In a plot twist that could only be imagined during a particularly odd tea time in a distant galaxy, the shiny yellow metal we call gold has decided to outshine Bitcoin – yes, the very Bitcoin that in some circles is revered almost as much as a slightly broken but still functional time machine! With a sparkly new valuation crashing through the $30 trillion ceiling like a clumsy elephant in a china shop, gold has now achieved fresh heights, resting comfortably at above $4,350 per ounce. If only Bitcoin could summon a similar slog of glittering success…

Unfortunately, today Bitcoin has gotten itself in quite the tizzy, sliding down by 3% and settling just below $108,000, thus triggering a somewhat dramatic-if not wholly unnecessary-crypto market liquidation that left more than a few speculative investors scratching their heads in confusion.

The Shiny Metal’s Continued Dominance

In a world teetering on the edge of chaos, with trust in fiat currencies lower than a Vogon’s approval rating, gold has boldly seized its throne as the reigning champ of “reserve assets.” Demand for the gleaming stuff has rocketed to unprecedented levels, and it’s trading like hotcakes at a charity bake sale.

In the astonishing year of 2025, the golden child has seen its worth balloon over 60%. Worth a mind-boggling $30 trillion, it easily outclasses Nvidia-the second-biggest asset-by a whopping $25 trillion. That’s enough cash to buy the entire planet a new wardrobe (though we hope they choose something more stylish than plaid).

This year alone, gold has gained over $11 trillion in value, affirming its role as the safe haven asset one turns to in times of economic doom and gloom, while crypto whales frantically swap their Bitcoin for tokenized gold-because why not keep up with the trends?

The never-ending U.S.-China trade tariff tiff has compounded the selling pressure on Bitcoin, making it clear that, for now, the silly golden metal is stealing all the small talk at the hedge asset cocktail party. 🥂

Is Bitcoin’s “Uptober” Rally More of a “Stop”?

