Markets 🤑

What to know: 🤓

So, the crypto market is basically a rollercoaster designed by a caffeine-addicted engineer, and everyone’s got a different strategy to keep their lunch down. 🌪️🎢

Bitcoin investors are all, “Let’s strangle and straddle this volatility like it’s a stubborn turkey on Thanksgiving.” Meanwhile, XRP traders are betting the rollercoaster will suddenly turn into a lazy river. 🦃🛶

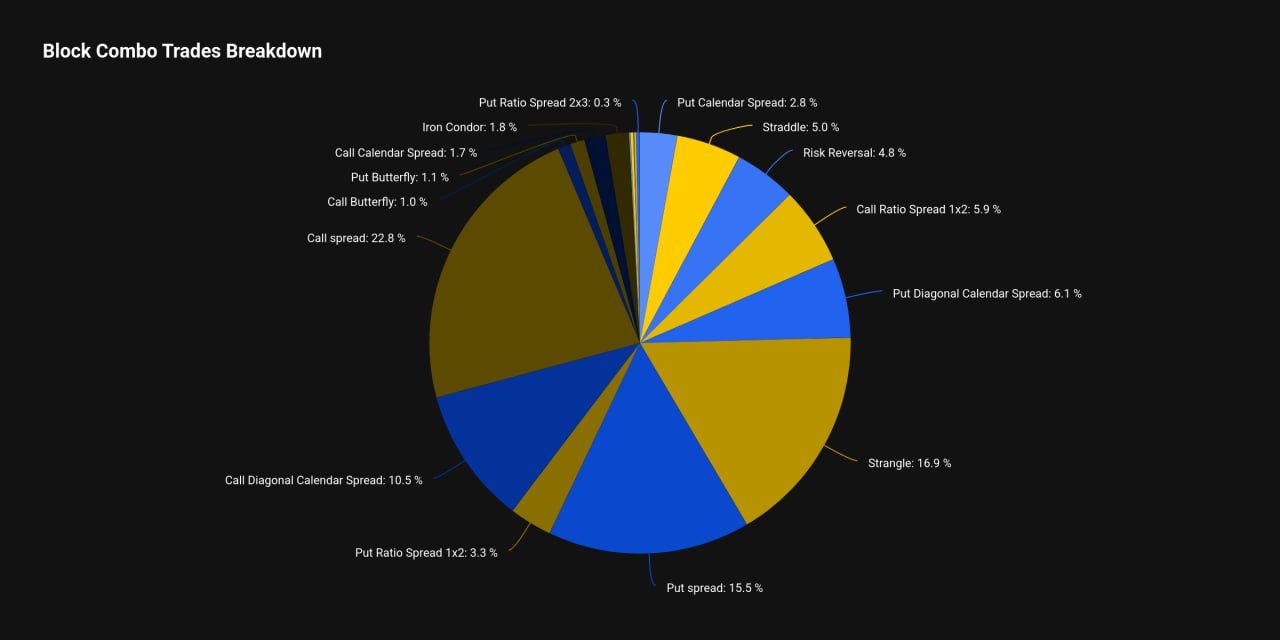

Over the past week, 16.9% of BTC option blocks were strangles, and 5% were straddles. That’s right, nearly 22% of traders are basically saying, “We have no idea where this is going, but it’s gonna be WILD.” XRP traders? They’re shorting strangles, which is like betting the rollercoaster will stop at the snack bar. 🍿🤷♀️

A strangle is like buying a ticket to both the front and back of the rollercoaster, hoping it goes crazy. For example, if BTC is at $104,700, you buy a $105,000 call and a $104,400 put. It’s the ultimate “I don’t know, but I’m ready for anything” move. 🎢🤪

A straddle? That’s like buying a ticket right in the middle, hoping for maximum drama. Higher cost, but oh boy, the thrill! Both strategies can leave you crying in the corner if nothing happens, though. 😭💸

Deribit CEO Luuk Strijers is like, “Yeah, traders are confused. They’re expecting fireworks but don’t know if it’s the 4th of July or a dud.” 🎆🤷♂️

Block option trades? Those are the VIP passes to the crypto circus, handled by big shots who don’t want to tip off the clowns. 🎪🤡

The crypto options market is booming because, let’s face it, guessing volatility is way more fun than guessing prices. It’s like betting on whether the weather will be crazy instead of just rainy or sunny. ☔🌞

Deribit’s BTC options market is worth $44 billion. That’s a lot of zeroes, folks. Meanwhile, ETH is chilling at $9 billion, doing diagonal spreads like it’s a yoga retreat. 🧘♀️💰

XRP: The Range-Bound Rebel 🤠

XRP’s options market is tiny-just $67.6 million. But when they trade, it’s like a mic drop in a library. 📉🎤

Last Wednesday, someone shorted a strangle on XRP, selling 40,000 contracts each of $2.2 calls and $2.6 puts. That’s 80,000 XRP, betting it stays between those prices. Bold move, Cotton. Let’s see if it pays off. 🍿🎲

Deribit’s Lin Chen is like, “This trader thinks macro jitters are priced in. They’re betting XRP will chill between $2.2 and $2.6. But if volatility spikes, they’re in for a wild ride.” 🚀💥

Shorting a strangle? That’s like tightrope walking without a net. Fun if you’re right, disastrous if you’re wrong. Not for the faint of heart-or the faint of wallet. 🪢💸

Read More

- All Golden Ball Locations in Yakuza Kiwami 3 & Dark Ties

- These are the 25 best PlayStation 5 games

- The MCU’s Mandarin Twist, Explained

- Movie Games responds to DDS creator’s claims with $1.2M fine, saying they aren’t valid

- Mario Tennis Fever Review: Game, Set, Match

- Gold Rate Forecast

- A Knight Of The Seven Kingdoms Season 1 Finale Song: ‘Sixteen Tons’ Explained

- Hollywood is using “bounty hunters” to track AI companies misusing IP

- What time is the Single’s Inferno Season 5 reunion on Netflix?

- Beyond Linear Predictions: A New Simulator for Dynamic Networks

2025-11-13 12:37