Hyperliquid: The Onchain Revolution That Stunned Traders in 2025 🚀

Hyperliquid didn’t rely on flashing lights, catchy jingles, or convincing people to buy “the next big thing.” No, it simply chugged along quietly, like a well-oiled, slightly eccentric machine that decided to rewrite the rules of crypto trading. And rewrite it did, leaving the industry scrambling to catch up, perhaps while sipping a martini and pondering the mysteries of the universe.

What on earth is Hyperliquid, Anyway?

Imagine a decentralized exchange (which is fancy talk for “money being moved around without a middleman, like magic but messier”) specially designed for perpetual futures trading – because why not have your cake, eat it, and then trade the cake forever? Unlike earlier DEXs that relied on bots, algorithms, or witchcraft, Hyperliquid boasts a fully onchain central limit order book. Yes, every trade, liquidation, and funding payment is proudly etched onto the blockchain. Record-keeping on a blockchain: because someday, someone might want to sue it for being too clever.

It’s all about balancing the scales of speed, market depth, and responsiveness – giving traders the polished, professional experience they’re accustomed to, but without handing over their savings to a shady middleman with a suspicious mustache. And all of this with a gentle nod to the idea of “non-custodial settlement,” which is a fancy way of saying “you hold your own keys, and nobody’s taking your money without permission.”

Who Had the Brilliant Idea?

Hyperliquid was brought into existence by Hyperliquid Labs, led by Jeff Yan, a high-frequency trader turned crypto-exchange wizard who had previously worked at Hudson River Trading (which sounds like a river but is really a high-tech trading firm of some sort). Jeff, having tasted the bitter collapse of FTX, decided to create something more stable and less likely to blow up in everyone’s face. No venture capital intrigue-just a dash of rebellion and a lot of caffeine.

From the start, the project took an unusual approach: it didn’t ask for outside funding or venture capital. Instead, it funded itself, which meant hyper-focused control (like owning a pet dragon-it’s both a burden and a badge of honor). This gave it a unique governance style, incentives, and a long-term vision: keep control where it belongs-in the hands of the builders, not the investors who want to flip the platform for a quick buck.

Where Does This Magical Playground Operate?

Hyperliquid runs on its own standalone Layer-1 blockchain-not on Ethereum or a “rollup,” which is a fancy word for “AI-powered cloud that’s probably spying on you.” Users bridge assets-mainly stablecoins like USDC-onto this blockchain universe, where trading costs are as close to free as possible (because nobody likes gas fees unless they’re talking about hot dogs). No central office to visit, no identity checks-just pure onchain anarchy, with validators doing their thing in a slightly less chaotic manner, sacrificing some decentralization for speed and efficiency.

Why Were Traders Mesmerized?

Hyperliquid hit the scene when traditional CEXs (centralized exchanges, essentially places where you trust someone else with your keys) started collapsing like a poorly-built house of cards. Traders, forever cautious and often craving leverage (that’s fancy for “making your bets seem bigger”), found a haven in Hyperliquid’s promise of fast execution, low fees, and everything onchain. It felt like trading on a platform they knew-without the risk of losing everything when the boss’s cousin’s cousin accidentally deletes the server.

