In the grand bazaar of capitalism, traders and seers alike gather their eyes like hawks on a gopher hole. They sift through support levels, scrutinize the short positions, and whisper the name of institutions as if they hold the secrets to the universe, attempting to divine the next act in this thrilling market drama.

Behold! The Unyielding Trendline of Bitcoin

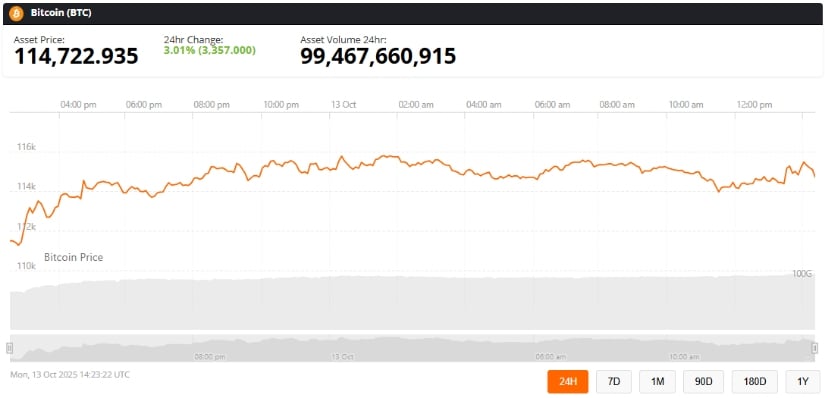

Ah, but lo! The most vital harbinger of fortune at present is none other than the enchanting trendline of Bitcoin-a veritable olive branch of hope. This upward line, stretching back to the grim shadows of 2023 when fortunes dipped near a mere $20,000, has become the sturdy bastion of support. On the fateful day of October 12, 2025, it danced dangerously down to $109,715 but rallied forth to close at $115,170! 🎉 It stood grandly above the sacred threshold of $110,000, proving that hope is indeed a stubborn creature.

As our dear BitBull (@AkaBull_) wisely remarked, “Should Bitcoin avoid the abyss beneath this trendline, the bull’s jig shall continue!” This implies the currents of bullish exuberance are still surging, even after a sudden plunge that swept away $19 billion quicker than a magician’s trick. 🎩✨

Liquidity and Institutions: The Unseen Hands of Fortune

Meanwhile, the analysts, with their magnifying glasses, dissect broader market dynamics. Crypto GEMs (@cryptogems555) note that Bitcoin may very well be chugging towards $180,000, in tandem with the Earth’s M2 money supply swelling like a turkey before Thanksgiving. Historically, Bitcoin’s upward spirals have often followed the generous rains of liquidity, growing between 20-30% annually-essentially plumping full account balances with the vigor of a corn-fed bull.

And lo! Glassnode’s data reveals a relative calm among long-term holders, showcasing a mystical 12% decrease in their eagerness to cast off their treasured Bitcoins. Despite the tempestuous tariffs swirling about, some investors are holding steadfast, like sailors in a storm clinging to their ship. 🛳️

A Short Squeeze: The Funniest Business in Town

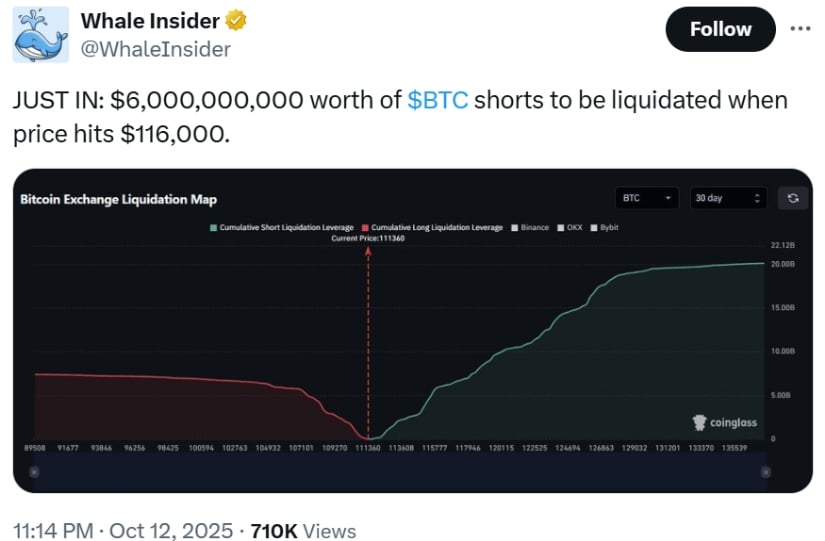

With baited breath, traders peer at the $116,000 threshold, where a sizable congregation of short positions has congregated like a choir at Sunday service. The enigmatic Whale Insider (@WhaleInsider) once proclaimed that $6 billion in shorts may face the guillotine if prices touch this level. However, their updated intel suggests confirmed shorts hovering between $1-1.5 billion at $117,000-much like rumors of a city-wide sale that turn out to be one lonely store with a single pair of shoes left. 👠

Some analysts caution us that these figures might be a touch inflated, a mirage shimmering in the distance. Nevertheless, the $116,000 level promises to be a thrill ride amidst the wild carousel of volatility, ready to sweep the market sentiment into tempestuous swings in the days ahead.

Eyes Fixed on the Elusive $180,000

In our hopeful gaze towards tomorrow, analysts and financial fortunetellers continue to dream of Bitcoin scaling the heights to a princely $180,000 by the year’s end in 2025. Institutions like VanEck chant the praises of greater adoption and ever-flowing ETF investments as they dance upon the historical patterns that follow liquidity expansions. Hitting this ambitious target would represent nearly a 45% gain from the current safety net-a potential treasure for those brave enough to venture forth. Gold coins shall rain like confetti! 💰

Besides, the mighty forces of macroeconomics-stable regulatory winds and the bold demand of long-term holders-fortify Bitcoin’s standing like walls of a medieval castle. Critical points of interest, such as $116,000 and the bastion at $110,000, rise like the towers of old as we march into the unknown months ahead.

Conclusion: Hold Onto Your Hats! 🎩

In the whirlwind of recent market contortions, Bitcoin stands resilient, beckoning many to dream and invest. The sturdy trendline, coupled with institutional allure, lays down a sound foundation for potential ascension.

However, let us not forget-the crypto market remains a tempestuous entity, and geopolitical earthquakes could shake our sandy shores at any moment. Thus, keeping a keen eye on critical junctures such as $116,000 and $180,000 becomes paramount for all seekers of fortune!

Read More

- All Golden Ball Locations in Yakuza Kiwami 3 & Dark Ties

- Gold Rate Forecast

- A Knight Of The Seven Kingdoms Season 1 Finale Song: ‘Sixteen Tons’ Explained

- Hollywood is using “bounty hunters” to track AI companies misusing IP

- Mario Tennis Fever Review: Game, Set, Match

- What time is the Single’s Inferno Season 5 reunion on Netflix?

- This free dating sim lets you romance your cleaning products

- 4. The Gamer’s Guide to AI Summarizer Tools

- Every Death In The Night Agent Season 3 Explained

- Beyond Linear Predictions: A New Simulator for Dynamic Networks

2025-10-13 23:18