Ah, the crypto market, that fickle siren, has once again lured the unwary to their doom, leaving behind a trail of liquidated dreams and shattered convictions. In a spectacle as predictable as a Nabokovian protagonist’s downfall, nearly one billion dollars has evaporated into the ether-quite literally, as Ethereum led the charge in this grand ballet of financial despair. Over 226,000 traders, poor souls, found their long positions unceremoniously guillotined, their bullish fervor reduced to ashes in the span of a mere 24 hours. 🪦✨

According to the oracles at CoinGlass, the total value of these liquidated positions reached a staggering $966 million from September 25, 12 pm UTC, to September 26, 12 pm UTC. A veritable massacre, with long positions accounting for $843.07 million of the carnage. Short positions, those wily survivors, managed to escape with a mere $122.93 million in losses. One can almost hear the schadenfreude in the data.

The sell-off, you see, occurred in a market already teetering on the edge of exhaustion, like a tightrope walker with a penchant for dramatics. Slowing spot ETF inflows and profit-taking from long-term holders had created a “fragile balance,” a phrase so delicate it practically whispers its own obituary. And then, as prices dipped, they entered what the inimitable Alex Krüger dubs the “$108-110k Desperate Zone,” where leveraged traders, those poor, deluded souls, are forced to dump their positions like so much unwanted baggage. 🧳💨

This deleveraging, a term so clinical for such a brutal event, triggered a cascade of forced liquidations, leaving bullish traders clutching their pearls and their empty wallets. As Krüger so aptly put it:

108-110 is the Desperate Zone, where people who are levered up or have no conviction dump (alts in particular)

– Alex Krüger (@krugermacro) September 25, 2025

Ethereum: The Maestro of Misery 🎻💔

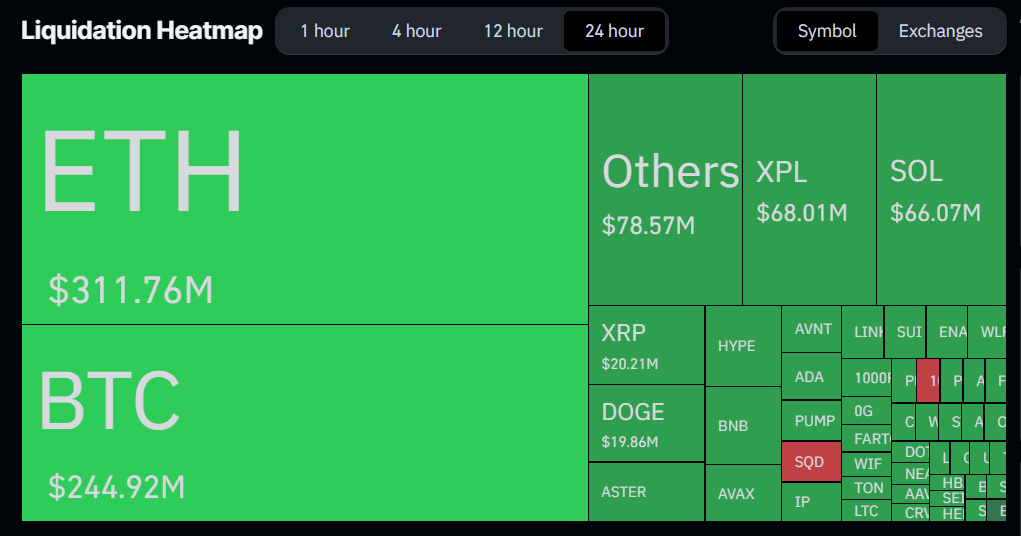

Ethereum, that erstwhile darling of the crypto world, spearheaded the deleveraging with a jaw-dropping $311 million in total liquidations. The pain was particularly acute for bullish traders, who saw over $271 million in long positions forcibly closed. Bitcoin, not to be outdone, followed closely with approximately $245 million in liquidations, its long positions accounting for over $235 million. A veritable duel of despair, if ever there was one. ⚔️

Behold, the heatmap of heartbreak, where Ethereum and Bitcoin reign supreme in their losses. ~ Source: coinglass.com

The altcoin market, too, was not spared the wrath of this financial tempest. Solana traders, those intrepid souls, saw over $66 million in positions closed, while XRP and Dogecoin, those lesser luminaries, faced approximately $20 million in liquidations each. A democratic slaughter, one might say, where no coin was safe from the reaper’s scythe. ⚰️

And so, as the dust settles and the tears dry, one is left to ponder the folly of it all. The crypto market, with its dizzying highs and crushing lows, remains a theater of the absurd, where greed and fear dance an eternal waltz. Until the next liquidation, dear reader, until the next liquidation. 🎭💃🕺

Read More

- All Golden Ball Locations in Yakuza Kiwami 3 & Dark Ties

- Hollywood is using “bounty hunters” to track AI companies misusing IP

- What time is the Single’s Inferno Season 5 reunion on Netflix?

- Gold Rate Forecast

- A Knight Of The Seven Kingdoms Season 1 Finale Song: ‘Sixteen Tons’ Explained

- Mario Tennis Fever Review: Game, Set, Match

- NBA 2K26 Season 5 Adds College Themed Content

- Train Dreams Is an Argument Against Complicity

- Every Death In The Night Agent Season 3 Explained

- Beyond Linear Predictions: A New Simulator for Dynamic Networks

2025-09-26 18:27