Ethereum‘s Rollercoaster: Will ETH Bounce Back to $3,000 or Keep Giving Us Whiplash? 🎢💸

Once upon a time in the universe of barely comprehensible financial instruments, Ethereum decided it was tired of being just another number on a screen. So, it took a nosedive to $2,625, possibly inspired by a really bad hangover. Now, it’s dreaming of a comeback – possibly to the mythical, fabled land of $2,800 to $3,000, if the macroeconomic gods smile kindly and stop throwing storm clouds our way.

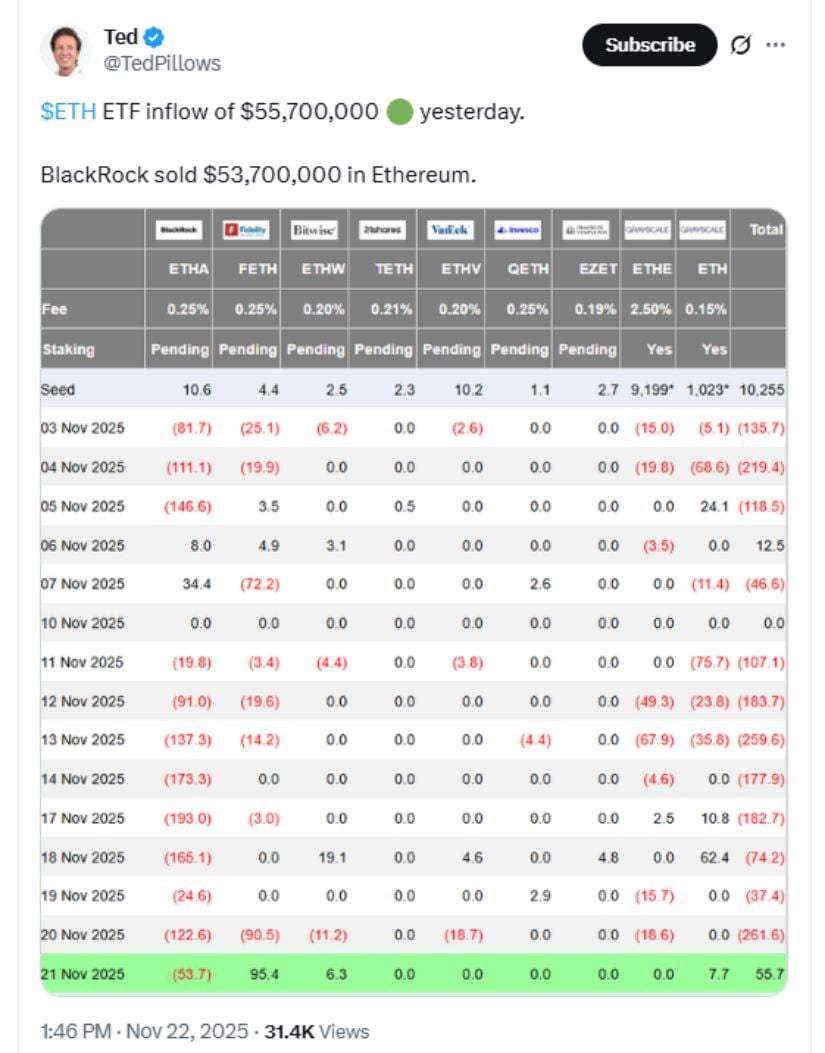

Meanwhile, in the mystical realm of ETF flows-a place where big money moves faster than a caffeinated squirrel-things took a turn for the ‘less catastrophic’. After nine days of us collectively holding our breath and praying to the crypto gods, inflows arrived like a badly timed caffeine rush. For those confused by the jargon:  a handful of $55.7 million dollars decided to remind everyone that yes, institutional investors still have a pulse, despite their emotional breakdowns during market dips.

a handful of $55.7 million dollars decided to remind everyone that yes, institutional investors still have a pulse, despite their emotional breakdowns during market dips.

ETF Inflows: The Slight Whisper of Confidence Amid Macro Headwinds

The big players, like Fidelity and BlackRock, had their moment of pattern recognition-selling, then largely buying again, flipping nets faster than a pancake on Sunday morning. Daniel K., an ETF whisperer, pointed out that this modest inflow-roughly 0.3% of the total-was enough to make market analysts wipe their glasses and mutter, “Well, perhaps this chaos isn’t the end of Ethereum just yet.”

Picture the macroeconomic scene: the US dollar strutting around with more confidence than a cat in a sunbeam, unemployment figures playing hide and seek, and volatility doing a dance that would make even the most seasoned traders dizzy. But history suggests that these storm clouds often spark rainbow-colored recoveries-unless, of course, they don’t. But hey, who’s keeping track?

