Ah, the cryptocurrency market… a swirling vortex of hope, despair, and frankly, questionable decisions. Now, it appears our esteemed investors – those titans of digital finance – are engaging in a most peculiar activity: removing their fortunes from the exchanges. Yes, you heard correctly. Billions in Bitcoin and Ethereum are vanishing, as if swallowed by a particularly mischievous digital goblin. 👻 Sentora, formerly known as IntoTheBlock (because even analytics firms suffer existential crises, it seems), notes this… disturbance. Prices, naturally, remain stubbornly indifferent, hovering like a fly around a forgotten samovar. But could this be… a change? A ripple in the vast, chaotic ocean of crypto?

A Great Unloading: Billions Flee Centralized Exchanges

Sentora, in its infinite wisdom, informs us that over two billion dollars worth of Bitcoin have decamped from centralized exchanges this past week. Two billion! It’s enough to make a frugal bureaucrat blush. And to think, mere days ago, the very same crypto world was lamenting a rather undignified tumble. A crash, you say? Such drama! 🎭 It’s all so… predictably unpredictable.

Apparently, these withdrawals signal confidence from the “whale” addresses – those creatures of immense holdings and even more immense mystery. They prefer, it seems, the cozy solitude of long-term storage over the bustling marketplace. Lookonchain, those diligent trackers of whale movements, corroborate this, pointing to two freshly minted wallets… whisking away 2,000 BTC (a trifling sum of $260 million, of course) from Binance. A mere pocket change for these titans.

Ethereum isn’t to be left out of this grand exodus! A respectable $600 million followed suit, seeking… well, who knows what they seek? Perhaps a quiet life, far from the prying eyes of analysts and the volatile whims of the market. 🤷♀️

But What Does It All Mean?

The whole affair is rather… befuddling. Both Bitcoin and Ethereum concluded October with decidedly un-bullish results. A most uncivilized end to “Uptober” – a period that had, for six consecutive years, reliably ushered in festive gains. 🕯️ This year? A paltry 4% drop for Bitcoin and a rather less cheerful 7.15% dip for Ethereum. It’s enough to make one suspect autumn itself has lost its optimistic spirit.

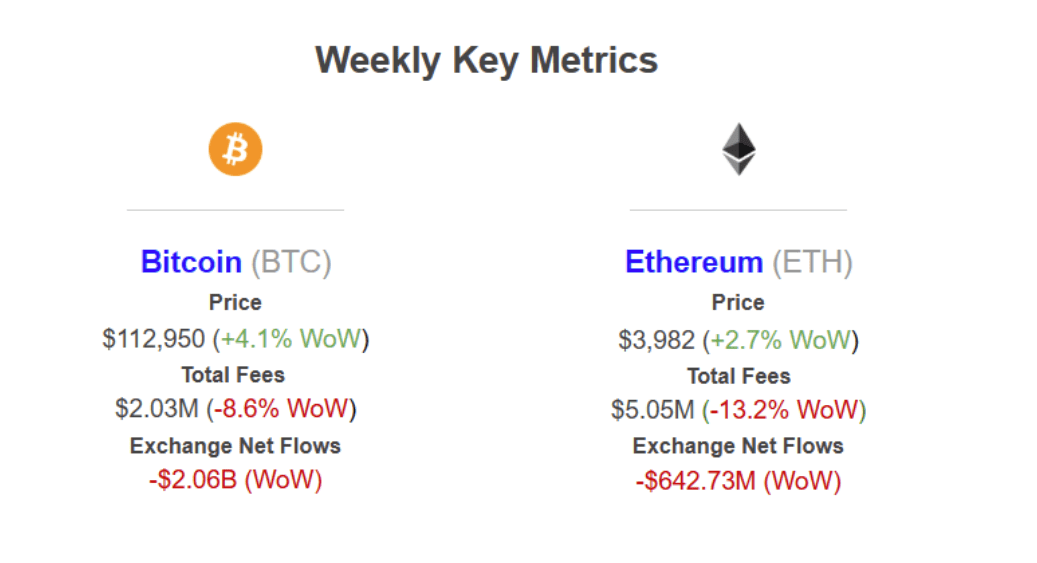

Sentora’s data suggests… lethargy. Fees on the Bitcoin blockchain have dwindled to a mere $2.03 million (a shocking 8.6% decrease!). Ethereum’s fees? Only $5.05 million – a decline of 13.2%! The very networks are yawning. Yet, these outflows… ah, these outflows offer a glimmer of hope. A lessening of selling pressure, as fewer coins languish readily available for disposal. A tightening of supply, naturally leading to…well, you know. Perhaps even a bullish November. The whales, no doubt, are already positioning themselves… or perhaps just rearranging their digital furniture. 🤔

Read More

- All Golden Ball Locations in Yakuza Kiwami 3 & Dark Ties

- NBA 2K26 Season 5 Adds College Themed Content

- Hollywood is using “bounty hunters” to track AI companies misusing IP

- What time is the Single’s Inferno Season 5 reunion on Netflix?

- Heated Rivalry Adapts the Book’s Sex Scenes Beat by Beat

- Gold Rate Forecast

- Brent Oil Forecast

- Mario Tennis Fever Review: Game, Set, Match

- He Had One Night to Write the Music for Shane and Ilya’s First Time

- EUR INR PREDICTION

2025-11-02 13:23