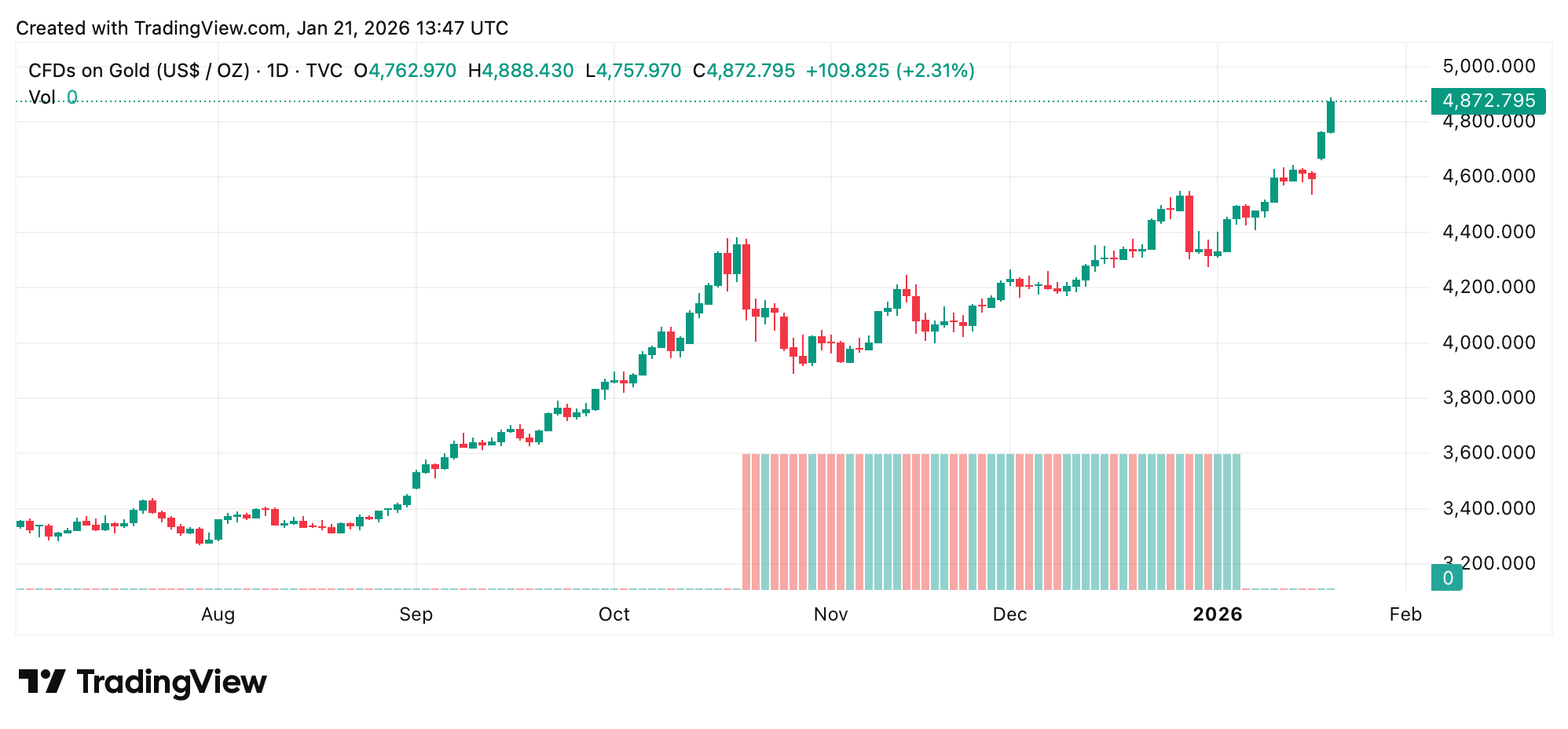

Behold, the faithful gather, their faces lit with the glow of gold, as the markets whisper of salvation through the alchemy of greed. A single Troy ounce of .999 fine gold, that eternal symbol of human folly, has leapt more than 2% against the greenback, now etching its name in the annals of financial madness at $4,886.

