So, there I was, minding my own business, when I stumbled upon this little tidbit: Galaxy Digital, the digital asset management firm, decided it needed a bit more Solana (SOL) in its life. Not just a little bit, mind you, but a whopping 1.35 million SOL, worth about $302 million. Talk about a shopping spree! 🛍️

It started innocently enough. According to SolanaFloor on X, Galaxy scooped up 430,000 SOL worth roughly $97 million in just one hour. One hour! That’s like buying a luxury car every second. 🚗💨

🚨JUST IN: @galaxyhq’s aggressive Solana accumulation continues as the firm bought 430,000 $SOL worth $97M from @binance in the last hour. Over the past 12 hours, Galaxy has accumulated 1.35M $SOL worth $302M.

– SolanaFloor (@SolanaFloor) September 11, 2025

But they didn’t stop there. Over the next 12 hours, Galaxy ramped up its efforts, acquiring 1.35 million SOL. I guess they decided to go all in, like when you bet your entire paycheck on red at the casino. 🎰

Galaxy Digital isn’t just buying for fun; they’re tasked with supplying decentralized asset treasury (DAT) companies with large amounts of SOL. They’re planning to deploy $354 million in stablecoins and have an additional $1 billion in cash reserves for future purchases. It’s like they’re preparing for a digital asset apocalypse. 😱

Part of these acquisitions will go toward building Multicoin’s SOL reserve, aiming to exceed $1 billion. Forward Industries, another key player, plans an even larger treasury targeting $1.65 billion. I mean, why stop at a billion when you can aim for a billion and a half, right? 💰✨

Arkham’s data reveals that recent purchases are from Forward Industries treasury, highlighting a rising trend in transparent, on-chain fundraising. It’s like a digital version of a charity gala, but without the awkward small talk. 🥂

Whale Clips: @galaxyhq has brokered the initial purchase of $SOL from @binance ($326m) for Forward Industries DAT.

– MartyParty (@martypartymusic) September 11, 2025

Meanwhile, whales have been busy pulling SOL from Coinbase Prime. Several transactions have been linked to four new wallets, possibly controlled by a single entity. It’s like a digital treasure hunt, but the treasure is already in someone else’s pocket. 🕵️♂️🔍

This indicates a growing competition for the available tokens, especially now that SOL is being eyed as a potential ETF reserve asset, much like Ethereum’s path. It’s like SOL is the new kid on the block, and everyone wants to be friends. 👫🎉

Market Performance and Growing Demand

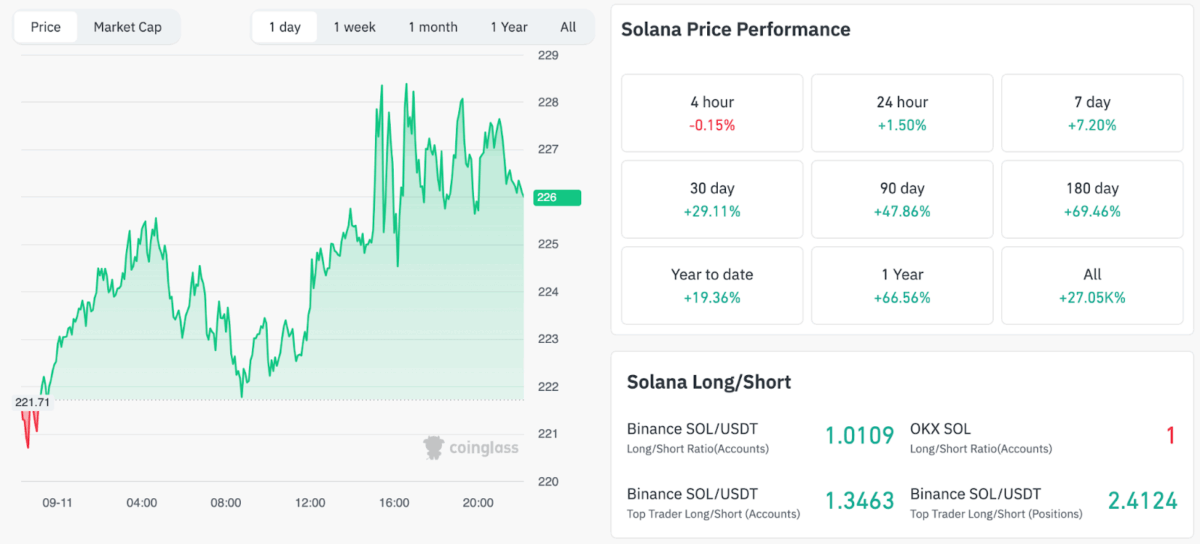

Solana’s price has been on a rollercoaster ride, moving from $221.71 to $226 in the past 24 hours. It briefly touched $229 before settling slightly lower, according to Coinglass data. SOL is up 1.50% daily, 7.20% weekly, and an impressive 29.11% over the past month. It’s like the token is on a mission to prove itself. 🌠

The data further shows that market sentiment is still bullish. Binance data shows a long-to-short ratio above 1, with top traders displaying more confidence. It’s like the market is giving SOL a big thumbs up. 👍

BitMining also joined the party, adding 17,221 SOL to its holdings for a total treasury worth $9.95 million. The company’s BTCM stock trades at $2.91, still positive but below its $6.25 peak. It’s like they’re saying, “Hey, we’re in this for the long haul.” ⏳

Aggressive buying by Galaxy Digital underscores the soaring demand for SOL while treasuries increase. With increased whale activity and ETF speculation, Solana could sustain this accumulation. It’s a wild ride, but who doesn’t love a good crypto adventure? 🚀💥

Read More

- All Golden Ball Locations in Yakuza Kiwami 3 & Dark Ties

- NBA 2K26 Season 5 Adds College Themed Content

- Hollywood is using “bounty hunters” to track AI companies misusing IP

- What time is the Single’s Inferno Season 5 reunion on Netflix?

- All Itzaland Animal Locations in Infinity Nikki

- Silver Rate Forecast

- Gold Rate Forecast

- Heated Rivalry Adapts the Book’s Sex Scenes Beat by Beat

- Brent Oil Forecast

- Elder Scrolls 6 Has to Overcome an RPG Problem That Bethesda Has Made With Recent Games

2025-09-12 00:27