Billions in Bitcoin: Are We Dancing with the Devil or Just a Bear in Sheep’s Clothing?

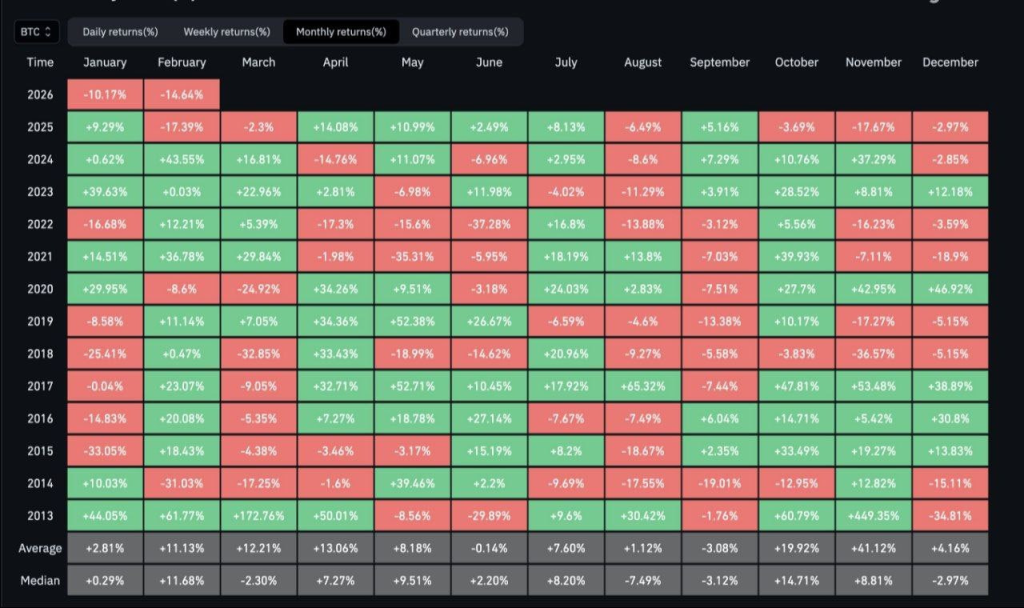

The price of Bitcoin, that fickle mistress, has been grinding lower, slipping below $64,000 with the grace of a drunken bureaucrat. The world’s largest cryptocurrency, once hailed as the harbinger of financial revolution, now clings to support levels like a man grasping at straws in a tempest. Each leg down is a dramatic sigh, a reminder that even the mightiest of digital titans can stumble.