Gold Rewrites the Record Books While Silver Dances Near Triple Digits

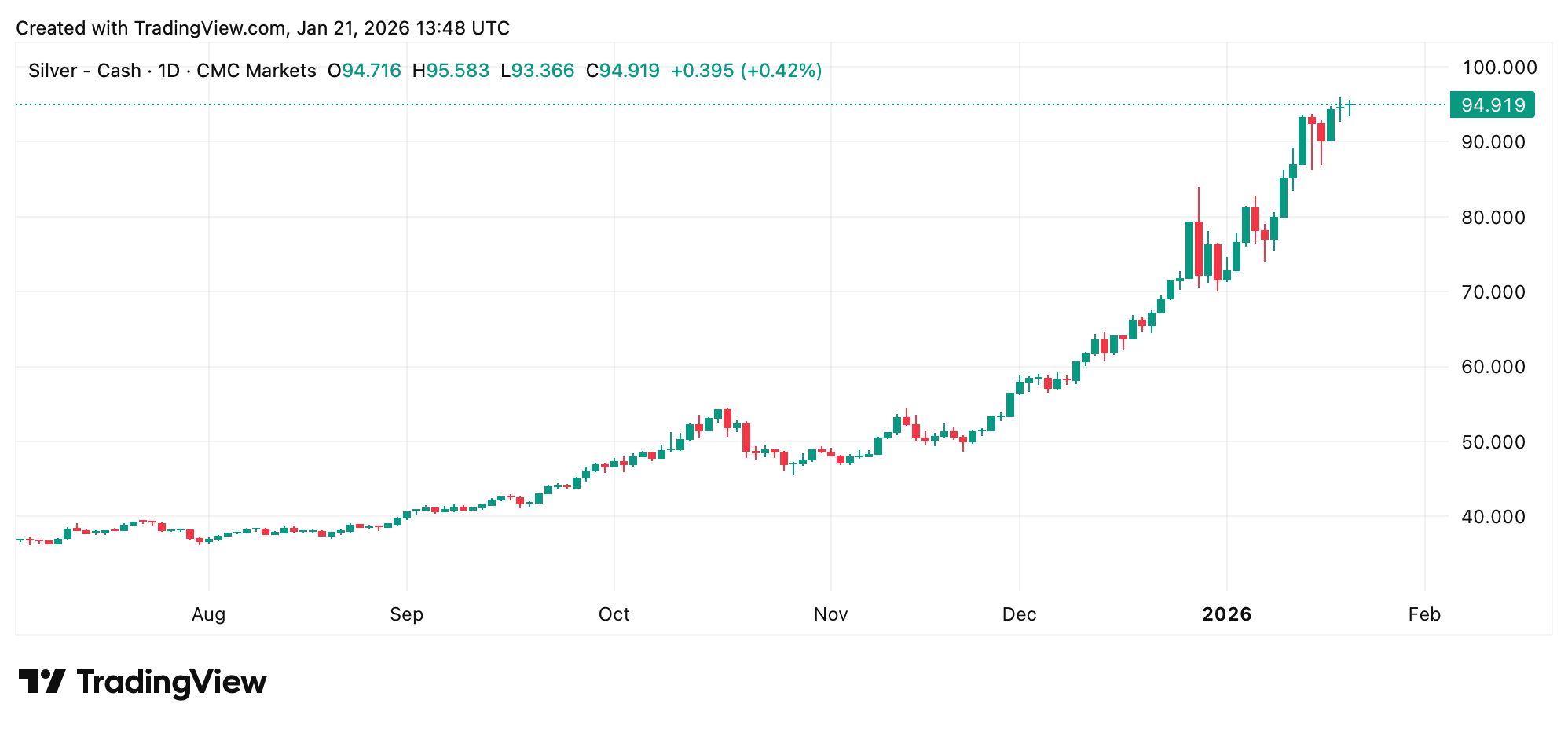

At 8:50 a.m. Eastern time, gold is trading at $4,872, while silver, that capricious lover, teases the digits of a hundred at $94.91. The move, fueled by geopolitical turmoil and the faint scent of fiat decay, has sent investors scrambling for the cold embrace of metal, as if it could shield them from the fevered dreams of their own making.

