Bitcoin’s Bearish Blues: Will 2026 Bring the Bull Back? 🐻💰

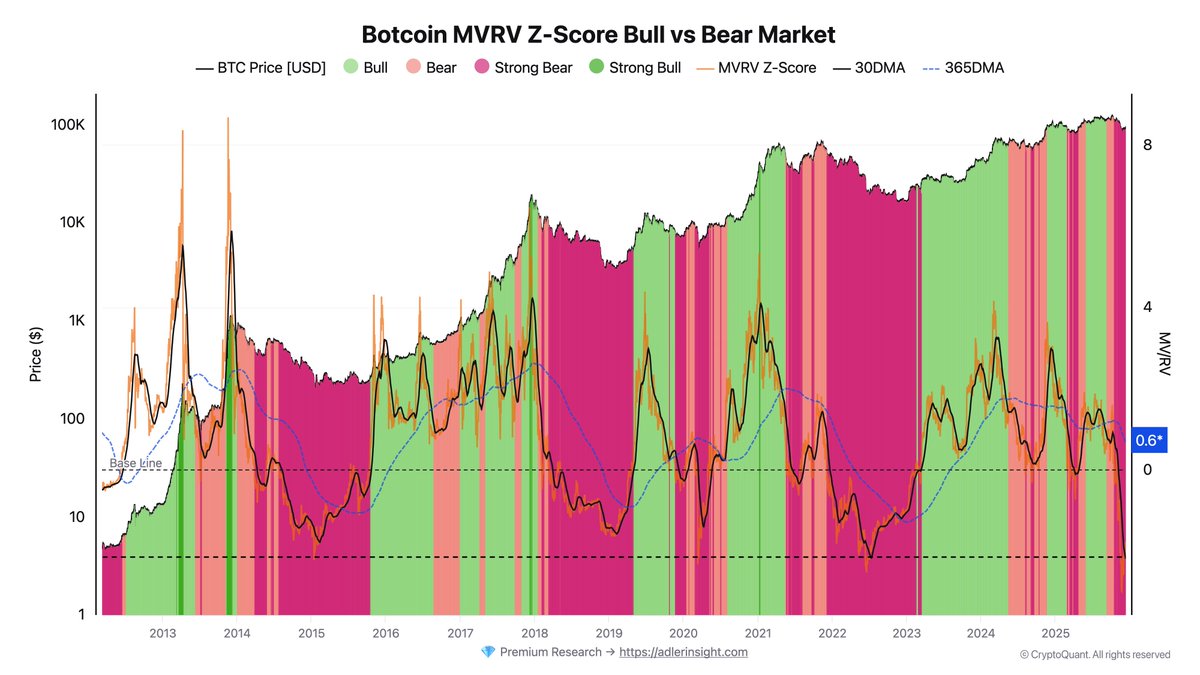

Axel Adler, the guy who probably has more charts than friends, says we’re in for more bearish times. Weakening demand, sell pressure that won’t quit, and liquidity drying up like my sense of humor at a family reunion. 🎭 Apparently, these are the signs of a prolonged corrective period. Who knew? Not me, I was too busy wondering why my Netflix subscription costs more than my gym membership, and I only use one of those.