Author: Denis Avetisyan

Researchers have developed a comprehensive index to measure systemic risk within the rapidly evolving cryptocurrency landscape.

This paper introduces the Aggregated Systemic Risk Index (ASRI), a novel tool for assessing the interconnected vulnerabilities of cryptocurrency markets, including DeFi and stablecoins.

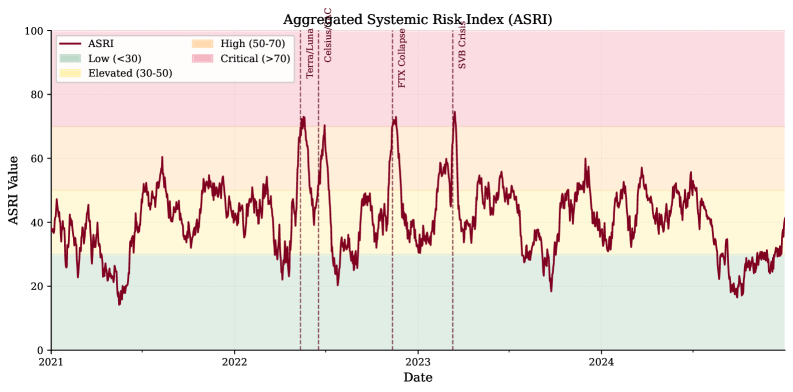

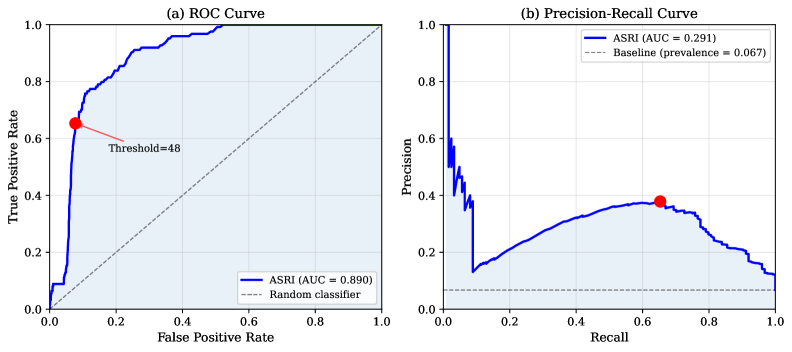

Despite the rapid growth of cryptocurrency markets-now exceeding $3 trillion in capitalization-a unified framework for monitoring systemic risk has remained absent, leaving regulators and investors vulnerable to interconnected failures. This paper introduces the Aggregated Systemic Risk Index (ASRI), a composite measure designed to quantify risk across cryptocurrency markets by integrating Stablecoin Concentration, DeFi Liquidity, Contagion, and Regulatory Opacity. Validated against historical crises-including the collapses of Terra/Luna, Celsius/3AC, FTX, and the SVB banking crisis-ASRI demonstrates statistically significant predictive power and identifies distinct risk regimes. Can this novel index provide the early warning signals needed to mitigate systemic vulnerabilities in the increasingly complex landscape of decentralized finance?

The Inevitable Interconnect: Mapping Systemic Risk

The increasing integration of cryptocurrency markets with traditional finance is forging new pathways for systemic risk. Once largely isolated, digital assets now share liquidity and counterparty exposures with established financial institutions through avenues like crypto lending, decentralized finance (DeFi) platforms, and exchange-traded funds. This interconnectedness means that instability in the crypto space can rapidly transmit to TradFi, and vice versa, potentially amplifying market shocks. The reliance of some financial entities on crypto-backed loans or their direct involvement in digital asset markets creates vulnerabilities not previously accounted for in conventional risk models. Consequently, a localized failure within the crypto ecosystem could trigger cascading effects throughout the broader financial system, demanding a reassessment of existing regulatory frameworks and risk management strategies to address these emerging challenges.

