What to know:

By Omkar Godbole (All times ET unless indicated otherwise)

Ah, dear crypto traders, how you must feel! Brace yourselves for yet another tempestuous whirlpool of volatility, as the monumental U.S. nonfarm payroll report for November threatens to disrupt the tranquility of your trading sanctuaries. It arrives today, accompanied by the retail sales data from October-a delightful double feature, wouldn’t you agree?

This employment data, like a seer gazing into the murky waters of the labor market, shall illuminate the depths of cooling that signify the U.S. economy’s delicate dance on the precipice of catastrophe, shaping our understanding of the Federal Reserve’s benevolent rate-cutting path.

“A weaker-than-expected NFP report could reinforce the notion that the U.S. economy is slowing more noticeably, thus strengthening the hope for monetary easing,” declares Linh Tran, a senior market analyst at XS.com, as if we were all waiting with bated breath. How charmingly optimistic!

Lower rates, my friends, mean that dismal data could ignite a reckless revival of risk-taking-a glimmering possibility of Bitcoin rising from its ashes, much akin to a phoenix. Yet, beware! The pain trade-oh, how delightful it sounds-might be lurking dangerously high, considering the market’s persistent gloominess of late. 😅

As we approach the hour of revelation, set for 8:30 a.m., the digital asset haven clings desperately to Monday’s losses, with the total market cap stuck like a fly in amber at around $3 trillion, while Bitcoin lingers near $86,400, down nearly 4% over the previous 24 hours. What a rollercoaster!

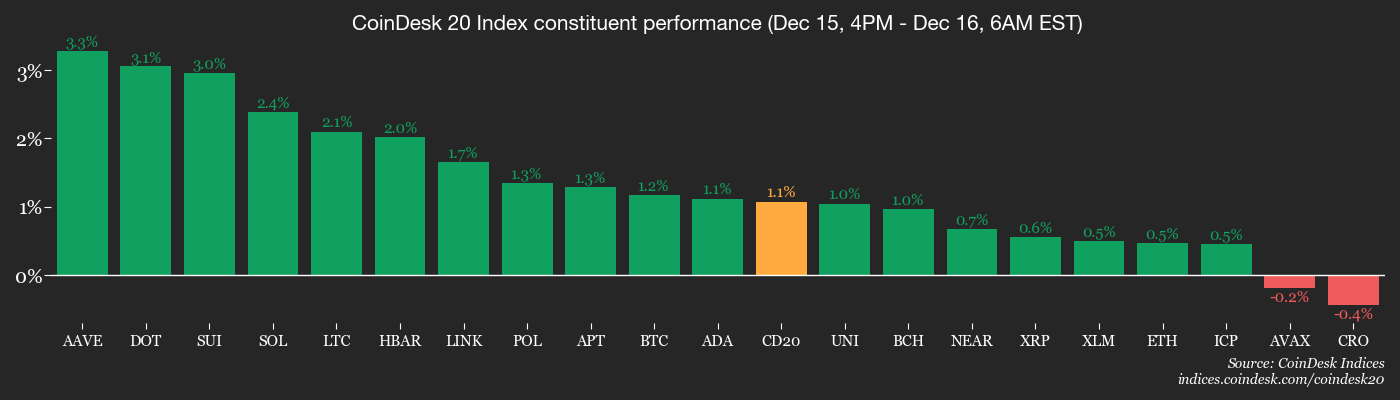

Both the CoinDesk 20 (CD20) and CoinDesk 80 (CD80) indices are down more than 5%, and the CoinDesk bitcoin trend indicator (BTI), that ever-reliable harbinger of doom, suggests an unyielding downtrend for the fourth consecutive day. Volmex’s one-day implied volatility index for BTC remains shackled within a range of an annualized 40%-60%, indicating that the market is not quite ready to unleash chaos upon the unsuspecting traders. 😊

Our beloved BTC seems heavily burdened by a waning institutional appetite for alternative investment vehicles. Just yesterday, the U.S.-listed spot ETFs suffered a net outflow of $357 million-the highest since Nov. 20. Oh, the humanity!

Moreover, the growth of stablecoins has taken a nosedive, signaling a retreat in fresh fiat inflows into our cherished crypto realm. “Even if absolute growth remains respectable,” muses Matrixport, “the deceleration in stablecoin growth rates points to a less bullish liquidity backdrop than many had dared to anticipate.” Quite the grim forecast, isn’t it?

The delay in the U.S. crypto market structure bill seems to exacerbate the prevailing bearish sentiment, leaving us all in a delightful state of suspense.

Meanwhile, in the realm of traditional markets, the Chinese yuan has gallantly surged to a two-month high of 7.0417 per dollar, prompting those bullish crypto enthusiasts to reminisce about the days when a weak yuan meant capital flowing out of China like water from a broken dam. Alas, a strong yuan now holds the opposite sway, though evidence linking the two assets directly remains as elusive as an honest politician.

Yet, let us not despair! A sustained rally of the yuan could indeed drag the dollar index (DXY) lower, just as a faltering yuan purportedly propels DXY higher, thus creating a gentle breeze-nay, a tailwind-for risky assets, including our dear BTC.

And what of gold? Its ascent has encountered turbulence, retreating to $4,277 an ounce from a lofty $4,350 on Monday, just shy of its record price of $4,381.48 set on that fateful day of Oct. 20. Meanwhile, the U.S. 10-year Treasury yield stubbornly hovers above 4%, despite last week’s Fed rate cut, reminding us all to stay vigilant!