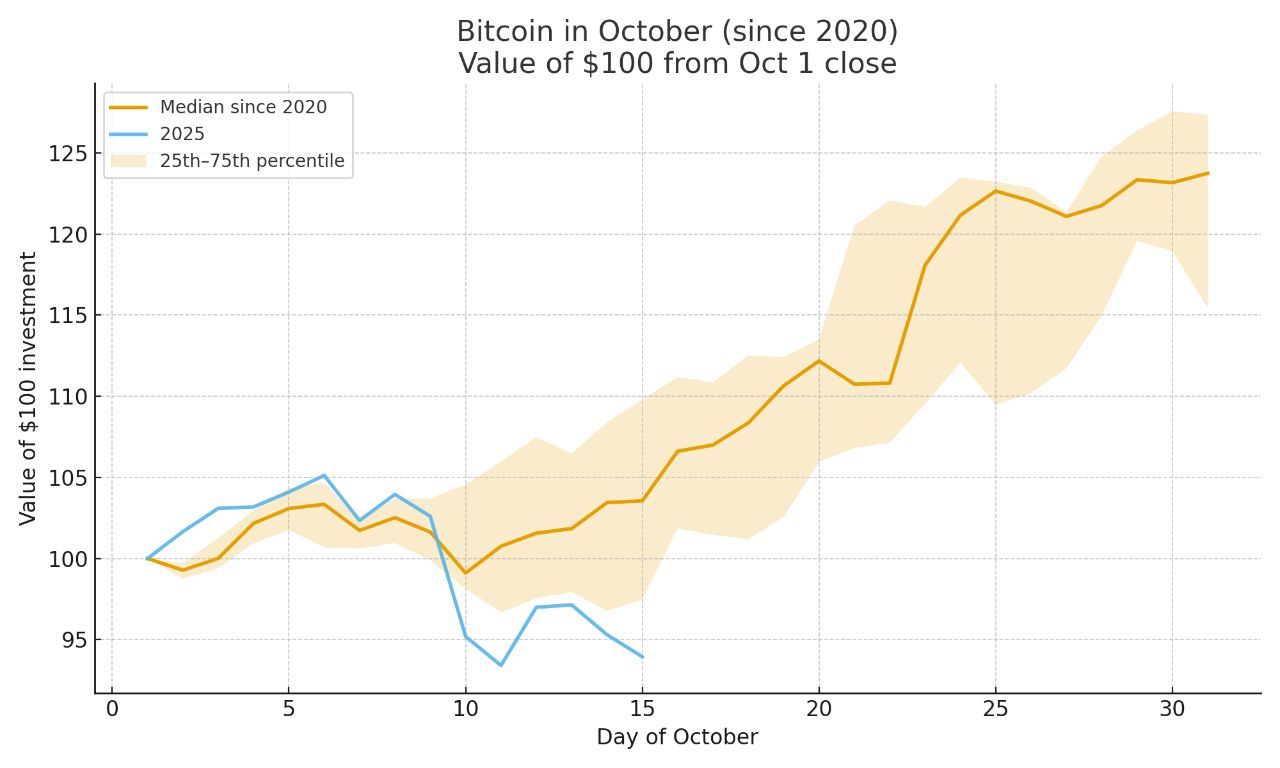

October started off with the fervor of a new intergalactic explorer setting foot on an entirely new planet, only for Bitcoin and the broader crypto universe to come crashing down faster than a poorly designed spaceship after 100% tariffs were slapped on China by good ol’ Trump. Excitement waned, and down came BTC and its groovy friends in the crypto market.

As negotiations meander, perhaps like a turtle on a leisurely stroll, ahead of the November 1 deadline, Bitcoin now sits languishing below $108,000, pressing that liquidation panic button once again. According to those numbers wizards at Ecoinometrics, the renewed U.S.-China trade tensions, like an unexpectedly long and tedious novel, are making Bitcoin’s shadows elongate once more.

Once again, the U.S.-China trade fracas has resurfaced, leading to Bitcoin’s lamentable struggle.

Earlier this year, a same-ish debacle prompted a 30% correction, and we all watched that episode unfold as if it were the latest season of a reality TV series – painful but impossible to ignore.

This time, Bitcoin has lost around 13% of its richness since its peak.

The eerie parallels between these downturns are enough to make even a quantum physicist raise an eyebrow…

– ecoinometrics (@ecoinometrics) October 16, 2025

From past experiences earlier this year, we know how such tensions initiated a whopping 30% correction, taking its sweet time to reach a bottom like someone trying to find their car keys in the dark. This time, BTC is down by 13%. If we play the numbers right, a 30% correction might see us waving goodbye to $90,000 in a hasty retreat! A certain crypto sage, Cryptos Rus, however, hasn’t thrown in the towel just yet regarding the potential for an “Uptober” miracle rally.

According to him, the loot-collecting activities of Bitcoin tend to be exponentially better during the latter half of October, suggesting that maybe-just maybe-the festivities could still surprise us. 🎉

Bitcoin’s anticipated performance in the delightful second-half of October. | Source: Cryptos Rus

On-chain data, the stuff of techno-magic that just sounds impressive, reveals a drop in exchange reserves alongside a rise in stablecoin liquidity. Historical shenanigans show that this precise concoction has led to late-month Bitcoin price surges before. So, hold onto your towels, folks; the month isn’t over yet!

Read More

- Movie Games responds to DDS creator’s claims with $1.2M fine, saying they aren’t valid

- The MCU’s Mandarin Twist, Explained

- These are the 25 best PlayStation 5 games

- SHIB PREDICTION. SHIB cryptocurrency

- Scream 7 Will Officially Bring Back 5 Major Actors from the First Movie

- Server and login issues in Escape from Tarkov (EfT). Error 213, 418 or “there is no game with name eft” are common. Developers are working on the fix

- Rob Reiner’s Son Officially Charged With First Degree Murder

- MNT PREDICTION. MNT cryptocurrency

- All Golden Ball Locations in Yakuza Kiwami 3 & Dark Ties

- ‘Stranger Things’ Creators Break Down Why Finale Had No Demogorgons

2025-10-17 14:16