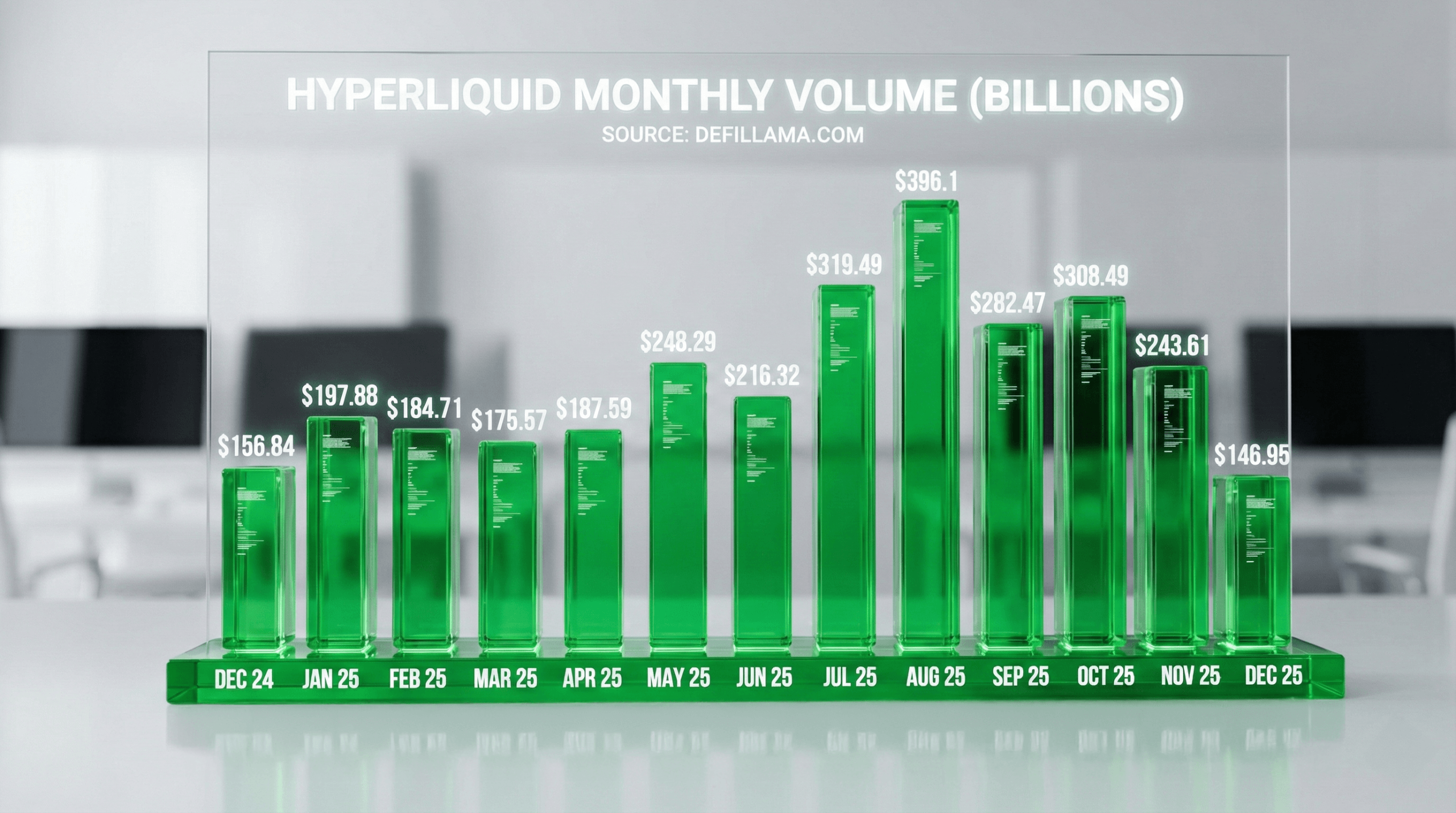

Liquidity and Market Fame

Liquidity suddenly became a thing-not just in theory, but practically, as market makers flocked in and the order books grew wider and more impressive. By 2025, Hyperliquid was the reigning monarch of decentralized perpetual trading, often handling volumes worth billions daily-much to the dismay of traditional giants like Binance, whose volumes sometimes looked like a tiny pond in comparison. At times, Hyperliquid’s futures volume made up double digits of Binance’s, proving that decentralization wasn’t just for fun-it was a serious contender.

Markets fluctuated, as markets tend to do, but Hyperliquid held its ground like a stubborn, caffeinated mule-sometimes even putting Binance’s volume into a tailspin with its daring moves.

