Ah, Bitcoin: that virtual treasure trove beloved by bulls, who refer to it as “digital gold“-as if the cryptocurrency world could possibly be that refined. Yet, it turns out that physical precious metals might actually have a better knack for predicting Bitcoin’s wild price swings than anything in the digital ether. Who knew? 🤔

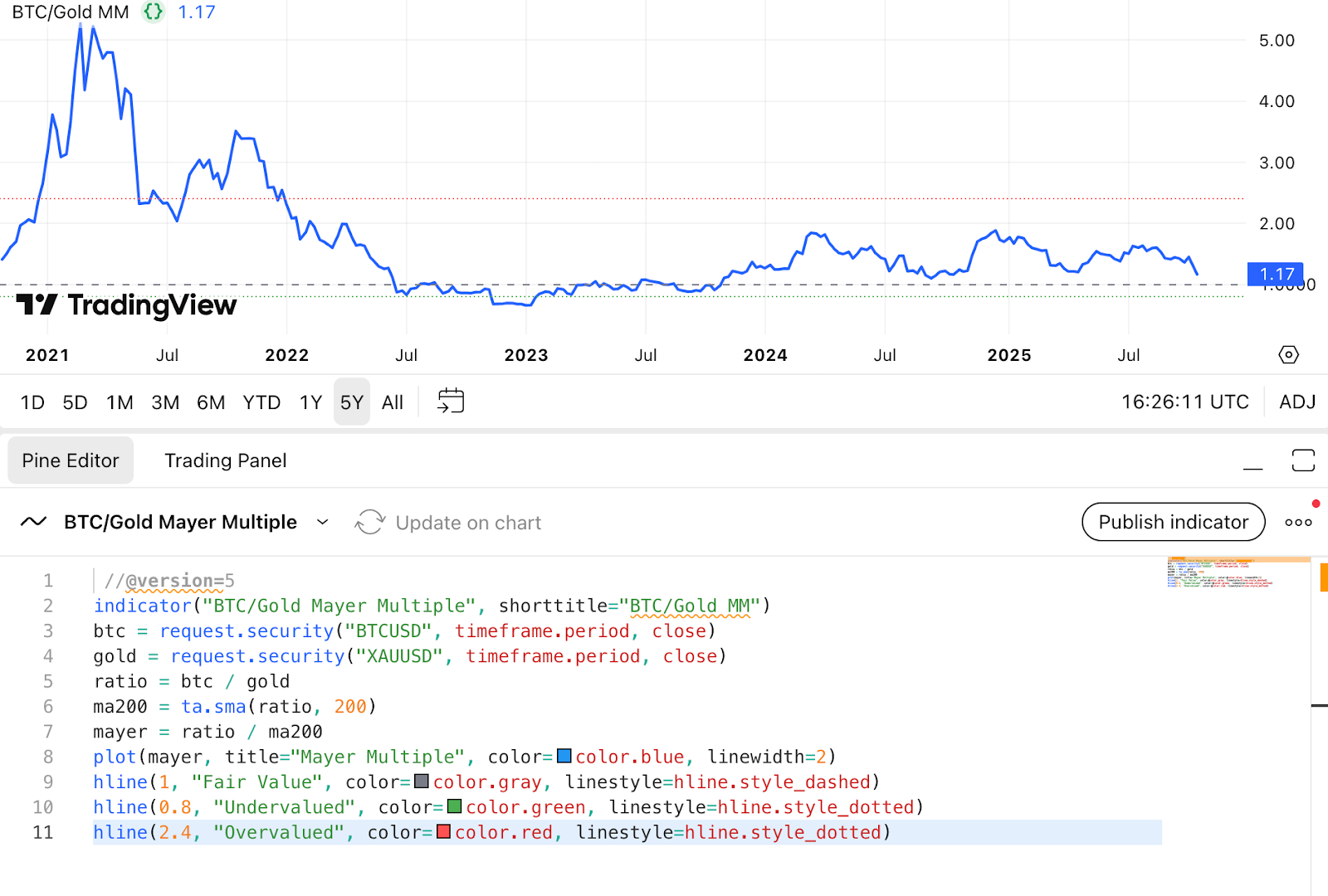

One enterprising Bitcoin trader, channeling the ghosts of market predictions past, invoked the BTC/Gold Mayer Multiple to justify their bullish fervor for crypto. Ah, the allure of numbers, how they dance! 🕺💃

The Mayer Multiple’s Glorious History

For those unfamiliar, the Mayer Multiple measures Bitcoin’s price relative to its 200-day moving average against the price of gold. If the ratio dips below 1, some enthusiasts claim that Bitcoin is “undervalued”-a term that, in financial circles, is often synonymous with “ripe for a jump.” ✨

One such Twitter sage boldly declared that the ratio has only ever been this low during Bitcoin crashes, suggesting that, if you aren’t all in yet, now might be the golden moment to jump on the bandwagon.

