XRP’s Fall: A Tragic Tale of Crypto’s Betrayal 🚀💸

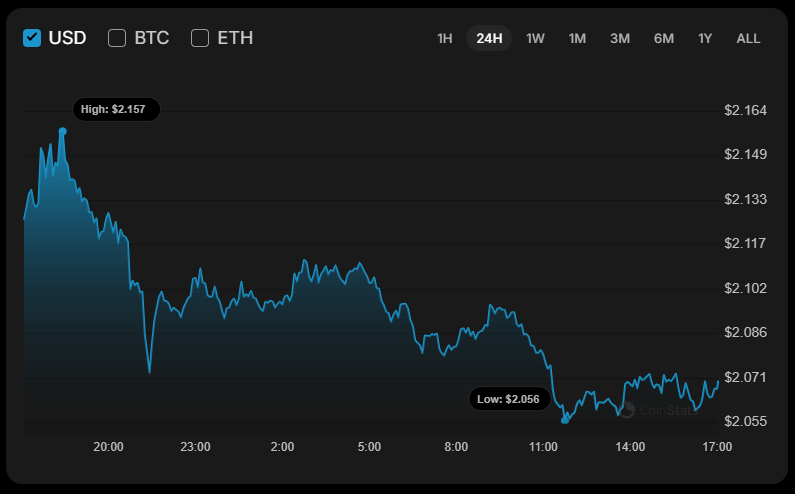

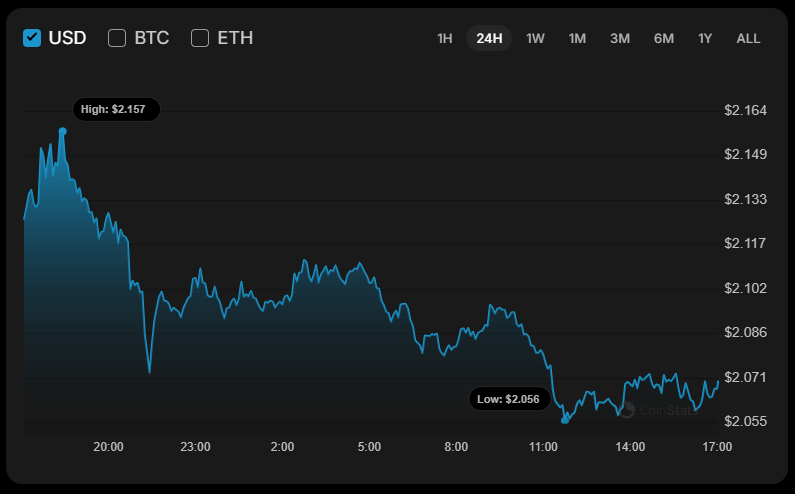

O cruel fate! The price of XRP has fallen by 1.49% in the last 24 hours-a mere drop in the ocean of despair. 😬💸

O cruel fate! The price of XRP has fallen by 1.49% in the last 24 hours-a mere drop in the ocean of despair. 😬💸

The price of SHIB has taken a nosedive, plummeting 4.34% since yesterday-like a poorly aimed catapult in a medieval joust. 🏰📉

In a macro thread on X (yes, the same X where people argue about toast), Delphi declares, “The Fed’s rate path is clearer than a glass of freshly squeezed lemonade!” 🍋 Futures are hinting at a 25-basis-point cut by December 2025, nudging the federal funds rate down to a cozy 3.5-3.75%. “By 2026, we’ll be sipping tea in the low 3s,” they chirp. How delightful! ☕

Silver, that most mercurial of metals, now teeters on the precipice of $60, a price so lofty it might make Midas blush. The rabble, it seems, has collectively decided that Bitcoin’s glow has dimmed, and gold’s luster feels positively démodé. 🌕💸

Oh, Solana… Always the center of attention.

Ah, the market, that fickle mistress, has been shaken to its core by Bitcoin’s latest decline. But this, dear reader, is no ordinary pullback. Alphractal, a platform of such advanced analytics it might as well be divination, has peered into the abyss and returned with insights both profound and comical. Using indicators that only the most enlightened (or perhaps the most deluded) could decipher, they declare this not a mere correction, but a full-scale capitulation-a moment when panic selling, forced liquidations, and existential dread converge in a symphony of despair. 🎻💔

Right now, the market’s in a state of “meh.” Bitcoin’s been trying to cozy up to that $90k floor for days, but it’s like a cat trying to sit on a keyboard-it just can’t commit. 🐱⌨️ And with the FOMC meeting looming, the pressure’s on. Retail investors? They’re hiding under their beds, clutching their fiat like it’s a security blanket. 🛏️💸

The latest symphony of debate began with 21Shares’ bold move, a 2x leveraged SUI ETF, the first of its kind. A senior ETF analyst from Bloomberg, with the wisdom of a sage, declared it the dawn of a new era. 🌅 Interestingly, this mirrors the XRP saga, where the first ETF was also leveraged-proof that history repeats, like a well-worn melody. 🎶

BeInCrypto, that most perspicacious of scribes, has scoured the ether for three altcoins worthy of your weekend attention. A task as thrilling as watching a penguin ride a velocipede, but with more candlesticks.

One must ask, with an eyebrow raised, “What be the future for this daring token in the year of our Lord 2026?” Courage, curiosity! Let us delve into the finest plans and fiery burnings! 🔥