So, Ethereum’s network is like that kid who finally grew up, took a shower, and now looks like they might actually get their life together. But before we all start sending out congratulatory messages, let’s hold on for a second and make sure it’s not just a fluke. Price confirmation signals-those tiny little beacons of clarity-are still required before we declare a full-fledged bullish trend. You know, just in case this is all just smoke and mirrors.

Using some fancy tools like TradingView chart data, Glassnode’s on-chain metrics, and L2Beat’s Layer 2 throughput stats (because who doesn’t like to overcomplicate things?), we see that Ethereum is, in fact, making some progress. We’re talking better block capacity, lower fees, and faster transaction speeds. Whoa, slow down there, Ethereum, are you trying to get us excited or something?

Analysts, in their infinite wisdom, are now keeping a close eye on the Fusaka upgrade. It’s like watching a reality show-you never know if it’s going to be an emotional rollercoaster or just a massive flop. Throw in some exchange reserve trends and technical chart structures, and maybe-just maybe-Ethereum can keep this momentum rolling toward a potential all-time high.

Ethereum Prepares for Key Milestone

Ethereum (ETH) is strutting toward the Fusaka upgrade, scheduled for December 2025. How do we know this? Well, it’s all in the Ethereum Foundation docs, developer calls, and GitHub discussions-because nothing says “trustworthy” like code and open-source repositories.

The Fusaka upgrade comes with two major upgrades. The first is PeerDAS (Peer Data Availability Sampling)-try saying that three times fast-which promises to reduce bandwidth requirements for nodes. This will, in theory, make Layer 2 networks much easier to navigate. You know, lower fees and faster transactions-basically a dream come true for everyone who’s ever waited a century for their Ethereum transaction to confirm.

The second enhancement is Verkle Trees (yes, trees, because why not?), a new data structure that speeds up and lightens Ethereum’s verification process. Expect lighter clients, less hardware overhead, and even more decentralization. If that wasn’t enough, we might even see a performance boost to the tune of 150 million gas. But don’t get too excited just yet-the real test is whether these upgrades can survive in the wild, outside of the testing environment.

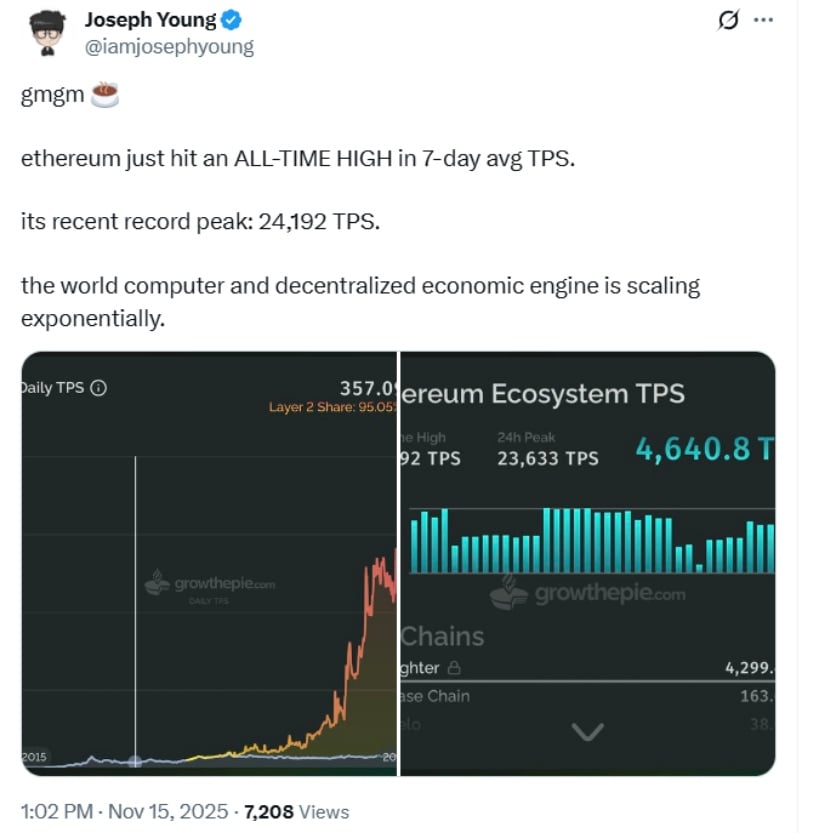

Record Transaction Throughput Signals Network Progress

According to L2Beat and EigenDA, Ethereum recently hit a record of 24,192 transactions per second (TPS)-that’s the highest it’s ever been. So, let’s all give Ethereum a round of applause. Not too loud though, we don’t want to scare it off. Of course, a portion of this growth is thanks to the Dencun upgrade (which, honestly, sounds like the name of a futuristic sandwich), which brought proto-danksharding and made Layer 2 data costs as low as your expectations after a Monday morning.