Current financial risk monitoring systems frequently operate in isolation, designed to assess threats within specific asset classes or institutions. This compartmentalization proves increasingly inadequate in the face of growing interconnectedness, particularly with the rise of digital assets like cryptocurrency. Traditional tools struggle to map the complex contagion pathways emerging between decentralized finance and established financial markets, hindering the ability to identify systemic vulnerabilities. Consequently, risks originating in the crypto space can propagate to TradFi – and vice versa – with limited early warning, potentially amplifying shocks and undermining overall financial stability. The lack of a unified, holistic view creates blind spots, leaving the system exposed to unforeseen consequences from even relatively localized disruptions.

A robust surveillance of financial stability now demands a shift towards holistic monitoring frameworks. Traditional, compartmentalized approaches fail to adequately capture the intricate contagion pathways emerging between cryptocurrency markets and traditional finance. These frameworks must move beyond isolated asset analysis to trace the flow of risk across interconnected systems, identifying potential vulnerabilities before they cascade into systemic events. This necessitates integrating diverse data sources, employing advanced analytical techniques-such as network analysis and stress testing-and developing early warning indicators that signal emerging risks. By proactively mapping these interdependencies, regulators and financial institutions can better anticipate, mitigate, and ultimately safeguard against the evolving landscape of financial instability.

ASRI: An Ecosystemic View of Risk

The ASRI framework addresses the growing systemic risk posed by the interconnection of Decentralized Finance (DeFi) and Traditional Finance (TradFi) through a unified monitoring approach. It achieves comprehensive risk assessment by integrating data from multiple sources, categorized as Tier 1 and Tier 2. Tier 1 data includes established economic indicators from sources like the Federal Reserve Economic Data (FRED) and on-chain metrics from DeFi Llama. Tier 2 data incorporates more dynamic, alternative datasets such as regulatory sentiment analysis and real-time exploit tracking. This integration allows ASRI to move beyond isolated analysis and consider the potential for risk propagation across both ecosystems, providing a more holistic view of systemic vulnerability than traditional, siloed approaches.

The ASRI framework employs a Constant Mean Model to define expected values for key risk indicators, facilitating the detection of anomalous behavior. This model calculates a time-series mean for each indicator, establishing a baseline against which current data is compared. Deviations from this established mean are flagged as potential risk events, with the magnitude of the deviation informing the severity assessment. The model continuously updates the mean as new data becomes available, adapting to changing market conditions and ensuring the baseline remains relevant. Statistical significance testing is then applied to these deviations to minimize false positives and confirm the emergence of genuine risk signals; the model does not simply react to any variance, but rather to statistically meaningful changes from the established mean.

ASRI employs stationarity tests as a critical component of its statistical validation process. These tests, including the Augmented Dickey-Fuller (ADF) test and the Kwiatkowski-Phillips-Schmidt-Shin (KPSS) test, are used to verify whether the time series data used in the Constant Mean Model meet the necessary requirements for reliable analysis. Specifically, stationarity-the property of a time series having constant statistical properties over time-is crucial to prevent regression to the mean and the misinterpretation of random fluctuations as meaningful risk signals. Non-stationary data can lead to spurious correlations and inaccurate risk assessments; therefore, data failing these tests undergo transformations, such as differencing, to achieve stationarity before being incorporated into the model. This ensures the robustness of ASRI’s risk indicators and minimizes the likelihood of false positives.

