Ah, Hedera, that delicate bloom in the crypto garden, has emerged from its slumber with all the vigor of a tortoise at tea time. HBAR, its price as constrained as a dandy in a straitjacket, quivers under the cautious gaze of the cryptocurrency market. Bitcoin, that fickle prima donna, and the macro conditions, as predictable as a Wildean wit, continue to stifle its aspirations.

Yet, my dear reader, the bears may soon find themselves in a predicament as amusing as a society matron caught in a rainstorm without her parasol. Derivatives positioning and capital flow indicators whisper of a shift, a potential upheaval in this dreary equilibrium.

Hedera Traders: A Tragedy in Three Acts

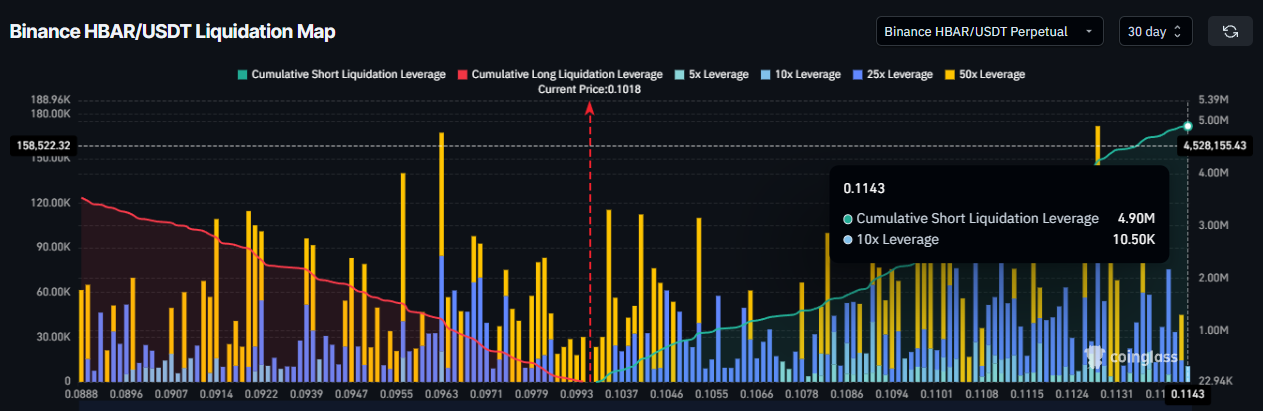

HBAR, poor darling, is currently the belle of the bearish ball, with traders opening short contracts as if they were invitations to a soiree. The liquidation map, a tableau of despair, reveals a skew so pronounced it could only be described as a melodrama. Should the price dare to cross the $0.1143 threshold, $4.9 million in liquidations await, a financial guillotine ready to drop with all the subtlety of a Wildean bon mot. Such forced liquidations, my dear, could unleash a volatility so rapid it would make a gossip’s tongue seem sluggish.

Craving more of this delectable drama? Subscribe to Editor Harsh Notariya’s Daily Crypto Newsletter, where every insight is as sharp as a Wildean quip.