Even Vitalik Buterin had to comment on this progress. Yes, the Ethereum co-founder himself made it official: “Ethereum is scaling. The improvements across rollups are becoming visible.” Well, at least someone’s excited.

Current Market Dynamics and ETH Price Today

As of now, Ethereum is chilling at $3,186. You can verify that on CoinMarketCap or TradingView, but we all know prices are as stable as your internet connection during a Zoom call.

Key market observations (based on Glassnode data):

-

Exchange reserves have dropped to 15.5 million ETH-apparently, people are hoarding their ETH like it’s the last piece of cake at a party.

-

ETH supply growth is negative thanks to EIP-1559 burn mechanics. Sounds technical, but basically, ETH is getting scarcer, which could drive prices up. Who knew scarcity was so in-demand?

-

Trading volume has dipped by 60% in the last 24 hours, now sitting at $23.4 billion. It’s like the market’s trying to figure out whether it’s excited or still waiting for a confirmation email.

Technical Analysis: Curved Trendline Structure and Breakout Conditions

Take a look at Ethereum’s daily chart on TradingView, and you’ll see a curved trendline structure. Yes, that’s right-a curve. Because who needs a straight line when you can have a beautiful, unpredictable arc? Technical analysts love this pattern because it signals that each pullback is getting slightly less painful. This could mean that buyers are getting in earlier. When paired with increased volume, this could signal an upward momentum-if we’re lucky.

If Ethereum breaks out above this curved trendline with confirmation signals-like a surge in trading volume and the RSI going above 60-we could see ETH hit the $6,000 to $7,000 range. Or, you know, it could just crash into oblivion. We’ll see.

Market Sentiment and Expanded Risk Considerations

Market sentiment is a bit like a rollercoaster: thrilling one minute, terrifying the next. There are a few caution signals though:

Caution signals identified:

-

RSI and MACD are showing weakening momentum on the daily chart. So, yeah, things might be slowing down.

-

Price exhaustion signals are popping up after every failed attempt to break resistance. You’ve gotta wonder, when will Ethereum learn?

-

Open interest is all over the place. Traders don’t seem too sure what’s going on, and it’s causing some unease.

Additional macro risks to consider:

-

Shifts in U.S. regulatory policy-because, of course, regulations are the life of the party.

-

Bitcoin dominance cycles might cause some liquidity rotations. It’s like a game of musical chairs, but with much higher stakes.

-

Global macroeconomic pressures could ruin everyone’s day, including inflation readings and the Federal Reserve’s interest rate outlook.

Analysts recommend waiting for confirmation signals, rather than jumping in with both feet. It’s a jungle out there.

Ethereum Forecast 2025 and Beyond

Looking to 2025 and beyond, Ethereum’s future largely depends on the Fusaka upgrade and the continued expansion of Layer 2 scaling solutions. If these upgrades work as planned, Ethereum could solidify its position in decentralized finance, NFTs, and enterprise blockchain applications. However, its price could still be influenced by both market and macroeconomic factors. Fingers crossed.

If things go really well, we could see Ethereum pushing toward the $6,000 to $7,000 range. But let’s not get too excited yet-there’s a long road ahead, and Ethereum still has to keep it together. On the other hand, if things go sideways, we might find Ethereum stuck between $2,900 and $3,500, waiting for things to calm down. So, in conclusion, Ethereum might break out or it might just… not. Hold onto your hats!

Read More

- Movie Games responds to DDS creator’s claims with $1.2M fine, saying they aren’t valid

- The MCU’s Mandarin Twist, Explained

- All Golden Ball Locations in Yakuza Kiwami 3 & Dark Ties

- These are the 25 best PlayStation 5 games

- SHIB PREDICTION. SHIB cryptocurrency

- Scream 7 Will Officially Bring Back 5 Major Actors from the First Movie

- Server and login issues in Escape from Tarkov (EfT). Error 213, 418 or “there is no game with name eft” are common. Developers are working on the fix

- Rob Reiner’s Son Officially Charged With First Degree Murder

- MNT PREDICTION. MNT cryptocurrency

- Every Death In The Night Agent Season 3 Explained

2025-11-17 01:10