Technical Analysis: Ethereum’s Game of Levels and Patterns

Ethereum is eyeballing the $2,800 resistance like a kid eyeing the cookie jar. This level isn’t just a random number; it’s a fortress lined with:

- Multiw-eek supply zones

- Flattened 20-day EMA (which is trading the same way I wish I could-calm and flattening)

- Mid-October’s volume-profile peak, because why not?

If ETH manages to punch through this barrier with volume enough to wake the neighbors, it could skedaddle toward $2,880, then possibly break the $3,000 barrier, reaching a broader target of $3,220-an area that once felt as daunting as trying to convince your grandma about blockchain.

Support levels are like safety nets: $2,620 (recent low) and $2,480 (a volume node from ages ago-well, Q2 2024, but who’s counting?). RSI and MACD indicators are doing the cha-cha, bouncing and flattening, as the market waits for its next move-like a caffeinated squirrel on a power line.

Derivative Data: The Cautious Optimism of LEVERAGE and the Whisper of Hope

Funding rates on ETH futures have crept up from 4% to about 6%, hinting that traders aren’t entirely convinced but are definitely peeking over the fence-probably wearing sunglasses to hide their nerves. Long-term traders, with all their patience and calculators, have nudged their positions upward, like a kid trying to impress at the school dance.

But here’s the thing: just because there’s a faint glimmer of hope doesn’t mean we’re out of the woods. Ethereum has to reclaim $2,800 with style, volume must sing a ballad across exchanges, and ETF inflows need to keep flowing like a bad soap opera plot-day after day, without pause.

The network’s getting a shiny new upgrade-Dencun-like giving Ethereum a fancy new suit that reduces fees by 80-90%. Because nothing says “I’m serious about my blockchain” like slashing fees faster than a flaming sword.

Coinbase Joins the Lending Carnival – Because Why Not?

Coinbase, ever the trailblazer, now offers ETH-backed loans of up to $1 million – yes, that’s more than most people’s annual income, as long as they’re not trying to buy a house. Borrowers need to watch out: drop below the collateral threshold, and it’s akin to borrowing Dad’s car and losing the keys. Interest rates can fluctuate more than the weather-fun for the thrill-seekers, terrifying for those with a mortgage.

Ultimately, this liquidity boost might help Ethereum’s market-if only a little-and could turn heads, or at least make traders scratch their heads in confusion.

Price Predictions: Looking into the Crystal (or Maybe the Mug of Coffee)

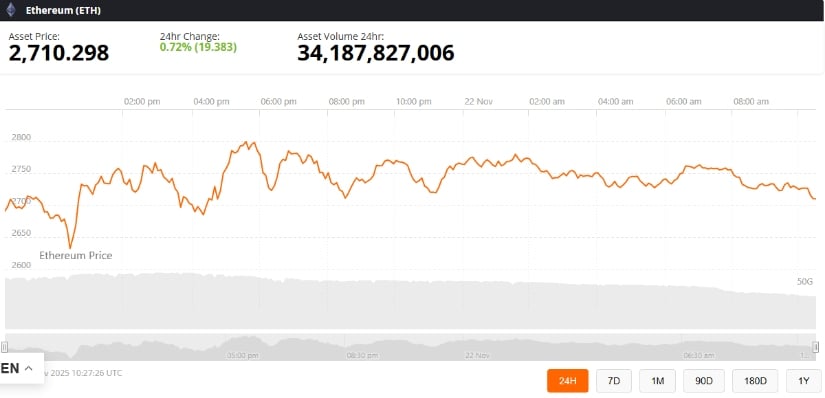

ETH is lounging around $2,770, playing hard to get. The game plan involves either jumping back above $2,800 or slipping below support, with potential pit stops at $2,620 or even as low as $2,350-the depths of the digital dungeon.

Long-term, analysts-those brave souls-are both optimistic and cautious. They see signs of Layer-2 adoption, ETF participation, and institutional staking-think of it as Ethereum’s version of a pep rally. But don’t hang up your hat just yet; confirmation is still needed, and markets have a sense of humor that’s darker than a blackout night.

Read More

- All Golden Ball Locations in Yakuza Kiwami 3 & Dark Ties

- NBA 2K26 Season 5 Adds College Themed Content

- What time is the Single’s Inferno Season 5 reunion on Netflix?

- Hollywood is using “bounty hunters” to track AI companies misusing IP

- All Itzaland Animal Locations in Infinity Nikki

- EUR INR PREDICTION

- Elder Scrolls 6 Has to Overcome an RPG Problem That Bethesda Has Made With Recent Games

- Heated Rivalry Adapts the Book’s Sex Scenes Beat by Beat

- BREAKING: Paramount Counters Netflix With $108B Hostile Takeover Bid for Warner Bros. Discovery

- Mario Tennis Fever Review: Game, Set, Match

2025-11-23 00:42