant on a slippery slope. It attempted a recovery, a brief, eager surge towards eighty-nine thousand and even, briefly, surpassed it. One might have believed, for a moment, that fortune favored it.

There was talk of ‘Fib retracements’ and ‘swing highs’ and ‘bulls’ pushing…all very dramatic terminology for what, in the end, amounted to a rather unremarkable wobble. They ventured above ninety thousand, yes, but lacked the staying power of a well-bred trotter. The climb proved, alas, unsustainable.

Now, a timid retreat below eighty-nine thousand. It rests, for the moment, above eighty-eight thousand two hundred, clinging to its ‘simple moving average’ like a drowning man to a splintered oar. A ‘rising channel’ is discerned, offering support at eighty-eight thousand one hundred. A comforting illusion, perhaps?

If it holds, it might attempt another ascent, a further, and likely equally futile, gesture. Resistance awaits at eighty-nine thousand one hundred and fifty, and beyond that, the formidable eighty-nine thousand eight hundred. To breach these barriers… that would be a sight worth witnessing, though I confess I remain skeptical.

Should it succeed in these endeavors, it may dare to challenge ninety thousand two hundred and fifty, perhaps even ninety-one thousand two hundred. However, do not be fooled; the market is a fickle mistress. Further resistance awaits at ninety-two thousand and ninety-two thousand five hundred. Such heights are rarely held for long.

A Question of Resolve

But should it falter, should it fail to overcome eighty-nine thousand one hundred and fifty, another decline is inevitable. Support can be found, momentarily, at eighty-eight thousand two hundred, but a more substantial fall is anticipated, towards eighty-seven thousand, and even, God forbid, eighty-seven thousand two hundred. Then it will be a sorry sight indeed.

Below eighty-seven thousand two hundred, the abyss beckons. Eighty-six thousand offers a final, desperate hold, but beyond that… well, one shudders to think. Recovery, at that point, would be a most improbable affair.

The ‘technical indicators,’ as they are called, speak of a ‘bearish zone’ and an ‘RSI’ below fifty. The language of the brokers is always so dramatically portentous, isn’t it?

Major Support Levels: eighty-eight thousand two hundred, then eighty-seven thousand.

Major Resistance Levels: eighty-nine thousand one hundred and fifty, and eighty-nine thousand eight hundred.

Read More

- All Itzaland Animal Locations in Infinity Nikki

- Exclusive: First Look At PAW Patrol: The Dino Movie Toys

- All Golden Ball Locations in Yakuza Kiwami 3 & Dark Ties

- James Gandolfini’s Top 10 Tony Soprano Performances On The Sopranos

- Silver Rate Forecast

- Gold Rate Forecast

- Ethereum’s Volatility Storm: When Whales Fart, Markets Tremble 🌩️💸

- Elder Scrolls 6 Has to Overcome an RPG Problem That Bethesda Has Made With Recent Games

- Unlocking the Jaunty Bundle in Nightingale: What You Need to Know!

- Super Animal Royale: All Mole Transportation Network Locations Guide

2026-01-29 05:46