The Token That Tried to Make a Splash

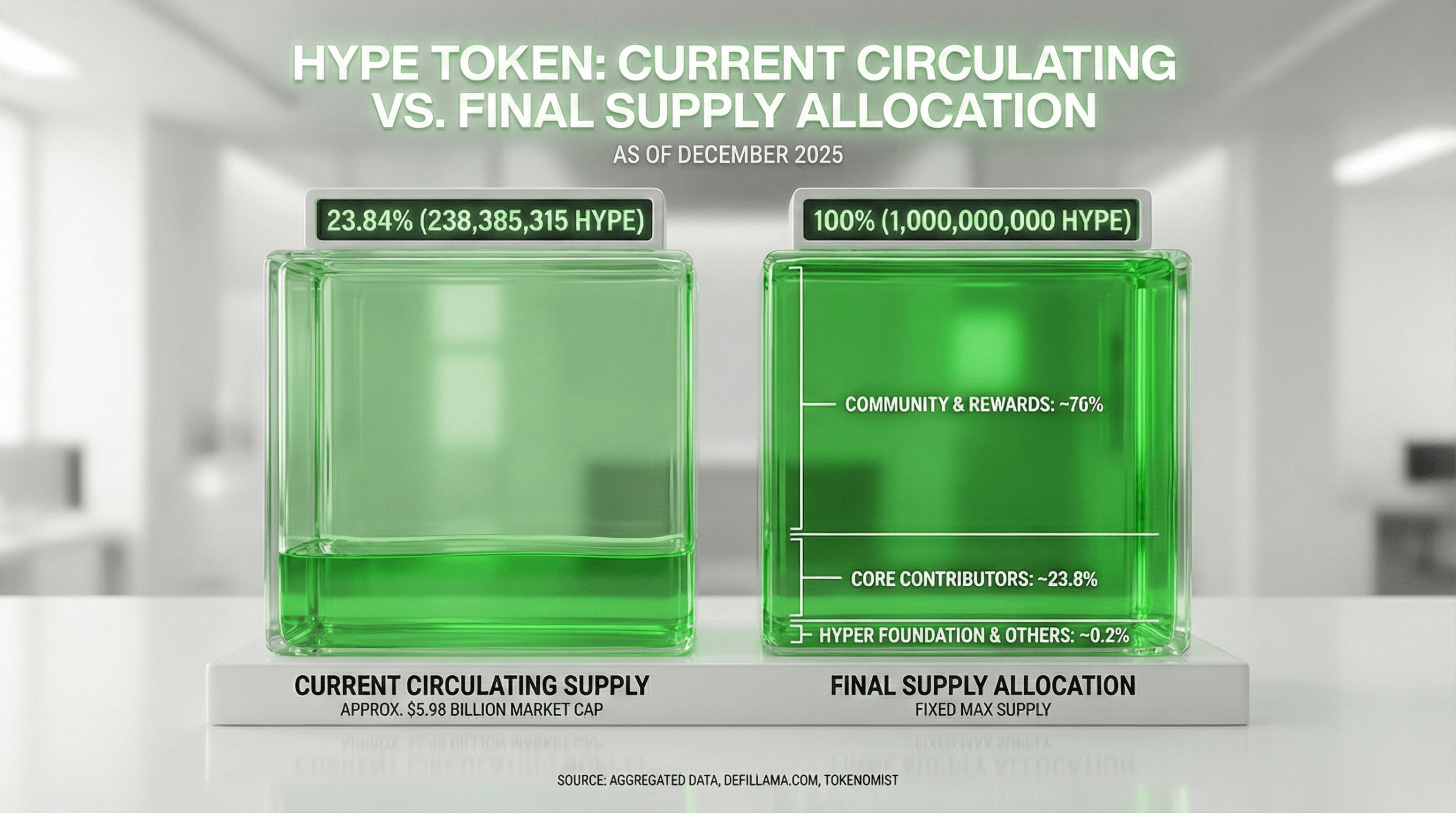

In late 2024, Hyperliquid whipped out its native token, HYPE, with nearly no fanfare-like a ninja slipping into your DMs. This token was for governance and network chores, not for encouraging speculation with meaningless inflationary rewards. Instead, it’s more about making sure the platform runs smoothly and the revenue gets reinvested or bought back-because who doesn’t love a good buyback?

Despite the hype about HYPE’s market antics, it was the platform’s trading activity and liquidity that really stole the show-no need for farming tokens like a crypto farmer in the rain.

The Stress Test Circus & Tech Follies

Late 2024, hyper-enthusiastic rumors of an exploit caused a stampede of withdrawals akin to a herd of caffeinated cats. Spoiler: no breach happened, and trading carried on with all its glorious chaos, reinforcing confidence in the system’s durability.

In 2025, the platform occasionally hiccupped-brief outages and API glitches, the equivalent of a digital sneeze. No catastrophic failures, just enough to remind everyone that running onchain infrastructure is a bit like juggling flaming torches while riding a unicycle.