BTC/Gold Mayer Multiple is now at its lowest level outside of bitcoin crash periods.

If you aren’t all in already, now is your moment.

– Alpine (@Alpine1031) October 19, 2025

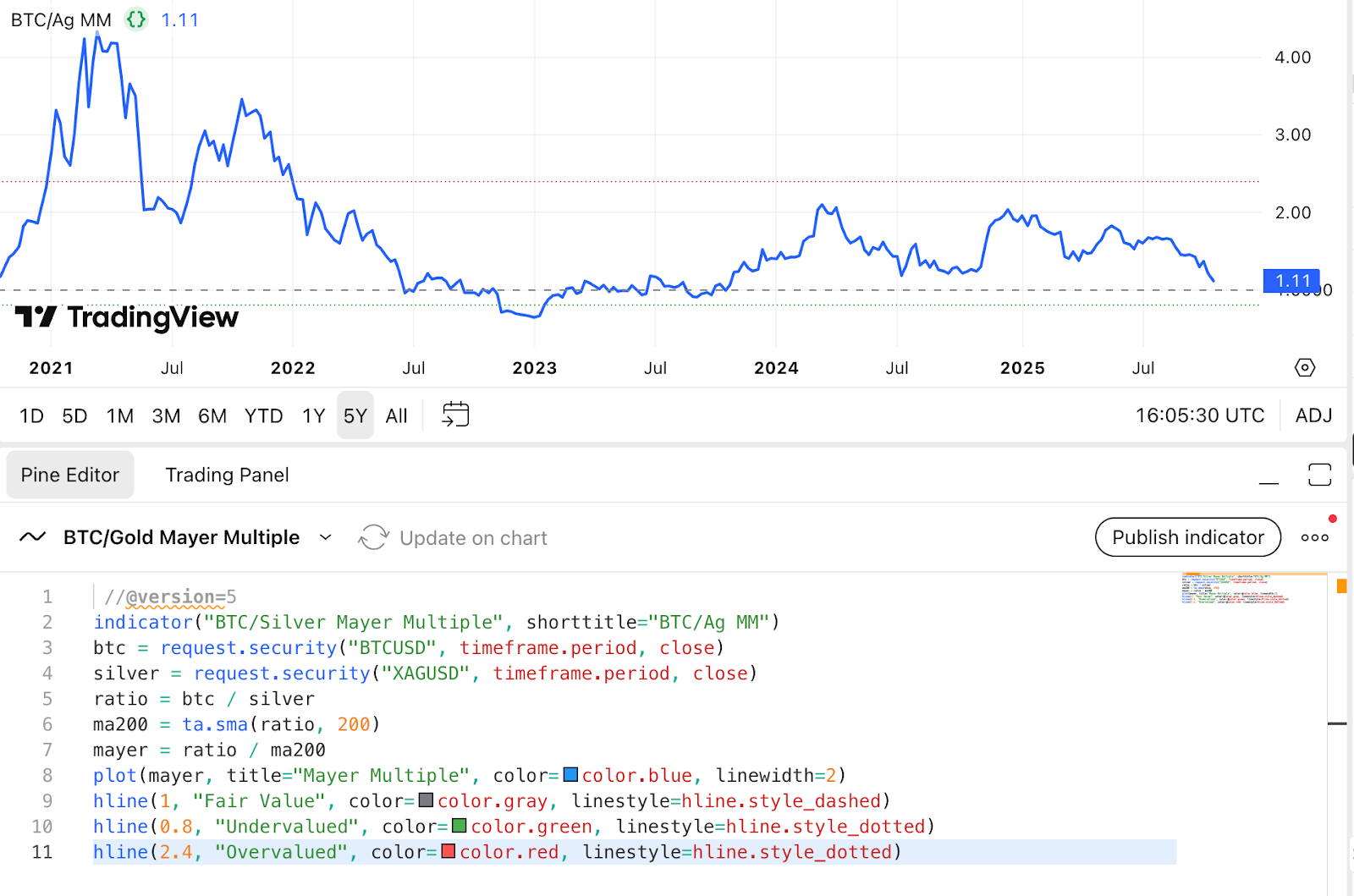

Of course, it’s wise to take a step back and ponder whether we should place our blind trust in a number that’s stuck in the past like a dusty fortune teller. Still, let’s entertain the idea of how gold and Bitcoin’s capricious prices correlate. Spoiler alert: silver has a say in this too. 🥈

The Mayer Multiple was the brainchild of Trace Mayer, a “monetary scientist” (yes, that’s a thing) who sought to track Bitcoin’s behavior by comparing its price against its historical average. The man clearly has a passion for trendspotting, and we’re here for it.