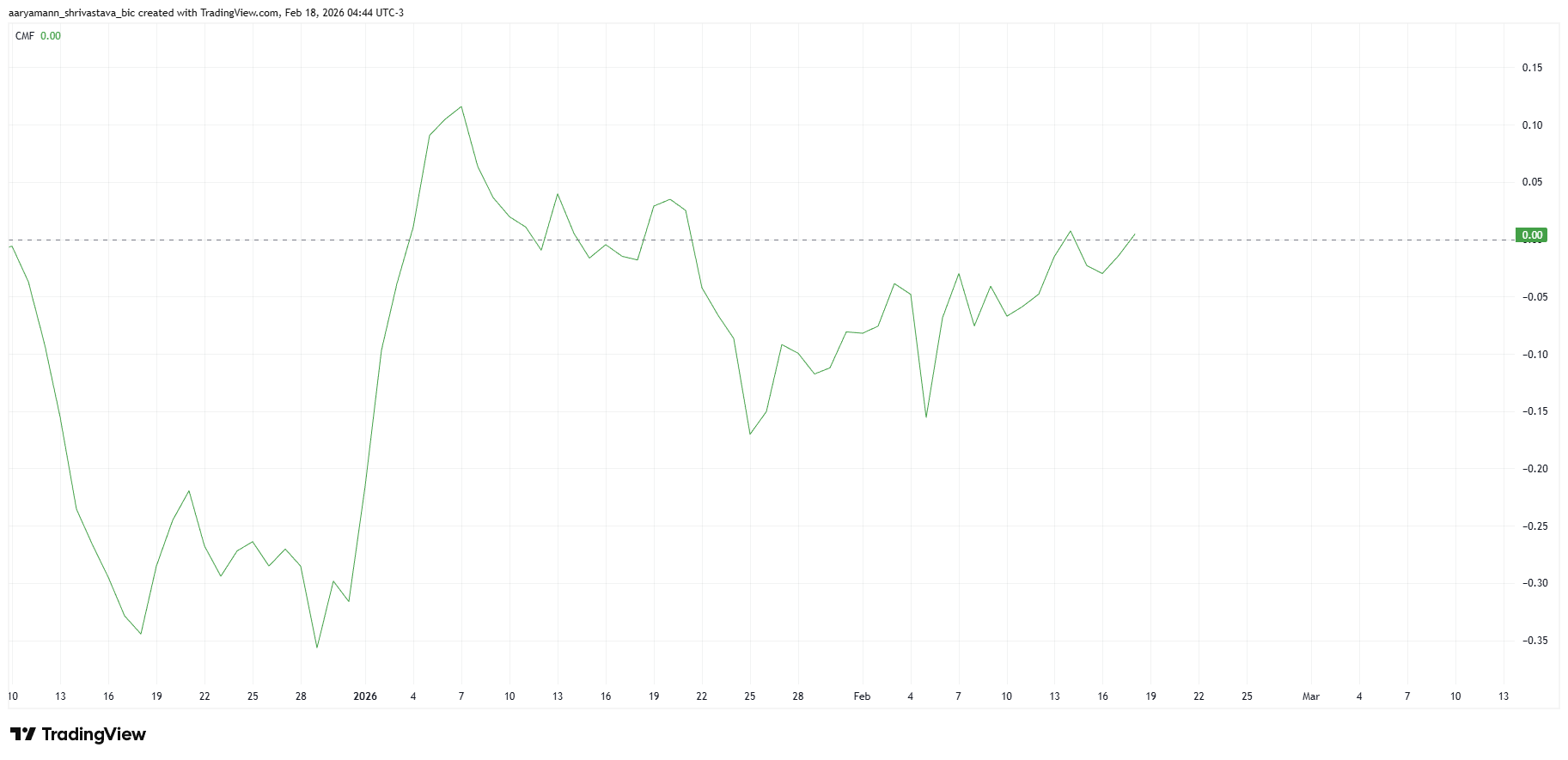

The Chaikin Money Flow indicator, that arbiter of financial fashion, offers a glimpse into the ebb and flow of capital. Rising, yet lingering at the zero line like a wallflower at a ball, it suggests outflows and inflows are engaged in a tedious waltz. But fear not, for the gap shall narrow as inflows ascend, and outflows, like a forgotten suitor, shall decline. Should this transition occur, HBAR might find the support it needs for a recovery as fleeting as a socialite’s attention span.

