Argentina Clicks ‘Unlock’ on Crypto: Goodbye Ban, Hello Bitcoin in Your App! 🚀

If the plans go through, Argentinians could soon be buying, selling, and storing Bitcoin right inside their banking apps-because what could go wrong? 🤔

If the plans go through, Argentinians could soon be buying, selling, and storing Bitcoin right inside their banking apps-because what could go wrong? 🤔

The digital vaults of Upbit, South Korea’s crypto titan, found themselves entangled in a rather unsavory waltz with malevolent code, prompting the frosty immobilization of $1.77 million in ill-gotten gains. 🤡 A temporary lockdown ensued, deposits and withdrawals suspended like fireflies in amber, while wallet systems were upgraded with the urgency of a poet chasing … Read more

Rewind to 2022: Coinbase launched in India with fanfare, only to have UPI payments suspended faster than you can say “regulatory nightmare.” By 2023, it had exited the market altogether, leaving everyone wondering if it would ever return. Enter John O’Loghlen, Coinbase’s APAC Director, who made the grand announcement at India Blockchain Week. His mission? To ensure compliance with FIU-IND, because nothing says “innovation” like navigating bureaucratic hoops 📜.

The chart, a tragicomic portrait of human hope and folly, depicts XRP/USDT on a one-hour timeframe. It reveals not merely lines and prices, but souls in conflict: buyers whispering sweet nothings of ascent, sellers grunting cold truths of descent. And there, in the middle, the poor price-squeezed like a pince-nez between two unyielding brows. 😳

Meanwhile, AMBCrypto dropped a report saying miner reserves are growing. Is this evidence of a local bottom? Maybe. Or maybe miners are just hoarding Bitcoin like it’s toilet paper during a pandemic. 😅

Did the bears ever tell you that Robinhood now gets cozy in a land feeding 19 million stock traders and 17 million crypto fanatics? These deals await the benevolent blessing of Indonesia’s Financial Services Authority, expected to wrap up by the first half of 2026. But we know bureaucracies; they love anticipation! 😏

In a twist that feels straight out of a bureaucratic comedy, Vanguard, the $10 trillion financial behemoth, has finally opened its arms to Bitwise’s XRP ETF. 👐 For years, Vanguard has treated crypto like a leper, banning it outright. But lo and behold, it now offers access to XRP ETFs. 🤯 Is this progress or a sign of the apocalypse? You decide.

Apparently, SHIB is gearing up for its big moment-like a dog finally learning to sit, but with charts. 📈 After months of being dragged through the mud, it’s stabilized and formed a higher low in November. 🎉 Sellers are throwing tantrums but can’t push it below $0.0000080. Buyers are like, “Yeah, we got this,” and sellers are like, “But I wanted to ruin everyone’s day!” 😭

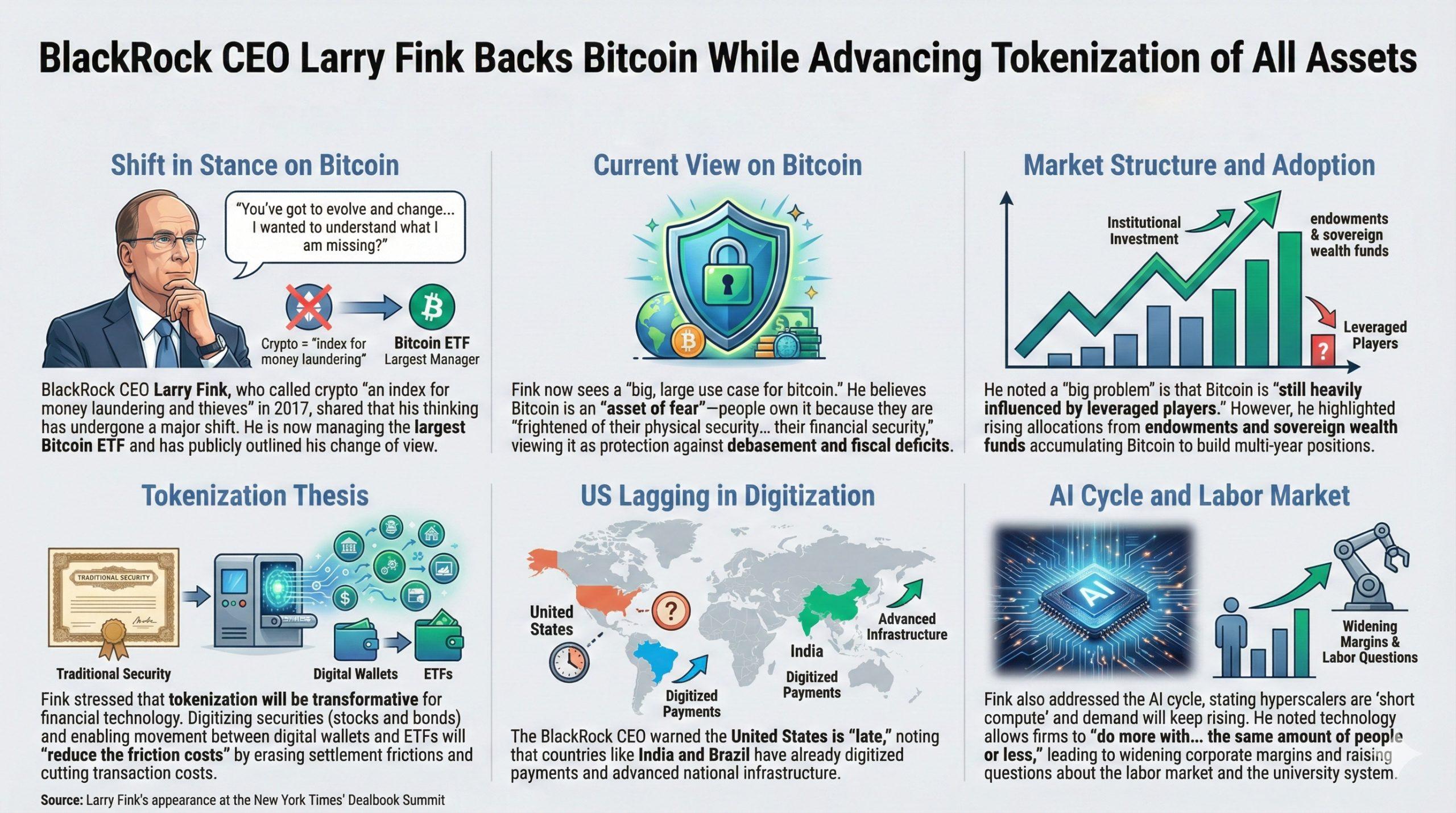

Larry Fink, Blackrock’s CEO and self-proclaimed “architect of capitalist dreams,” recently confessed at the New York Times’ Dealbook Summit that his views on Bitcoin have evolved from “money laundering index” to “fear-based financial fairy tale.” One wonders if this revelation came after a late-night chat with a ghost of Marx or perhaps a cryptic message from a mysterious investor in a fur hat. 🧠❄️

The latest spark? Investor Fred Krueger, who has apparently discovered the concept of “both/and” (a revolutionary idea in a world where people still argue about socks). He endorses Nick Szabo’s dual strategy: “Let’s build bridges! Or at least both banks and castles!” 🏰🏰