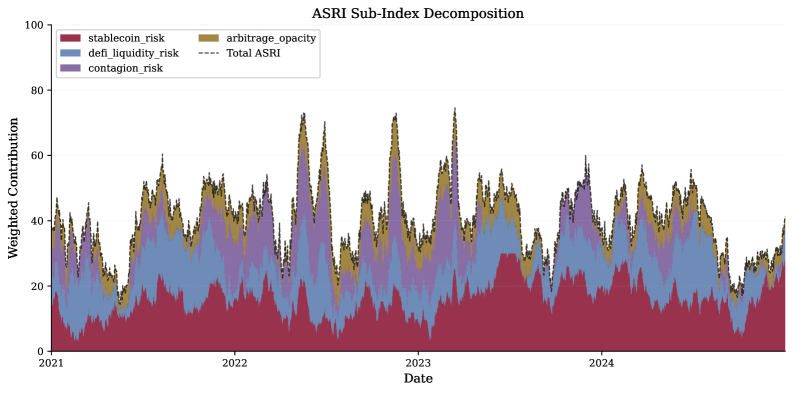

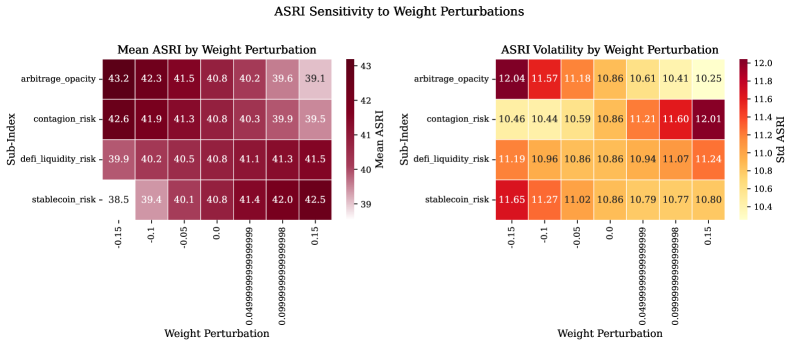

The ASRI framework utilizes a modular design, integrating data from both Tier 1 sources – including established economic indicators from FRED and on-chain data from DeFi Llama – and Tier 2 sources such as regulatory sentiment analysis and real-time exploit tracking. This data is then applied to a weighted risk assessment, prioritizing Stablecoin Concentration Risk at 30% of the overall score. DeFi Liquidity Risk and Contagion Risk each contribute 25% to the final assessment, allowing ASRI to quantify interconnectedness and potential systemic vulnerabilities across DeFi and TradFi systems.

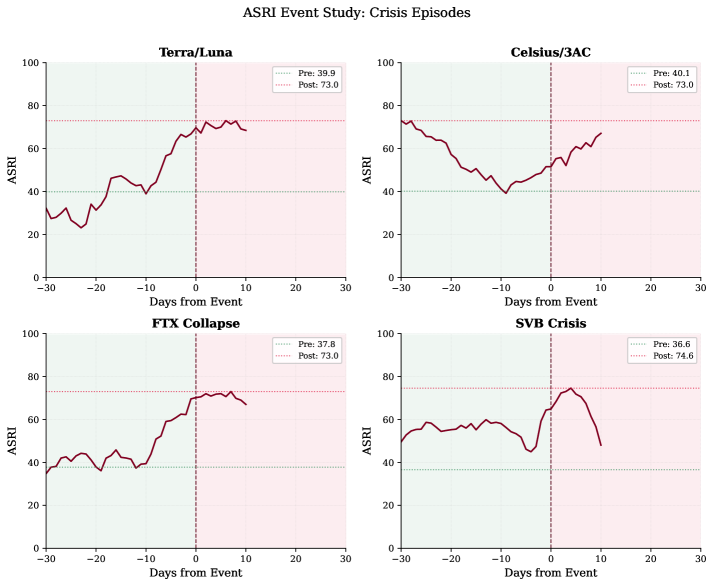

Validating the Inevitable: Stress Testing for Systemic Resilience

ASRI utilizes Event Studies to quantify the impact of discrete events – such as smart contract exploits or significant regulatory announcements – on market behavior. This methodology examines market dynamics within a defined 90-day window surrounding the event, encompassing both pre- and post-event periods. Data collected within this timeframe is analyzed to determine statistically significant changes in relevant metrics, allowing for the isolation of the event’s influence from broader market trends. The 90-day window provides sufficient data to establish a baseline and capture both immediate and lagged effects, enhancing the reliability of the analysis and facilitating a nuanced understanding of event-driven market responses.