Bitcoin: The Unreliable Companion

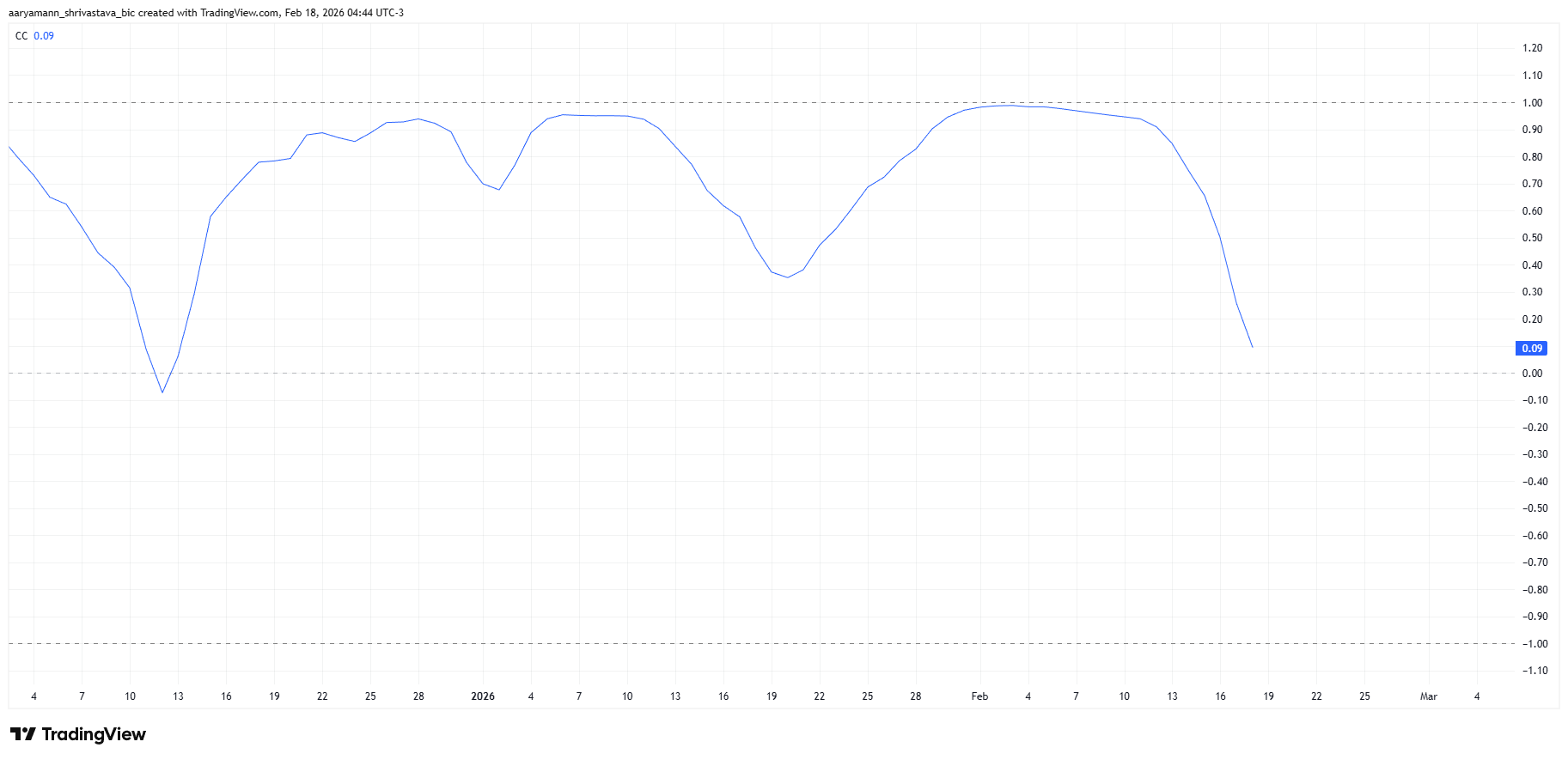

Correlation trends, those fickle friends, reveal HBAR’s bond with Bitcoin weakening, like a marriage of convenience on the brink of annulment. The coefficient, a mere 0.09, hints at a dissociation so complete it would make a Wildean divorce seem amicable. This independence, my dear, could be HBAR’s saving grace, allowing it to chart a course as unique as a Wildean protagonist.

HBAR’s Hurdles: A Comedy of Errors

HBAR, trading at $0.1019, clings to the $0.0961 support level like a debutante to her reputation. Resistance at $0.1035, a barrier as formidable as a society matron’s disapproval, caps its upward momentum. Should it flip this level into support, a short-term breakthrough might ensue, fueling a recovery rally as sudden as a Wildean plot twist. The target? $0.1109, a level so critical it could trigger buying fervor among investors, pushing HBAR past $0.1143 and into the realm of $4.9 million in shorts liquidations.

Sustained strength, my dear, could see gains extend to $0.1215 and $0.1349, a recovery as dramatic as a Wildean finale. Yet, should bullish signals fail to materialize, consolidation may reign, and a breakdown below $0.0961 could expose HBAR to further downside, a fate as bleak as a forgotten novel.

In this financial farce, only time will tell whether HBAR emerges as the hero or the fool. But one thing is certain: the drama is as rich as a Wildean play, and the stakes are as high as a society scandal.

Read More

- United Airlines can now kick passengers off flights and ban them for not using headphones

- All Golden Ball Locations in Yakuza Kiwami 3 & Dark Ties

- How To Find All Jade Gate Pass Cat Play Locations In Where Winds Meet

- How to Complete Bloom of Tranquility Challenge in Infinity Nikki

- Every Battlefield game ranked from worst to best, including Battlefield 6

- Best Zombie Movies (October 2025)

- Gold Rate Forecast

- 29 Years Later, A New Pokémon Revival Is Officially Revealed

- Pacific Drive’s Delorean Mod: A Time-Traveling Adventure Awaits!

- The ARC Raiders Dev Console Exploit Explained

2026-02-19 01:31