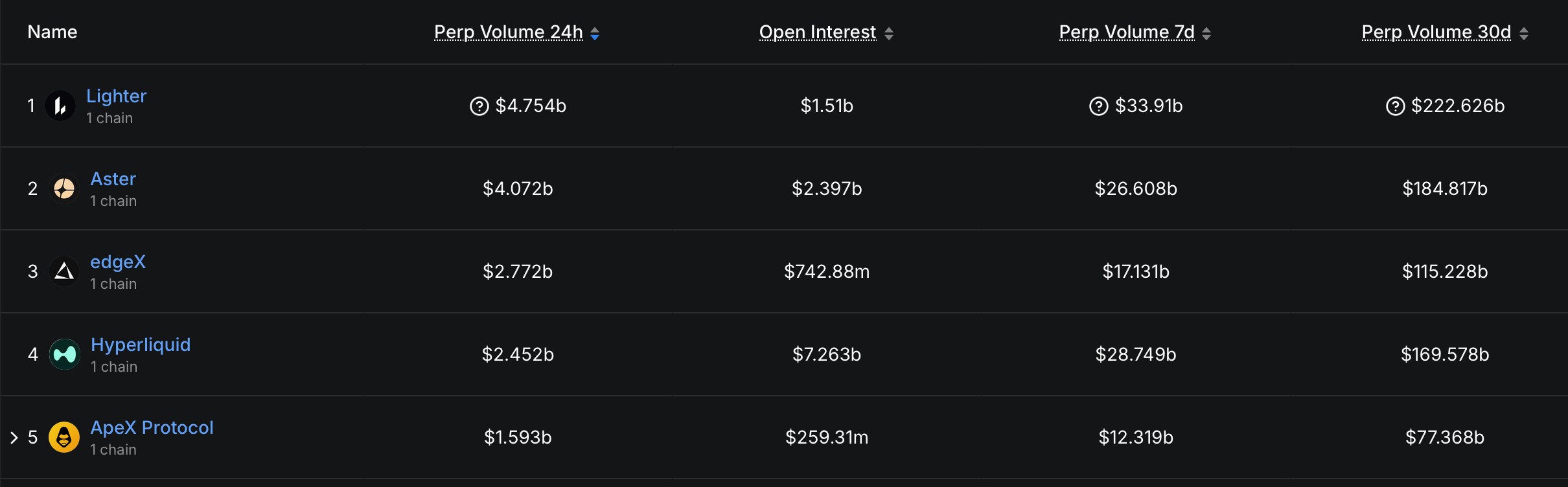

The Competition Enters Stage Left

As Hyperliquid kept winning hearts and volumes, new rivals entered the arena-some with flashy incentives, aggressive airdrops, and promises of “volume at any cost.” This gave rise to the infamous “2025 perp DEX wars,” where liquidity was the prize and liquidity providers were the gladiators. While Hyperliquid’s market share shrank a little-like a balloon losing helium-it remained a heavyweight, especially in liquidity and open interest.

The 2025 Sensation

Hyperliquid wasn’t just about competing; it was about rewriting expectations. It proved that decentralized exchanges could handle institutional-grade derivatives without relying on shady offchain shortcuts or handing your crypto to a suspiciously twitchy custodian. Its self-funding model, restrained token emissions, and focus on infrastructure became industry benchmarks-like the Swiss Army knife of crypto trading platforms.

What’s Next, You Ask?

By the end of 2025, Hyperliquid evolved from being a mere trading venue into a full-blown ecosystem-an onchain infrastructure supported by third-party applications like a digital metropolis. Whether it will stay on top or get overtaken by newer, shinier platforms remains a mystery, but it’s clear Hyperliquid forced the entire industry to rethink the rules-and sometimes, just sometimes, that’s what matters most in the chaotic realm of crypto.

FAQ ❓

- What’s Hyperliquid?

A decentralized exchange focusing on perpetual futures, running on its own Layer-1 blockchain-think of it as the Swiss watch of crypto platforms. 🎩 - Who’s behind it?

Jeff Yan, a former high-frequency trader turned crypto hero, who saw the FTX disaster coming and decided to rebuild the world of trading one block at a time. - Why did it catch everyone’s eye in 2025?

Because it blended the speed and familiarity of centralized trading with the safety and sovereignty of onchain settlement-like having your cake and trading it too. - Requires KYC?

Nope! Just deposit your assets, connect your wallet, and you’re good to go-like trading in your pajamas but feeling very professional.

Read More

- Movie Games responds to DDS creator’s claims with $1.2M fine, saying they aren’t valid

- The MCU’s Mandarin Twist, Explained

- These are the 25 best PlayStation 5 games

- SHIB PREDICTION. SHIB cryptocurrency

- Scream 7 Will Officially Bring Back 5 Major Actors from the First Movie

- All Golden Ball Locations in Yakuza Kiwami 3 & Dark Ties

- Server and login issues in Escape from Tarkov (EfT). Error 213, 418 or “there is no game with name eft” are common. Developers are working on the fix

- Rob Reiner’s Son Officially Charged With First Degree Murder

- MNT PREDICTION. MNT cryptocurrency

- Every Major Assassin’s Creed DLC, Ranked

2026-01-01 19:03