O my brethren, the crypto market, that most enigmatic of beasts, has stirred from its slumber, its value now hovering at a mere $3.23 trillion-a figure both tantalizing and despairing. Alas, the specter of a bear market, which once haunted our dreams, now lingers in the shadows, as the Fear and Greed Index, that most unreliable of prophets, hovers at 50/100, a testament to our collective indecision. 🧠💰

Top 3 Crypto Events This Week To Consider

Bitcoin Bullish Breakout 🧨

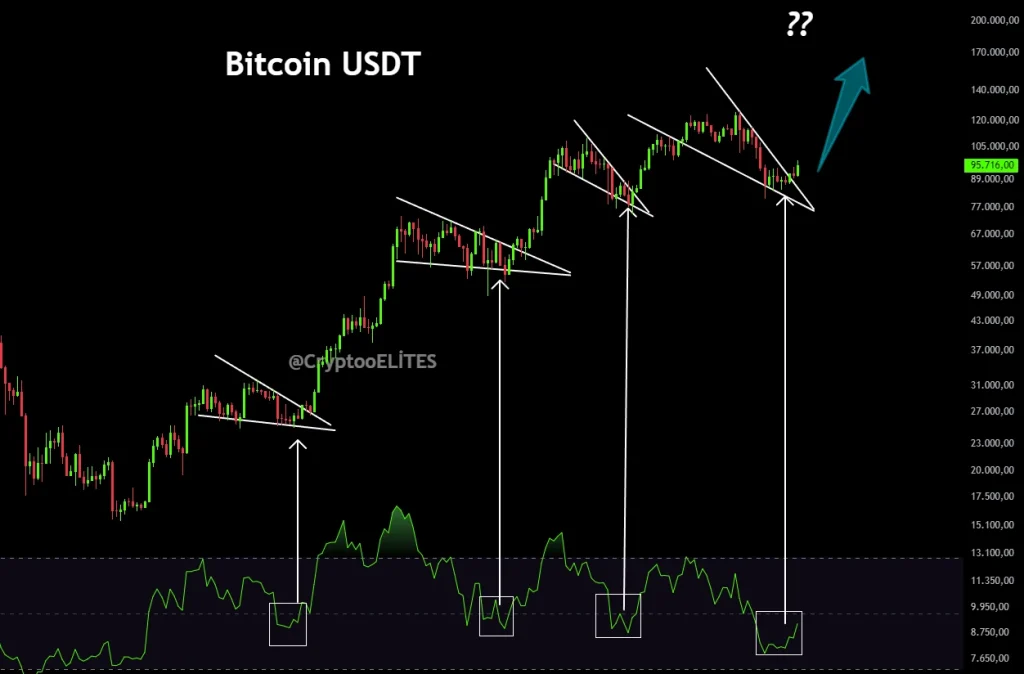

Bitcoin’s price, that elusive phantom, has ascended to a 2-month high of $97.7k, only to retreat to $95.4k, a dance of hope and despair. The BTC/USD pair, that most stubborn of lovers, teeters on the brink of a breakout, while the $94.4k supply level, a fortress of resistance, has been breached. Will this be the dawn of parabolic growth, or merely a fleeting mirage? 🧨

As such, the BTC/USD pair is on the cusp of breaking out of a falling logarithmic trend to kickstart its parabolic growth in the near term. Furthermore, Bitcoin price has broken out of a crucial supply level around $94.4k.

Ethereum and Major Altcoins Signal Bullish Outlook 🧠

The altcoin industry, led by Ethereum (ETH), has signaled bullish momentum this week. According to market data analysis from Santiment, the wider crypto market gained a bullish outlook this week catalyzed by rising Open Interest. 🧠

The altcoin industry has maintained bullish sentiment as Mike Novogratz led the crypto community in anticipating the passage of the Clarity Act in the coming weeks. Will this legislation be the salvation we crave, or another bureaucratic farce? 🧨

Institutional Investors Returns Amid the Delayed Senate Markup for the Clarity Act 🧨

The demand for crypto assets by institutional investors surged this week amid heated regulatory debate in the United States Senate. The United States spot Bitcoin exchange-traded funds (ETFs), led by BlackRock’s IBIT and Fidelity’s FBTC, recorded more than $2 billion in net cash inflows. 🧨

Strategy also recorded its first major Bitcoin purchase after getting pushed to the defensive during the fourth quarter. At the beginning of this week, the company purchased 13,627 BTCs for over $1.2 billion, thus increasing its holdings to 687,410 coins. A true testament to the power of patience-or recklessness. 🧠

The renewed demand for crypto by institutional investors coincided with the hallmark of a bipartisan Senate debate on crypto legislation. Earlier this week, Coinbase CEO Brian Armstrong withdrew its support for the Clarity Act due to the negative influence of the traditional banking industry. How quaint! 🧨

Read More

- All Golden Ball Locations in Yakuza Kiwami 3 & Dark Ties

- Hollywood is using “bounty hunters” to track AI companies misusing IP

- A Knight Of The Seven Kingdoms Season 1 Finale Song: ‘Sixteen Tons’ Explained

- Gold Rate Forecast

- What time is the Single’s Inferno Season 5 reunion on Netflix?

- Mario Tennis Fever Review: Game, Set, Match

- Beyond Linear Predictions: A New Simulator for Dynamic Networks

- All Songs in Helluva Boss Season 2 Soundtrack Listed

- This free dating sim lets you romance your cleaning products

- 4. The Gamer’s Guide to AI Summarizer Tools

2026-01-17 02:52