In short, the Mayer Multiple is calculated by dividing Bitcoin’s current price by its 200-day moving average. So, if Bitcoin is strutting at $120,000 and the 200-day average is at $100,000, we’re looking at a 1.2 Mayer Multiple. Simple math. Simple minds. Or is it? 😏

If the ratio ventures over 2.4, that signals Bitcoin’s been indulging in one too many cocktails at the “overbought” bar. Meanwhile, a 0.8 Mayer Multiple suggests it’s time to scoop up Bitcoin like it’s on sale. 💸

Oct 27, 2025: The Mayer Multiple is 1.06.

The price of $BTC is 114,874.81 $USD w/ a 200 day moving average of $108,797.55 $USD.@TIPMayerMultple has historically been higher 61.22% of the time w/ an average of 1.20.

Learn more at

– Mayer Multiple (@TIPMayerMultple) October 27, 2025

But wait, there’s more! The Mayer Multiple isn’t just about Bitcoin-it also compares the value of gold or silver to Bitcoin. Yes, it’s a two-way street. Try to keep up, folks. 💁♂️

Like all indicators, the Mayer Multiple relies on lagging indicators-basically history trying to predict the future, which is a bit like reading tea leaves. Still, when the stars align, miracles happen.

How Gold and Silver Prices Affect Bitcoin

When gold or silver prices surge ahead of Bitcoin for too long, it’s like a giant warning bell that Bitcoin could be about to catch up. And when it catches up, it tends to do so dramatically. Think of it as the tortoise and hare of the financial world, only with more fireworks. 🎇

Gold and Bitcoin are often paired in the BTC/Gold Mayer Multiple, while Bitcoin’s flirtation with silver is captured in the BTC/Silver Mayer Multiple. Both of these gauge Bitcoin’s performance relative to its 200-day moving average, compared to these glittery metals.

If the Mayer Multiple dips below 1, it’s often taken as a sign that Bitcoin is undervalued in comparison to its precious companions. And when has that ever not been a “buy-the-dip” opportunity? 🤷♂️

Take, for example, the following:

- The BTC/Gold Mayer Multiple dropped to 0.70 in November 2022 and 0.85 in March 2020-both times near Bitcoin’s market bottom. Not too shabby, right? In the months following, Bitcoin nearly doubled. Who wouldn’t want that kind of return? 🤑

- The BTC/Silver Mayer Multiple fell below 1 in September 2020 when Bitcoin was lingering at around $10,900. By April 2021, it was a hair’s breadth away from $60,000. And it happened again between late 2022 and early 2023. Cue dramatic music. 🎶

Just recently, the BTC/Gold ratio dipped to a modest 0.84, while the BTC/Silver ratio momentarily fell under 1 in October. Dips like these-even the smallest ones-have historically been a green light for the “buy-the-dip” brigade. 🟢

So, in conclusion, when the precious metals’ ratios fall below 1, it’s often the prelude to a major Bitcoin rally. Keep your wallets handy. 💼

What Gold and Silver Prices Mean for Bitcoin

Both the gold and silver Mayer Multiples are currently flashing a bullish outlook for Bitcoin. Simple logic: when the precious metals outperform Bitcoin for too long, Bitcoin gets jealous. It catches up. And when it catches up, oh boy-it does it with a vengeance. 🏃♂️💨

This year alone, gold is up a respectable 54%, silver has soared 63%, and Bitcoin is trailing with a more modest 21%. But don’t get too comfortable, Bitcoin’s ready to play catch-up, and it’s bringing some serious momentum. 💥

In the long run, Bitcoin is sitting pretty: it’s up a staggering 700% over the last five years, while gold and silver have only doubled their worth. Can we get a round of applause for Bitcoin, please? 👏

And let’s not forget the broader, macroeconomic factors that support Bitcoin’s bullish case-lower interest rates, pro-crypto policies, and the ever-increasing institutional interest in crypto. It’s the perfect storm for Bitcoin to break out and claim its spot as the king of digital assets once again. 👑

Read More

- United Airlines can now kick passengers off flights and ban them for not using headphones

- SHIB PREDICTION. SHIB cryptocurrency

- Movie Games responds to DDS creator’s claims with $1.2M fine, saying they aren’t valid

- Scream 7 Will Officially Bring Back 5 Major Actors from the First Movie

- These are the 25 best PlayStation 5 games

- The MCU’s Mandarin Twist, Explained

- Rob Reiner’s Son Officially Charged With First Degree Murder

- Server and login issues in Escape from Tarkov (EfT). Error 213, 418 or “there is no game with name eft” are common. Developers are working on the fix

- MNT PREDICTION. MNT cryptocurrency

- Gold Rate Forecast

2025-10-28 23:20