If the latest derivatives data for Bitcoin and its merry band of altcoins were a melodrama, September 2025 would be the scene where the villain cackles and pulls the lever marked “Liquidation.” 🎭

How does one prepare for such financial tomfoolery? Fear not, dear reader, for we shall dissect this spectacle with the precision of a butler serving cucumber sandwiches at a garden party.

September Derivatives Market: A Circus Tent Stuffed With $220 Billion of High-Wire Acts

The first act in this three-ring financial circus is the Open Interest, currently lounging at a record high like a cat who’s stolen the cream. This, as any self-respecting trader knows, is the market’s way of whispering, “Buckle up, buttercup.”

CoinGlass, that ever-reliable oracle of digital doom, reports that crypto futures Open Interest has sashayed past $220 billion-a figure so large it could buy a small country or at least a very fancy hat. Short-term traders, bless their leveraged hearts, are piling in like punters at a racetrack, convinced the next economic event will be their golden ticket.

The second reason? Derivatives trading has elbowed spot trading into the gutter like a rugby player at last call. Futures volumes are now eight to ten times higher than spot, which is roughly the same ratio as Bertie Wooster’s hangovers to productive mornings.

All this points to one inevitable conclusion: liquidations so massive they’d make a whale blush. And just to spice things up, the Federal Reserve is due to drop its latest interest rate decision-a move as predictable as Jeeves raising an eyebrow at one of Bertie’s schemes.

The third reason? Volatility, that fickle sprite who delights in turning traders’ dreams into confetti. Analyst Crypto Bully, a chap who clearly enjoys watching the world burn, notes that the FOMC meeting won’t guarantee price direction-just chaos. Glorious, wallet-emptying chaos.

FOMC does not bring guaranteed upside or downside

It brings volatility. And that’s where opportunity lies for traders

Notes on chart + How to use:

– Delta

– Price Action

– Open InterestHere’s how you trade FOMC and News events profitably

– Crypto Bully 🔥 (@BullyDCrypto) September 16, 2025

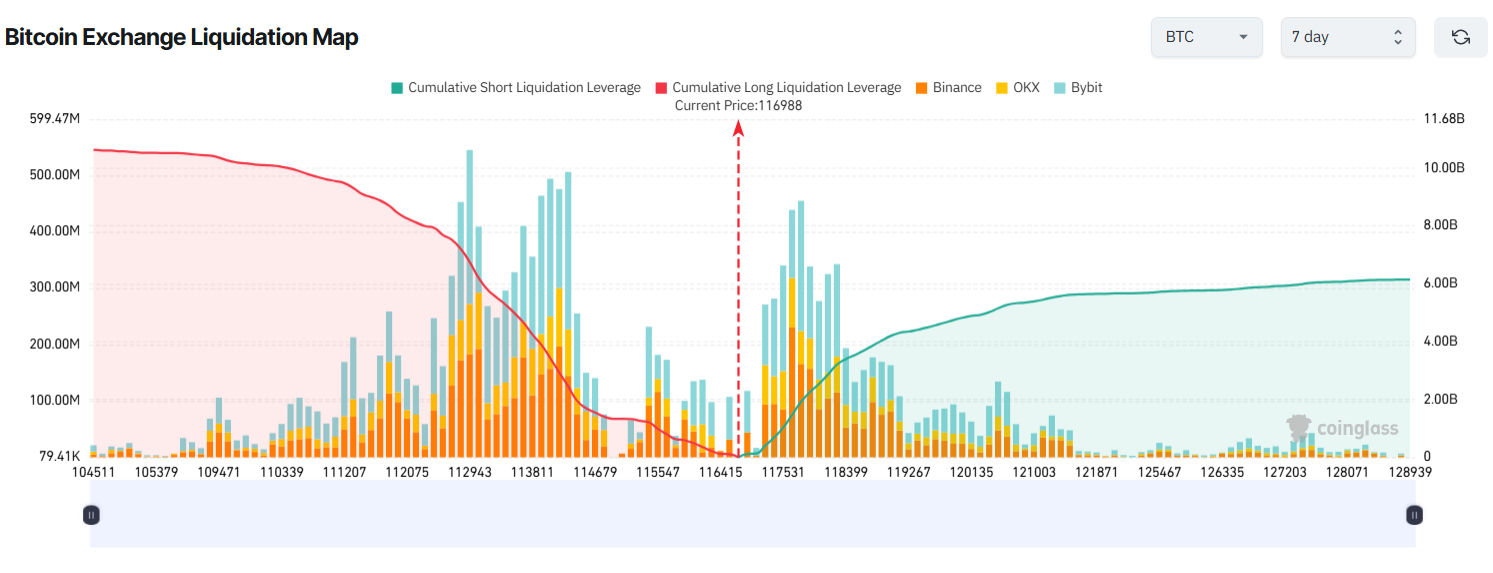

CoinGlass, ever the bearer of cheerful news, adds that liquidation-heavy positions are lurking above and below Bitcoin’s current price like sharks at a beach party.

“High leverage liquidity. Both long and short high leveraged positions will be liquidated,” CoinGlass predicted, with all the enthusiasm of a man announcing rain at a picnic.

Should Bitcoin tumble to $104,500, long positions could cough up $10 billion faster than a teetotaler at a wine tasting. Conversely, if BTC moons to $124,000, shorts will be nursing $5.5 billion in losses-roughly equivalent to the GDP of a small island nation or Aunt Agatha’s annual hat budget.

BeInCrypto, never one to leave a stone unturned, has also flagged several altcoins for imminent liquidation peril. Because why suffer alone when you can drag others down with you?

What’s a trader to do? Analyst Luckshury sagely advises that trading derivatives is like arm-wrestling an exchange-you’re bound to lose unless you identify liquidation zones and limit your positions. Or, as Jeeves might say, “Discretion is the better part of not being financially obliterated, sir.”

Read More

- All Golden Ball Locations in Yakuza Kiwami 3 & Dark Ties

- Hollywood is using “bounty hunters” to track AI companies misusing IP

- NBA 2K26 Season 5 Adds College Themed Content

- Gold Rate Forecast

- What time is the Single’s Inferno Season 5 reunion on Netflix?

- Mario Tennis Fever Review: Game, Set, Match

- Pokemon LeafGreen and FireRed listed for February 27 release on Nintendo Switch

- Beyond Linear Predictions: A New Simulator for Dynamic Networks

- Train Dreams Is an Argument Against Complicity

- EUR INR PREDICTION

2025-09-17 10:59