Bonferroni correction is a statistical method employed within ASRI’s Event Studies to address the problem of increased false positive rates when conducting multiple hypothesis tests. Specifically, it adjusts the significance level (alpha) for each individual comparison by dividing it by the number of comparisons made. For example, if a researcher conducts 20 tests with an initial alpha of 0.05, the Bonferroni-corrected alpha becomes 0.0025 (0.05 / 20). This more stringent significance level reduces the probability of incorrectly identifying a statistically significant result when none truly exists, thereby increasing the reliability of the Event Study findings. The application of Bonferroni correction ensures that observed effects are less likely attributable to random chance and more likely reflective of genuine market reactions to specific events.

Placebo analysis within the ASRI framework involves introducing randomly selected, non-impactful ‘events’ into the historical dataset and subjecting them to the same analytical processes as actual, potentially market-moving events. This methodology is designed to rigorously test the system’s propensity to falsely identify correlations where none exist. By evaluating the frequency with which the framework incorrectly signals an impact from these placebo events, ASRI maintains a controlled false positive rate of 5%. This stringent control ensures the reliability of identified correlations and minimizes the risk of misinterpreting random market fluctuations as genuine responses to specific events.

ASRI incorporates a suite of sub-indices designed to isolate and quantify specific risk factors within the digital asset ecosystem. These include, but are not limited to, ‘Stablecoin Concentration Risk’, which measures systemic vulnerability arising from reliance on a limited number of stablecoin issuers, and ‘DeFi Liquidity Risk’, which assesses the potential for price impact and execution failure due to insufficient liquidity within decentralized finance protocols. By disaggregating overall risk into these granular components, ASRI facilitates a more precise understanding of potential vulnerabilities and allows for targeted risk management strategies. These sub-indices are constructed using a combination of on-chain data and market metrics, providing a data-driven assessment of evolving risk landscapes.

The Present Moment & The Trajectory of Risk

The December 2024 assessment reveals a ‘Moderate Risk’ profile within the increasingly intertwined decentralized finance (DeFi) and traditional finance (TradFi) systems. This categorization doesn’t suggest complacency, but rather highlights a complex interplay of factors demanding sustained attention. While not currently indicative of imminent systemic failure, the interconnectedness introduces potential contagion pathways – vulnerabilities where instability in one area could propagate rapidly through the other. This moderate risk level arises from a combination of emerging technologies, evolving regulatory landscapes, and the inherent volatility of digital assets, all compounded by the growing scale of capital flowing between these traditionally separate financial worlds. Continued vigilance, proactive monitoring, and adaptive risk management strategies are therefore crucial to prevent localized issues from escalating into broader systemic concerns.

The Automated Systemic Risk Indicator (ASRI) framework places significant emphasis on monitoring stablecoin reserves due to their inherent capacity to escalate systemic risk within the decentralized finance (DeFi) and traditional finance (TradFi) intersection. While designed to maintain a 1:1 peg with fiat currencies, the actual backing of these digital assets – the composition and liquidity of their reserves – remains a crucial, and often obscured, point of vulnerability. Insufficient or poorly managed reserves could trigger a ‘run’ on stablecoins, rapidly propagating instability across the interconnected digital asset ecosystem and potentially spilling over into traditional markets. The scale of stablecoin issuance, now exceeding hundreds of billions of dollars, necessitates continuous scrutiny of reserve adequacy, asset quality, and redemption mechanisms, as even seemingly minor disruptions could trigger cascading failures and widespread financial contagion.

