Markets

What to know:

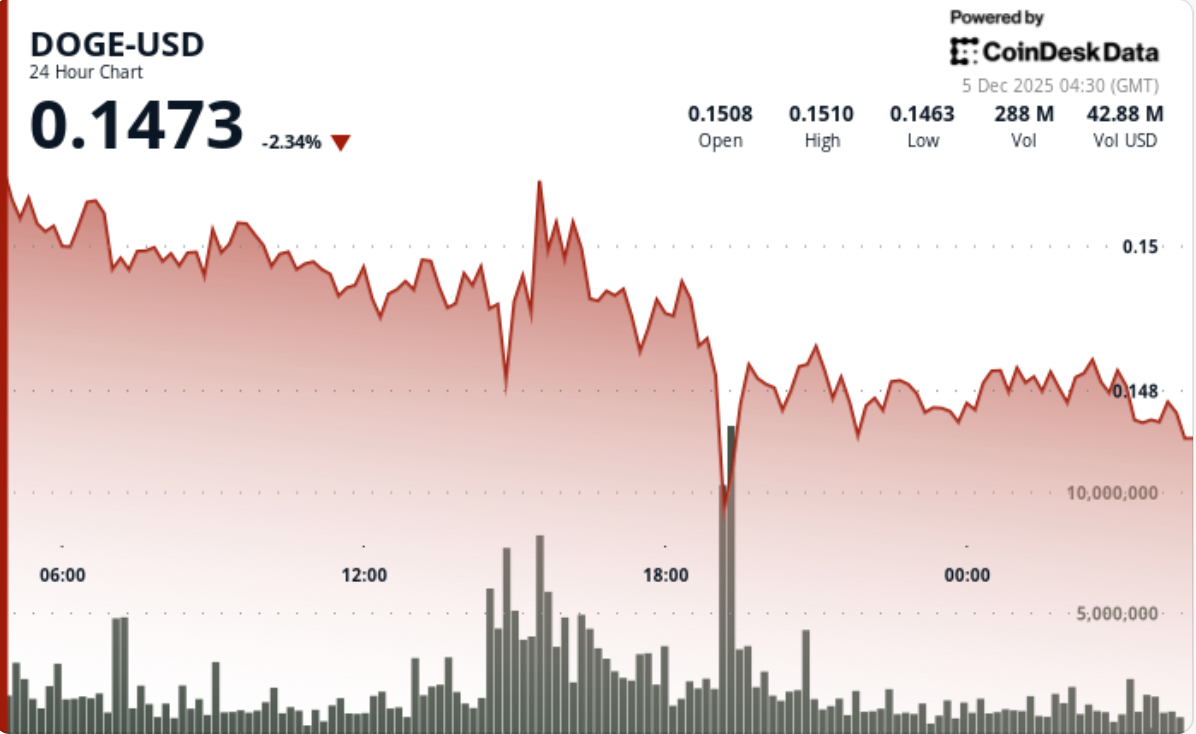

- Dogecoin, that whimsical creature of the crypto zoo, has stumbled yet again, despite its network buzzing like a beehive on espresso. 🍯☕ Institutional trades, those cold-hearted titans, dominated the session, leaving retail traders in the dust. 🏛️💨

- Technical analysis, the soothsayer of charts, reveals DOGE’s failure to cling to its support levels-a tragicomic tale of ambition and gravity. 📉✨ Unless buyers stage a heroic comeback, the downside looms like a Chekhovian storm cloud. ☁️⚡

- Active addresses reached a September-esque high, but the price remains as sullen as a Russian winter, weighed down by weak momentum and bearish whims. 🌨️🐻

The meme coin, once a darling of the internet, now breaks technical levels with the grace of a drunk at a ballet. 🩰🍷 Institutional-sized trades ruled Wednesday’s session, their cold logic drowning out ETF filing buzz. 📊🚀

News Background

- Dogecoin’s decline, a melodrama in three acts, unfolded despite an uptick in network activity and ETF whispers. 🎭💬

- 21Shares and Grayscale, those ambitious suitors, advanced filings for spot DOGE ETFs, fueling hopes that meme coins might yet grace institutional portfolios. 📄💼 Yet, hope, as always, is a fickle mistress. 🌪️❤️

- On-chain metrics painted a curious picture: 71,589 active addresses, the highest since September, yet the price drooped like a wilted flower. 🌼😔 Rising engagement, it seems, is no match for market ennui. 🌀😑

- Whale activity, once a roaring torrent, now resembles a sluggish stream, and ETF inflows remain as tepid as yesterday’s tea. 🍵🐳 The divergence between network participation and price is a tragicomedy of modern finance. 🎭💸

- With crypto sentiment as risk-off as a hermit crab, DOGE’s technical posture has stolen the spotlight from its on-chain virtues. 🦀🎥

Technical Analysis

- The breakdown was as clean as a Chekhovian ending-decisive, inevitable, and driven by institutional or algorithmic flows. 🧮⚰️ DOGE’s failure to hold $0.1487 came after three failed attempts at $0.1522, each marked by dwindling upside volume, a classic harbinger of buyer despair. 😢📉

- Once sellers breached the $0.1487 floor, volume surged like a Chekhovian monologue, with three hourly candles exceeding 400M tokens traded. 🕯️💥 Large players, it seems, were unloading with the urgency of a man fleeing a burning dacha. 🏠🔥

- The price action formed a descending triangle, a geometric metaphor for DOGE’s plight. 🔻🐶 The breakdown aligns with this structure, suggesting continuation unless buyers reclaim the $0.1487-$0.1510 region-a tall order in this theater of the absurd. 🎭🤹

- Despite active addresses surging, momentum indicators and volume signatures remain as bearish as a Siberian winter. 🐻❄️ RSI drifts lower, and trend-following signals point south. Until DOGE reclaims $0.1487, sellers hold the reins. 🏇⚔️

reclaiming $0.1487 is essential to neutralize the breakdown, while a move through $0.1510 would signal a legitimate trend shift. 🏹🚀

Read More

- All Golden Ball Locations in Yakuza Kiwami 3 & Dark Ties

- NBA 2K26 Season 5 Adds College Themed Content

- Hollywood is using “bounty hunters” to track AI companies misusing IP

- Gold Rate Forecast

- What time is the Single’s Inferno Season 5 reunion on Netflix?

- Mario Tennis Fever Review: Game, Set, Match

- Beyond Linear Predictions: A New Simulator for Dynamic Networks

- A Knight Of The Seven Kingdoms Season 1 Finale Song: ‘Sixteen Tons’ Explained

- EUR INR PREDICTION

- Exclusive: First Look At PAW Patrol: The Dino Movie Toys

2025-12-05 08:34