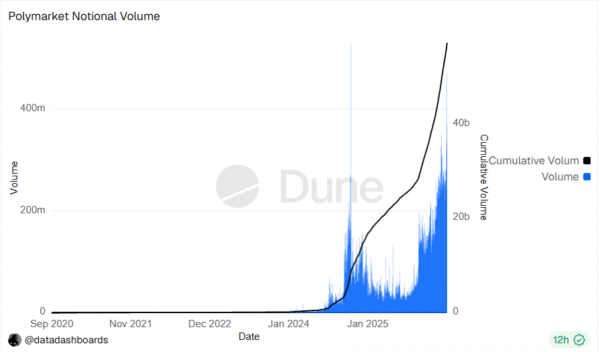

Polymarket’s $478M Gamble: A Tale of Geopolitical Wagers and Unseemly Profits

Elsewhere, rival prediction market Kalshi, that beacon of ethical market practices, found itself in hot water after a contentious contract involving the Khamenei market. It’s a wonder the platform didn’t collapse under the weight of its own moral ambiguity.