Markets

What to know:

- Trend Research, a trading firm led by Liquid Capital founder Jack Yi, built a $2 billion leveraged long position in ether by borrowing stablecoins against ETH collateral.

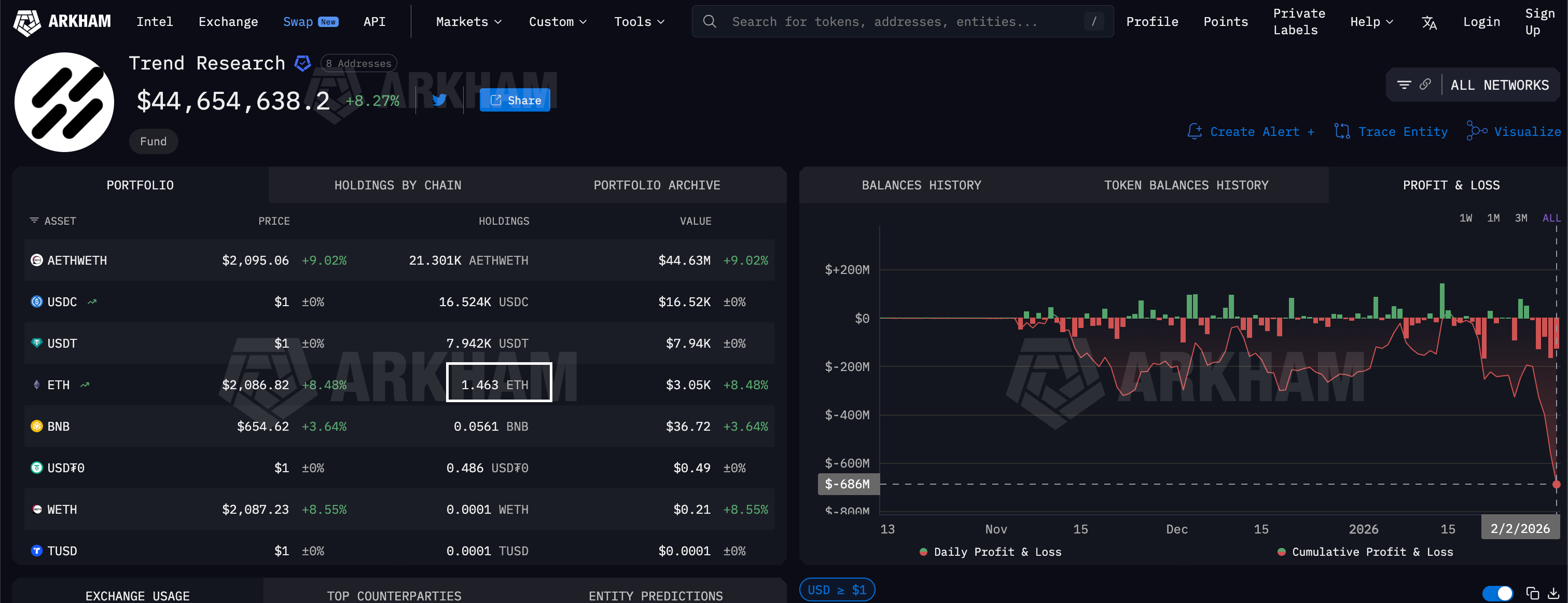

- As ether’s price slid to $1,750 this week, the firm’s looped ETH position unraveled, resulting in an estimated $686 million loss.

- Yi framed the massive sales as risk control and said he remains bullish on a “mega” crypto bull market, predicting ETH above $10,000 and bitcoin above $200,000 despite the setback.

In the gray dawn of this market, a beast named leverage gnaws at the bones of men who count coins on a screen. An ether bull, clinging to promised skies, has learned that the sky is woven from debt and fear. The spectacle is not drama but the daily bread of men who mistake numbers for destiny.

That beast of numbers is Trend Research, a firm led by Jack Yi of the house called Liquid Capital. For months they stitched a bullish dream around ether, two billion in borrowed gold from the DeFi sky, tethering hope to ETH as if hope were a stake they could stake again and again.

The position tore as ether tumbled toward 1,750 dollars this week, and the looped bet snapped like a dry rope, leaving a rent in the ledger: a loss of 686 million, etched in the cold light of Arkham’s reckoning.

The blow teaches the unkind math of markets: volatility is a harsh tutor, and leverage is a loud student that never learns discipline. Traders chase these risky loops-borrowing stablecoins against ETH collateral-until the lesson arrives as a roar and a ruin.

How it went down

The team believed ether’s future shone like a furnace in winter and expected a brisk ascent from its October retreat below four thousand.

Yet the light never materialized-ether kept slipping, threatening the very loop that bound their fate. As prices fell, the stablecoin collateral withered, while the debt stood firm, a hulking shadow in the room of numbers.

The final blow came as ether and bitcoin slid together, on February 4, to the nadir of the year, the lowest breath since last spring. Trend Research answered with a flood of ether to Binance to repay AAVE debt, and data tells a stark tale: 332k ETH moved to Binance over five days, a river of coins that emptied into a single bin. The firm now holds but 1.463 ETH.

Jack Yi called these moves risk-control measures, as if a man can steady a storm by rearranging furniture.

“As multi-heads in this round, we remain optimistic about the performance of the new bull market: ETH reaching over $10,000, BTC exceeding $200,000 USD. We’re just making some adjustments to control risk, with no change in our expectations for the future mega bull market,” Yi wrote to the void of X, where voices echo louder than facts.

He added that volatility is the crypto circle’s grand feature, a carnival ride with sharp drops and sharper slogans. “Historically, countless bulls have been shaken off by this volatility, but often what follows is a doubled rebound,” he said, as if the cosmos were a coin flipping in a pocket full of optimism and smoke.

Read More

- All Golden Ball Locations in Yakuza Kiwami 3 & Dark Ties

- These are the 25 best PlayStation 5 games

- The MCU’s Mandarin Twist, Explained

- Movie Games responds to DDS creator’s claims with $1.2M fine, saying they aren’t valid

- A Knight Of The Seven Kingdoms Season 1 Finale Song: ‘Sixteen Tons’ Explained

- Gold Rate Forecast

- Mario Tennis Fever Review: Game, Set, Match

- Hollywood is using “bounty hunters” to track AI companies misusing IP

- Beyond Linear Predictions: A New Simulator for Dynamic Networks

- All Songs in Helluva Boss Season 2 Soundtrack Listed

2026-02-07 11:01