Well, butter my biscuit and call me impressed! Despite the crypto market’s occasional tantrums, HBAR is sitting pretty at $0.17, flexing its bullish muscles like it’s got a date with the moon. 🌕 Analysts, those ever-optimistic soothsayers, are chirping about renewed strength, thanks to ETF inflows and enterprise adoption. Because, you know, nothing says “I’m serious” like a bunch of suits buying into your blockchain. 💼✨

Canary HBAR ETF: The Token Hoarder Strikes Again

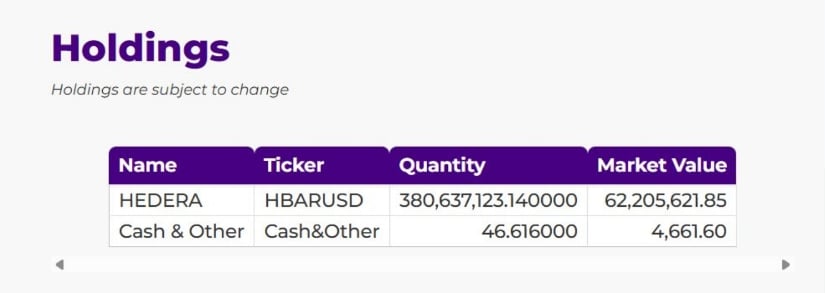

On November 5, 2025, the Canary ETF (HBR) decided it wasn’t hoarding enough tokens and scooped up a cool 380 million HBAR. That’s right, 380,637,123 tokens, to be precise. 🧮 According to ALLINCRYPTO, this stash is worth a whopping $66 million. Talk about a shopping spree! This makes Canary ETF one of the biggest institutional players in the Hedera Hashgraph game, proving that even the big boys are betting on this blockchain’s scalability and energy efficiency. 🌍⚡

Oh, and did I mention they’ve got a measly $4,661 in cash reserves? That’s like finding a quarter in your couch cushions after buying a mansion. 🛋️ Clearly, they’re all-in on HBAR, betting big on enterprise adoption and blockchain utility. Because who needs diversification when you’ve got a token that’s practically the prom queen of the crypto world? 👑

Institutions Are Swooning Over Hedera’s Charm

Canary ETF’s token binge isn’t happening in a vacuum. Hedera’s been busy, what with tokenized asset projects, enterprise partnerships, and decentralized apps popping up like mushrooms after a rainstorm. 🍄 This has the suits swooning, making HBAR a hot ticket in blockchain portfolios. And let’s not forget its real-world use cases-payments, supply chain tracking, and decentralized identity management. Because who doesn’t love a blockchain that’s actually useful? 🛠️

Market observers (aka the folks with monocles and spreadsheets) note that big funds like Canary ETF can juice up liquidity and put HBAR on the map. If the price keeps climbing, the ETF’s valuation could hit $70 million. Cha-ching! 💸

Analysts: “Hold Onto Your Hats, Folks!”

Analyst BOLUCEE_BLOCK, the crypto Nostradamus, predicts a consolidation phase for HBAR. Apparently, the token might take a breather, trading sideways through the rest of 2025 and into 2026. Because even blockchains need a nap after a growth spurt. 😴 The best-case scenario? Institutional inflows and network usage send HBAR soaring again. The worst-case? It chills in its current range, waiting for the next big catalyst. Either way, those institutional holdings should keep the market from completely losing its marbles. 🧩

HBAR Flexes Its Muscles Above $0.17

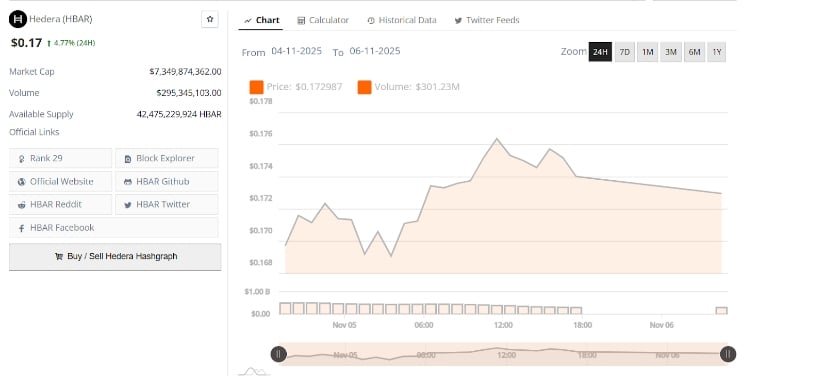

At press time, HBAR was strutting around at $0.17, up 4.77% in the last 24 hours. Its market cap? A cool $7.3 billion. Trading volume? Nearly $295 million. That’s what I call a flex. 💪 Intraday, it even hit $0.176 before some profit-takers brought it back down to $0.172. Classic. But the real star here is the support level at $0.168, where buyers are swooping in like seagulls at a picnic. 🦅 If HBAR stays above this, $0.18 could be next. And with trading volume on the rise, it looks like the party’s just getting started. 🎉

So, there you have it. HBAR’s ETF-fueled rise is the talk of the town, and institutions are lining up like it’s Black Friday. Whether it’s consolidation or liftoff next, one thing’s for sure: this token isn’t going anywhere. Except maybe up. 🚀

Read More

- All Golden Ball Locations in Yakuza Kiwami 3 & Dark Ties

- NBA 2K26 Season 5 Adds College Themed Content

- Hollywood is using “bounty hunters” to track AI companies misusing IP

- What time is the Single’s Inferno Season 5 reunion on Netflix?

- EUR INR PREDICTION

- Elder Scrolls 6 Has to Overcome an RPG Problem That Bethesda Has Made With Recent Games

- BREAKING: Paramount Counters Netflix With $108B Hostile Takeover Bid for Warner Bros. Discovery

- All Itzaland Animal Locations in Infinity Nikki

- Heated Rivalry Adapts the Book’s Sex Scenes Beat by Beat

- 2026 Upcoming Games Release Schedule

2025-11-07 00:37