With pressures piling like bricks on a crumbling wall, analysts and market watchers, those modern-day prophets, predict precious metals will climb ever higher, as if the world’s anxieties were a wellspring of endless profit. Wednesday’s rise sees gold pressing forward, while silver-fresh from its eye-popping sprint-seems to catch its breath, only to gasp again at the sight of a $100 target.

Bloomberg’s lead commodity analyst Mike McGlone says silver is behaving as it always has-dramatic, unruly, and deeply allergic to moderation. In his view, the metal’s face-melting sprint has effectively hit the brakes on its own supply squeeze, with a near-historic breakdown in the gold-to-silver ratio suggesting things moved a bit too far, a bit too fast. One might call it the dance of the damned.

McGlone argues silver’s infamous nickname as the “devil’s metal” is earning its keep once again. According to a report from the London Bullion Market Association (LBMA), experts think gold could “average 38% above last year’s levels.” LBMA researchers add that expectations are being driven by U.S. central bank easing and a steady drift by central banks away from the dominant greenback-a tale as old as time, but with more spreadsheets.

LBMA’s report laid out a wide-ranging outlook, with a bearish call of $3,450 an ounce for gold and an extremely bullish target of $7,150. “Geopolitical tension continues to cement gold’s role as the world’s premier safe haven,” the LBMA annual Precious Metals Analyst Survey noted this week. A safe haven? More like a gilded cage for the desperate.

In short, gold and silver are still being treated as sturdy bets for 2026, even after punching through record levels above $4,850 for gold and $95 for silver, largely because geopolitical tensions refuse to cool. Pressure from U.S. tariff threats aimed at Greenland and Europe, the risk of flare-ups involving Iran and Venezuela, and President Trump’s jabs at Federal Reserve independence are all feeding safe-haven demand. One might wonder if the world is preparing for a second coming-or a third.

Whatever the angle, gold and silver are acting less like quick-hit trades and more like barometers for global anxiety. With geopolitical risks humming, central banks loosening policy, and faith in fiat systems wearing thin, hard assets remain front and center. A fitting tribute to the age of uncertainty, where even the most basic truths are subject to the whims of the market.

Even after sharp rallies and pauses to catch their breath, precious metals keep commanding attention as investors hedge uncertainty, hinting that 2026 could continue to favor those looking for shelter beyond traditional monetary channels. A sad testament to the human condition, where the only certainty is the illusion of control.

FAQ

- Why are gold and silver prices hitting record levels in 2026?

Because the world has finally lost its mind, and the only sanity left is in the form of yellow and white metal. Or perhaps it’s the last gasp of a dying system. - What is driving silver’s move toward $100 an ounce?

Strong investment demand and a sharp shift in the gold-to-silver ratio have lifted silver, even as short-term consolidation suggests a pause. A pause before the next plunge, of course. - How high could gold prices go next, according to analysts?

The London Bullion Market Association outlines a wide range, with forecasts stretching from $3,450 to as high as $7,150 an ounce. A range as wide as the chasms of despair, and just as profitable for the few. - Why are investors favoring precious metals over fiat assets?

Ongoing geopolitical risk, tariff threats, and doubts about central bank independence are reinforcing gold and silver’s role as safe havens. A safe haven? More like a gilded prison for the anxious.

Read More

- Movie Games responds to DDS creator’s claims with $1.2M fine, saying they aren’t valid

- The MCU’s Mandarin Twist, Explained

- These are the 25 best PlayStation 5 games

- SHIB PREDICTION. SHIB cryptocurrency

- Scream 7 Will Officially Bring Back 5 Major Actors from the First Movie

- All Golden Ball Locations in Yakuza Kiwami 3 & Dark Ties

- Server and login issues in Escape from Tarkov (EfT). Error 213, 418 or “there is no game with name eft” are common. Developers are working on the fix

- Rob Reiner’s Son Officially Charged With First Degree Murder

- MNT PREDICTION. MNT cryptocurrency

- ‘Stranger Things’ Creators Break Down Why Finale Had No Demogorgons

2026-01-21 17:27