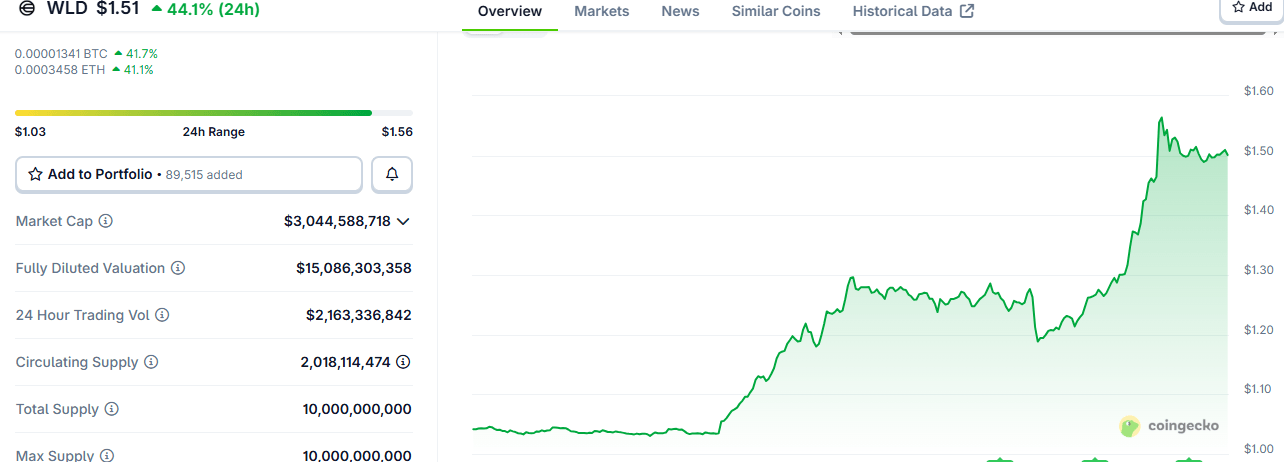

On the rather propitious day of September 8, WLD catapulted more than 40%, propelled by Eightco Holdings’ theatrical announcement of a $250 million private placement, ostensibly to pursue a “WLD treasury strategy.” Meanwhile, Eightco’s shares performed an acrobatic 4,300% high dive, landing gallantly at $77.92-quite the spectacle for those still clutching their portfolios.

The Grand Treasury Gambit That Set WLD & Eightco Stock Ablaze

World Network’s native token-yes, the brainchild of the ever-dashing Sam Altcoin-pirouetted upward by over 40% on September 8 after the Nasdaq-listed Eightco Holdings declared their intention to embark on this grand WLD treasury adventure. Witness, if you will, WLD’s ascent from a modest $1.03 at dawn to a sprightly $1.51 by dusk, crowning it one of the altcoins’ top performers in the cutthroat 24-hour carnival.

Such exuberance pushed WLD’s weekly gains beyond a decadent 70%, while its trading volume exploded to a flamboyant $2.15 billion-leaving in its wake the humbler sub-$150 million levels endured since September 1. Meanwhile, Eightco’s stock performed a veritable high-wire act, soaring to a staggering $77.92, a prodigious 4,300% climb from the humble $1.43 mark just days prior. At the moment this was penned, the ticker danced near $65, providentially lowering the heart rate of faint-hearted investors.

In the official communiqué-naturally orchestrated with all the pomp of a London debutante ball-the transaction involves the sale of approximately 171.2 million common shares at a genteel $1.46 each, alongside an additional $20 million sprinkle from Bitmine Immersion Technologies acquiring 13.7 million shares. The affair was led by MOZAYYX and drew an esteemed membership roll worthy of any high society gala: World Foundation, Discovery Capital Management, Kraken, Pantera, Coinfund, and the ever-mysterious Brevan Howard.

The closing curtain is slated for around September 11, pending the usual ritualistic approval from Nasdaq and other customary conditions. Subsequent to this, Eightco aspires to crown WLD as its primary treasury reserve-alongside the secondary trysts with cash and Ethereum (ETH). A modest costume change will see the company rechristen its Nasdaq ticker symbol as “ORBS,” presumably signaling a new orbit of ambition.

“This, dear readers, is the next grand act in the AI revolution concerning authentication and Proof of Human,” declared Dan Ives, the freshly anointed chairman of Eightco Holdings, with all the gravitas of a Shakespearean soliloquy. “World is the internet of people. While AI teases us with infinite abundance, World doles out infinite trust and authentication.”

Bitmine Chairman Tom Lee, ever the pragmatist, hailed the WLD-Ethereum liaison as indispensable, dubbing the token as “essential to future trust and safety between technology platforms and their billions of human users.” One imagines a rather cosmopolitan dinner party conversation there.

This investments marks the inaugural flourish of Bitmine’s “Moonshot” strategy-a cunning plan to back ventures bold enough to bolster the Ethereum empire. Eightco’s affection for Worldcoin signifies a blossoming romance with blockchain identity solutions, just as AI reshapes our digital tête-à-têtes and the economics of the Interweb.

“If we pull off this ambitious lark,” mused Altman, “World could become the largest network of real people online. It might just reinvent the very manners and means by which we interact and transact across the endless Internet.”

In the grand scheme, Eightco’s gambit places them at the vanguard of a brave new world where AI-integrated finance waltzes hand-in-hand with identity infrastructure, and Worldcoin emerges as the slick, dashing reserve asset of trust in this digital age. One only hopes the dance doesn’t end in a wallflower’s misstep.

Read More

- All Itzaland Animal Locations in Infinity Nikki

- Exclusive: First Look At PAW Patrol: The Dino Movie Toys

- All Golden Ball Locations in Yakuza Kiwami 3 & Dark Ties

- James Gandolfini’s Top 10 Tony Soprano Performances On The Sopranos

- Not My Robin Hood

- Ethereum’s Volatility Storm: When Whales Fart, Markets Tremble 🌩️💸

- Super Animal Royale: All Mole Transportation Network Locations Guide

- Silver Rate Forecast

- Gold Rate Forecast

- 7 Lord of the Rings Scenes That Prove Fantasy Hasn’t Been This Good in 20 Years

2025-09-08 21:43