What to Watch

For a more comprehensive list of events this week, see CoinDesk’s “Crypto Week Ahead”.

Token Events

For a more comprehensive list of events this week, see CoinDesk’s “Crypto Week Ahead”.

Conferences

For a more comprehensive list of events this week, see CoinDesk’s “Crypto Week Ahead”.

- Nothing scheduled.

Market Movements

- BTC is up 0.18% from 4 p.m. ET Monday at $86,363.38 (24hrs: -3.07%)

- ETH is down 0.61% at $2,927.41 (24hrs: -6.72%)

- CoinDesk 20 is down 0.19% at 2,696.69 (24hrs: -4.31%)

- Ether CESR Composite Staking Rate is up 3 bps at 2.84%

- BTC funding rate is at 0.0017% (1.8615% annualized) on Binance

- DXY is down 0.12% at 98.19

- Gold futures are down 0.66% at $4,306.80

- Silver futures are down 0.76% at $63.10

- Nikkei 225 closed down 1.56% at 49,383.29

- Hang Seng closed down 1.54% at 25,235.41

- FTSE is down 0.3% at 9,722.49

- Euro Stoxx 50 is down 0.14% at 5,744.63

- DJIA closed on Monday down 0.09% at 48,416.56

- S&P 500 closed down 0.16% at 6,816.51

- Nasdaq Composite closed down 0.59% at 23,057.41

- S&P/TSX Composite closed down 0.14% at 31,483.44

- S&P 40 Latin America closed up 0.17% at 3,178.81

- U.S. 10-Year Treasury rate is down 0.2 bps at 4.18%

- E-mini S&P 500 futures are down 0.19% at 6,809.75

- E-mini Nasdaq-100 futures are down 0.3% at 25,266.00

- E-mini Dow Jones Industrial Average Index futures are down 0.12% at 48,778.00

Bitcoin Stats

- BTC Dominance: 59.25% (+0.29%)

- Ether-bitcoin ratio: 0.03386 (-1.31%)

- Hashrate (seven-day moving average): 1,047 EH/s

- Hashprice (spot): $36.86

- Total fees: 2.78 BTC / $244,700

- CME Futures Open Interest: 122,980 BTC

- BTC priced in gold: 20.3 oz.

- BTC vs gold market cap: 5.82%

Technical Analysis

- The chart reveals BTC’s daily price fluctuations in candlestick format, a veritable work of art! 🎨

- Monday’s candle closed beneath the support level for the mini-bullish trendline connecting the lows of Nov. 21 and Dec. 1. A poetic breakdown indeed, consistent with the broader downtrend since early October, hinting at a possible re-test of recent lows near $80,000. Such drama!

Crypto Equities

- Coinbase Global (COIN): closed on Monday at $250.42 (-6.37%), -0.36% at $249.51 in pre-market

- Circle (CRCL): closed at $75.46 (-9.60%), -0.99% at $74.71

- Galaxy Digital (GLXY): closed at $24.54 (-8.26%), -0.61% at $24.39

- Bullish (BLSH): closed at $42.43 (-2.55%), -1.44% at $41.82

- MARA Holdings (MARA): closed at $10.70 (-7.12%), -0.47% at $10.65

- Riot Platforms (RIOT): closed at $13.71 (-10.39%), -0.88% at $13.59

- Core Scientific (CORZ): closed at $15.28 (-7.56%), -1.24% at $15.09

- CleanSpark (CLSK): closed at $11.91 (-15.07%), -1.38% at $11.75

- CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed at $37.93 (-11.25%)

- Exodus Movement (EXOD): closed at $13.56 (-10.97%)

Crypto Treasury Companies

- Strategy (MSTR): closed at $162.08 (-8.14%), unchanged in pre-market

- Semler Scientific (SMLR): closed at $16.03 (-10.8%)

- SharpLink Gaming (SBET): closed at $9.51 (-9.51%), -0.11% at $9.50

- Upexi (UPXI): closed at $2.04 (-9.73%), +1.96% at $2.08

- Lite Strategy (LITS): closed at $1.53 (-10.53%)

ETF Flows

Spot BTC ETFs

- Daily net flows: -$357.6 million

- Cumulative net flows: $57.53 billion

- Total BTC holdings ~1.31 million

Spot ETH ETFs

- Daily net flows: -$224.8 million

- Cumulative net flows: $12.88 billion

- Total ETH holdings ~6.3 million

Read More

- All Itzaland Animal Locations in Infinity Nikki

- All Golden Ball Locations in Yakuza Kiwami 3 & Dark Ties

- Unlocking the Jaunty Bundle in Nightingale: What You Need to Know!

- James Gandolfini’s Top 10 Tony Soprano Performances On The Sopranos

- Gold Rate Forecast

- Elder Scrolls 6 Has to Overcome an RPG Problem That Bethesda Has Made With Recent Games

- Super Animal Royale: All Mole Transportation Network Locations Guide

- YouTuber streams himself 24/7 in total isolation for an entire year

- There’s a simple way to watch Finding Lucy doc Storyville: The Darkest Web for free

- Tales of Xillia Remastered 1.0.3 update fixes diagonal movement, progression issues, graphical issues, & more

2025-12-16 16:20