Regulatory opacity represents a significant vulnerability within the rapidly evolving digital asset landscape. The analytical framework identifies that a lack of clear, consistent, and publicly available regulations concerning decentralized finance (DeFi) and its interaction with traditional finance (TradFi) creates opportunities for risk amplification. This isn’t simply a matter of absent rules, but the complex interplay of differing jurisdictional approaches and the inherent difficulty in applying existing financial regulations to novel technologies. Without enhanced transparency in regulatory oversight – including clear guidelines on stablecoin reserves, custodial practices, and cross-border transactions – systemic risks can accumulate undetected, potentially undermining the stability of the broader financial system. Addressing this requires international cooperation and a commitment to proactively clarifying the regulatory perimeter surrounding digital assets.

Continuous surveillance leveraging the Automated Systemic Risk Indicator (ASRI) is paramount to navigating the dynamic landscape of digital assets and safeguarding financial stability. This proactive monitoring isn’t simply about reacting to crises; it’s designed to anticipate emerging vulnerabilities before they cascade into systemic events. ASRI’s capacity to analyze complex interconnections within the decentralized finance (DeFi) and traditional finance (TradFi) spheres allows for the early detection of escalating risks, such as liquidity crunches or contagion effects. The insights generated directly inform the development of targeted mitigation strategies, enabling regulators and institutions to adapt policies and protocols in real-time. Ultimately, consistent application of ASRI fosters a more resilient digital asset ecosystem, promoting innovation while minimizing the potential for widespread disruption and maintaining confidence in the evolving financial system.

The construction of ASRI, as detailed in the study, isn’t a matter of imposing order, but of mapping the inevitable decay already present within the cryptocurrency ecosystem. It acknowledges that concentration of stablecoins, liquidity fluctuations, and regulatory unknowns aren’t bugs to be fixed, but fundamental forces of change. As Epicurus observed, “It is impossible to live pleasantly without living prudently, honourably, and justly.” ASRI, in its aggregation of risk factors, doesn’t prevent systemic failure, it merely illuminates the patterns of that failure-a pragmatic acceptance of entropy rather than a futile attempt at control. The index foresees, rather than averts, the currents of contagion.

What Lies Ahead?

The aggregation of risk, as this work demonstrates with ASRI, merely clarifies the inevitability of its concentration. One builds an index to measure systemic fragility, not to resolve it. The factors identified – stablecoin dominance, liquidity constraints, regulatory shadows – are not bugs in the system, but emergent properties of any complex, interconnected network. Each connection, each point of leverage, becomes a potential vector for cascading failure. The index, then, is a map of future vulnerabilities, a premonition etched in data.

Future iterations will undoubtedly refine the weighting of these factors, perhaps incorporating on-chain behavioral metrics or sentiment analysis. Yet, such improvements address symptoms, not causes. The fundamental problem remains: the pursuit of innovation often outpaces the capacity to understand – let alone mitigate – its systemic implications. As the cryptocurrency landscape expands, embracing ever more intricate financial instruments, the network of dependencies will only thicken.

The true challenge isn’t to build a perfect risk index, but to accept the inherent limitations of prediction in complex systems. One can identify the fault lines, but not prevent the earthquake. The index serves as a reminder that every innovation carries the seed of its own unraveling, and that the illusion of control is often more dangerous than acknowledging the underlying chaos.

Original article: https://arxiv.org/pdf/2602.03874.pdf

Contact the author: https://www.linkedin.com/in/avetisyan/

See also:

- All Golden Ball Locations in Yakuza Kiwami 3 & Dark Ties

- Hollywood is using “bounty hunters” to track AI companies misusing IP

- What time is the Single’s Inferno Season 5 reunion on Netflix?

- NBA 2K26 Season 5 Adds College Themed Content

- A Knight Of The Seven Kingdoms Season 1 Finale Song: ‘Sixteen Tons’ Explained

- Gold Rate Forecast

- Mario Tennis Fever Review: Game, Set, Match

- 4. The Gamer’s Guide to AI Summarizer Tools

- Train Dreams Is an Argument Against Complicity

- Every Death In The Night Agent Season 3 Explained

2026-02-05 07:12