In the labyrinth of the financial Gulag, Ethereum’s once-mighty march has stumbled, its boots mired in the mud of resistance at the $4,400 threshold. The air, thick with the scent of speculative greed, now carries a chill as the bullish fervor wanes. Like a prisoner’s hope in the dead of winter, the short-term momentum has frozen, betrayed by a local bearish divergence and the cruel shift in market structure. Yet, the mid-term uptrend, a stubborn sentinel, still stands guard, though its resolve is tested.

The coming days shall be a trial by fire, a reckoning to discern whether this is but a fleeting correction or the harbinger of a deeper, more brutal pullback. The markets, ever capricious, demand their tribute in uncertainty. 🌪️

Technical Analysis

By Shayan

The Daily Chart

On the daily canvas, ETH remains shackled within its ascending channel, a prisoner of its own ambition. The $4,800 resistance, a barbed wire fence, has repelled its advances once more. Now, the asset slumps toward the channel’s lower trendline, its last line of defense at $4,000, where the 100-day moving average awaits like a stern warden. The RSI, a weary sentinel, has cooled to 49, signaling that the bullish flame flickers but has not yet been snuffed out. Yet, should $4,000 fall, the gates to $3,400-the next gulag of demand-shall swing open. 🛑

The 4-Hour Chart

In the 4-hour vigil, ETH has confirmed its Market Structure Shift (MSS), a betrayal of its own making, after failing to sustain higher highs near $4,800. A bearish divergence on the RSI, a whispered warning, foretold this fall. Now, the price enters a corrective phase, a penitent’s pilgrimage to the $4,200-$4,100 zone, where past demand lies in wait. For the buyers to reclaim their throne, $4,500 must be retaken, the lower-high formation annulled. Until then, the short-term bias remains bearish, a shadow cast by the broader bullish channel. 🦹♂️

Sentiment Analysis

Open Interest

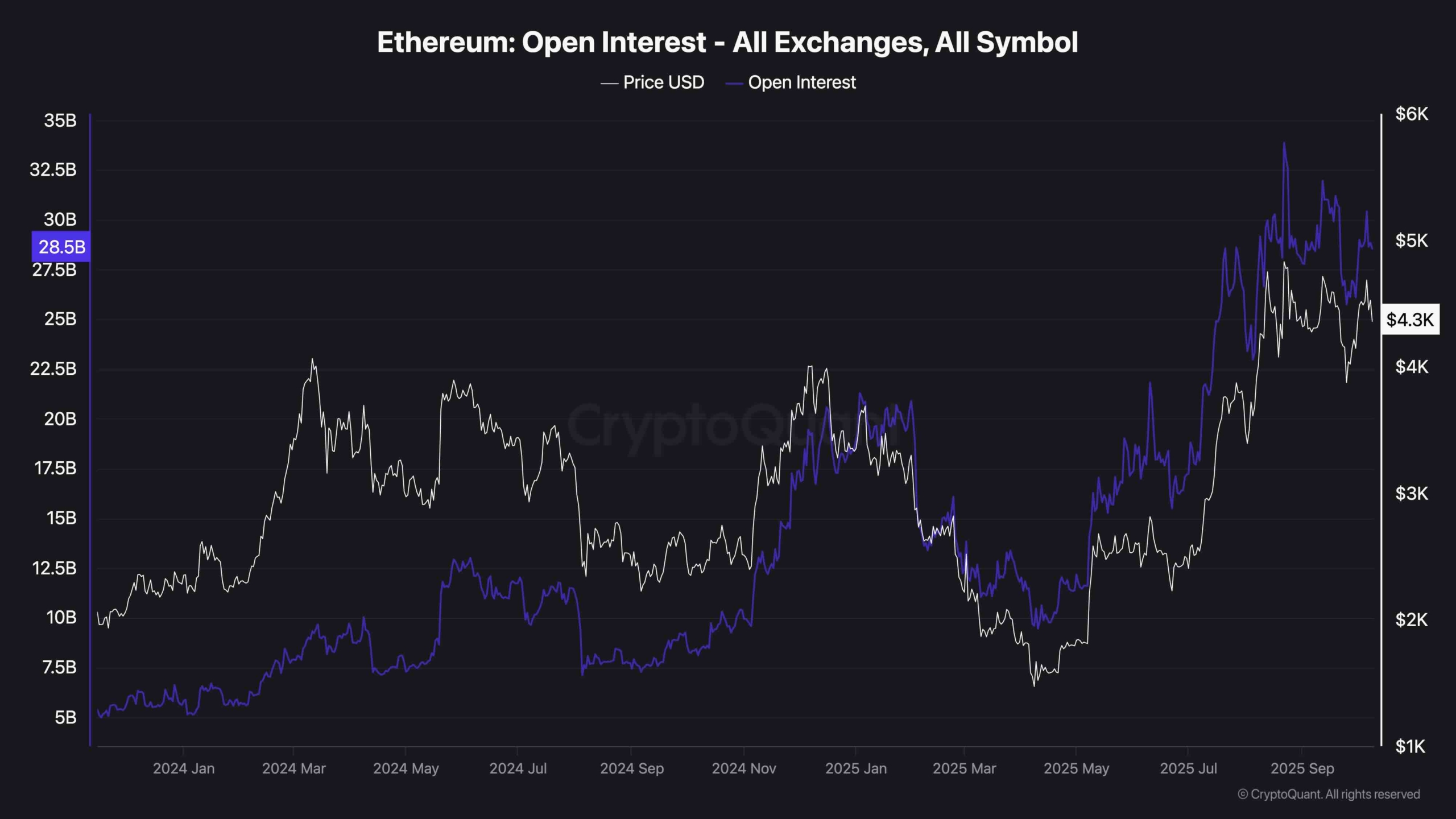

Open interest, a bloated leviathan, looms at $28.5 billion, a testament to the derivatives traders’ hubris. Their positions, stacked like prisoners in a cell, show no sign of retreat despite the pullback. This is both a fortress of speculative interest and a powder keg of vulnerability. Should volatility strike, liquidations shall cascade like a prison riot. Yet, if open interest cools gradually, it may signal a healthy resetting of leverage, a quiet before the next storm. The market, ever a cruel master, holds the whip. 💥

Read More

- All Golden Ball Locations in Yakuza Kiwami 3 & Dark Ties

- Gold Rate Forecast

- Hollywood is using “bounty hunters” to track AI companies misusing IP

- What time is the Single’s Inferno Season 5 reunion on Netflix?

- NBA 2K26 Season 5 Adds College Themed Content

- Mario Tennis Fever Review: Game, Set, Match

- Exclusive: First Look At PAW Patrol: The Dino Movie Toys

- Heated Rivalry Adapts the Book’s Sex Scenes Beat by Beat

- Beyond Linear Predictions: A New Simulator for Dynamic Networks

- A Knight Of The Seven Kingdoms Season 1 Finale Song: ‘Sixteen Tons’ Explained

2025-10-10 11:30